Question

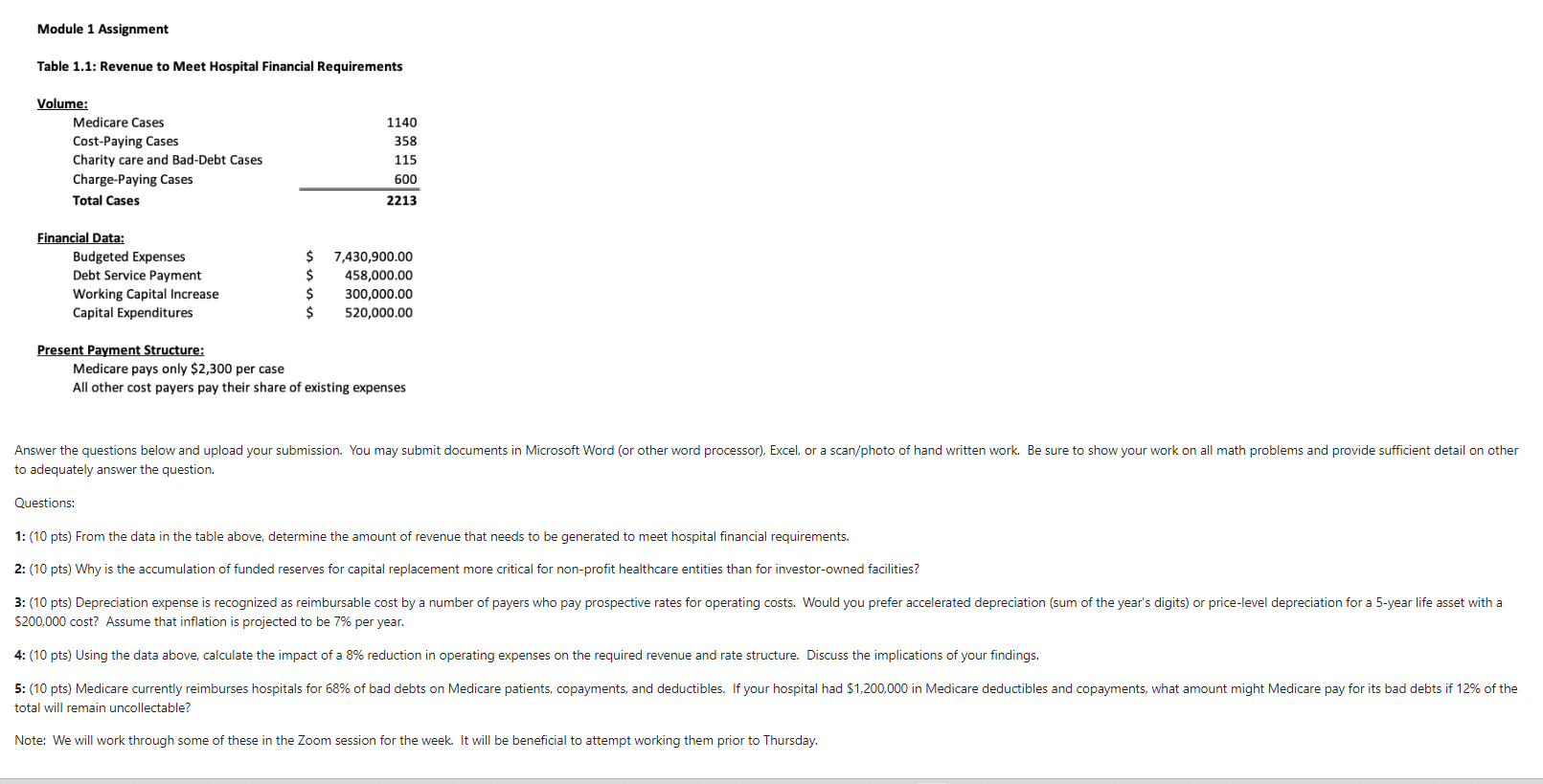

1: (10 pts) From the data in the table above, determine the amount of revenue that needs to be generated to meet hospital financial requirements.

1: (10 pts) From the data in the table above, determine the amount of revenue that needs to be generated to meet hospital financial requirements.

2: (10 pts) Why is the accumulation of funded reserves for capital replacement more critical for non-profit healthcare entities than for investor-owned facilities?

3: (10 pts) Depreciation expense is recognized as reimbursable cost by a number of payers who pay prospective rates for operating costs. Would you prefer accelerated depreciation (sum of the year's digits) or price-level depreciation for a 5-year life asset with a $200,000 cost? Assume that inflation is projected to be 7% per year.

4: (10 pts) Using the data above, calculate the impact of a 8% reduction in operating expenses on the required revenue and rate structure. Discuss the implications of your findings.

5: (10 pts) Medicare currently reimburses hospitals for 68% of bad debts on Medicare patients, copayments, and deductibles. If your hospital had $1,200,000 in Medicare deductibles and copayments, what amount might Medicare pay for its bad debts if 12% of the total will remain uncollectable?

Module 1 Assignment Table 1.1: Revenue to Meet Hospital Financial Requirements Volume: Medicare Cases 1140 Cost-Paying Cases 358 Charity care and Bad-Debt Cases 115 Charge-Paying Cases Total Cases 600 2213 Financial Data: Budgeted Expenses $ 7,430,900.00 Debt Service Payment $ 458,000.00 Working Capital Increase Capital Expenditures $ 300,000.00 $ 520,000.00 Present Payment Structure: Medicare pays only $2,300 per case All other cost payers pay their share of existing expenses Answer the questions below and upload your submission. You may submit documents in Microsoft Word (or other word processor), Excel, or a scan/photo of hand written work. Be sure to show your work on all math problems and provide sufficient detail on other to adequately answer the question. Questions: 1: (10 pts) From the data in the table above, determine the amount of revenue that needs to be generated to meet hospital financial requirements. 2: (10 pts) Why is the accumulation of funded reserves for capital replacement more critical for non-profit healthcare entities than for investor-owned facilities? 3: (10 pts) Depreciation expense is recognized as reimbursable cost by a number of payers who pay prospective rates for operating costs. Would you prefer accelerated depreciation (sum of the year's digits) or price-level depreciation for a 5-year life asset with a $200,000 cost? Assume that inflation is projected to be 7% per year. 4: (10 pts) Using the data above, calculate the impact of a 8% reduction in operating expenses on the required revenue and rate structure. Discuss the implications of your findings. 5: (10 pts) Medicare currently reimburses hospitals for 68% of bad debts on Medicare patients, copayments, and deductibles. If your hospital had $1,200,000 in Medicare deductibles and copayments, what amount might Medicare pay for its bad debts if 12% of the total will remain uncollectable? Note: We will work through some of these in the Zoom session for the week. It will be beneficial to attempt working them prior to Thursday.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started