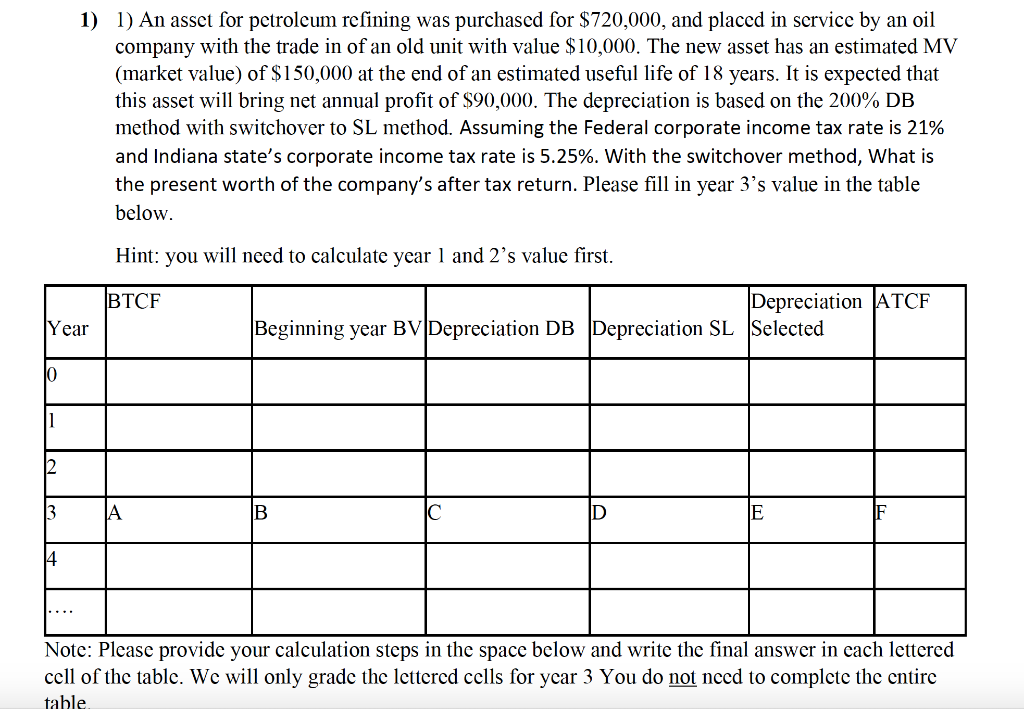

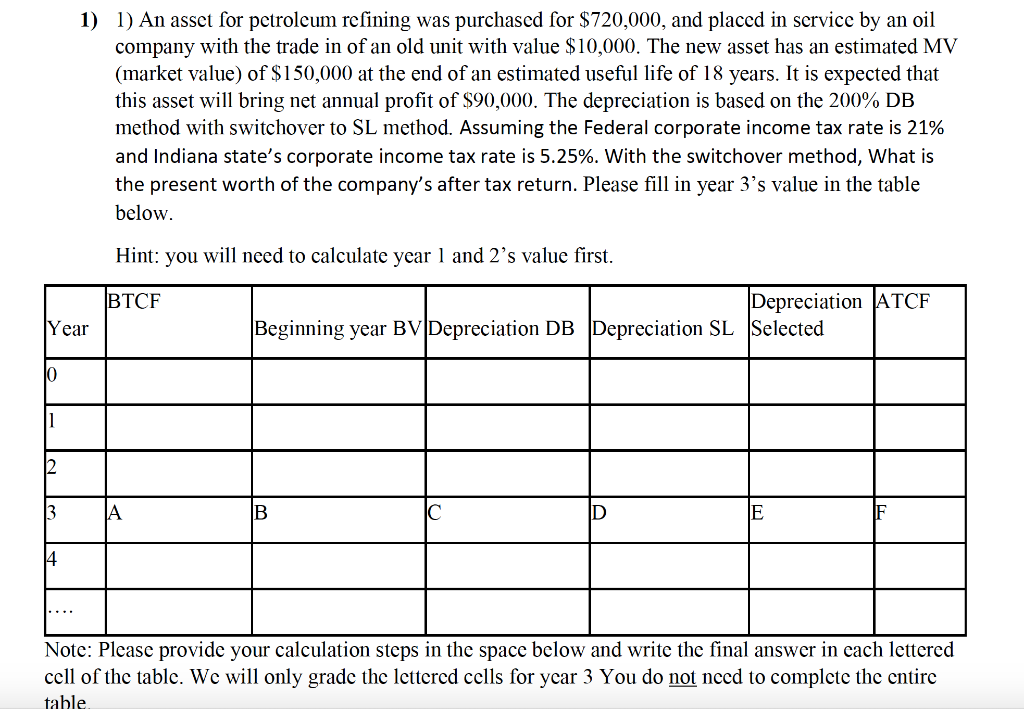

1) 1) An asset for petroleum refining was purchased for $720,000, and placed in service by an oil company with the trade in of an old unit with value $10,000. The new asset has an estimated MV (market value) of $150,000 at the end of an estimated useful life of 18 years. It is expected that this asset will bring net annual profit of $90,000. The depreciation is based on the 200% DB method with switchover to SL method. Assuming the Federal corporate income tax rate is 21% and Indiana state's corporate income tax rate is 5.25%. With the switchover method, What is the present worth of the company's after tax return. Please fill in year 3's value in the table below. Hint: you will need to calculate year 1 and 2's value first. BTCF Year Depreciation ATCF Beginning year BV Depreciation DB Depreciation SL Selected 0 1 2 3 A B D E 14 Note: Please provide your calculation steps in the space below and write the final answer in each lettered cell of the table. We will only grade the lettered cells for year 3 You do not need to complete the entire table 1) 1) An asset for petroleum refining was purchased for $720,000, and placed in service by an oil company with the trade in of an old unit with value $10,000. The new asset has an estimated MV (market value) of $150,000 at the end of an estimated useful life of 18 years. It is expected that this asset will bring net annual profit of $90,000. The depreciation is based on the 200% DB method with switchover to SL method. Assuming the Federal corporate income tax rate is 21% and Indiana state's corporate income tax rate is 5.25%. With the switchover method, What is the present worth of the company's after tax return. Please fill in year 3's value in the table below. Hint: you will need to calculate year 1 and 2's value first. BTCF Year Depreciation ATCF Beginning year BV Depreciation DB Depreciation SL Selected 0 1 2 3 A B D E 14 Note: Please provide your calculation steps in the space below and write the final answer in each lettered cell of the table. We will only grade the lettered cells for year 3 You do not need to complete the entire table