Answered step by step

Verified Expert Solution

Question

1 Approved Answer

07. You have plan to invest Rs.10,000/- in one risky asset that will give you 12,000/- return in one year if the market performs well

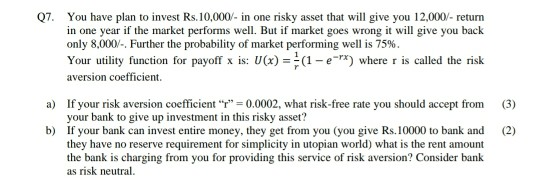

07. You have plan to invest Rs.10,000/- in one risky asset that will give you 12,000/- return in one year if the market performs well . But if market goes wrong it will give you back only 8,000/-. Further the probability of market performing well is 75%. Your utility function for payoff x is: U(x) = (1 - e-*) where r is called the risk aversion coefficient a) If your risk aversion coefficient "Y" = 0.0002, what risk-free rate you should accept from your bank to give up investment in this risky asset? b) If your bank can invest entire money, they get from you (you give Rs.10000 to bank and they have no reserve requirement for simplicity in utopian world) what is the rent amount the bank is charging from you for providing this service of risk aversion? Consider bank as risk neutral. (3) (2) 07. You have plan to invest Rs.10,000/- in one risky asset that will give you 12,000/- return in one year if the market performs well . But if market goes wrong it will give you back only 8,000/-. Further the probability of market performing well is 75%. Your utility function for payoff x is: U(x) = (1 - e-*) where r is called the risk aversion coefficient a) If your risk aversion coefficient "Y" = 0.0002, what risk-free rate you should accept from your bank to give up investment in this risky asset? b) If your bank can invest entire money, they get from you (you give Rs.10000 to bank and they have no reserve requirement for simplicity in utopian world) what is the rent amount the bank is charging from you for providing this service of risk aversion? Consider bank as risk neutral. (3) (2)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started