Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 2 3 4 5 6 7 8 9 10 11 12 Perpetual Inventory Using Weighted Average Beginning inventory, purchases, and sales for WCS12 are

1

2

3

4

5

6

7

8

9

10

11

12

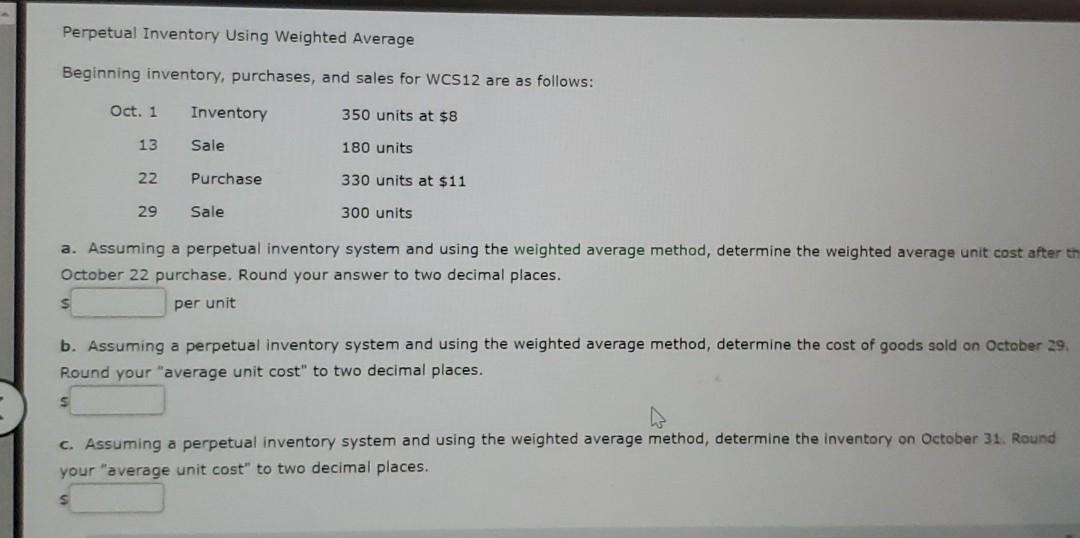

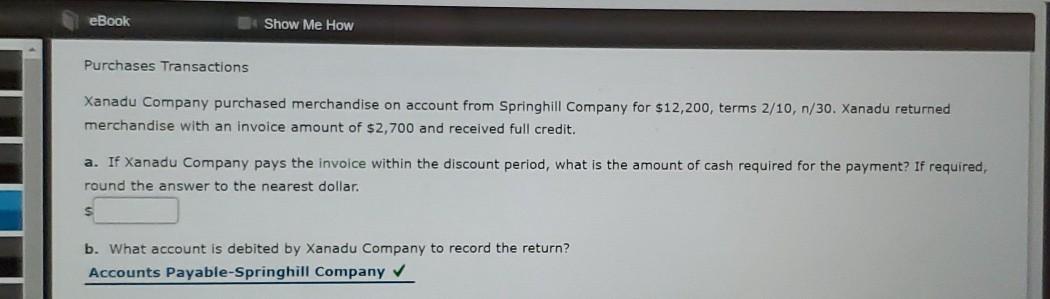

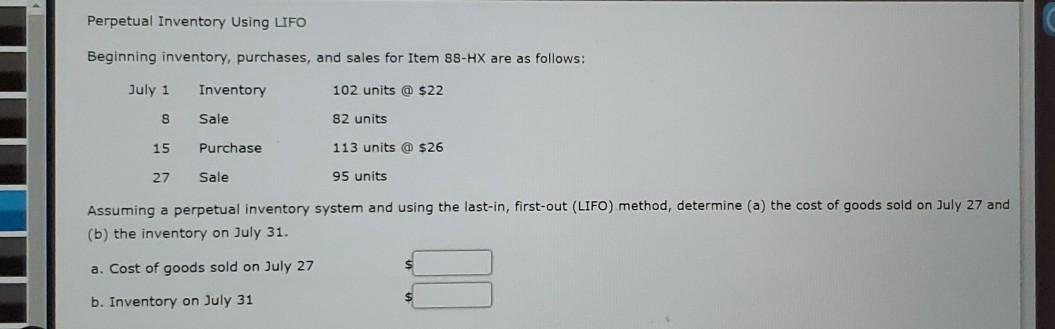

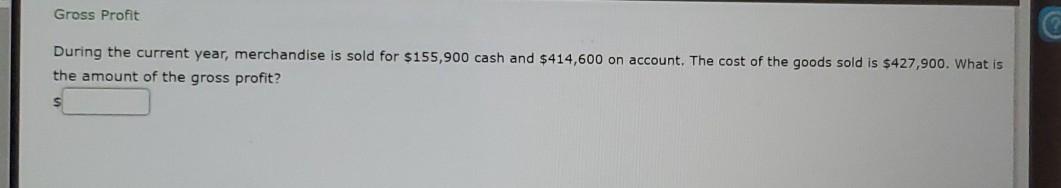

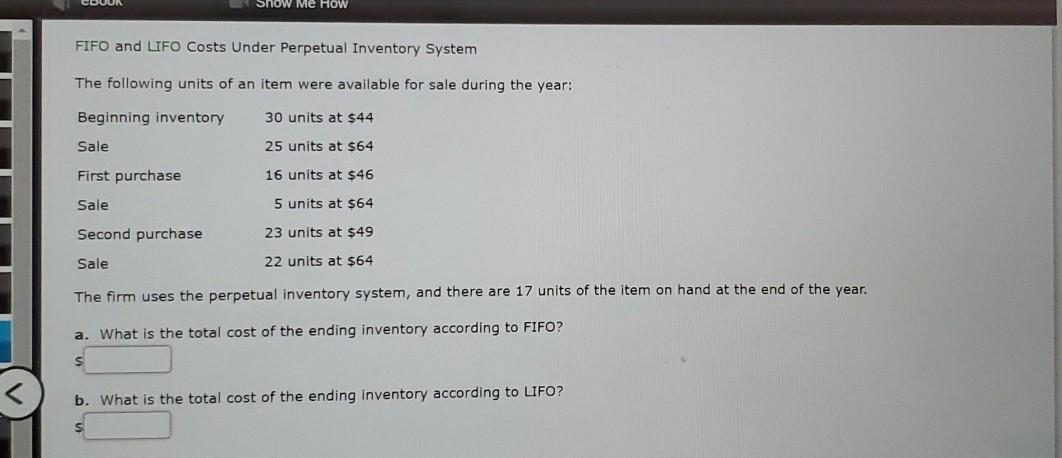

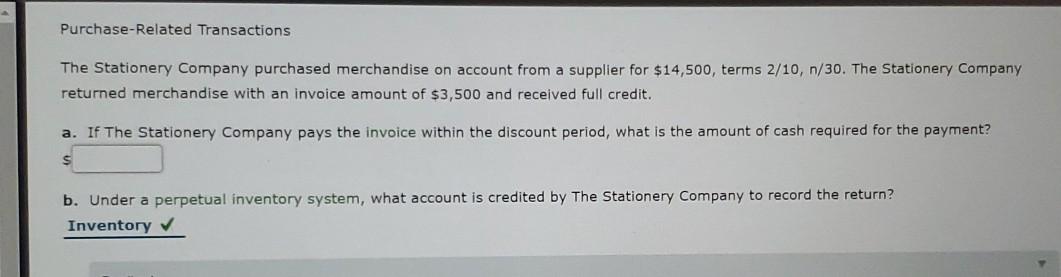

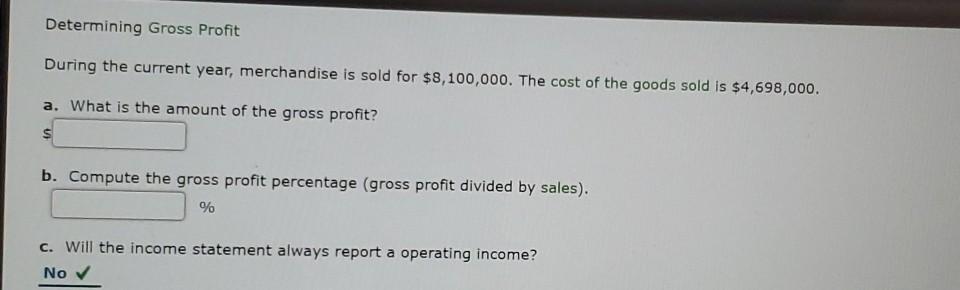

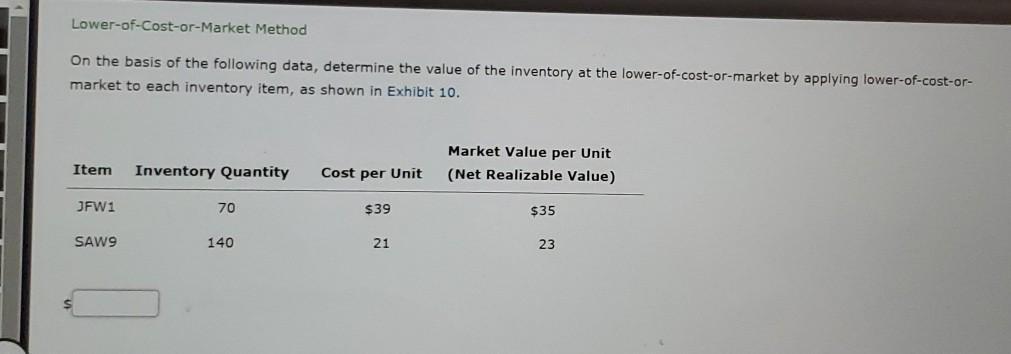

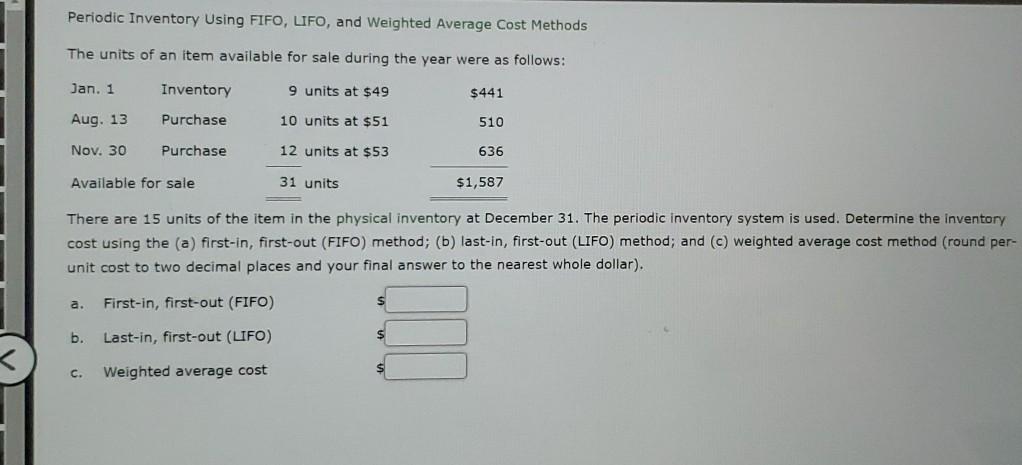

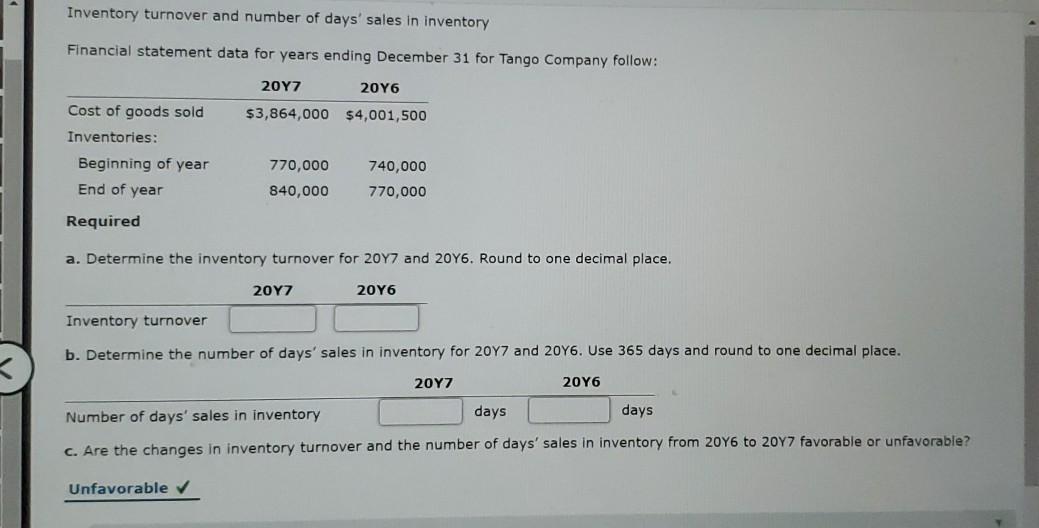

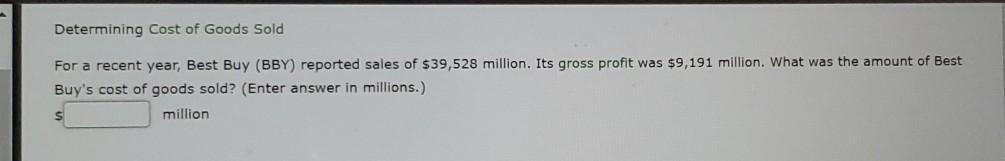

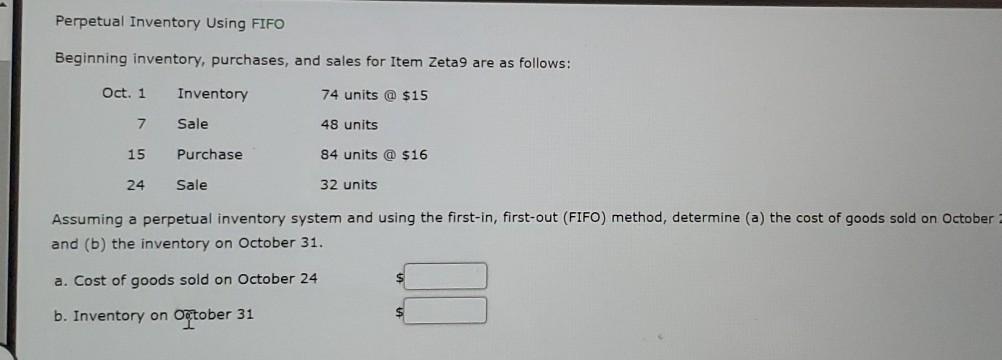

Perpetual Inventory Using Weighted Average Beginning inventory, purchases, and sales for WCS12 are as follows: Oct. 1 Inventory 350 units at $8 13 Sale 180 units 22 Purchase 330 units at $11 29 Sale 300 units a. Assuming a perpetual inventory system and using the weighted average method, determine the weighted average unit cost after th October 22 purchase. Round your answer to two decimal places. per unit b. Assuming a perpetual inventory system and using the weighted average method, determine the cost of goods sold on