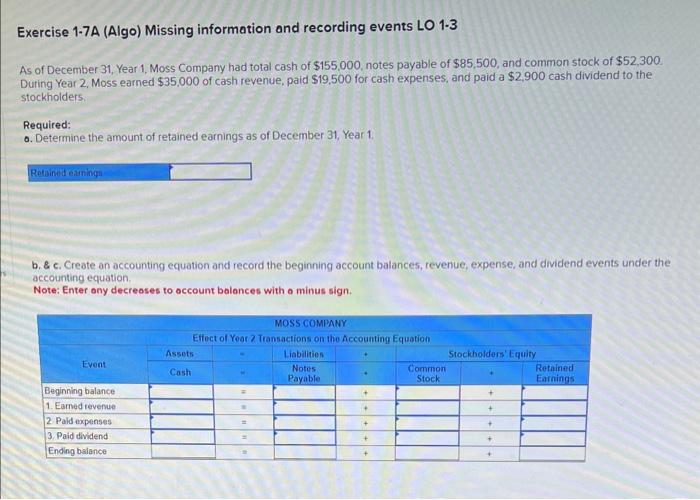

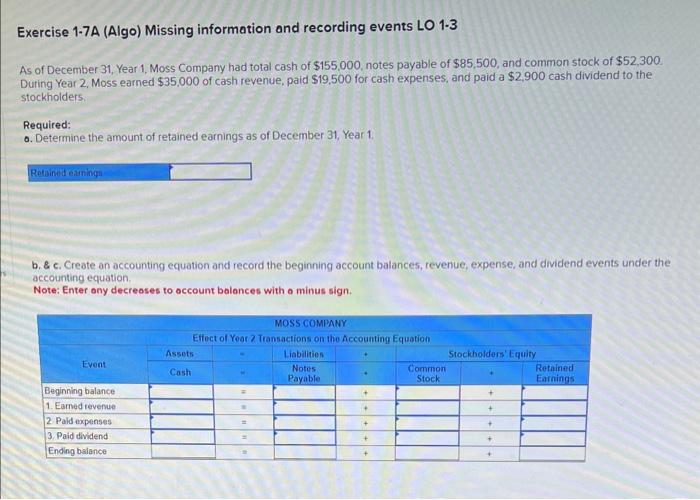

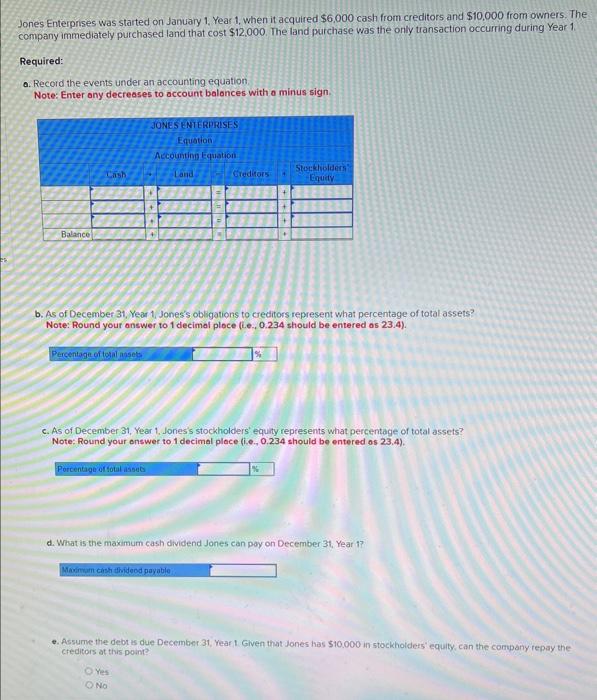

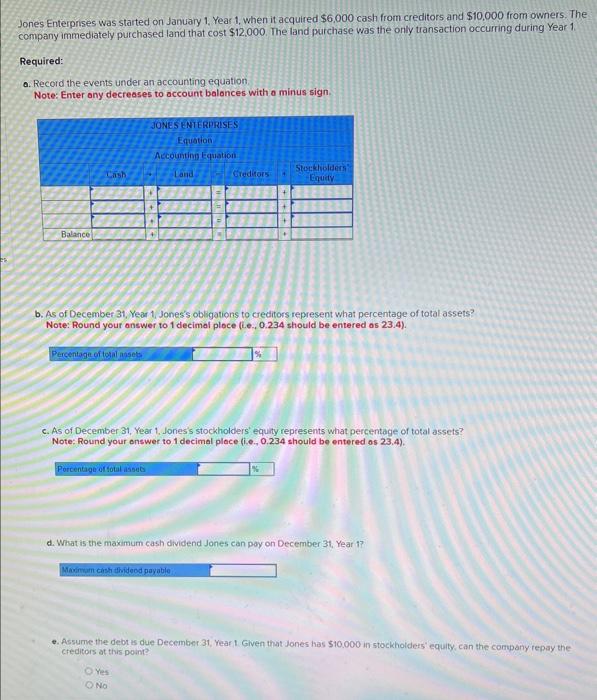

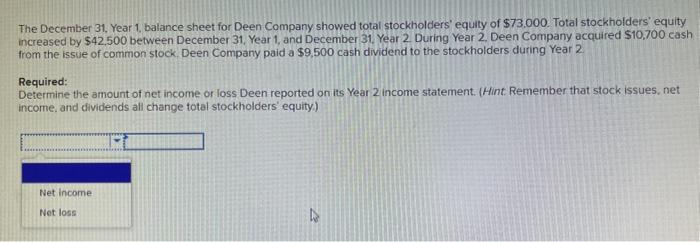

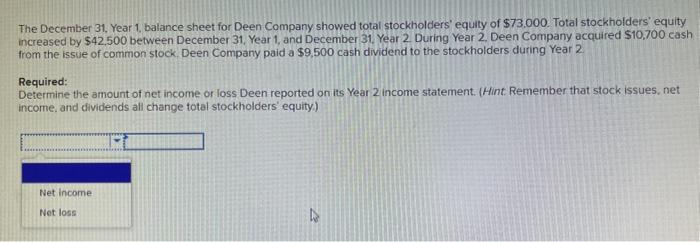

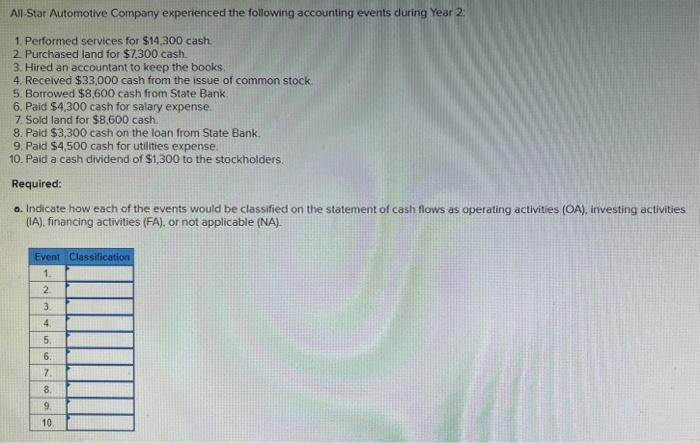

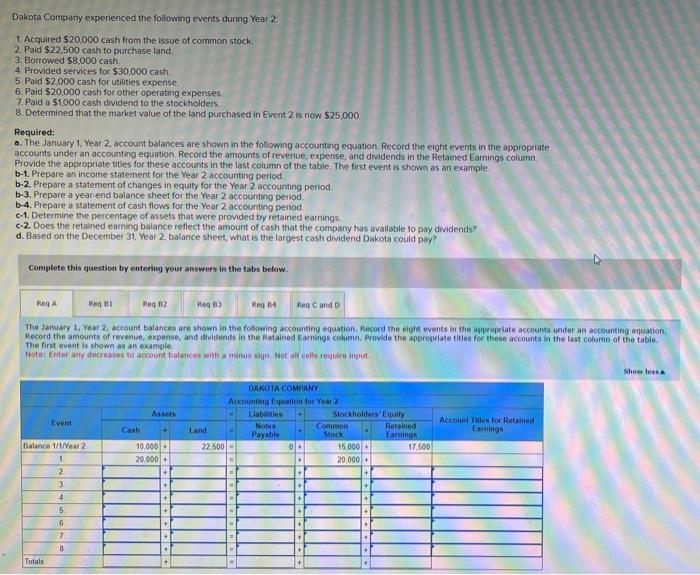

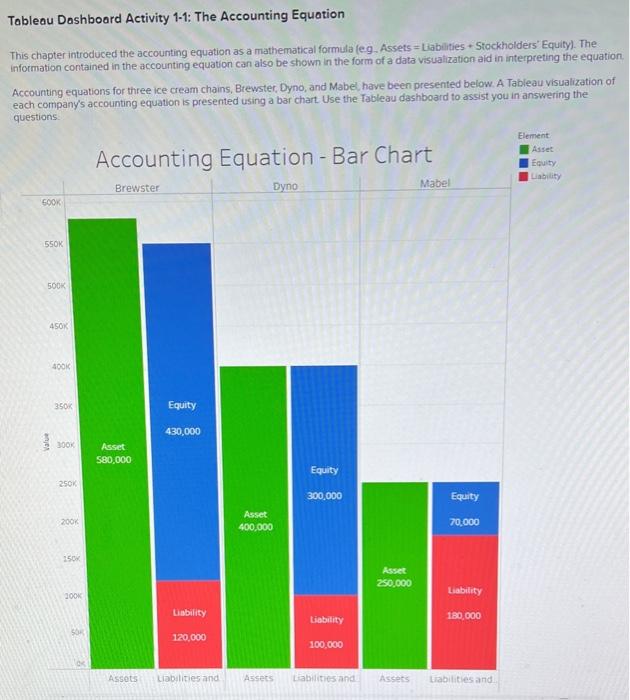

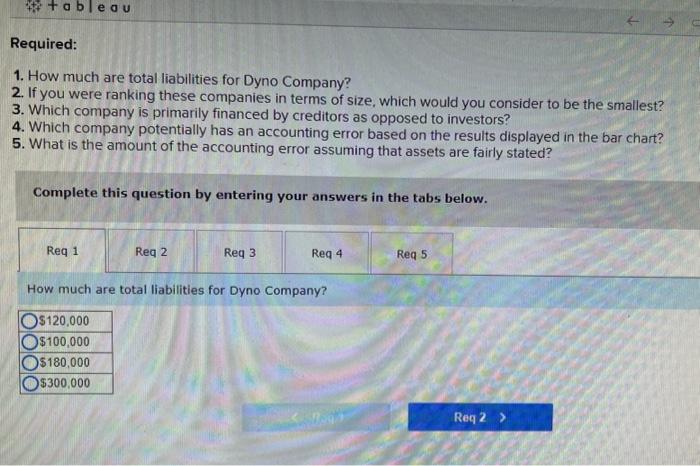

Exercise 1.7A (Algo) Missing information and recording events LO 1.3 As of December 31, Year 1, Moss Company had total cash of $155,000, notes payable of $85,500, and common stock of $52,300. During Year 2, Moss earned $35,000 of cash revenue, paid $19,500 for cash expenses, and paid a $2,900 cash dividend to the stockholders. Required: o. Determine the amount of retained earnings as of December 31 , Year 1. b. \& c. Create an accounting equation and record the beginning account balances, revenue, expense, and dividend events under the accounting equation. Note: Enter any decreoses to occount balances with o minus sign. Jones Enterprises was started on January 1, Year 1, when it acquired $6.000 cash from creditors and $10,000 from owners. The company immediately purchased land that cost $12.000. The land purchase was the only transaction occurring during Year 1. Required: a. Record the events under an accounting equation. Note: Enter any decreases to account balances with o minus sign. b. As of December 31 , Year 1, Jones's obligations to creditors represent what percentage of total assets? Note: Round your answer to 1 decimal ploce (L.e. 0.234 should be entered as 23.4). c. As of December 31, Year 1, Jones's