Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 0 Problem 6 - 9 ( Algo ) Short - term versus longer - term borrowing [ LO 6 - 3 ] Sauer Food

Problem Algo Shortterm versus longerterm borrowing LO

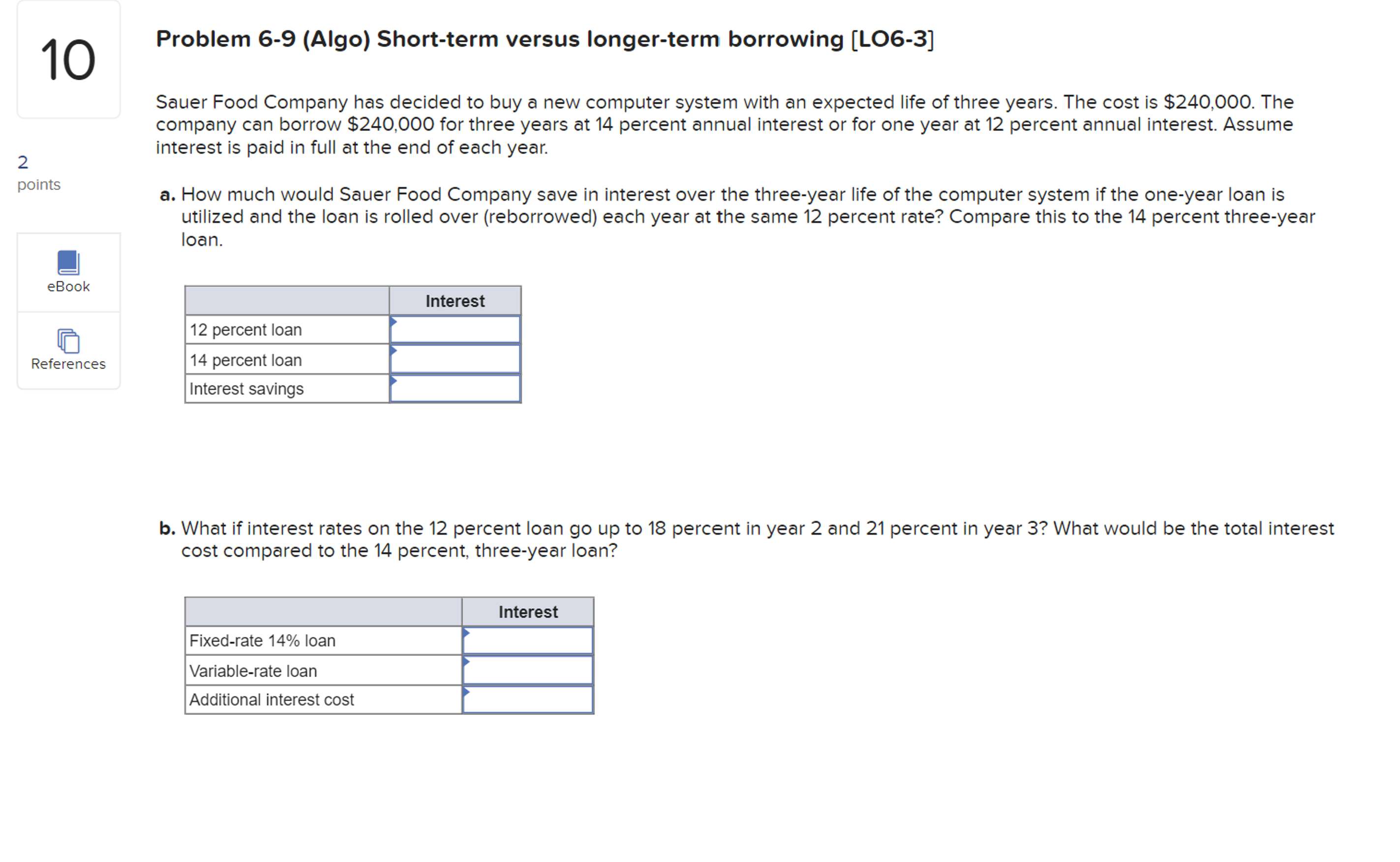

Sauer Food Company has decided to buy a new computer system with an expected life of three years. The cost is $ The

company can borrow $ for three years at percent annual interest or for one year at percent annual interest. Assume

interest is paid in full at the end of each year.

a How much would Sauer Food Company save in interest over the threeyear life of the computer system if the oneyear loan is

utilized and the loan is rolled over reborrowed each year at the same percent rate? Compare this to the percent threeyear

loan.

b What if interest rates on the percent loan go up to percent in year and percent in year What would be the total interest

cost compared to the percent, threeyear loan?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started