1.

2.

2.

3.

3.

4.

4.

5.

5.

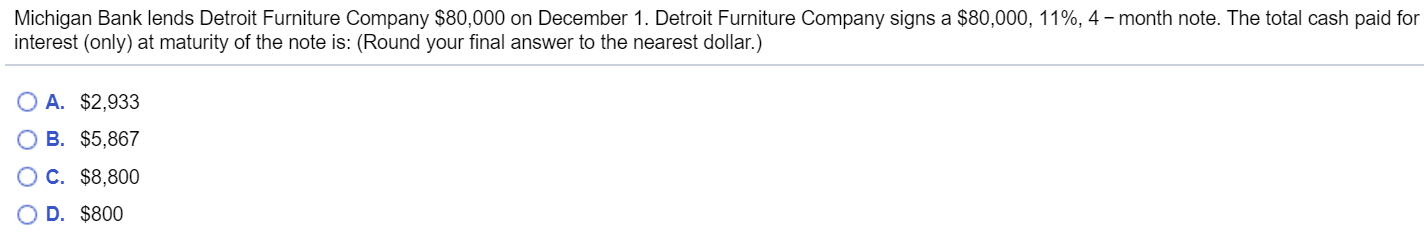

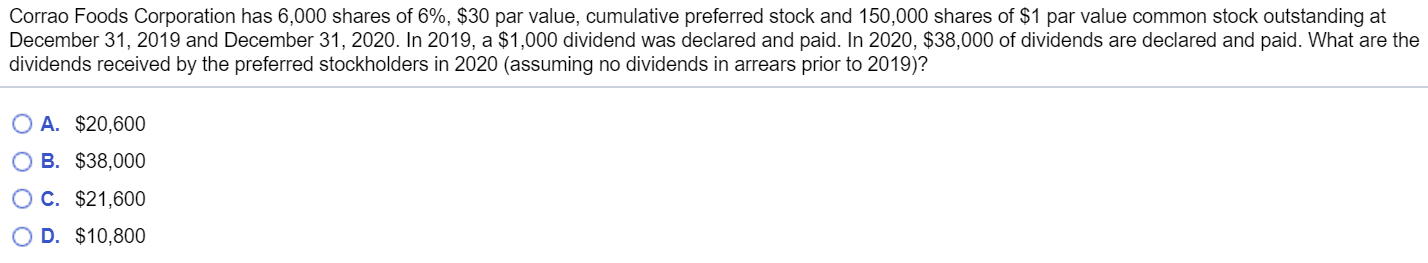

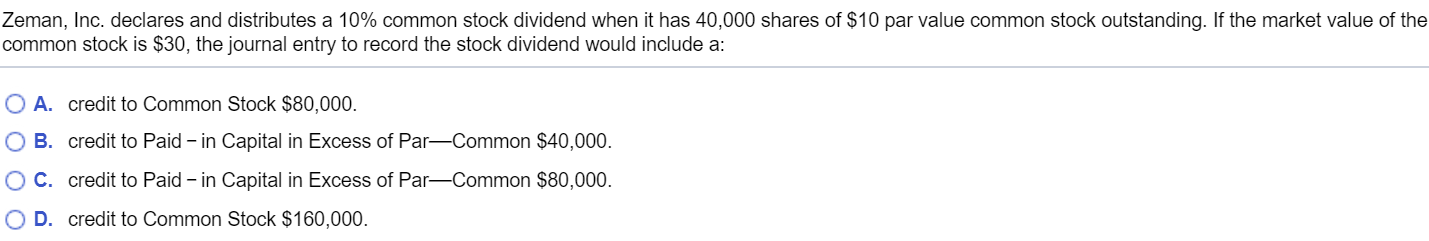

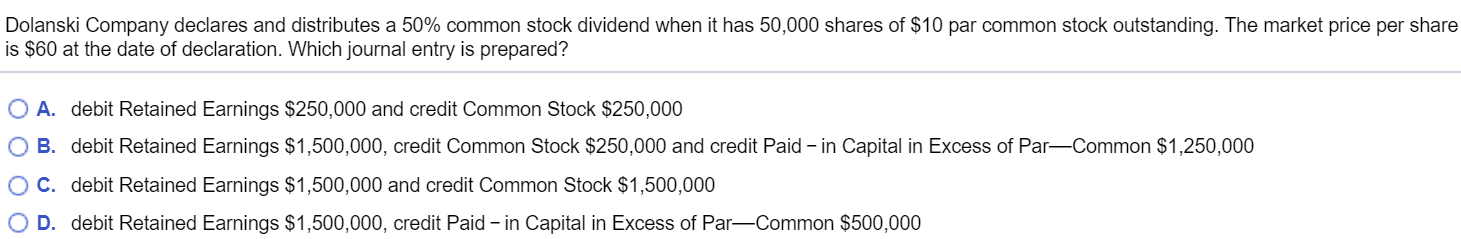

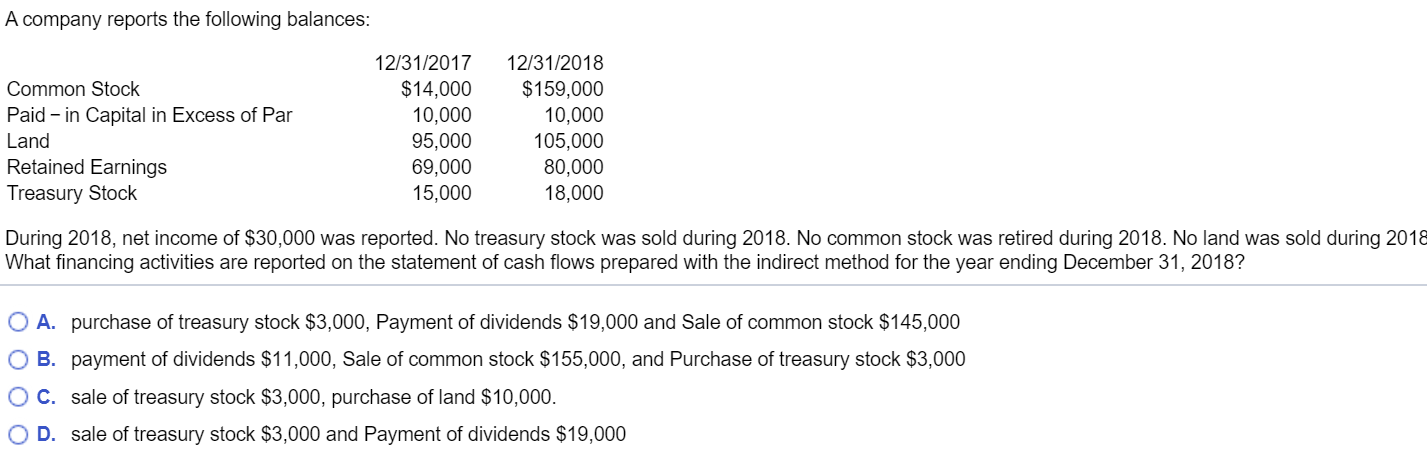

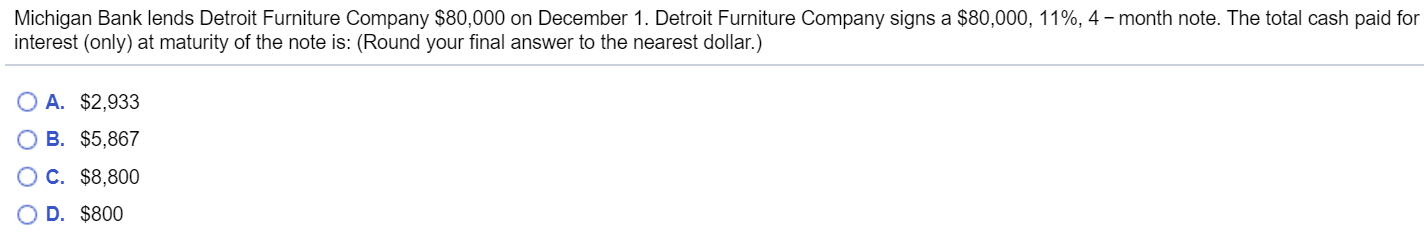

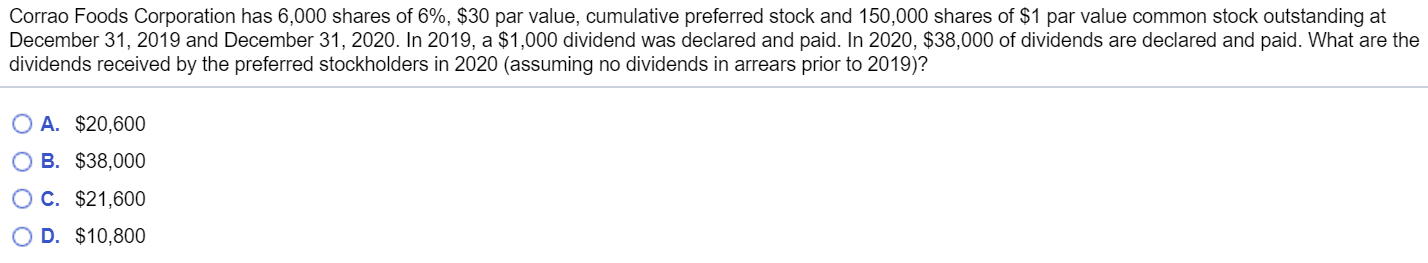

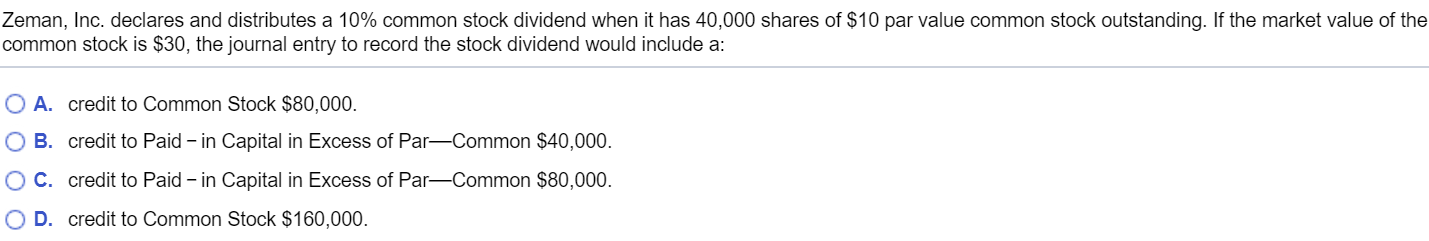

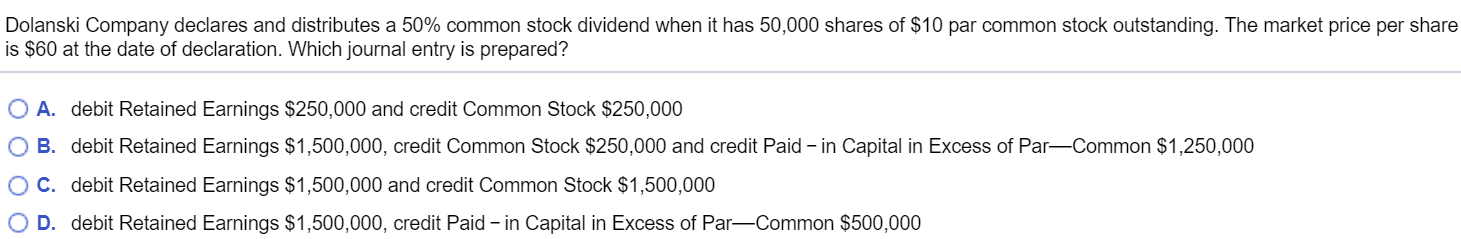

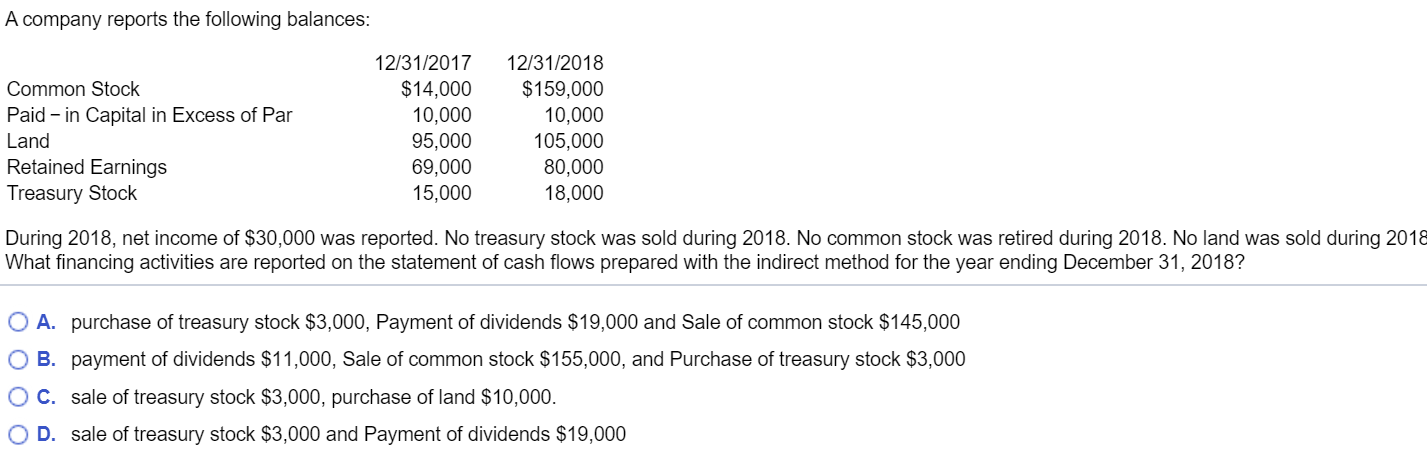

Corrao Foods Corporation has 6,000 shares of 6%, $30 par value, cumulative preferred stock and 150,000 shares of $1 par value common stock outstanding at December 31, 2019 and December 31, 2020. In 2019, a $1,000 dividend was declared and paid. In 2020, $38,000 of dividends are declared and paid. What are the dividends received by