Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. (11-A1) Exercises in Compound Interest: Answers Supplied Use the appropriate interest table from Appendix B (see page A6 or A9) to complete the following

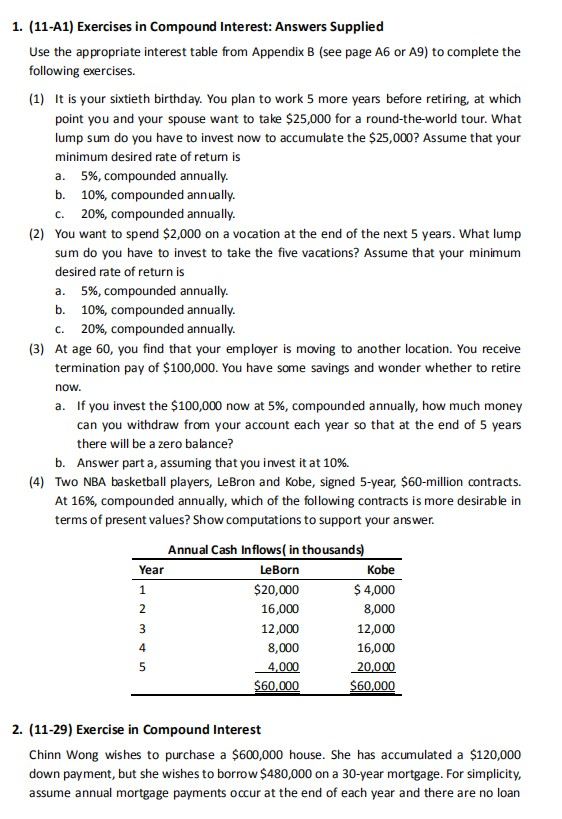

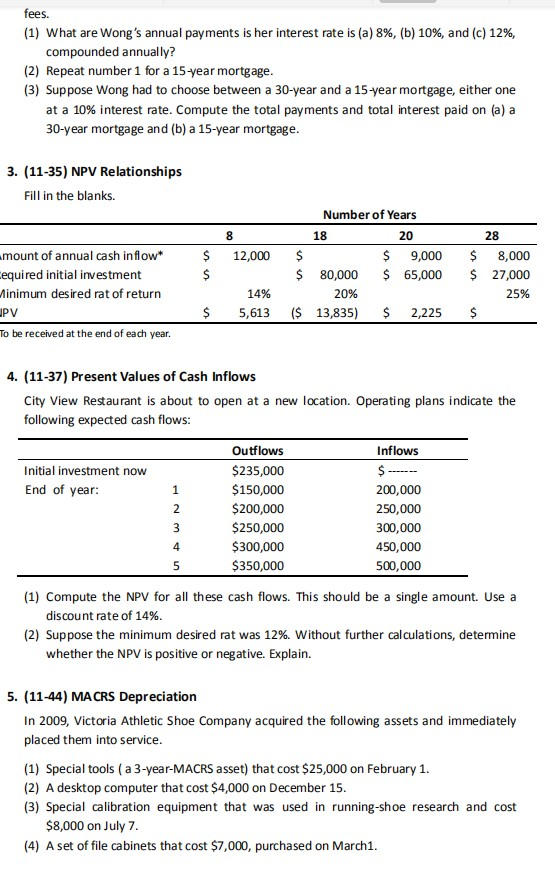

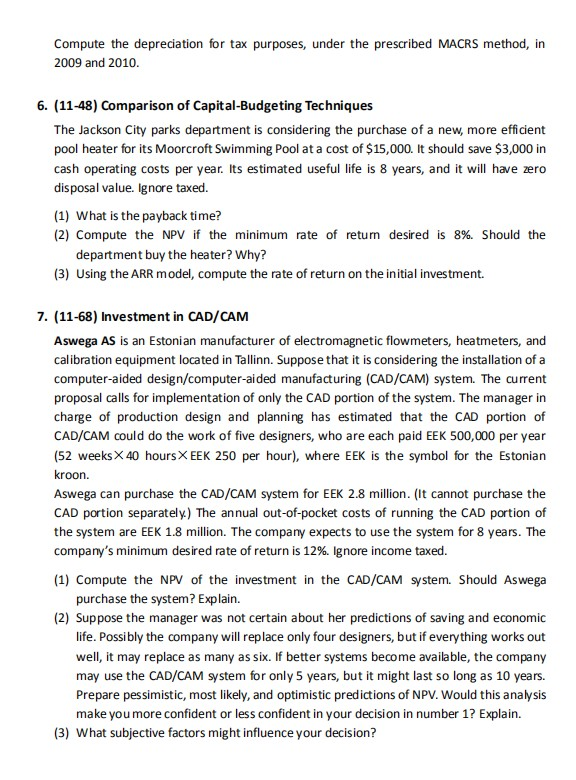

1. (11-A1) Exercises in Compound Interest: Answers Supplied Use the appropriate interest table from Appendix B (see page A6 or A9) to complete the following exercises. (1) It is your sixtieth birthday. You plan to work 5 more years before retiring, at which point you and your spouse want to take $25,000 for a round-the-world tour. What lump sum do you have to invest now to accumulate the $25,000? Assume that your minimum desired rate of return is a. 5%, compounded annually. 10%, compounded annually. b. 20%, compounded annually. C. (2) You want to spend $2,000 on a vocation at the end of the next 5 years. What lump sum do you have to invest to take the five vacations? Assume that your minimum desired rate of return is 5%, compounded annually. a. b. 10%, compounded annually. 20%, compounded annually. C. (3) At age 60, you find that your employer is moving to another location. You receive termination pay of $100,000. You have some savings and wonder whether to retire now. a. If you invest the $100,000 now at 5%, compounded annually, how much money can you withdraw from your account each year so that at the end of 5 years there will be a zero balance? b. Answer part a, assuming that you invest it at 10%. (4) Two NBA basketball players, LeBron and Kobe, signed 5-year, $60-million contracts. At 16%, compounded annually, which of the following contracts is more desirable in terms of present values? Show computations to support your answer. Annual Cash Inflows( in thousands) Year LeBorn Kobe $ 4,000 $20,000 16,000 2. 8,000 12,000 12,000 8,000 16,000 4,000 20,000 $60,000 $60,000 2. (11-29) Exercise in Compound Interest Chinn Wong wishes to purchase a $600,000 house. She has accumulated a $120,000 down payment, but she wishes to borrow $480,000 on a 30-year mortgage. For simplicity, assume annual mortgage payments occur at the end of each year and there are no loan fees. (1) What are Wong's annual payments is her interest rate is (a) 8%, (b) 10%, and (c) 12%, compounded annually? (2) Repeat number 1 for a 15-year mortgage. (3) Suppose Wong had to choose between a 30-year and a 15-year mortgage, either one at a 10% interest rate. Compute the total payments and total interest paid on (a) a 30-year mortgage and (b) a 15-year mortgage. 3. (11-35) NPV Relationships Fill in the blanks. Number of Years 8. 