Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1 Q2 Q3 Q4 Q5 PLZ ANSWER ALL THE QUESTIONS I WILL LEAVE A GOOD COMMENT AND RATINGS THANKS Which of the following is one

Q1

Q2

Q3

Q4

Q5

PLZ ANSWER ALL THE QUESTIONS I WILL LEAVE A GOOD COMMENT AND RATINGS THANKS

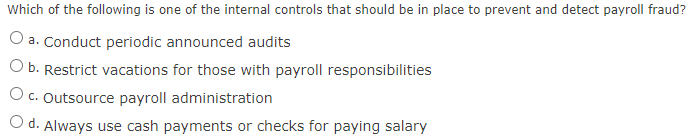

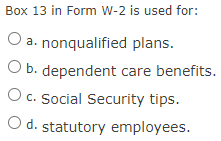

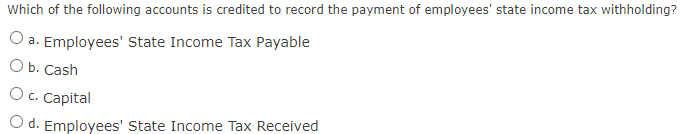

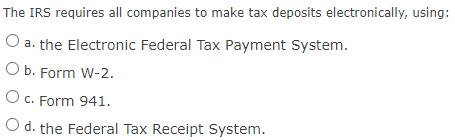

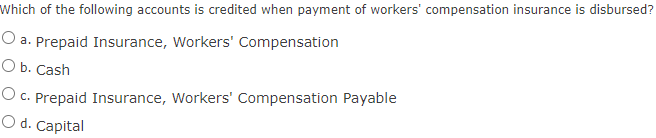

Which of the following is one of the internal controls that should be in place to prevent and detect payroll fraud? O a. Conduct periodic announced audits O b. Restrict vacations for those with payroll responsibilities O c. Outsource payroll administration O d. Always use cash payments or checks for paying salary Box 13 in Form W-2 is used for: O a. nonqualified plans. O b. dependent care benefits. O c. Social Security tips. O d. statutory employees. Which of the following accounts is credited to record the payment of employees' state income tax withholding? a. Employees' State Income Tax Payable O b. Cash O c. Capital O d. Employees' State Income Tax Received The IRS requires all companies to make tax deposits electronically, using: O a. the Electronic Federal Tax Payment System. O b. Form W-2. O c. Form 941. O d. the Federal Tax Receipt System. Which of the following accounts is credited when payment of workers' compensation insurance is disbursed? O a. Prepaid Insurance, Workers' Compensation O b. Cash O c. Prepaid Insurance, Workers' Compensation Payable O d. Capital

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started