October 29. Round your "average unit cost" to two decimal places. c. Assuming a perpetual inventory system and using the weighted average method, determine the inventory on October 31. Round your "average unit cost to two decimal places. eBook Show Me How Purchases Transactions Xanadu Company purchased merchandise on account from Springhill Company for $12,200, terms 2/10, n/30. Xanadu returned merchandise with an invoice amount of $2,700 and received full credit. a. If Xanadu Company pays the invoice within the discount period, what is the amount of cash required for the payment? If required, round the answer to the nearest dollar. b. What account is debited by Xanadu Company to record the return? Accounts Payable-Springhill Company Perpetual Inventory Using LIFO Beginning inventory, purchases, and sales for item 88-HX are as follows: July 1 Inventory 102 units @ $22 8 Sale 82 units 15 Purchase 113 units @ $26 27 Sale 95 units Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of goods sold on July 27 and (b) the inventory on July 31. a. Cost of goods sold on July 27 II b. Inventory on July 31 Gross Profit During the current year, merchandise is sold for $155,900 cash and $414,600 on account. The cost of the goods sold is $427,900. What is the amount of the gross profit? Show Me How FIFO and LIFO Costs Under Perpetual Inventory System The following units of an item were available for sale during the year: Beginning inventory 30 units at $44 Sale 25 units at $64 First purchase 16 units at $46 Sale 5 units at $64 Second purchase 23 units at $49 Sale 22 units at $64 The firm uses the perpetual inventory system, and there are 17 units of the item on hand at the end of the year. a. What is the total cost of the ending inventory according to FIFO? b. What is the total cost of the ending inventory according to LIFO? Purchase-Related Transactions The Stationery Company purchased merchandise on account from a supplier for $14,500, terms 2/10, n/30. The Stationery Company returned merchandise with an invoice amount of $3,500 and received full credit. a. If The Stationery Company pays the invoice within the discount period, what is the amount of cash required for the payment? b. Under a perpetual inventory system, what account is credited by The Stationery Company to record the return? Inventory Determining Gross Profit During the current year, merchandise is sold for $8,100,000. The cost of the goods sold is $4,698,000. a. What is the amount of the gross profit? S