1.

2.

3.

4.

5.

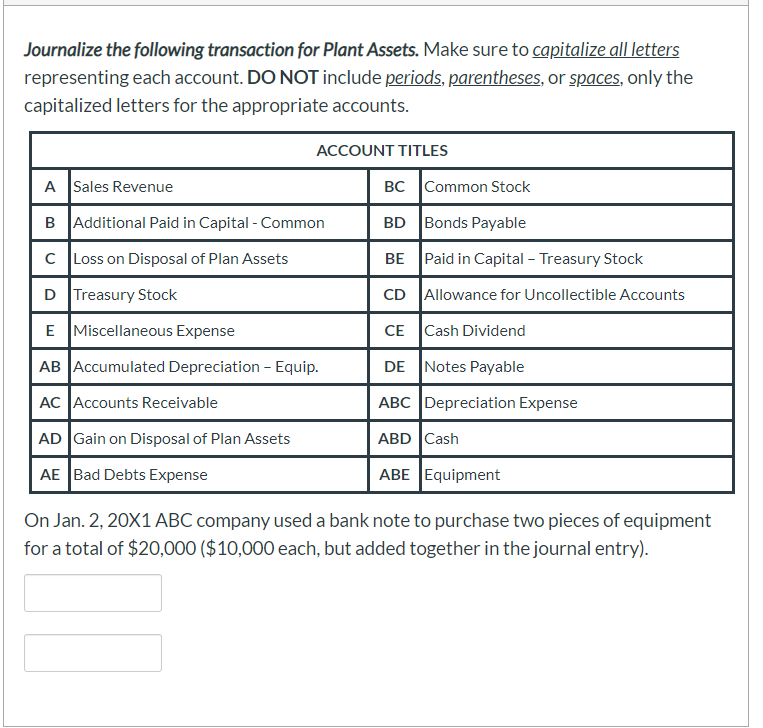

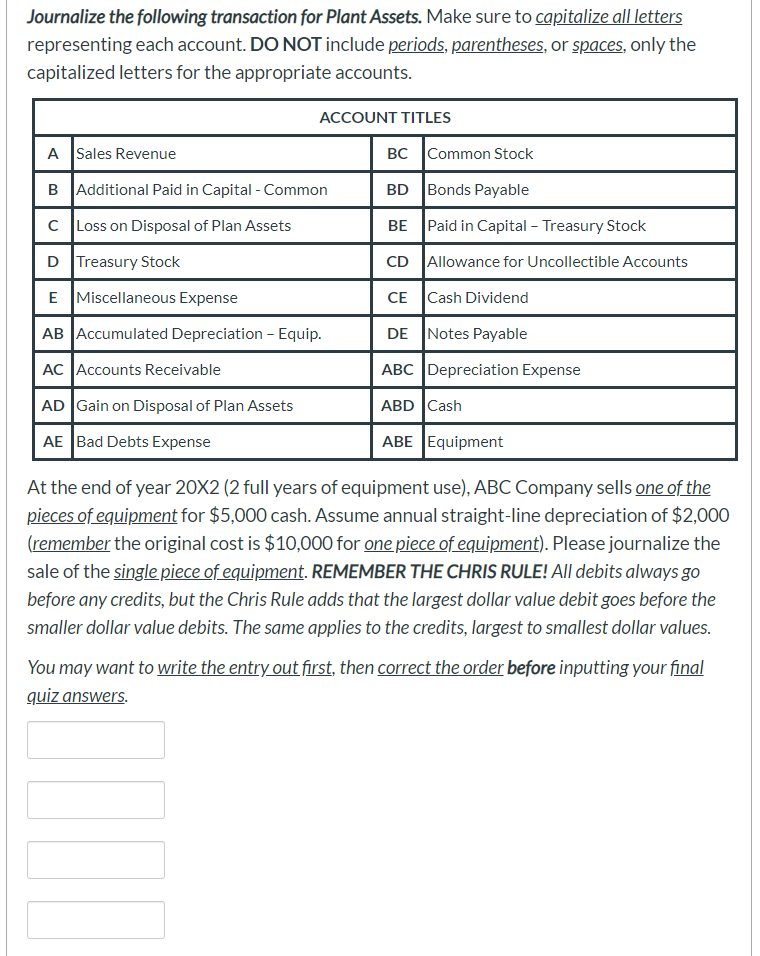

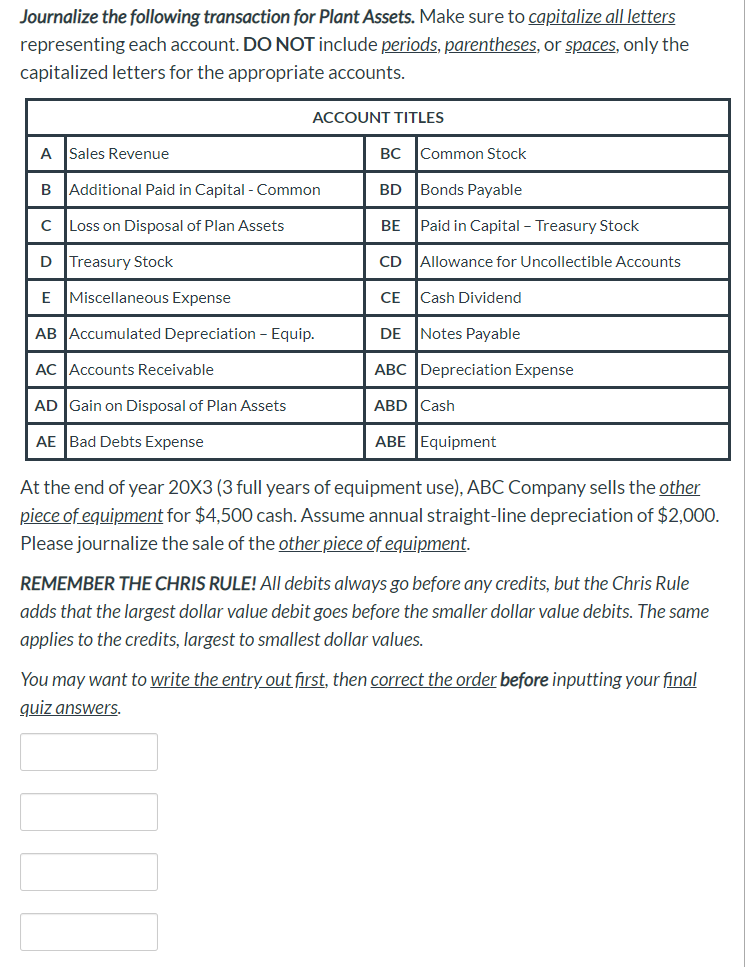

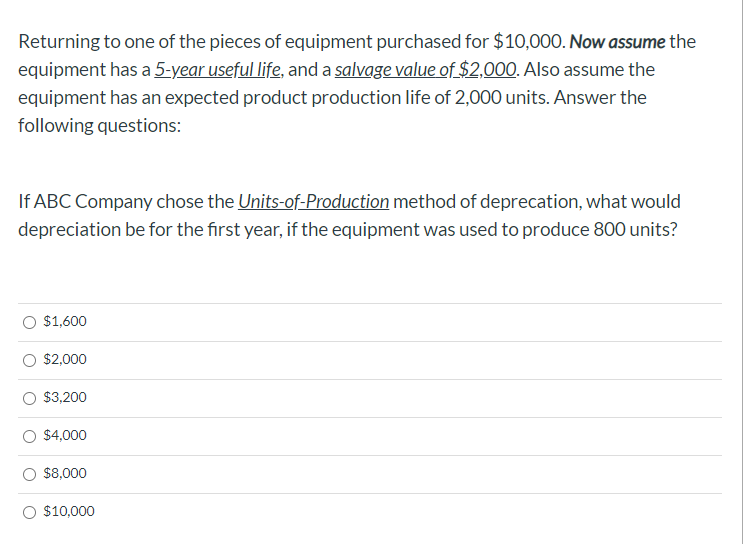

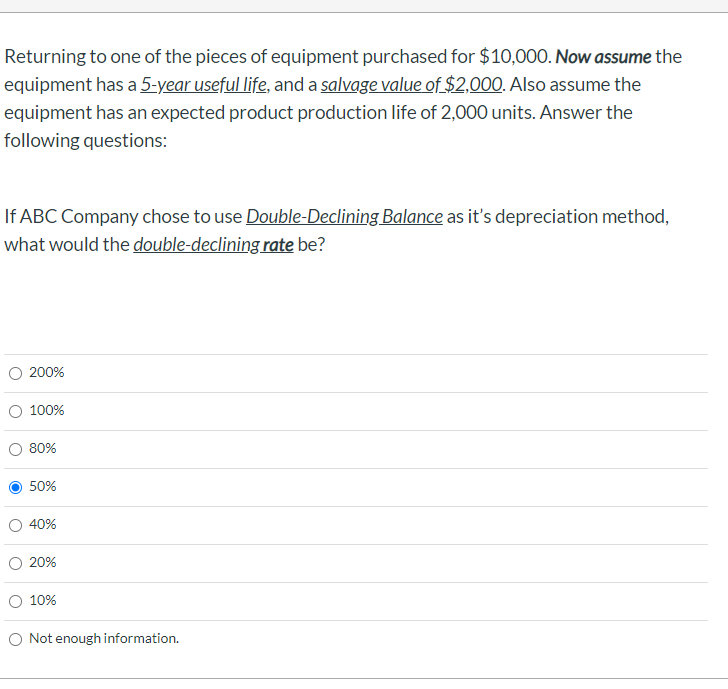

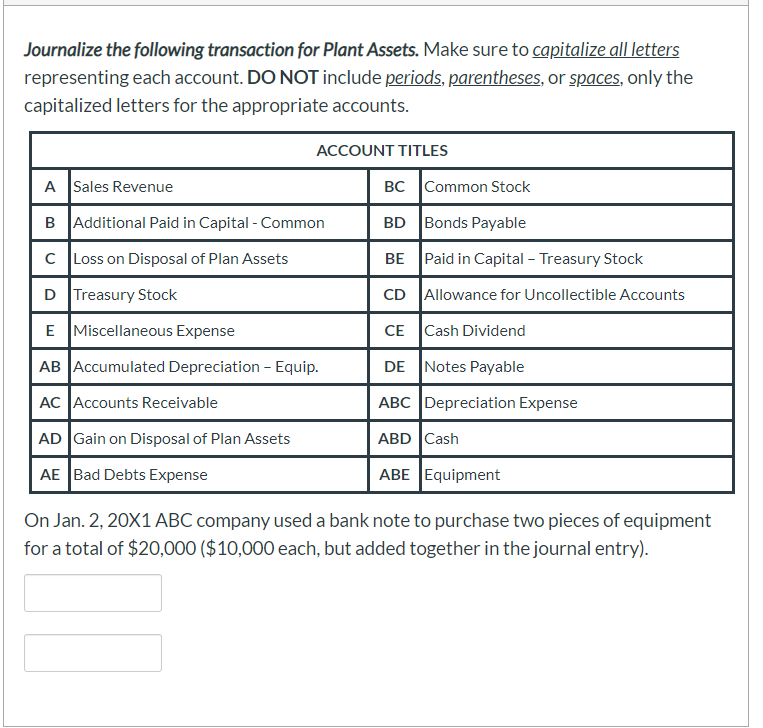

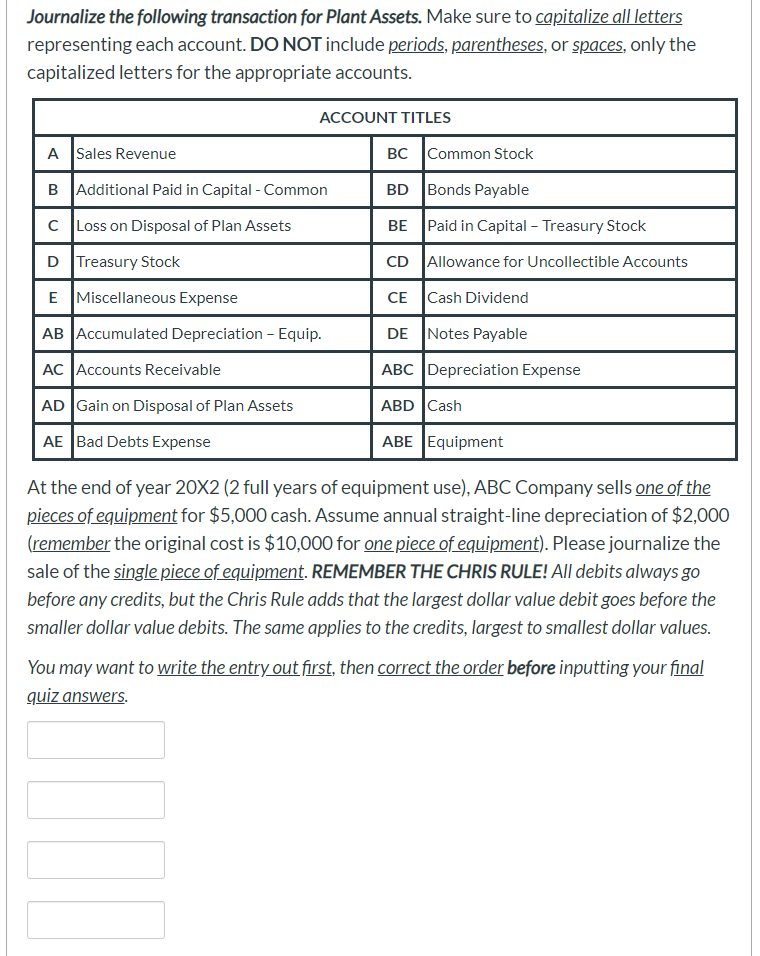

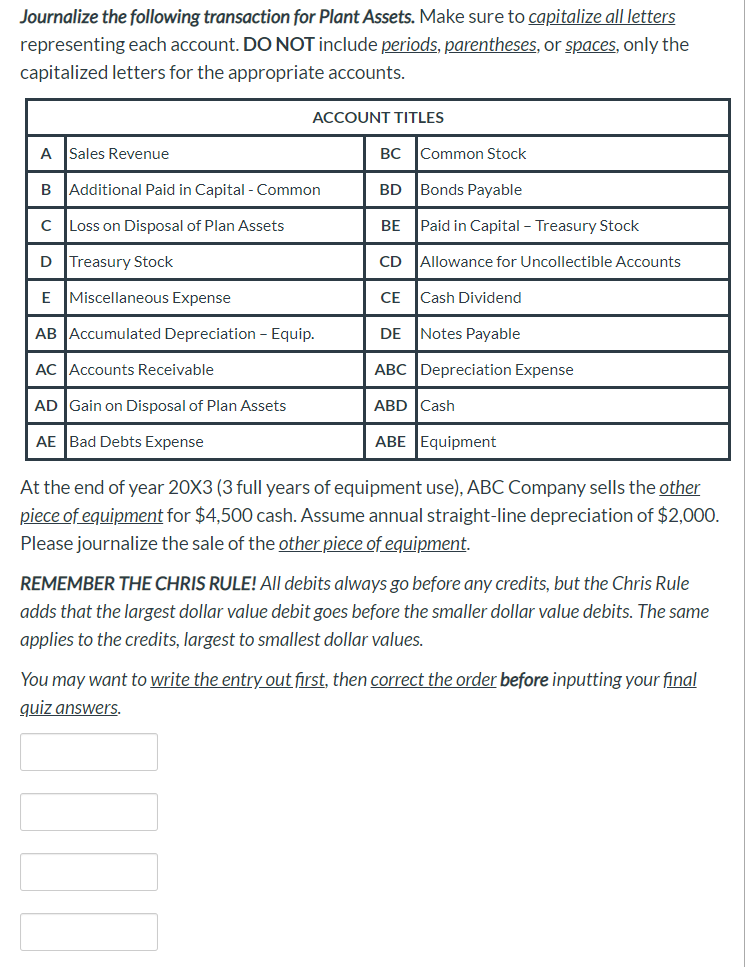

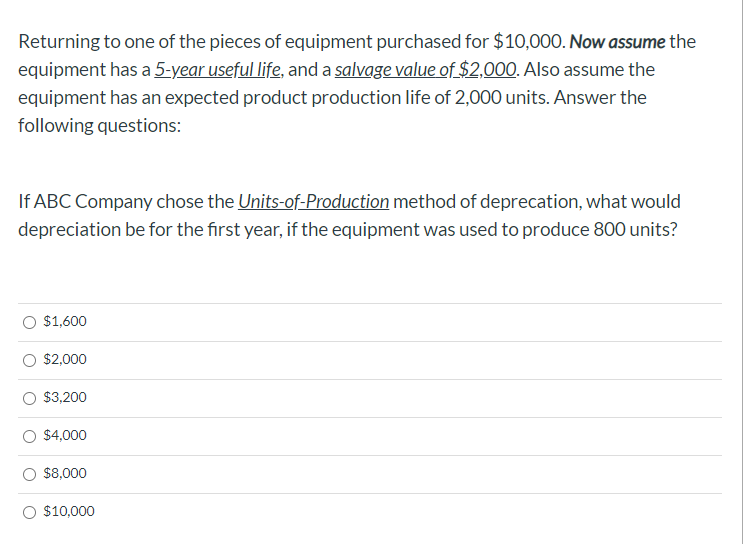

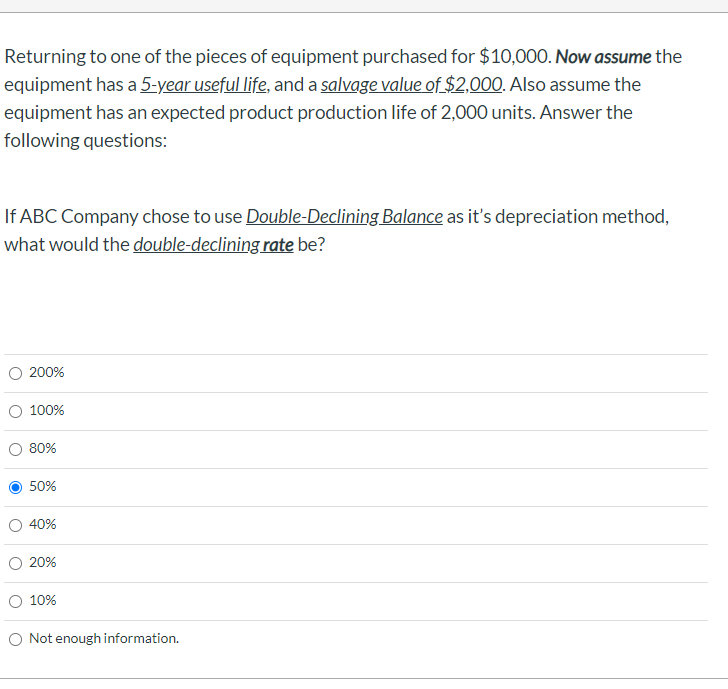

Journalize the following transaction for Plant Assets. Make sure to capitalize all letters representing each account. DO NOT include periods, parentheses, or spaces, only the capitalized letters for the appropriate accounts. ACCOUNT TITLES A Sales Revenue BC Common Stock B Additional Paid in Capital - Common BD Bonds Payable C Loss on Disposal of Plan