Question

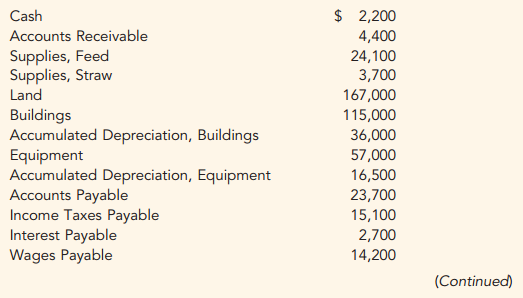

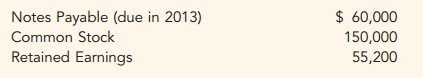

COMPREHENSIVE PROBLEM: REVIEWING THE ACCOUNTING CYCLE Wilburton Riding Stables provides stables, care for animals, and grounds for riding and showing horses. The account balances at

COMPREHENSIVE PROBLEM: REVIEWING THE ACCOUNTING CYCLE

Wilburton Riding Stables provides stables, care for animals, and grounds for riding and showing horses. The account balances at the beginning of 2009 were:

During 2009, the following transactions occurred:

a. Wilburton provided animal care services, all on credit, for $210,300. Wilburton rented stables to customers who cared for their own animals and paid cash of $20,500. Wilburton rented its grounds to individual riders, groups, and show organizations for $41,800 cash.

b. There remains $15,600 of accounts receivable to be collected at December 31, 2009.

c. Feed in the amount of $62,900 was purchased on credit and debited to the supplies, feed account.

d. Straw was purchased for $7,400 cash and debited to the supplies, straw account.

e. Wages payable at the beginning of 2009 were paid early in 2009. Wages were earned and paid during 2009 in the amount of $112,000.

f. The income taxes payable at the beginning of 2009 were paid early in 2009. The accounts payable at the beginning of the year were also paid during the year. There remains $13,600 of accounts payable unpaid at year-end.

g. One years interest at 9 percent was paid on the note payable on July 1, 2009.

h. During 2009, Jon Wilburton, a principal stockholder, purchased a horse for his wife Jennifer to ride. The horse cost $7,000, and Wilburton used his personal credit to purchase it. The horse is stabled at the Wilburtons home rather than at the riding stables.

i. Property taxes were paid on the land and buildings in the amount of $17,000.

j. Dividends were declared and paid in the amount of $7,200. The following data are available for adjusting entries:

* Feed in the amount of $26,000 remained unused at year-end. Straw in the amount of $4,400 remained unused at year-end.

* Annual depreciation on the buildings is $6,000.

* Annual depreciation on the equipment is $5,500.

* Wages of $4,000 were unrecorded and unpaid at year-end.

* Interest for six months at 9 percent per year on the note is unpaid and unrecorded at year-end.

* The income tax rate is 30 percent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started