stockholders' equity represents what percentage of total assets? Note: Round your onswer to 1 decimal place (i.e., 0.234 should be entered os 23.4). d. What is the maximum cash dividend Jones can poy on December 3t, Year 1 ? -. Assume the debt is due December 31 , Year 1 Given that Jones has $10.000 in stockhoidets' equity, can the company repay the creditors at this point? The December 31, Year 1. balance sheet for Deen Company showed total stockholders' equity of $73.000. Total stockholders' equity increased by $42,500 between December 31, Year 1, and December 31, Year 2. During Year 2. Deen Company acquired $10,700 cash from the issue of common stock. Deen Company paid a $9,500 cash dividend to the stockholders during Year 2 Required: Determine the amount of net income or loss Deen reported on its Year 2 income statement. (Hint. Remember that stock issues, net income. and dividends all change total stockholders' equity.) All-Star Automotive Company experienced the following accounting events during Year 2 : 1. Performed services for $14,300 cash. 2. Purchased land for $7,300 cash. 3. Hired an accountant to keep the books. 4. Recelved $33,000 cash from the issue of common stock. 5. Borrowed $8,600 cash from State Bank. 6. Paid $4,300 cash for salary expense. 7. Sold land for $8,600 cash. 8. Paid $3,300 cash on the loan from State Bank. 9. Paid $4,500 cash for utilities expense. 