Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) 2) 3) 4) 5) On January 1, 2024, the Allegheny Corporation purchased equipment for $130,000. The estimated service life of the equipment is 10

1)

2)

3)

4)

5)

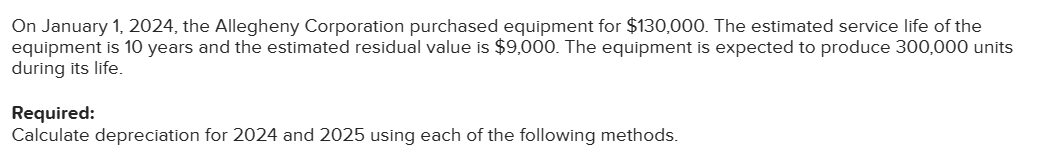

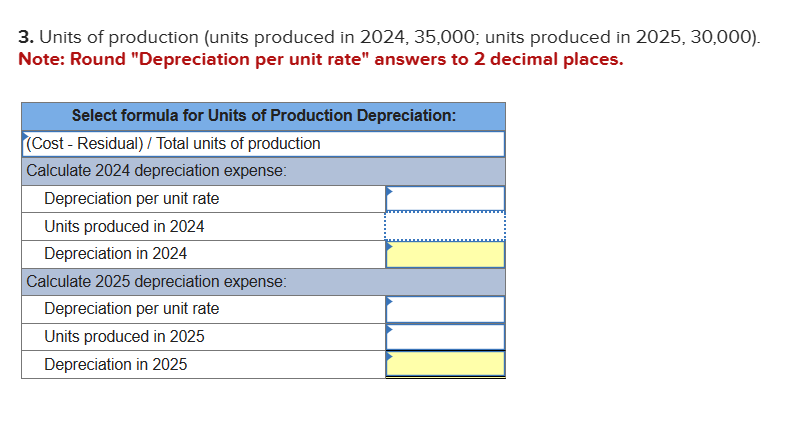

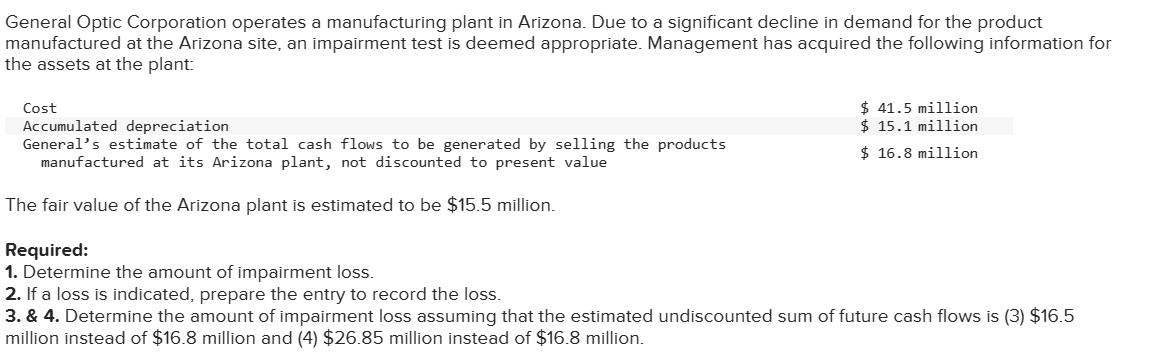

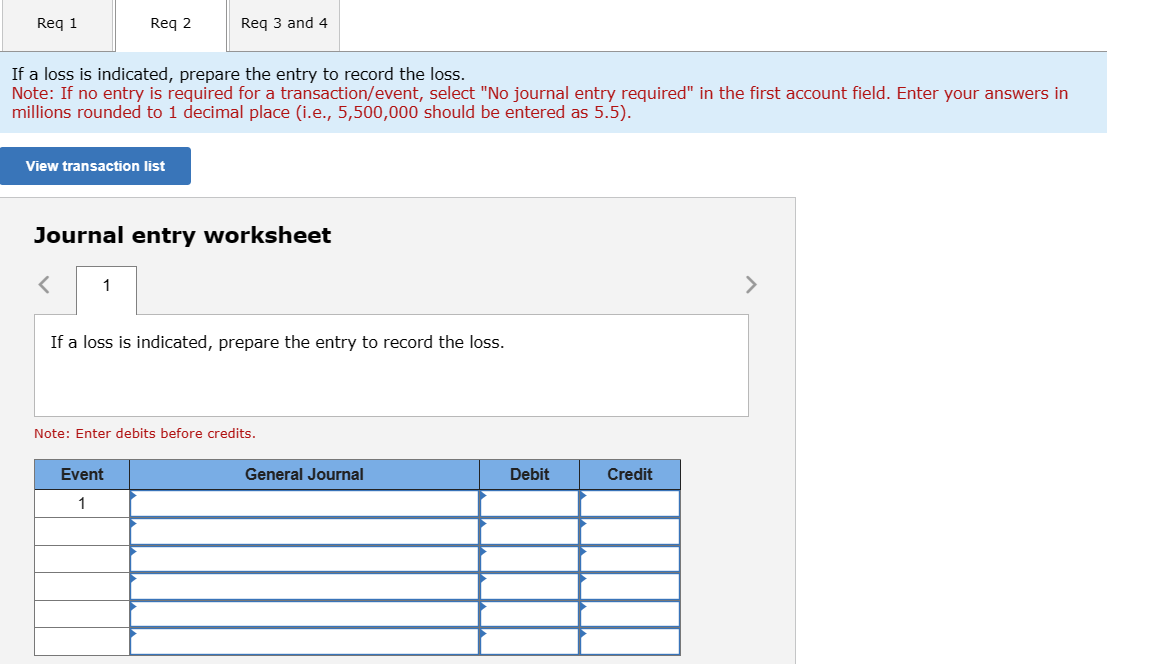

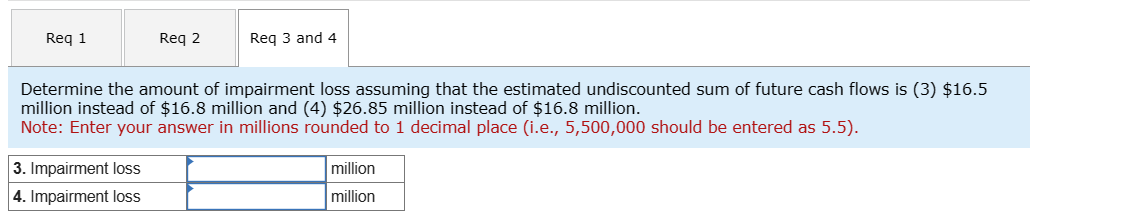

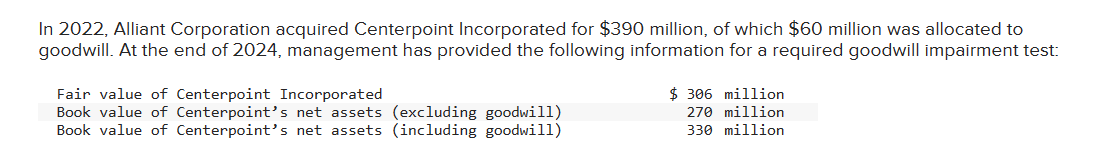

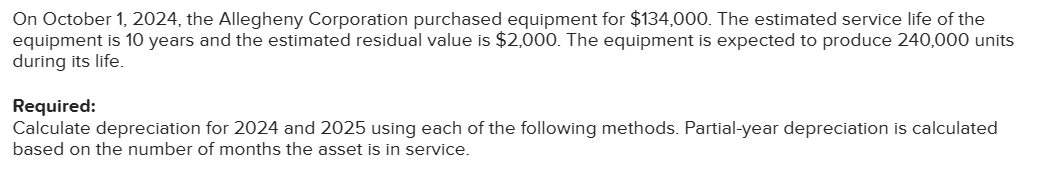

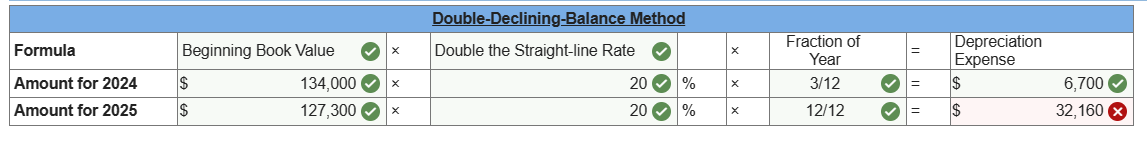

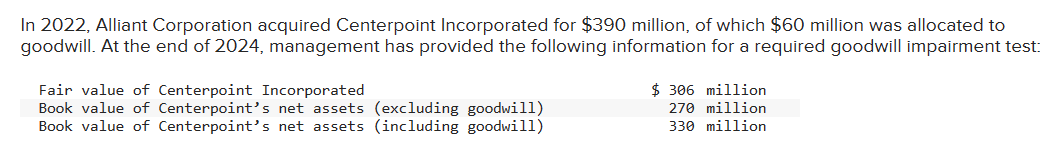

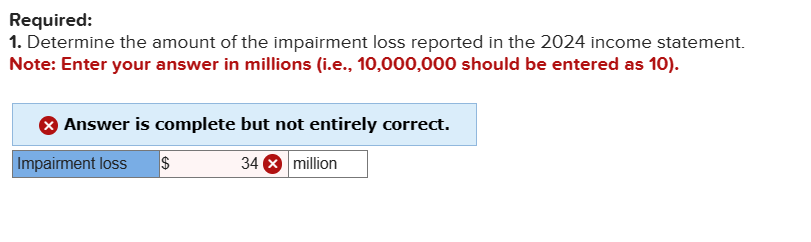

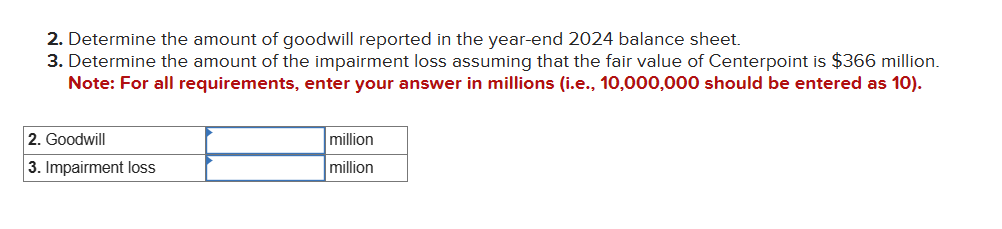

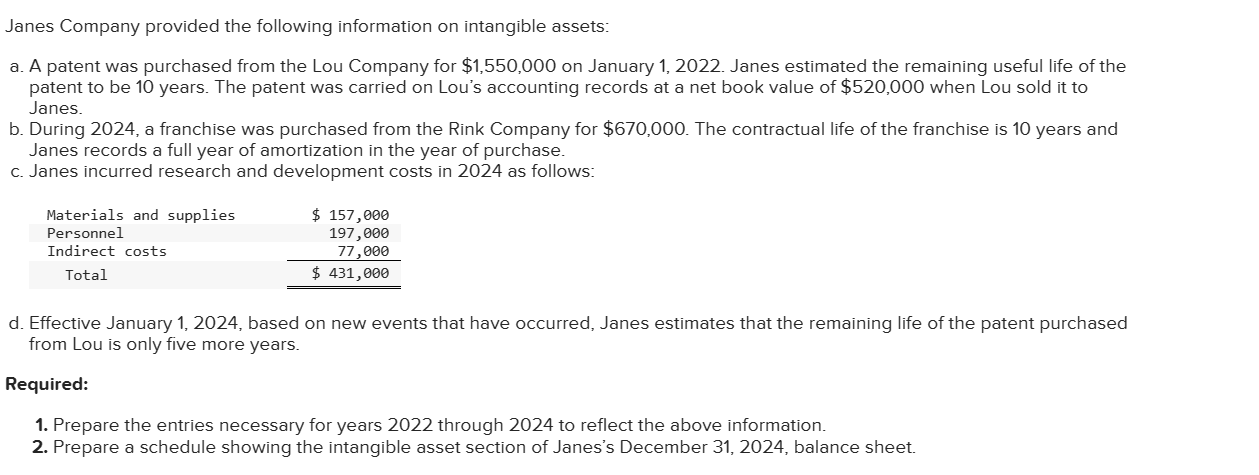

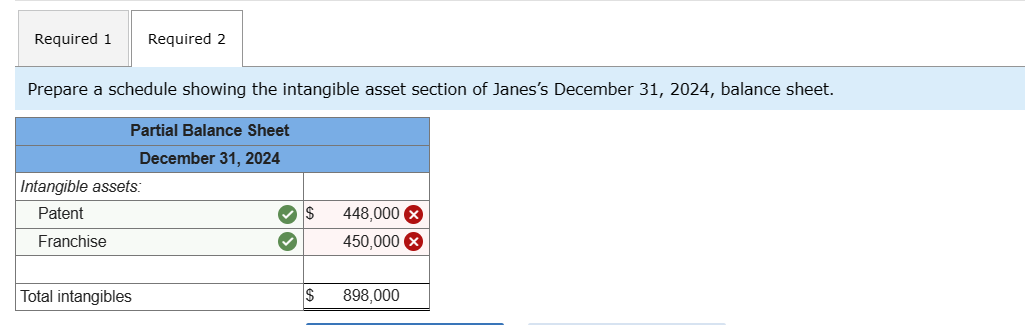

On January 1, 2024, the Allegheny Corporation purchased equipment for $130,000. The estimated service life of the equipment is 10 years and the estimated residual value is $9,000. The equipment is expected to produce 300,000 units during its life. Required: Calculate depreciation for 2024 and 2025 using each of the following methods. 3. Units of production (units produced in 2024, 35,000; units produced in 2025, 30,000). Note: Round "Depreciation per unit rate" answers to 2 decimal places. General Optic Corporation operates a manufacturing plant in Arizona. Due to a