18 20 28 mount of annual cash inflow* 12,000 9,000 8,000 cequired initial investment $ 80,000 $ 65,000 $ 27,000 Minimum desired rat of return 14% 20% 25% UPV ($ 13,835) 5,613 2,225 To be received at the end of each year. 4. (11-37) Present Values of Cash Inflows City View Restaurant is about to open at a new location. Operating plans indicate the following expected cash flows: Outflows Inflows Initial investment now $235,000 $ - End of year: $150,000 200,000 $200,000 2 250,000 $250,000 300,000 $300,000 4 450,000 $350,000 500,000 (1) Compute the NPV for all these cash flows. This should be a single amount. Use a discount rate of 14%. (2) Suppose the minimum desired rat was 12%. Without further calculations, determine whether the NPV is positive or negative. Explain. 5. (11-44) MACRS Depreciation In 2009, Victoria Athletic Shoe Company acquired the following assets and immediately placed them into service. (1) Special tools (a 3-year-MACRS asset) that cost $25,000 on February 1. (2) A desktop computer that cost $4,000 on December 15. (3) Special calibration equipment that was used in running-shoe research and cost $8,000 on July 7. (4) A set of file cabinets that cost $7,000, purchased on March1. Compute the depreciation for tax purposes, under the prescribed MACRS method, in 2009 and 2010. 6. (11-48) Comparison of Capital-Budgeting Techniques The Jackson City parks department is considering the purchase of a new, more efficient pool heater for its Moorcroft Swimming Pool at a cost of $15,000. It should save $3,000 in cash operating costs per year. Its estimated useful life is 8 years, and it will have zero disposal value. Ignore taxed. (1) What is the payback time? (2) Compute the NPV if the minimum rate of return desired is 8%. Should the department buy the heater? Why? (3) Using the ARR model, compute the rate of return on the initial investment. 7. (11-68) Investment in CAD/CAM Aswega AS is an Estonian manufacturer of electromagnetic flowmeters, heatmeters, and calibration equipment located in Tallin. Suppose that it is considering the installation of a computer-aided design/computer-aided manufacturing (CAD/CAM) system. The current proposal calls for implementation of only the CAD portion of the system. The manager in charge of production design and planning has estimated that the CAD portion of CAD/CAM could do the work of five designers, who are each paid EEK 500,000 per year (52 weeksX 40 hoursX EEK 250 per hour), where EEK is the symbol for the Estonian kroon. Aswega can purchase the CAD/CAM system for EEK 2.8 million. (It cannot purchase the CAD portion separately) The annual out-of-pocket costs of running the CAD portion of the system are EEK 1.8 million. The company expects to use the system for 8 years. The company's minimum desired rate of return is 12%. Ignore income taxed. (1) Compute the NPV of the investment in the CAD/CAM system. Should Aswega purchase the system? Explain. (2) Suppose the manager was not certain about her predictions of saving and economic life. Possibly the company will replace only four designers, but if everything works out well, it may replace as many as six. If better systems become available, the company may use the CAD/CAM system for only 5 years, but it might last so long as 10 years. Prepare pessimistic, most likely, and optimistic predictions of NPV. Would this analysis make you more confident or less confident in your decision in number 1? Explain. (3) What subjective factors might influence your decision? 