Answered step by step

Verified Expert Solution

Question

1 Approved Answer

) 1 2 3 4 5 16 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64

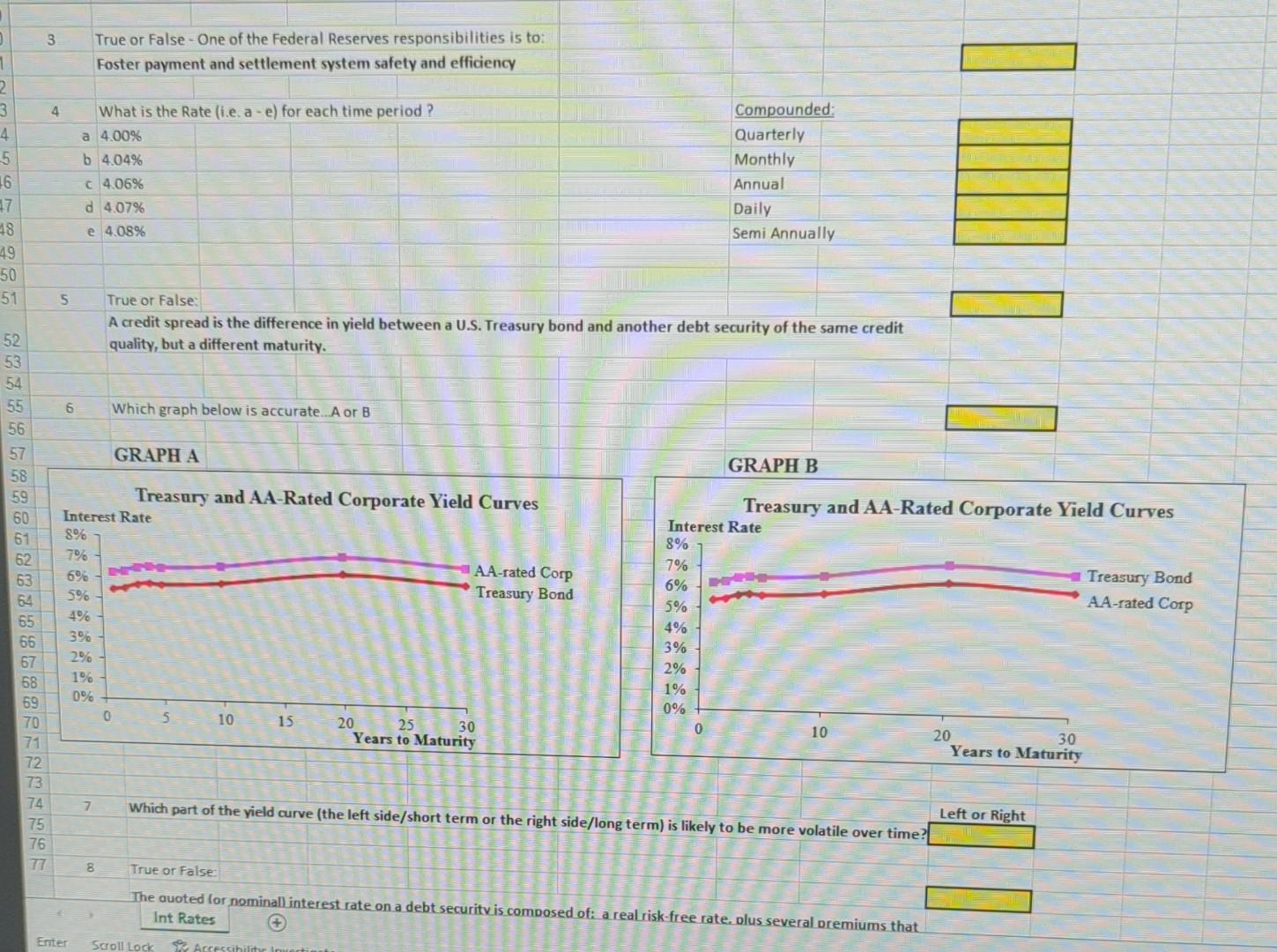

) 1 2 3 4 5 16 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 3 75 76 77 4 5 True or False-One of the Federal Reserves responsibilities is to: Foster payment and settlement system safety and efficiency What is the Rate (i.e. a - e) for each time period? Compounded: Quarterly a 4.00% b 4.04% Monthly Annual C 4.06% d 4.07% Daily e 4.08% Semi Annually True or False: A credit spread is the difference in yield between a U.S. Treasury bond and another debt security of the same credit quality, but a different maturity. 6 Which graph below is accurate...A or B GRAPH A GRAPH B Treasury and AA-Rated Corporate Yield Curves Treasury and AA-Rated Corporate Yield Curves AA-rated Corp Treasury Bond Treasury Bond AA-rated Corp 0 5 10 15 30 0 10 20 25 Years to Maturity 20 7 Which part of the yield curve (the left side/short term or the right side/long term) is likely to be more volatile over time? 8 True or False The quoted (or nominall interest rate on a debt security is composed of: a real risk-free rate. plus several premiums that Int Rates Scroll Lock Accessibilitir Invertian Interest Rate 8% 7% - 6%- N 5% 4% 3% 2% 1% 0% Enter Interest Rate 8% 7% 6% 5% 4% 3% 2% 1% 0% 30 Years to Maturity Left or Right ) 1 2 3 4 5 16 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 3 75 76 77 4 5 True or False-One of the Federal Reserves responsibilities is to: Foster payment and settlement system safety and efficiency What is the Rate (i.e. a - e) for each time period? Compounded: Quarterly a 4.00% b 4.04% Monthly Annual C 4.06% d 4.07% Daily e 4.08% Semi Annually True or False: A credit spread is the difference in yield between a U.S. Treasury bond and another debt security of the same credit quality, but a different maturity. 6 Which graph below is accurate...A or B GRAPH A GRAPH B Treasury and AA-Rated Corporate Yield Curves Treasury and AA-Rated Corporate Yield Curves AA-rated Corp Treasury Bond Treasury Bond AA-rated Corp 0 5 10 15 30 0 10 20 25 Years to Maturity 20 7 Which part of the yield curve (the left side/short term or the right side/long term) is likely to be more volatile over time? 8 True or False The quoted (or nominall interest rate on a debt security is composed of: a real risk-free rate. plus several premiums that Int Rates Scroll Lock Accessibilitir Invertian Interest Rate 8% 7% - 6%- N 5% 4% 3% 2% 1% 0% Enter Interest Rate 8% 7% 6% 5% 4% 3% 2% 1% 0% 30 Years to Maturity Left or Right

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started