Assets BE Paid in Capital - Treasury Stock D Treasury Stock CD Allowance for Uncollectible Accounts E Miscellaneous Expense CE Cash Dividend AB Accumulated Depreciation - Equip. DE Notes Payable AC Accounts Receivable ABC Depreciation Expense AD Gain on Disposal of Plan Assets ABD Cash ABE Equipment AE Bad Debts Expense On Jan. 2, 20X1 ABC company used a bank note to purchase two pieces of equipment for a total of $20,000 ($10,000 each, but added together in the journal entry). Journalize the following transaction for Plant Assets. Make sure to capitalize all letters representing each account. DO NOT include periods, parentheses, or spaces, only the capitalized letters for the appropriate accounts. ACCOUNT TITLES A Sales Revenue BC Common Stock B Additional Paid in Capital - Common BD Bonds Payable C Loss on Disposal of Plan Assets BE Paid in Capital - Treasury Stock D Treasury Stock CD Allowance for Uncollectible Accounts E Miscellaneous Expense CE Cash Dividend AB Accumulated Depreciation - Equip. DE Notes Payable AC Accounts Receivable ABC Depreciation Expense AD Gain on Disposal of Plan Assets ABD Cash AE Bad Debts Expense ABE Equipment At the end of year 20X2 (2 full years of equipment use), ABC Company sells one of the pieces of equipment for $5,000 cash. Assume annual straight-line depreciation of $2,000 (remember the original cost is $10,000 for one piece of equipment). Please journalize the sale of the single piece of equipment. REMEMBER THE CHRIS RULE! All debits always go before any credits, but the Chris Rule adds that the largest dollar value debit goes