1. (11-A1) Exercises in Compound Interest: Answers Supplied Use the appropriate interest table from Appendix B (see page A6 or A9) to complete the following exercises. (1) It is your sixtieth birthday. You plan to work 5 more years before retiring, at which point you and your spouse want to take $25,000 for a round-the-world tour. What lump sum do you have to invest now to accumulate the $25,000? Assume that your minimum desired rate of return is a. 5%, compounded annually. 10%, compounded annually. b. 20%, compounded annually. C. (2) You want to spend $2,000 on a vocation at the end of the next 5 years. What lump sum do you have to invest to take the five vacations? Assume that your minimum desired rate of return is 5%, compounded annually. a. b. 10%, compounded annually. 20%, compounded annually. C. (3) At age 60, you find that your employer is moving to another location. You receive termination pay of $100,000. You have some savings and wonder whether to retire now. a. If you invest the $100,000 now at 5%, compounded annually, how much money can you withdraw from your account each year so that at the end of 5 years there will be a zero balance? b. Answer part a, assuming that you invest it at 10%. (4) Two NBA basketball players, LeBron and Kobe, signed 5-year, $60-million contracts. At 16%, compounded annually, which of the following contracts is more desirable in terms of present values? Show computations to support your answer. Annual Cash Inflows( in thousands) Year LeBorn Kobe $ 4,000 $20,000 16,000 2. 8,000 12,000 12,000 8,000 16,000 4,000 20,000 $60,000 $60,000 2. (11-29) Exercise in Compound Interest Chinn Wong wishes to purchase a $600,000 house. She has accumulated a $120,000 down payment, but she wishes to borrow $480,000 on a 30-year mortgage. For simplicity, assume annual mortgage payments occur at the end of each year and there are no loan fees. (1) What are Wong's annual payments is her interest rate is (a) 8%, (b) 10%, and (c) 12%, compounded annually? (2) Repeat number 1 for a 15-year mortgage. (3) Suppose Wong had to choose between a 30-year and a 15-year mortgage, either one at a 10% interest rate. Compute the total payments and total interest paid on (a) a 30-year mortgage and (b) a 15-year mortgage. 3. (11-35) NPV Relationships Fill in the blanks. Number of Years 8. 18 20 28 mount of annual cash inflow* 12,000 9,000 8,000 cequired initial investment $ 80,000 $ 65,000 $ 27,000 Minimum desired rat of return 14% 20% 25% UPV ($ 13,835) 5,613 2,225 To be received at the end of each year. 4. (11-37) Present Values of Cash Inflows City View Restaurant is about to open at a new location. Operating plans indicate the following expected cash flows: Outflows Inflows Initial investment now $235,000 $ - End of year: $150,000 200,000 $200,000 2 250,000 $250,000 300,000 $300,000 4 450,000 $350,000 500,000 (1) Compute the NPV for all these cash flows. This should be a single amount. Use a discount rate of 14%. (2) Suppose the minimum desired rat was 12%. Without further calculations, determine whether the NPV is positive or negative. Explain. 