Answered step by step

Verified Expert Solution

Question

1 Approved Answer

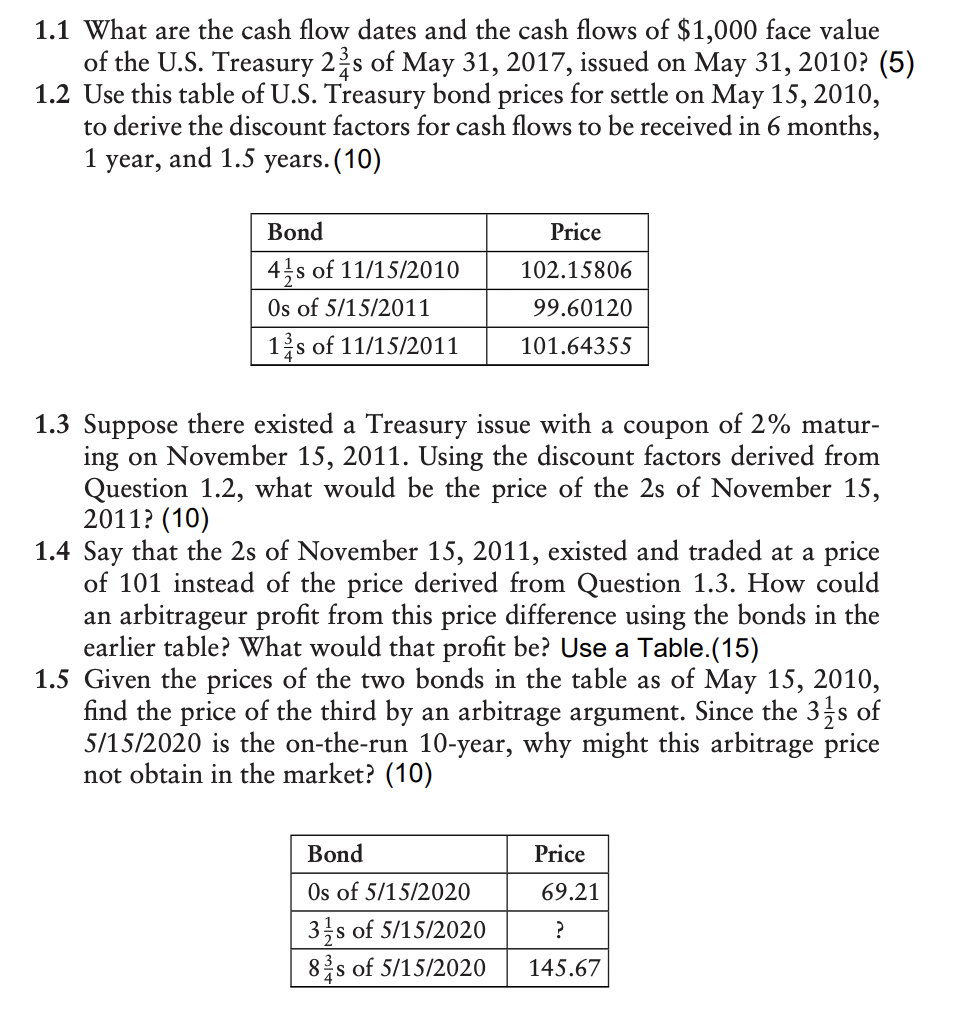

1 . 1 What are the cash flow dates and the cash flows of $ 1 , 0 0 0 face value of the U

What are the cash flow dates and the cash flows of $ face value

of the US Treasury s of May issued on May

Use this table of US Treasury bond prices for settle on May

to derive the discount factors for cash flows to be received in months,

year, and years.

Suppose there existed a Treasury issue with a coupon of matur

ing on November Using the discount factors derived from

Question what would be the price of the s of November

Say that the s of November existed and traded at a price

of instead of the price derived from Question How could

an arbitrageur profit from this price difference using the bonds in the

earlier table? What would that profit be Use a Table.

Given the prices of the two bonds in the table as of May

find the price of the third by an arbitrage argument. Since the of

is the ontherun year, why might this arbitrage price

not obtain in the market?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started