Answered step by step

Verified Expert Solution

Question

1 Approved Answer

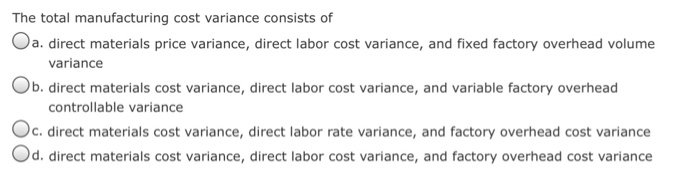

1) 2) 3) 4) 5) The total manufacturing cost variance consists of Oa. direct materials price variance, direct labor cost variance, and fixed factory overhead

1)

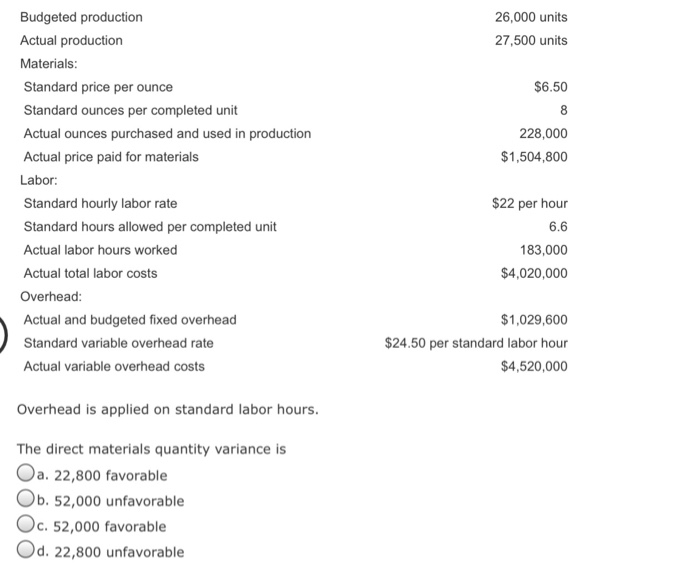

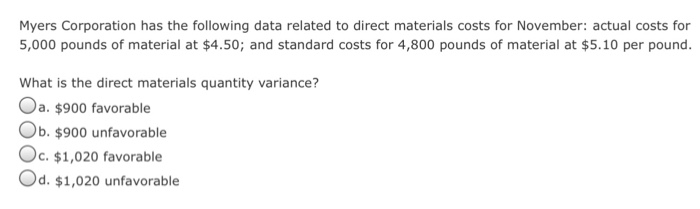

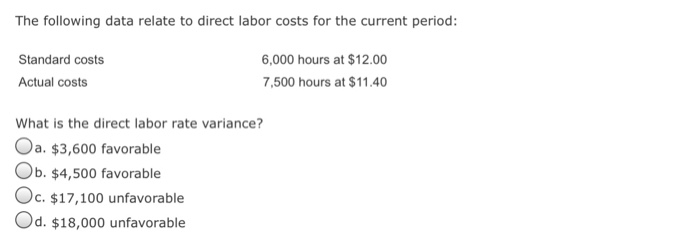

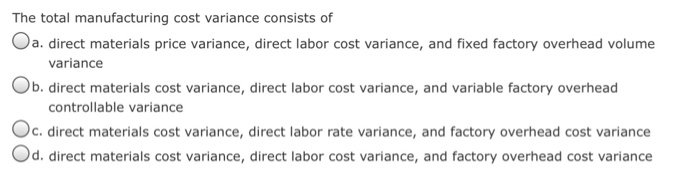

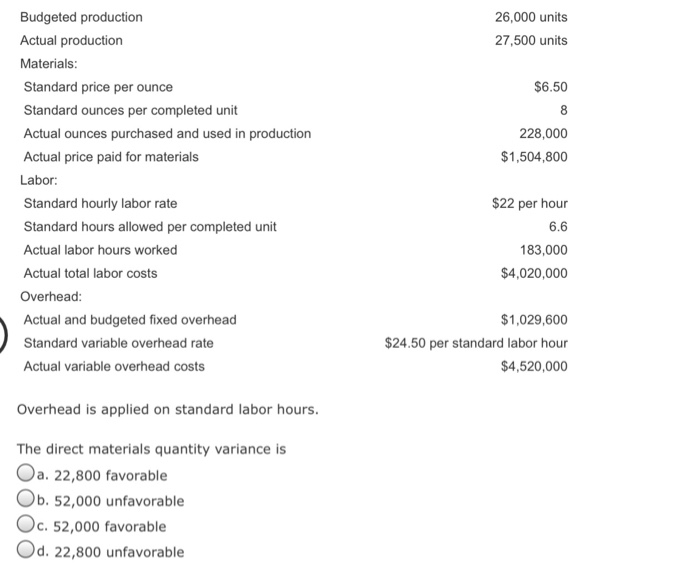

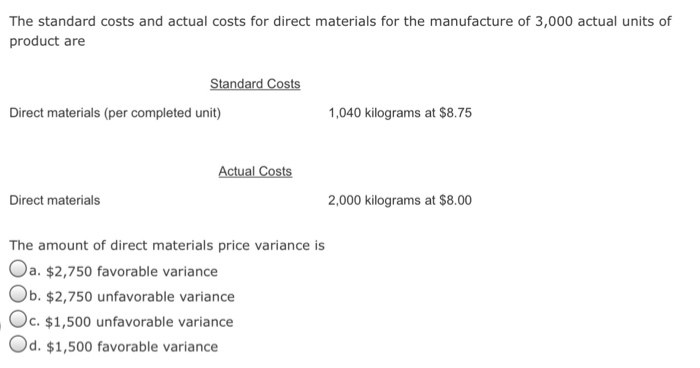

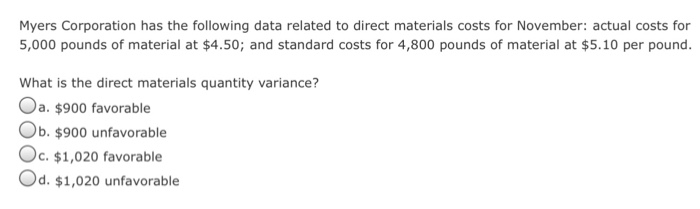

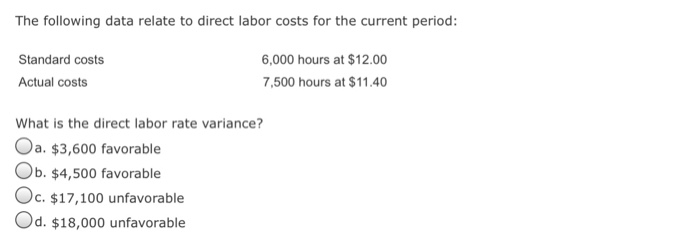

The total manufacturing cost variance consists of Oa. direct materials price variance, direct labor cost variance, and fixed factory overhead volume Ob. direct materials cost variance, direct labor cost variance, and variable factory overhead Oc. direct materials cost variance, direct labor rate variance, and factory overhead cost variance variance controllable variance Od. direct materials cost variance, direct labor cost variance, and factory overhead cost variance Budgeted production Actual production Materials Standard price per ounce Standard ounces per completed unit Actual ounces purchased and used in production Actual price paid for materials Labor: Standard hourly labor rate Standard hours allowed per completed unit Actual labor hours worked Actual total labor costs Overhead Actual and budgeted fixed overhead Standard variable