significant decline in demand for the product manufactured at the Arizona site, an impairment test is deemed appropriate. Management has acquired the following information for the assets at the plant: Cost Accumulated depreciation General's estimate of the total cash flows to be generated by selling the products manufactured at its Arizona plant, not discounted to present value $41.5 million $15.1 million $16.8 million The fair value of the Arizona plant is estimated to be $15.5 million. Required: 1. Determine the amount of impairment loss. 2. If a loss is indicated, prepare the entry to record the loss. 3. \& 4. Determine the amount of impairment loss assuming that the estimated undiscounted sum of future cash flows is (3) $16.5 million instead of $16.8 million and (4) $26.85 million instead of $16.8 million. Determine the amount of impairment loss. Note: Enter your answer in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). If a loss is indicated, prepare the entry to record the loss. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). Journal entry worksheet If a loss is indicated, prepare the entry to record the loss. Note: Enter debits before credits. Determine the amount of impairment loss assuming that the estimated undiscounted sum of future cash flows is (3) $16.5 million instead of $16.8 million and (4) \$26.85 million instead of $16.8 million. Note: Enter your answer in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). In 2022, Alliant Corporation acquired Centerpoint Incorporated for $390 million, of which $60 million was allocated to goodwill. At the end of 2024, management has provided the following information for a required goodwill impairment test: On October 1, 2024, the Allegheny Corporation purchased equipment for $134,000. The estimated service life of the equipment is 10 years and the estimated residual value is $2,000. The equipment is expected to produce 240,000 units during its life. Required: Calculate depreciation for 2024 and 2025 using each of the following methods. Partial-year depreciation is calculated based on the number of months the asset is in service. In 2022, Alliant Corporation acquired Centerpoint Incorporated for $390 million, of which $60 million was allocated to goodwill. At the end of 2024, management has provided the following information for a required goodwill impairment test: Required: 1. Determine the amount of the impairment loss reported in the 2024 income statement. Note: Enter your answer in millions (i.e., 10,000,000 should be entered as 10). Answer is complete but not entirely correct. 2. Determine the amount of goodwill reported in the year-end 2024 balance sheet. 3. Determine the amount of the impairment loss assuming that the fair value of Centerpoint is $366 million. Note: For all requirements, enter your answer in millions (i.e., 10,000,000 should be entered as 10). Janes Company provided the following information on intangible assets: a. A patent was purchased from the Lou Company for $1,550,000 on January 1,2022 . Janes estimated the remaining useful life of the patent to be 10 years. The patent was carried on Lou's accounting records at a net book value of $520,000 when Lou sold it to Janes. b. During 2024, a franchise was purchased from the Rink Company for $670,000. The contractual life of the franchise is 10 years and Janes records a full year of amortization in the year of purchase. c. Janes incurred research and development costs in 2024 as follows: d. Effective January 1, 2024, based on new events that have occurred, Janes estimates that the remaining life of the patent purchased from Lou is only five more years. Required: 1. Prepare the entries necessary for years 2022 through 2024 to reflect the above information. 2. Prepare a schedule showing the intangible asset section of Janes's December 31, 2024, balance sheet. Prepare a schedule showing the intangible asset section of Janes's December 31,2024 , balance sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started