Question

1. 1. Redwood City Pet Shoppe purchased a new insurance policy on July 1st, covering 12 months. Adjust for the expired insurance in July. 2.

1.

1.

1. Redwood City Pet Shoppe purchased a new insurance policy on July 1st, covering 12 months. Adjust for the expired insurance in July.

2. The July depreciation for the Van is $716, and the July depreciation for the building is $7,850.

3. The Office supplies on hand were $3,570; make the adjusting entry for July.

4. The bank notified the company that the July interest was $6,000, and the payment was due in August.

5. In June, a customer paid $2,400 for a new pet; she received the new pet in July.

6. The Pet Shoppe has a 5-day workweek, and the salaries paid in one week are $6,400. At the end of July is on a Tuesday; prepare the adjusting entry for the last week in July.

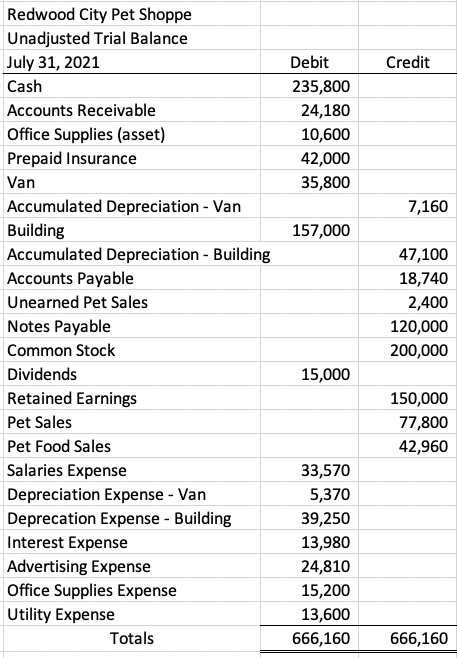

7. Using the Redwood City Pet Shoppe Unadjusted Trial Balance from July 31st, add the adjusting entries prepared to create an Adjusted Trial Balance for July 2021 and present it below. Note: the Adjusted Trial Balance is required; the worksheet is helpful, and an excel template with the (Unadjusted) account names and dollar amounts is available at the beginning of the exam.

8. Using the Redwood City Pet Shoppe Adjusted Trial Balance for July 31st from the last question; Prepare An Income Statement for the Redwood City Pet Shoppe as of July 31, 2021.

9. Using the Redwood City Pet Shoppe Adjusted Trial Balance for July 31st, which you created; Prepare A Statement of Retained Earnings for the Redwood City Pet Shoppe as of July 31, 2021.

10. Using the Redwood City Pet Shoppe Adjusted Trial Balance for July 31st, which you created; Prepare A Balance Sheet for the Redwood City Pet Shoppe as of July 31, 2021.

\begin{tabular}{|l|r|r|} \hline Redwood City Pet Shoppe & \\ \hline Unadjusted Trial Balance & \\ \hline July 31, 2021 & Debit & \multicolumn{1}{|c|}{ Credit } \\ \hline Cash & 235,800 & \\ \hline Accounts Receivable & 24,180 & \\ \hline Office Supplies (asset) & 10,600 & \\ \hline Prepaid Insurance & 42,000 & \\ \hline Van & 35,800 & \\ \hline Accumulated Depreciation - Van & & \\ \hline Building & 157,000 & \\ \hline Accumulated Depreciation - Building & & \\ \hline Accounts Payable & & 47,100 \\ \hline Unearned Pet Sales & & 18,740 \\ \hline Notes Payable & & 2,400 \\ \hline Common Stock & & 120,000 \\ \hline Dividends & & \\ \hline Retained Earnings & & \\ \hline Pet Sales & & \\ \hline Pet Food Sales & & \\ \hline Salaries Expense & & \\ \hline Depreciation Expense - Van & & \\ \hline Deprecation Expense - Building & 39,000,600 \\ \hline Interest Expense & & \\ \hline Advertising Expense & & \\ \hline Office Supplies Expense & & \\ \hline Utility Expense & & \\ \hline & & \\ \hline \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline Redwood City Pet Shoppe & \\ \hline Unadjusted Trial Balance & \\ \hline July 31, 2021 & Debit & \multicolumn{1}{|c|}{ Credit } \\ \hline Cash & 235,800 & \\ \hline Accounts Receivable & 24,180 & \\ \hline Office Supplies (asset) & 10,600 & \\ \hline Prepaid Insurance & 42,000 & \\ \hline Van & 35,800 & \\ \hline Accumulated Depreciation - Van & & \\ \hline Building & 157,000 & \\ \hline Accumulated Depreciation - Building & & \\ \hline Accounts Payable & & 47,100 \\ \hline Unearned Pet Sales & & 18,740 \\ \hline Notes Payable & & 2,400 \\ \hline Common Stock & & 120,000 \\ \hline Dividends & & \\ \hline Retained Earnings & & \\ \hline Pet Sales & & \\ \hline Pet Food Sales & & \\ \hline Salaries Expense & & \\ \hline Depreciation Expense - Van & & \\ \hline Deprecation Expense - Building & 39,000,600 \\ \hline Interest Expense & & \\ \hline Advertising Expense & & \\ \hline Office Supplies Expense & & \\ \hline Utility Expense & & \\ \hline & & \\ \hline \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started