before the smaller dollar value debits. The same applies to the credits, largest to smallest dollar values. You may want to write the entry out first, then correct the order before inputting your final quiz answers. Journalize the following transaction for Plant Assets. Make sure to capitalize all letters representing each account. DO NOT include periods, parentheses, or spaces, only the capitalized letters for the appropriate accounts. ACCOUNT TITLES A Sales Revenue BC Common Stock B Additional Paid in Capital - Common BD Bonds Payable Loss on Disposal of Plan Assets BE Paid in Capital - Treasury Stock D Treasury Stock CD Allowance for Uncollectible Accounts E Miscellaneous Expense CE Cash Dividend AB Accumulated Depreciation - Equip. DE Notes Payable AC Accounts Receivable ABC Depreciation Expense AD Gain on Disposal of Plan Assets ABD Cash AE Bad Debts Expense ABE Equipment At the end of year 20X3 (3 full years of equipment use), ABC Company sells the other piece of equipment for $4,500 cash. Assume annual straight-line depreciation of $2,000. Please journalize the sale of the other piece of equipment. REMEMBER THE CHRIS RULE! All debits always go before any credits, but the Chris Rule adds that the largest dollar value debit goes before the smaller dollar value debits. The same applies to the credits, largest to smallest dollar values. You may want to write the entry out first, then correct the order before inputting your final guiz answers. Returning to one of the pieces of equipment purchased for $10,000. Now assume the equipment has a 5-year useful life, and a salvage value of $2,000. Also assume the equipment has an expected product production life of 2,000 units. Answer the following questions: If ABC Company chose the Units-of-Production method of deprecation, what would depreciation be for the first year, if the equipment was used to produce 800 units? $1,600 $2,000 $3,200 $4,000 $8,000 $10,000 Returning to one of the pieces of equipment purchased for $10,000. Now assume the equipment has a 5-year useful life, and a salvage value of $2,000. Also assume the equipment has an expected product production life of 2,000 units. Answer the following questions: If ABC Company chose to use Double-Declining Balance as it's depreciation method, what would the double-declining rate be? 200% O 100% 80% 50% 40% 20% O 10% O Not enough information