Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2 3. 4 5 In Year 1, a company's first year of business, the following events occurred: 6. 7 1. Received $32,000 from

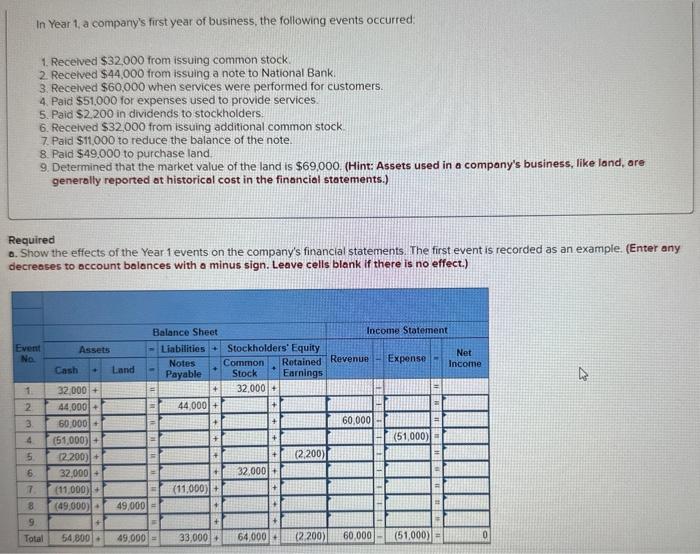

1. 2 3. 4 5 In Year 1, a company's first year of business, the following events occurred: 6. 7 1. Received $32,000 from issuing common stock. 2. Received $44,000 from issuing a note to National Bank. 3. Received $60,000 when services were performed for customers. Required a. Show the effects of the Year 1 events on the company's financial statements. The first event is recorded as an example. (Enter any decreases to account balances with a minus sign. Leave cells blank if there is no effect.) 8 4. Paid $51,000 for expenses used to provide services. 5. Paid $2,200 in dividends to stockholders. Event No. 6. Received $32,000 from issuing additional common stock. 7. Paid $11,000 to reduce the balance of the note. 8. Paid $49,000 to purchase land. 9. Determined that the market value of the land is $69,000. (Hint: Assets used in a company's business, like land, are generally reported at historical cost in the financial statements.) 9. Total Cash Assets 32,000+ 44,000+ 60,000+ (51,000)+ (2.200)+ 32,000+ (11,000)+ (49,000)+ 54,800 + Land Balance Sheet -Liabilities + Stockholders Equity F 49,000 = 49,000 - Notes Payable + 44,000+ (11,000) + Common Retained Revenue Stock Earnings 32,000+ + 33,000+ 64,000 + ++ 32,000+ + * (2,200) Income Statement (2.200) 60,000 60,000 Expense (51,000) (51,000) Net Income 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Balance Sheet Assets Cash 54000 Land 49000 Liabilities Notes Payable 33000 Stockholders Equity Commo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started