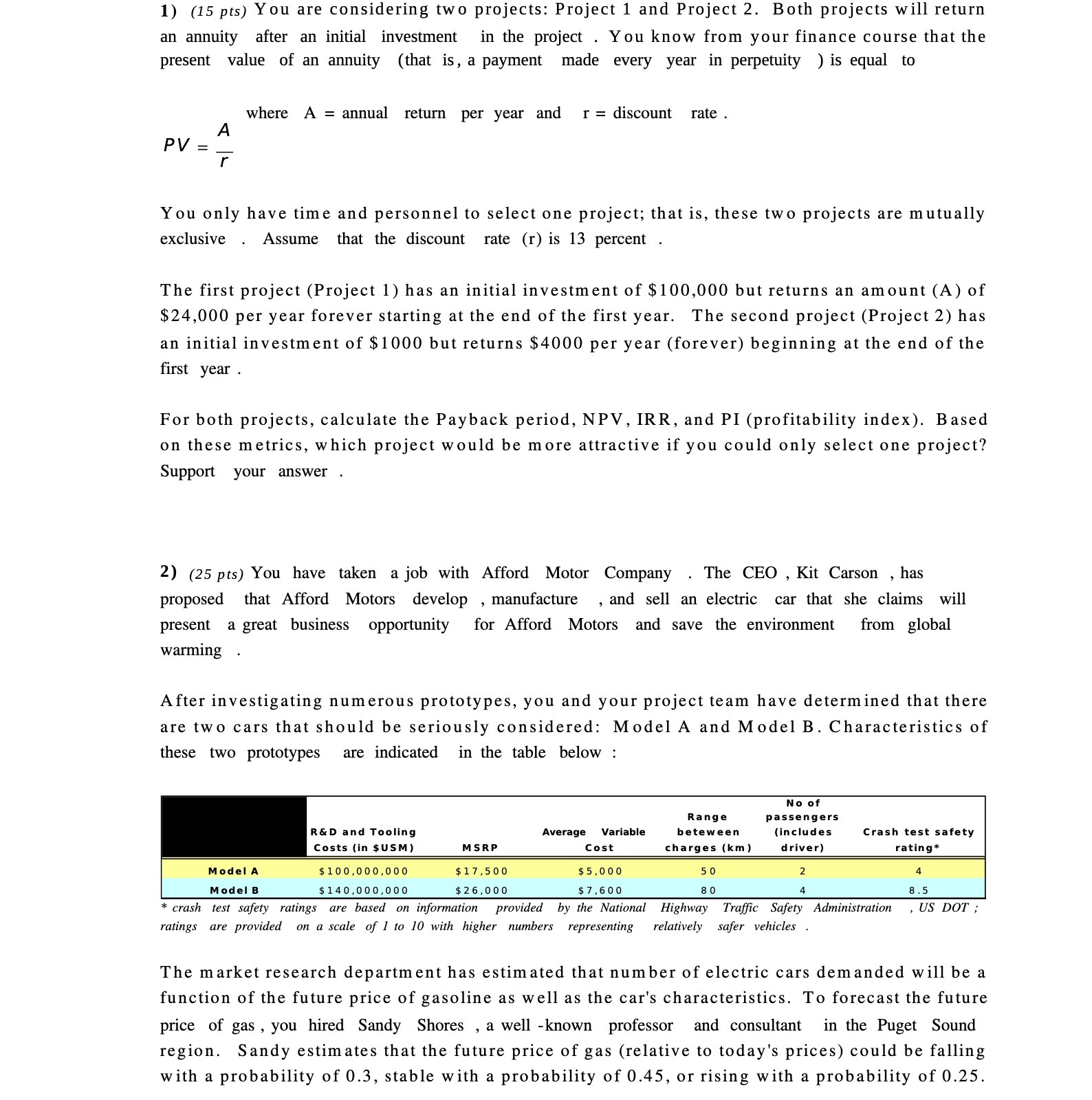

1) (15 pts) You are considering two projects: Project 1 and Project 2. Both projects will return an annuity after an initial investment in the project . You know from your finance course that the present value of an annuity (that is, a payment made every year in perpetuity )is equal to where A = annual return per year and r = discount rate . A PV: r. You only have time and personnel to select one project; that is, these two projects are mutually exclusive . Assume that the discount rate (r) is 13 percent . The first project (Project 1) has an initial investment of $100,000 but returns an amount (A) of $24,000 per year forever starting at the end of the first year. The second project (Project 2) has an initial investment of $1000 but returns $4000 per year (forever) beginning at the end of the rst year . For both projects, calculate the Payback period, NPV, IRR, and PI (profitability index). Based on these metrics, which project would be more attractive if you could only select one project? Support your answer . 2) (25 pts) You have taken a job with Afford Motor Company . The CEO , Kit Carson , has proposed that Afford Motors develop , manufacture , and sell an electric car that she claims will present a great business opportunity for Afford Motors and save the environment from global warming After investigating numerous prototypes, you and your project team have determined that there are two cars that should be seriously considered: Model A and Model B. Characteristics of these two prototypes are indicated in the table below : [In of Range passengers RED and Tooling Average Varlahle heteween (includes Crash test safety Costsiln $USM) Cast charges (km) drlvar] ratlng' $100,000,000 $17,500 $140,000,000 $26,000 * crash test safety ratings are based on information provided by the National Highway Tm'ic Safety Administration ratings are provided on a scale of 1 in 10 with higher numbers representing relatively safer vehicles . . US DOT: The market research department has estimated that number of electric cars demanded will be a function of the future price of gasoline as well as the car's characteristics. To forecast the future price of gas , you hired Sandy Shores , a well -known professor and consultant in the Puget Sound region. Sandy estimates that the future price of gas (relative to today's prices) could be falling with a probability of 0.3, stable with a probability of 0.45, or rising with a probability of 0.25