1.

2.

3.

4.

5.

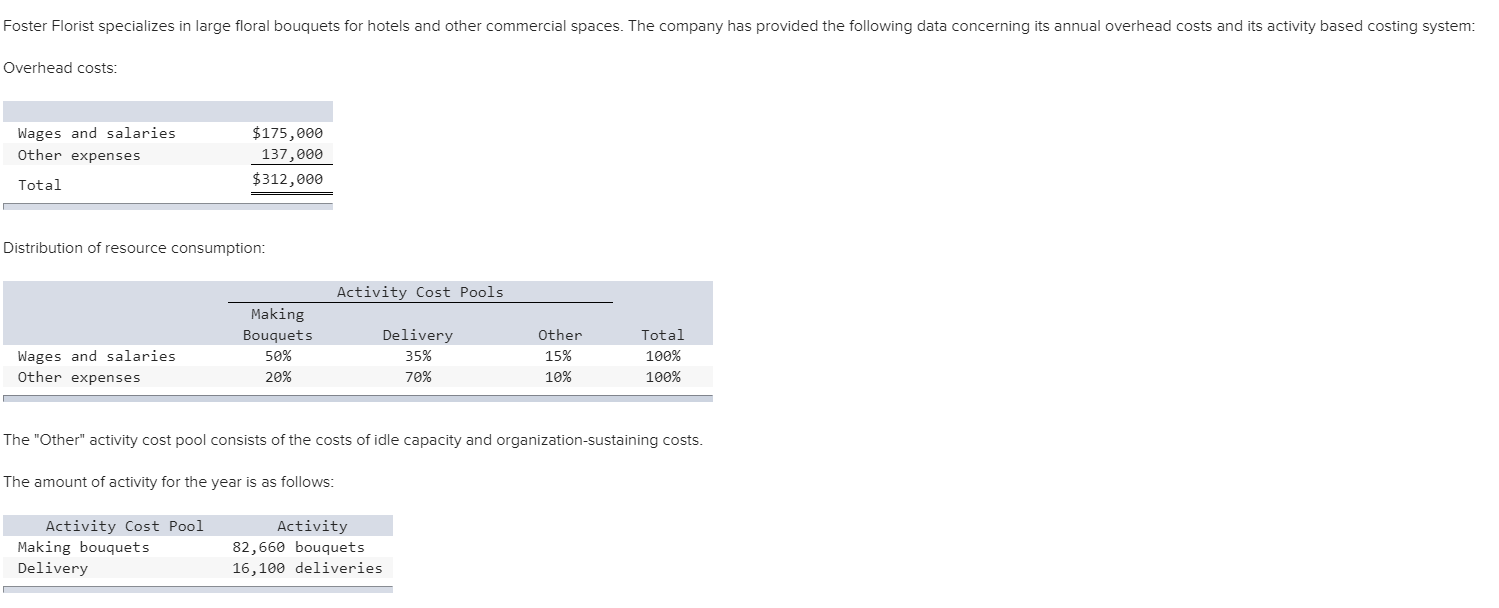

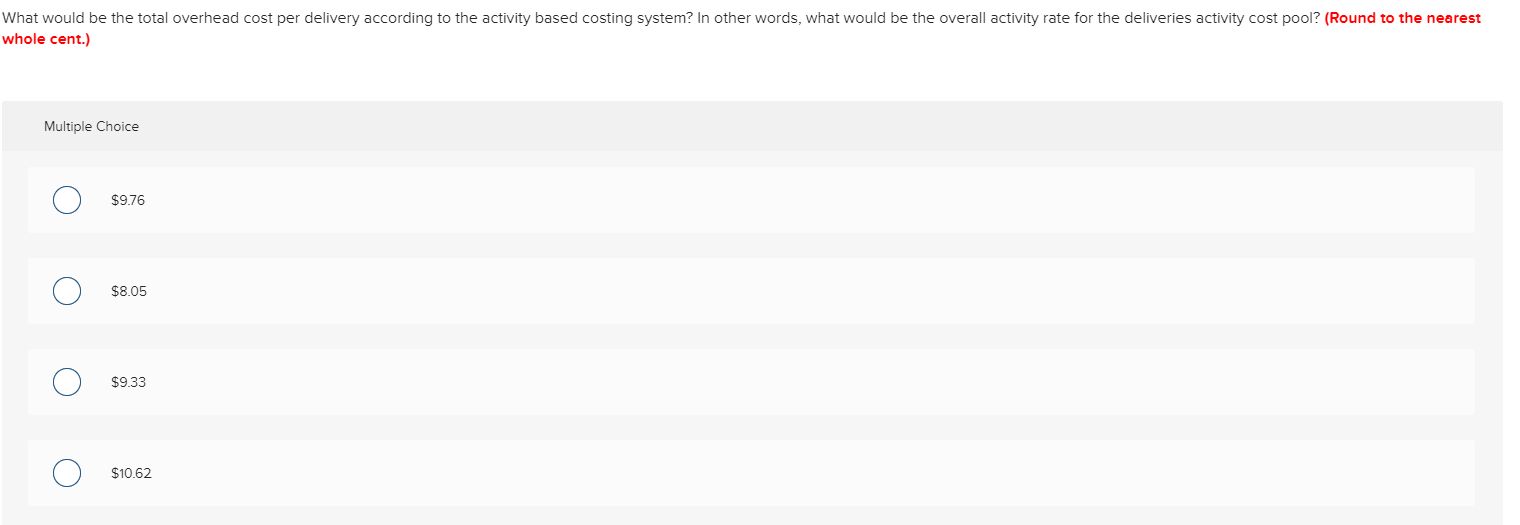