5. (11-44) MACRS Depreciation In 2009, Victoria Athletic Shoe Company acquired the following assets and immediately placed them into service. (1) Special tools (a 3-year-MACRS asset) that cost $25,000 on February 1. (2) A desktop computer that cost $4,000 on December 15. (3) Special calibration equipment that was used in running-shoe research and cost $8,000 on July 7. (4) A set of file cabinets that cost $7,000, purchased on March1. Compute the depreciation for tax purposes, under the prescribed MACRS method, in 2009 and 2010. 6. (11-48) Comparison of Capital-Budgeting Techniques The Jackson City parks department is considering the purchase of a new, more efficient pool heater for its Moorcroft Swimming Pool at a cost of $15,000. It should save $3,000 in cash operating costs per year. Its estimated useful life is 8 years, and it will have zero disposal value. Ignore taxed. (1) What is the payback time? (2) Compute the NPV if the minimum rate of return desired is 8%. Should the department buy the heater? Why? (3) Using the ARR model, compute the rate of return on the initial investment. 7. (11-68) Investment in CAD/CAM Aswega AS is an Estonian manufacturer of electromagnetic flowmeters, heatmeters, and calibration equipment located in Tallin. Suppose that it is considering the installation of a computer-aided design/computer-aided manufacturing (CAD/CAM) system. The current proposal calls for implementation of only the CAD portion of the system. The manager in charge of production design and planning has estimated that the CAD portion of CAD/CAM could do the work of five designers, who are each paid EEK 500,000 per year (52 weeksX 40 hoursX EEK 250 per hour), where EEK is the symbol for the Estonian kroon. Aswega can purchase the CAD/CAM system for EEK 2.8 million. (It cannot purchase the CAD portion separately) The annual out-of-pocket costs of running the CAD portion of the system are EEK 1.8 million. The company expects to use the system for 8 years. The company's minimum desired rate of return is 12%. Ignore income taxed. (1) Compute the NPV of the investment in the CAD/CAM system. Should Aswega purchase the system? Explain. (2) Suppose the manager was not certain about her predictions of saving and economic life. Possibly the company will replace only four designers, but if everything works out well, it may replace as many as six. If better systems become available, the company may use the CAD/CAM system for only 5 years, but it might last so long as 10 years. Prepare pessimistic, most likely, and optimistic predictions of NPV. Would this analysis make you more confident or less confident in your decision in number 1? Explain. (3) What subjective factors might influence your decision

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started