10. Paid a cash dividend of $1,300 to the stockholders. Required: a. Indicate how each of the events would be classified on the statement of cash flows as operating activities (OA), investing activities (IA), financing activities (FA), or not applicable (NA). b. Prepare a statement of cash flows. Assume All-Star Automotive had a beginning cash balance of $9,300. Note: Amounts to be deducted should be indicated with a minus sign. Dakota Company experienced the following events during Year 2 1. Acquired 520,000 cash from the issue of common stock. 2. Paid $22.500 cash to purchase land. 3. Borrowed $8,000 cash. 4. Provided services for $30,000cash 5 Paid $2000 cash for utilities expense. 6. Paid $20,000 cash for other operating expenses. 7. Paid a 51,000 cash dividend to the stockholders. 8. Determined that the market value of the land purchased in Event 2 is now $25,000. Required: a. The January 1, Year 2 , account balances are shown in the following accounting equation. Record the eight events in the appropriate accounts under an accounting equation. Record the amounts of revenue, expense, and dividends in the Retained Earnings column. Provide the appropriate titles for these accounts in the last column of the table. The first event is shown as an example. b-1. Prepare an income statement for the Year 2 accounting period. b-2. Prepare a statement of changes in equity for the Year 2 accounting period: b-3. Prepare a year-end balance sheet for the Year 2 accounting period. b-4. Prepare a statement of cash flows for the Year 2 accounting petiod c-1. Determine the percentage of assets that were provided by retained earnings, c-2. Does the retained earning balance reflect the amount of cash that the compary hos avilable to pay dividends? d. Based on the December 31, Year 2 balance sheet, what is the largest cash dividend Dakota could pay? Complete this question by