1.

2.

3.

4.

5.

5.

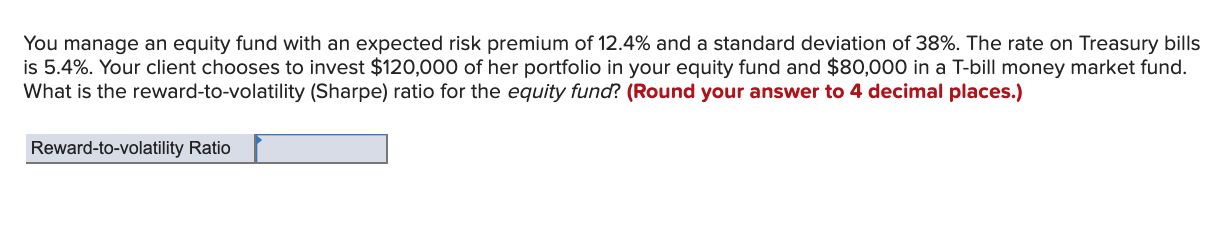

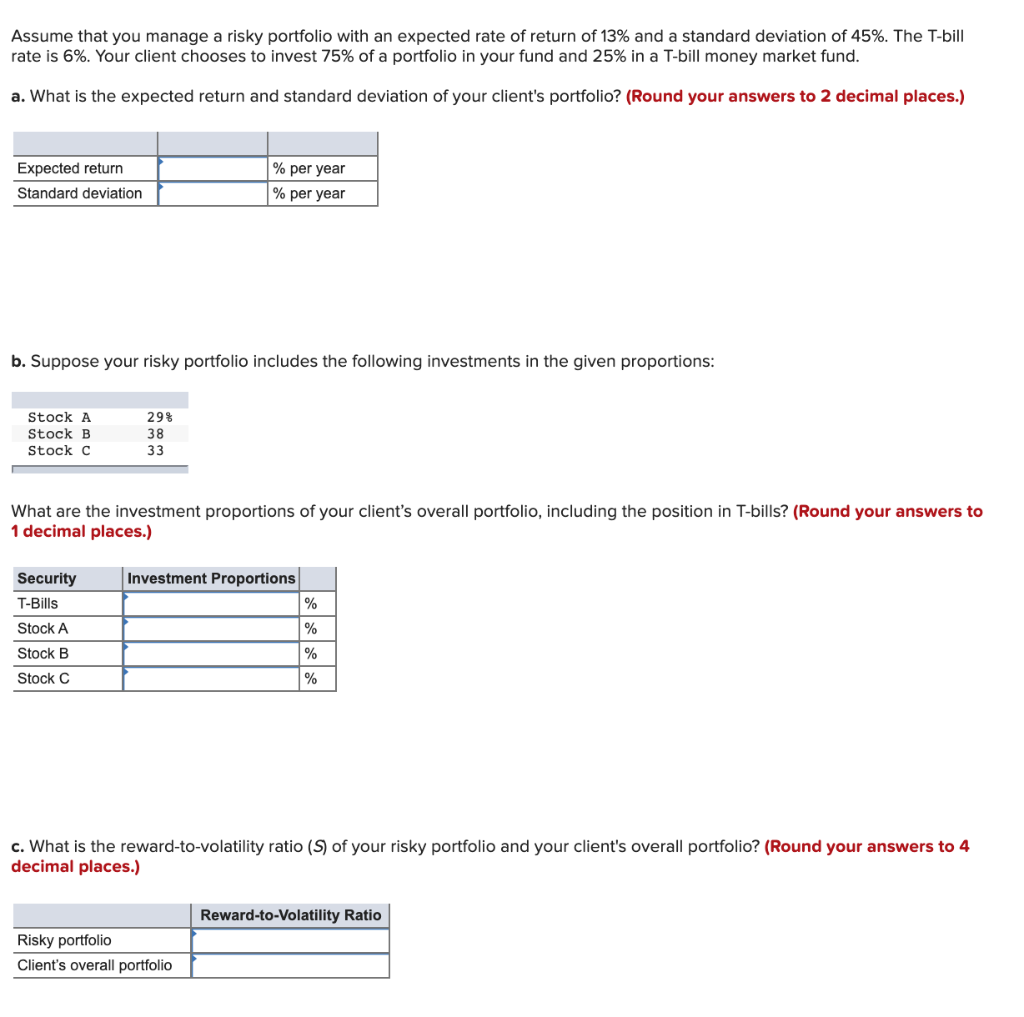

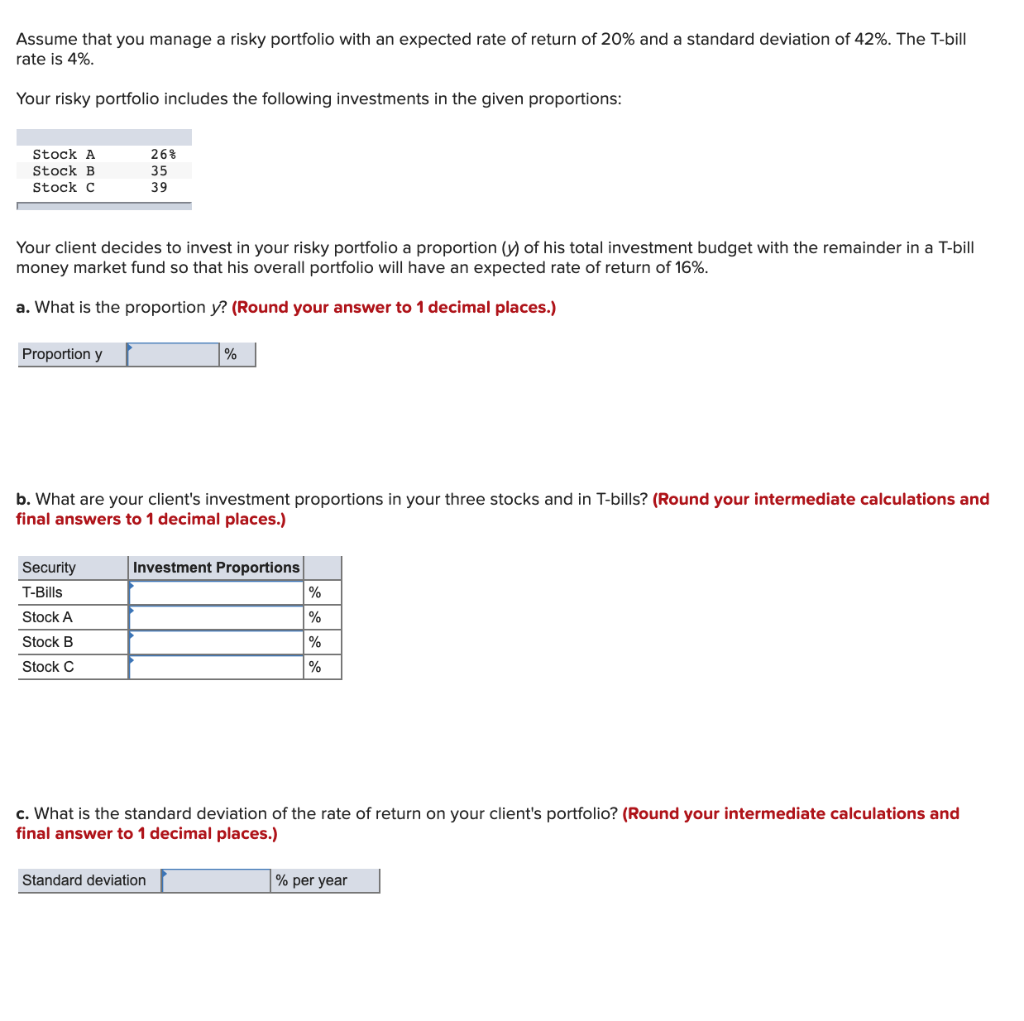

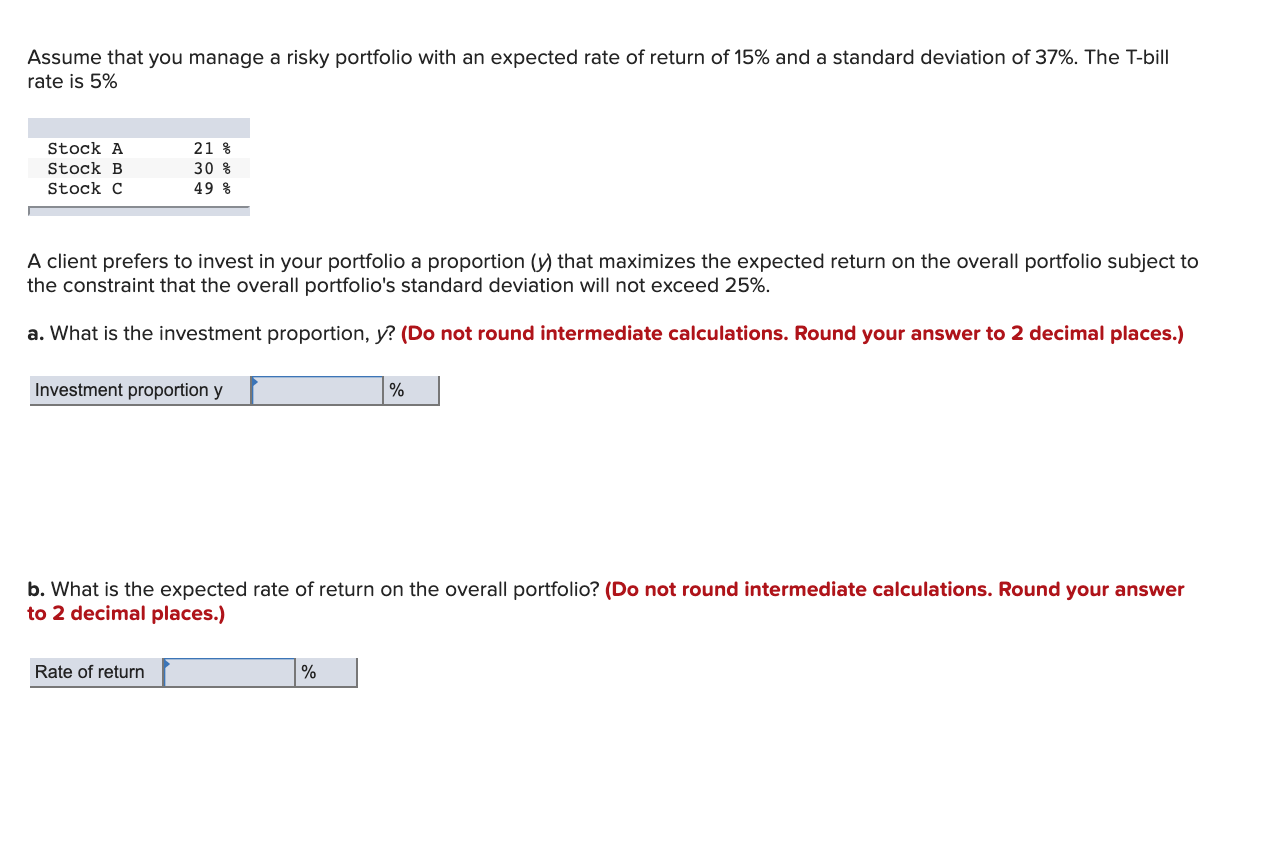

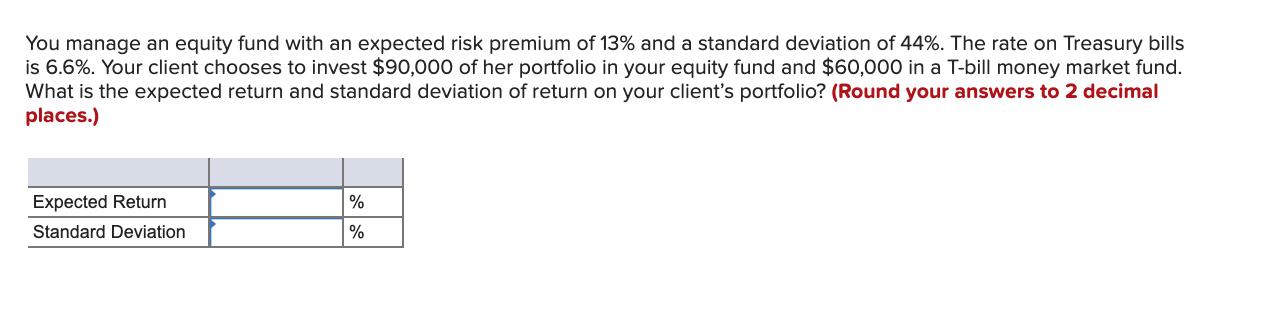

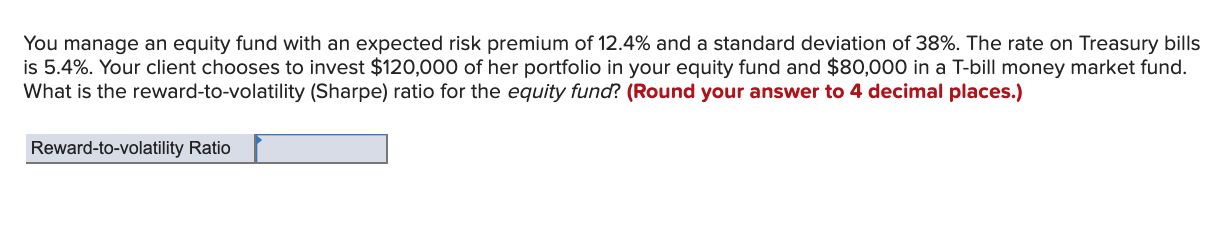

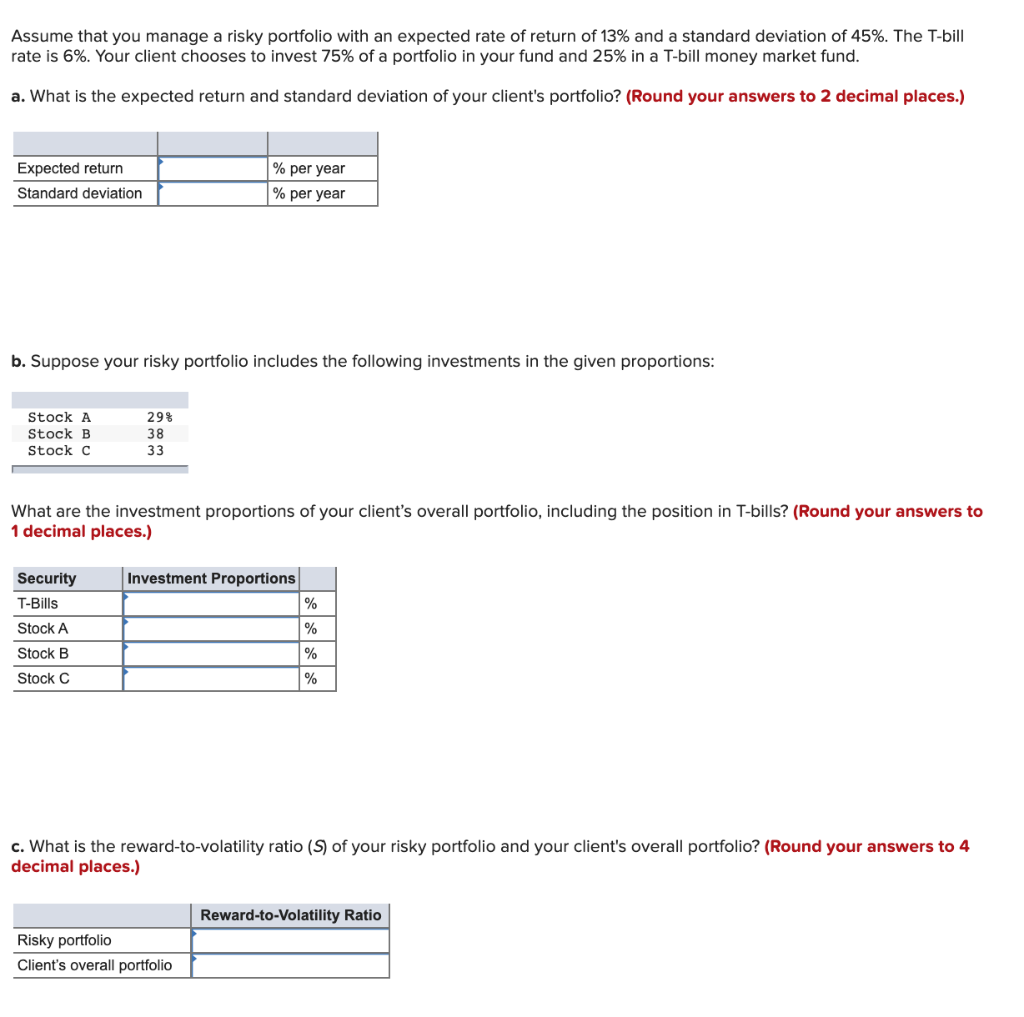

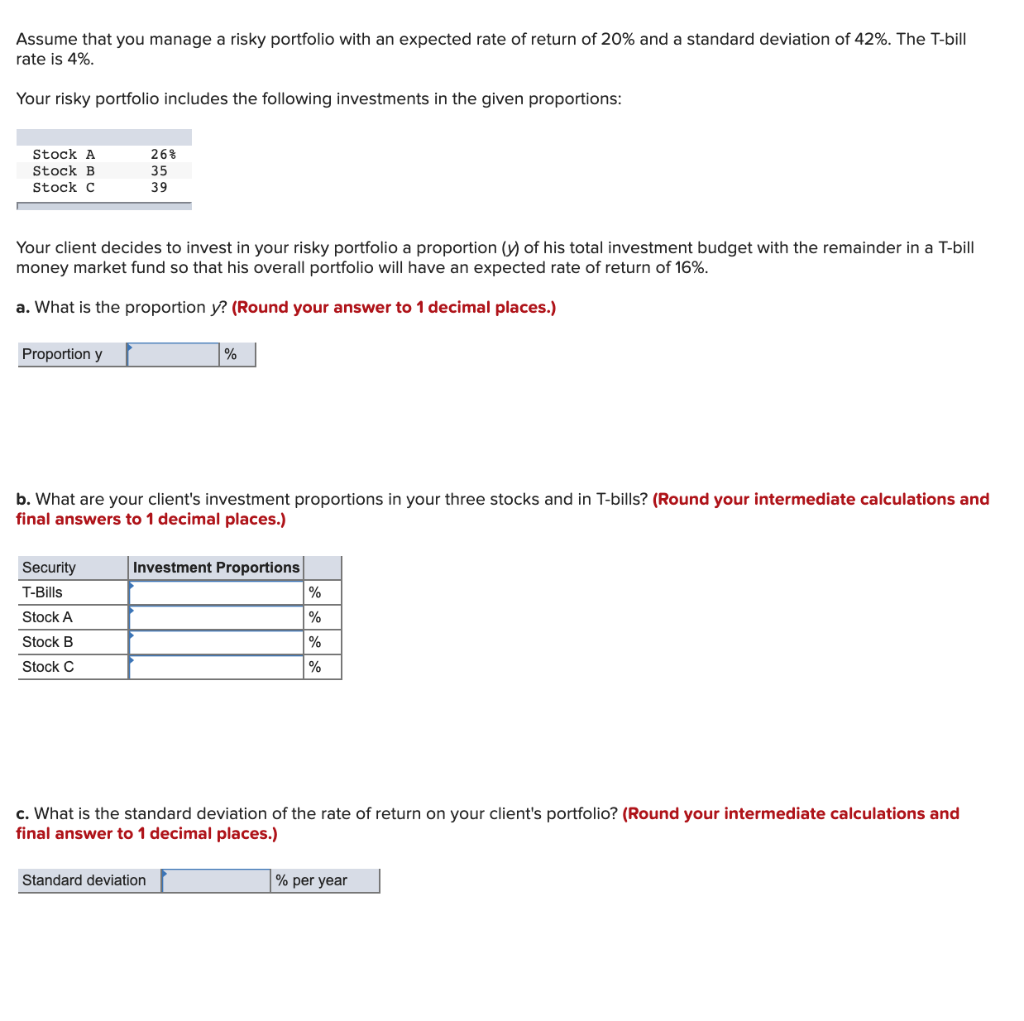

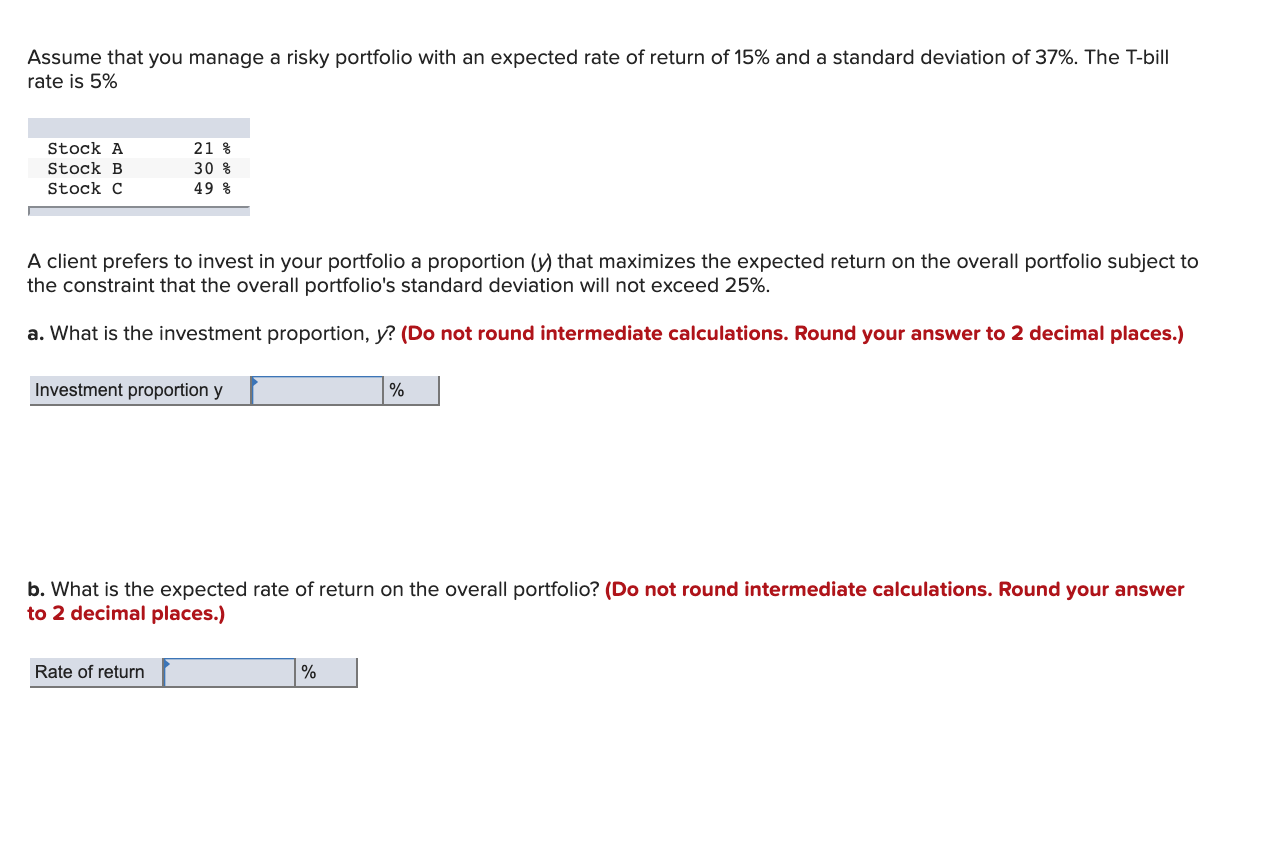

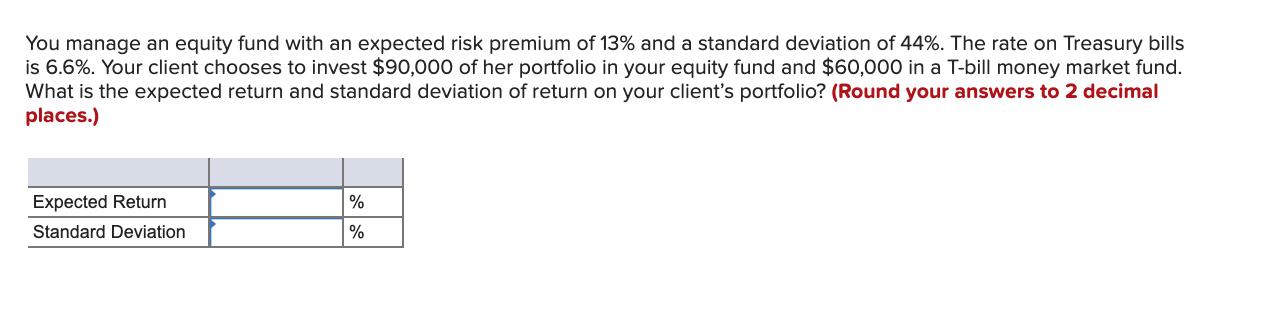

Assume that you manage a risky portfolio with an expected rate of return of 13% and a standard deviation