Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This should make more sense now help please. Thank you You have been tasked with the preparation of the 2017 annual budget. The pertinent information

This should make more sense now help please. Thank you

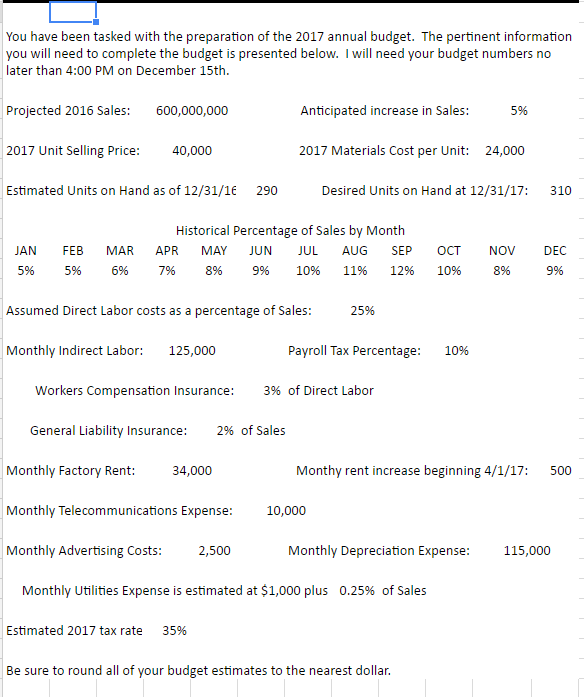

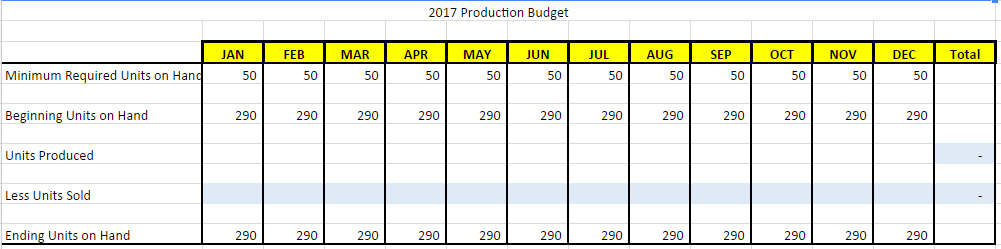

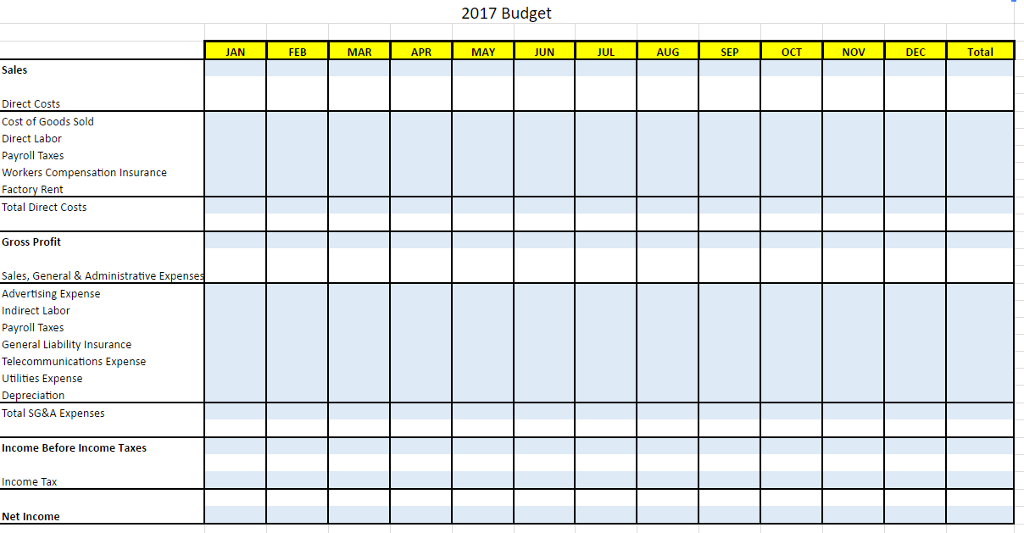

You have been tasked with the preparation of the 2017 annual budget. The pertinent information you will need to complete the budget is presented below. Iwill need your budget numbers no later than 4:00 PM on December 15th. Projected 2016 Sales 600,000,000 Anticipated increase in Sales 596, 2017 unit selling price: 40,000 2017 Materials Cost per Unit: 24,000 Estimated Units on Hand as of 12/31/16 290 Desired Units on Hand at 12/31/17: 310 Historical Percentage of Sales by Month JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC 596 59% 69% 79% 89% 99% 109% 119% 12% 10% 896 99% Assumed Direct Labor costs as a percentage of Sales 2596 Payroll Tax Percentage 1096 Monthly Indirect Labor 125,000 Workers Compensation Insurance 3% of Direct Labor General Liability Insurance 29% of Sales Monthly Factory Rent: Monthy rent increase beginning 4/1/17: 500 34,000 Monthly Telecommunications Expense: 10,000 Monthly Advertising Costs: Monthly Depreciation Expense: 115,000 2,500 Monthly Utilities Expense is estimated at $1,000 plus 0.25% of Sales Estimated 2017 tax rate 35% Be sure to round all of your budget estimates to the nearest dollarStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started