the preferred stockholders in 2020 (assuming no dividends in arrears prior to 2019)? O A. $20,600 O B. $38,000 O C. $21,600 OD. $10,800 Zeman, Inc. declares and distributes a 10% common stock dividend when it has 40,000 shares of $10 par value common stock outstanding. If the market value of the common stock is $30, the journal entry to record the stock dividend would include a: O A. credit to Common Stock $80,000. O B. credit to Paid - in Capital in Excess of ParCommon $40,000. O C. credit to Paid - in Capital in Excess of ParCommon $80,000. OD. credit to Common Stock $160,000. Dolanski Company declares and distributes a 50% common stock dividend when it has 50,000 shares of $10 par common stock outstanding. The market price per share is $60 at the date of declaration. Which journal entry is prepared? O A. debit Retained Earnings $250,000 and credit Common Stock $250,000 O B. debit Retained Earnings $1,500,000, credit Common Stock $250,000 and credit Paid - in Capital in Excess of ParCommon $1,250,000 O C. debit Retained Earnings $1,500,000 and credit Common Stock $1,500,000 OD. debit Retained Earnings $1,500,000, credit Paid - in Capital in Excess of ParCommon $500,000 A company reports the following balances: Common Stock Paid - in Capital in Excess of Par Land Retained Earnings Treasury Stock 12/31/2017 $14,000 10,000 95,000 69,000 15,000 12/31/2018 $159,000 10,000 105,000 80,000 18,000 During 2018, net income of $30,000 was reported. No treasury stock was sold during 2018. No common stock was retired during 2018. No land was sold during 2018 What financing activities are reported on the statement of cash flows prepared with the indirect method for the year ending December 31, 2018? O A. purchase of treasury stock $3,000, Payment of dividends $19,000 and Sale of common stock $145,000 OB. payment of dividends $11,000, Sale of common stock $155,000, and Purchase of treasury stock $3,000 O C. sale of treasury stock $3,000, purchase of land $10,000. O D. sale of treasury stock $3,000 and Payment of dividends $19,000 Michigan Bank lends Detroit Furniture Company $80,000 on December 1. Detroit Furniture Company signs a $80,000, 11%, 4 - month note. The total cash paid for interest (only) at maturity of the note is: (Round your final answer to the nearest dollar.) O A. $2,933 O B. $5,867 O C. $8,800 OD. $800

2.

2. 3.

3. 4.

4. 5.

5.