of 45%. The T-bill rate is 6%. Your client chooses to invest 75% of a portfolio in your fund and 25% in a T-bill money market fund. a. What is the expected return and standard deviation of your client's portfolio? (Round your answers to 2 decimal places.) Expected return Standard deviation % per year % per year b. Suppose your risky portfolio includes the following investments in the given proportions: 29% Stock A Stock B Stock C 33 What are the investment proportions of your client's overall portfolio, including the position in T-bills? (Round your answers to 1 decimal places.) Investment Proportions Security T-Bills Stock A Stock B Stock C c. What is the reward-to-volatility ratio (s) of your risky portfolio and your client's overall portfolio? (Round your answers to 4 decimal places.) Reward-to-Volatility Ratio Risky portfolio Client's overall portfolio Assume that you manage a risky portfolio with an expected rate of return of 20% and a standard deviation of 42%. The T-bill rate is 4%. Your risky portfolio includes the following investments in the given proportions: Stock A Stock B Stock C WWN Your client decides to invest in your risky portfolio a proportion of his total investment budget with the remainder in a T-bill money market fund so that his overall portfolio will have an expected rate of return of 16%. a. What is the proportion y? (Round your answer to 1 decimal places.) Proportion y % b. What are your client's investment proportions in your three stocks and in T-bills? (Round your intermediate calculations and final answers to 1 decimal places.) Investment Proportions % Security T-Bills Stock A Stock B Stock