overhead rate Actual variable overhead costs 26,000 units 27,500 units 6.50 8 228,000 $1,504,800 $22 per hour 6.6 183,000 $4,020,000 $1,029,600 $24.50 per standard labor hour $4,520,000 Overhead is applied on standard labor hours The direct materials quantity variance is Oa. 22,800 favorable Ob. 52,000 unfavorable Oc. 52,000 favorable Od. 22,800 unfavorable The standard costs and actual costs for direct materials for the manufacture of 3,000 actual units of product are Standard Costs Direct materials (per completed unit) 1,040 kilograms at $8.75 Actual Costs Direct materials 2,000 kilograms at $8.00 The amount of direct materials price variance is Oa. $2,750 favorable variance Ob. $2,750 unfavorable variance Oc.$1,500 unfavorable variance Od. $1,500 favorable variance Myers Corporation has the following data related to direct materials costs for November: actual costs for 5,000 pounds of material at $4.50; and standard costs for 4,800 pounds of material at $5.10 per pound What is the direct materials quantity variance? Oa. $900 favorable Ob. $900 unfavorable Oc-$1,020 favorable Od. $1,020 unfavorable The following data relate to direct labor costs for the current period: Standard costs Actual costs 6,000 hours at $12.00 7,500 hours at $11.40 What is the direct labor rate variance? Oa. $3,600 favorable Ob. $4,500 favorable Oc. $17,100 unfavorable Od. $18,000 unfavorable

2)

3)

4)

5)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started