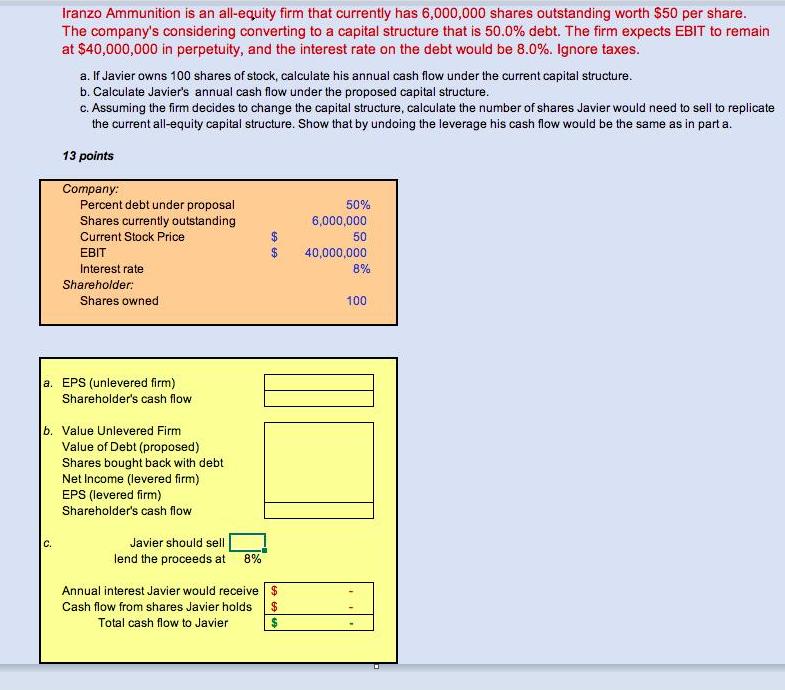

Question: Iranzo Ammunition is an all-equity firm that currently has 6,000,000 shares outstanding worth $50 per share. The company's considering converting to a capital structure

Iranzo Ammunition is an all-equity firm that currently has 6,000,000 shares outstanding worth $50 per share. The company's considering converting to a capital structure that is 50.0% debt. The firm expects EBIT to remain at $40,000,000 in perpetuity, and the interest rate on the debt would be 8.0%. Ignore taxes. a. If Javier owns 100 shares of stock, calculate his annual cash flow under the current capital structure. b. Calculate Javier's annual cash flow under the proposed capital structure. c. Assuming the firm decides to change the capital structure, calculate the number of shares Javier would need to sell to replicate the current all-equity capital structure. Show that by undoing the leverage his cash flow would be the same as in part a. 13 points C. Company: Percent debt under proposal Shares currently outstanding Current Stock Price EBIT Interest rate Shareholder: Shares owned a. EPS (unlevered firm) Shareholder's cash flow b. Value Unlevered Firm Value of Debt (proposed) Shares bought back with debt Net Income (levered firm) EPS (levered firm) Shareholder's cash flow B Javier should sell lend the proceeds at 8% Annual interest Javier would receive Cash flow from shares Javier holds Total cash flow to Javier 69 69 $ $ $ 50% 6,000,000 50 40,000,000 8% 100

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Lets break down the problem step by step a To calculate Javiers annual cash flow under the current capital structure we first need to find the earning... View full answer

Get step-by-step solutions from verified subject matter experts