C % c. What is the standard deviation of the rate of return on your client's portfolio? (Round your intermediate calculations and final answer to 1 decimal places.) Standard deviation % per year Assume that you manage a risky portfolio with an expected rate of return of 15% and a standard deviation of 37%. The T-bill rate is 5% Stock A Stock B Stock C 21 % 30 % 49% A client prefers to invest in your portfolio a proportion () that maximizes the expected return on the overall portfolio subject to the constraint that the overall portfolio's standard deviation will not exceed 25%. a. What is the investment proportion, y? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Investment proportion y % b. What is the expected rate of return on the overall portfolio? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Rate of return You manage an equity fund with an expected risk premium of 13% and a standard deviation of 44%. The rate on Treasury bills is 6.6%. Your client chooses to invest $90,000 of her portfolio in your equity fund and $60,000 in a T-bill money market fund. What is the expected return and standard deviation of return on your client's portfolio? (Round your answers to 2 decimal places.) Expected Return Standard Deviation You manage an equity fund with an expected risk premium of 12.4% and a standard deviation of 38%. The rate on Treasury bills is 5.4%. Your client chooses to invest $120,000 of her portfolio in your equity fund and $80,000 in a T-bill money market fund. What is the reward-to-volatility (Sharpe) ratio for the equity fund? (Round your answer to 4 decimal places.) Reward-to-volatility Ratio

5.

5.