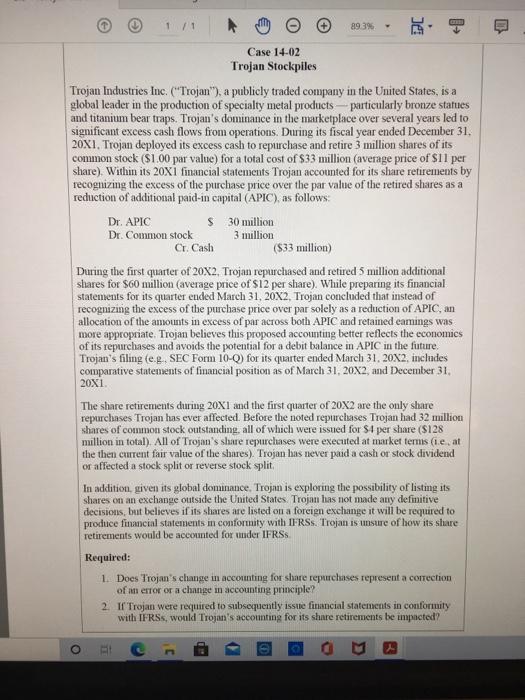

1 / 1 89.3% EL Case 14-02 Trojan Stockpiles Trojan Industries Inc. ("Trojan"), a publicly traded company in the United States, is a global leader in the production of specialty metal products - particularly bronze statues and titanium bear traps. Trojan's dominance in the marketplace over several years led to significant excess cash flows from operations. During its fiscal year ended December 31, 20X1. Trojan deployed its excess cash to repurchase and retire 3 million shares of its common stock ($1.00 par value) for a total cost of $33 million (average price of $11 per share). Within its 20x1 financial statements Trojan accounted for its share retirements by recognizing the excess of the purchase price over the par value of the retired shares as a reduction of additional paid-in capital (APIC), as follows: Dr. APIC S 30 million Dr. Common stock 3 million Cr. Cash ($33 million) During the first quarter of 20x2. Trojan repurchased and retired 5 million additional shares for $60 million (average price of $12 per share). While preparing its financial statements for its quarter euded March 31, 20X2, Trojan concluded that instead of recognizing the excess of the purchase price over par solely as a reduction of APIC, an allocation of the amounts in excess of par across both APIC and retained eamings was more appropriate. Trojan believes this proposed accounting better reflects the economics of its repurchases and avoids the potential for a debit balance in APIC in the future. Trojan's filing (e.... SEC Form 10-0) for its quarter ended March 31, 20X2, includes comparative statements of financial position as of March 31, 20X2and December 31, 20X1 The share retirements during 20X1 and the first quarter of 20X2 are the only share repurchases Trojan has ever affected. Before the noted repurchases Trojan had 32 million shares of common stock outstanding, all of which were issued for S4 per share (5128 million in total). All of Trojan's share repurchases were executed at market fernis (ie, at the then current fair value of the shares). Trojan has never paid a cash or stock dividend or affected a stock split or reverse stock split In addition, given its global dominance, Trojan is exploring the possibility of listing its shares on an exchange outside the United States. Trojan has not made any definitive decisions, but believes if its shares are listed on a foreign exchange it will be required to produce financial statements in conformity with IFRSs. Trojan is unsure of how its share retirements would be accounted for under IFRSs. Required: 1. Does Trojan's change in accouting for share repurchases represent a correction of an error or a change in accounting principle? 2. If Trojan were required to subsequently issue financial statements in conformity with IFRSs, would Trojan's accounting for its share retirements be impacted? o A. Explain the issue as you see it and what challenges there are in addressing the matter in this specific instance and more broadly. B. Ultimately you must decide on how you want to treat the issue and support your decision with relevant research and citations which you feel support your argument. C. link directly to any accounting standards or sources of information you use in your analysis. 3 1 C