entering your answers in the tabs below. The Jandary 1. Year 2 , account balances are shown in the following accounting equation. Pecord the eight events in the appropiate accounts under an accounting equation. Record the amounts of revenue, expense, and dividende in the Retained carnings column. Provide the appropriate tities for these accounti in the tast column of the table. The first event is shown as an example. Notel Enter any decreases to acoount balances with a minusi sign. Not ali Cells require input. Tableau Dashboard Activity 1-1: The Accounting Equation This chapter introduced the accounting equation as a mathematical formula (eg. Assets = Liablities + Stockholders' Equify). The information contained in the accounting equation can also be shown in the form of a data visualization aid in interpreting the equation. Accounting equations for three ice cream chains, Btewster, Dyno, and Mabel, have been presented below. A. Tableau visualization of each company's accounting equation is presented using a bar chart. Use the Tableau dashboard to assist you in answering the questions: Required: 1. How much are total liabilities for Dyno Company? 2. If you were ranking these companies in terms of size, which would you consider to be the smallest? 3. Which company is primarily financed by creditors as opposed to investors? 4. Which company potentially has an accounting error based on the results displayed in the bar chart? 5. What is the amount of the accounting error assuming that assets are fairly stated? Complete this question by entering your answers in the tabs below. How much are total liabilities for Dyno Company