b. Compute the gross profit percentage (gross profit divided by sales). % c. Will the income statement always report a operating income? No Lower-of-Cost-or-Market Method On the basis of the following data, determine the value of the inventory at the lower-of-cost-or-market by applying lower-of-cost-or- market to each inventory item, as shown in Exhibit 10. Market Value per Unit (Net Realizable Value) Item Inventory Quantity Cost per Unit JFW1 70 $39 $35 SAW9 140 21 23 Periodic Inventory Using FIFO, LIFO, and weighted Average Cost Methods The units of an item available for sale during the year were as follows: Jan. 1 Inventory 9 units at $49 $441 Aug. 13 Purchase 10 units at $51 510 Nov. 30 Purchase 12 units at $53 636 Available for sale 31 units $1,587 There are 15 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost using the (a) first-in, first-out (FIFO) method; (b) last-in, first-out (LIFO) method; and (c) weighted average cost method (round per- unit cost to two decimal places and your final answer to the nearest whole dollar). First-in, first-out (FIFO) b. Last-in, first-out (LIFO) $ C. Weighted average cost $ Inventory turnover and number of days' sales in inventory Financial statement data for years ending December 31 for Tango Company follow: 2017 2016 $3,864,000 $4,001,500 Cost of goods sold Inventories: Beginning of year 770,000 840,000 740,000 770,000 End of year Required a. Determine the inventory turnover for 2017 and 20Y6. Round to one decimal place. 2017 2016 Inventory turnover b. Determine the number of days' sales in inventory for 2017 and 20Y6. Use 365 days and round to one decimal place. 20Y7 2016 Number of days' sales in inventory days days c. Are the changes in inventory turnover and the number of days' sales in inventory from 2016 to 20,7 favorable or unfavorable? Unfavorable Determining Cost of Goods Sold For a recent year, Best Buy (BBY) reported sales of $39,528 million. Its gross profit was $9,191 million. What was the amount of Best Buy's cost of goods sold? (Enter answer in millions.) million Perpetual Inventory Using FIFO Beginning inventory, purchases, and sales for Item Zeta 9 are as follows: Oct. 1 Inventory 74 units @ $15 7 Sale 48 units 15 Purchase 84 units @ $16 24 Sale 32 units Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of goods sold on October and (b) the inventory on October 31. a. Cost of goods sold on October 24 II b. Inventory on October 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started