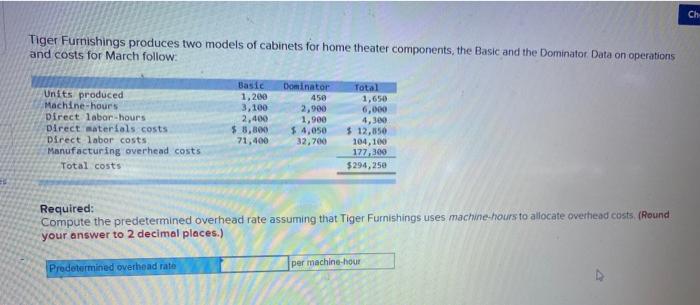

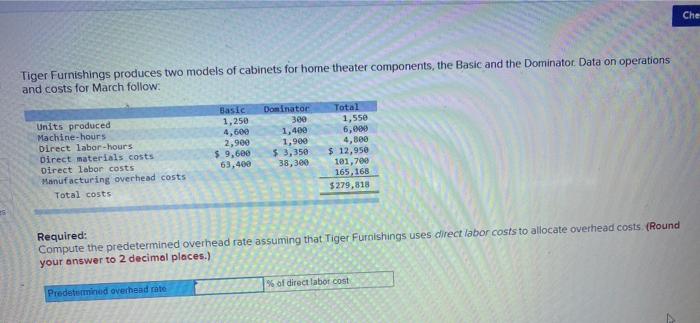

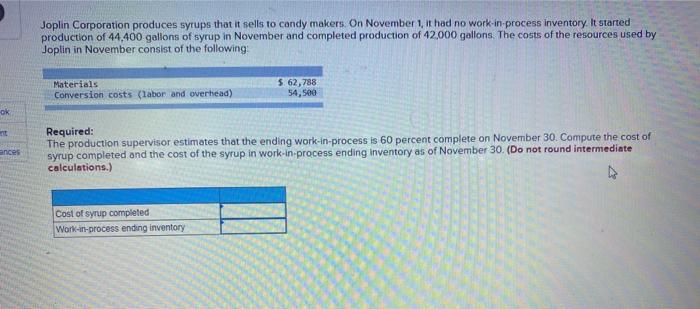

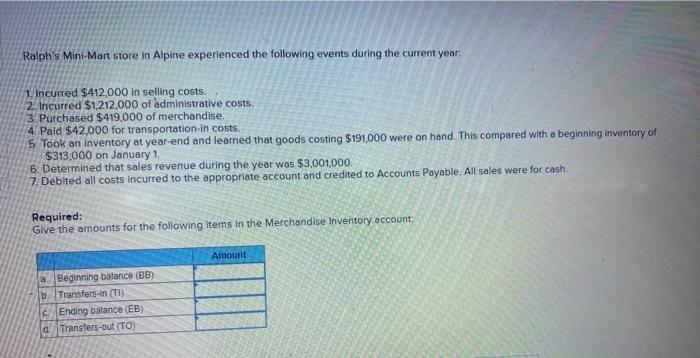

Ch. Tiger Furnishings produces two models of cabinets for home theater components, the Basic and the Dominator Data on operations and costs for March follow Units produced Machine-hours Direct labor-hours Direct materials costs Direct labor costs Manufacturing overhead costs Total costs Basic 1,200 3,100 2.400 $ 3,80 71,400 Dominator 450 2,900 1,900 $ 4,050 32,700 Total 1,650 6,000 4,300 $ 12,850 104,100 177,300 $294, 25e Required: Compute the predetermined overhead rate assuming that Tiger Furnishings uses machine hours to allocate overhead costs (Round your answer to 2 decimal places.) Predetermined overhead rate per machine-hour Che Tiger Furnishings produces two models of cabinets for home theater components, the Basic and the Dominator Data on operations and costs for March follow: Units produced Machine-hours Direct labor-hours Direct materials costs Direct labor costs Manufacturing overhead costs Total costs Basic 1,250 4,600 2,900 $ 9,600 63,400 Dominator 300 1,400 1,900 $ 3,350 38,300 Total 1,550 6,000 4,860 $ 12,950 101,700 165,168 $279,818 Required: Compute the predetermined overhead rate assuming that Tiger Furnishings uses direct labor costs to allocate overhead costs. (Round your answer to 2 decimal places.) % of direct labor cost Predetermined overhead rate Joplin Corporation produces syrups that it sells to candy makers. On November 1, it had no work-in-process inventory. It started production of 44,400 gallons of syrup in November and completed production of 42,000 gallons. The costs of the resources used by Joplin in November consist of the following: Materials Conversion costs (labor and overhead) 5.62,788 54,500 ok ances Required: The production supervisor estimates that the ending work-in-process is 60 percent complete on November 30. Compute the cost of syrup completed and the cost of the syrup in work-in-process ending inventory as of November 30. (Do not round intermediate calculations.) Cost of Syrup completed Work-in-process ending inventory Ralph's Mini-Mort store in Alpine experienced the following events during the current year. 1. Incurred $412,000 in selling costs. 2 incurred $1,212,000 of administrative costs 3. Purchased $419,000 of merchandise. 4. Paid $42,000 for transportation in costs. 5 Took an Inventory at year-end and learned that goods costing $191,000 were on hand. This compared with a beginning inventory of $313,000 on January 1 6. Determined that sales revenue during the year was $3.001,000. 7. Debited all costs incurred to the appropriate account and credited to Accounts Payable. All sales were for cash. Required: Give the amounts for the following items in the Merchandise Inventory account Amount a Beginning balance (BB) b Transfers-in (TI) C Ending balance (EB) a Transfers-out (TO)