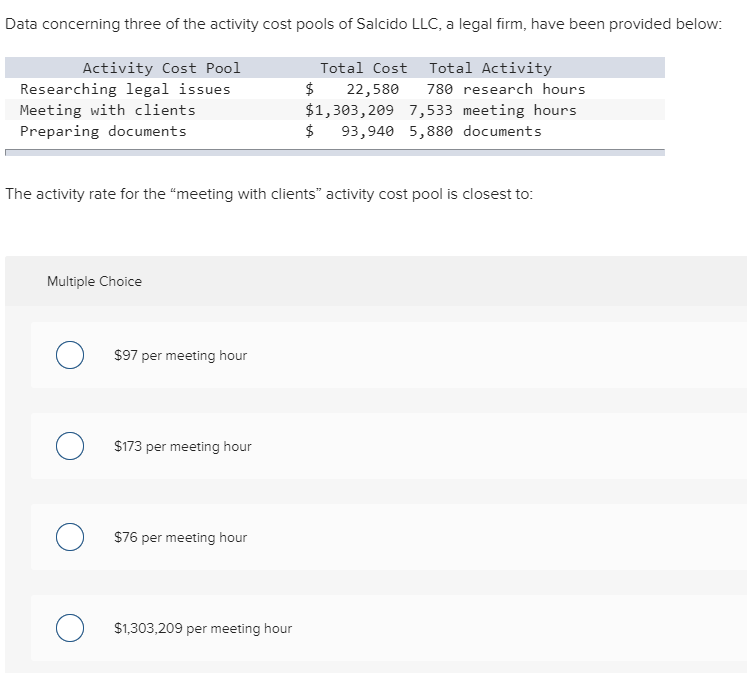

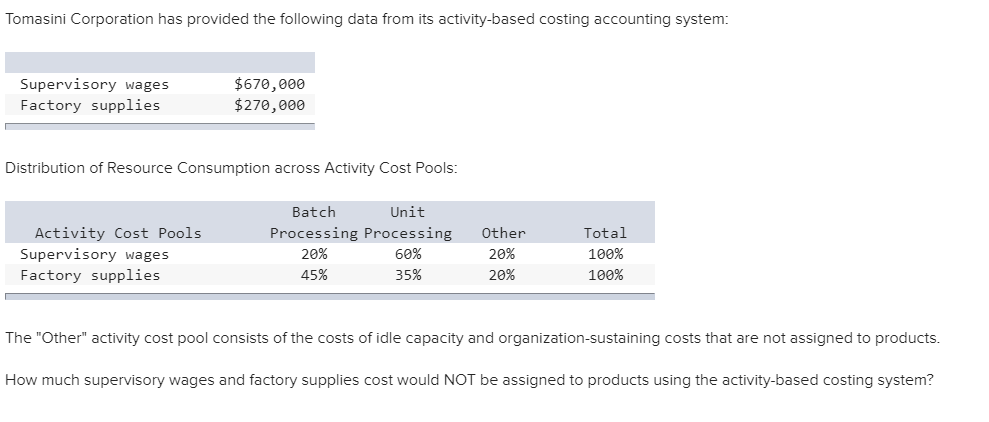

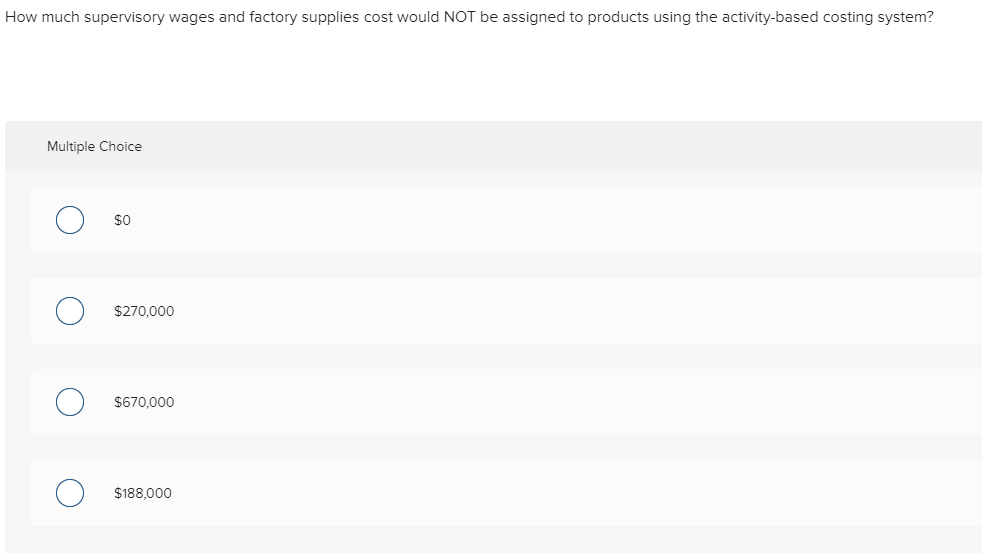

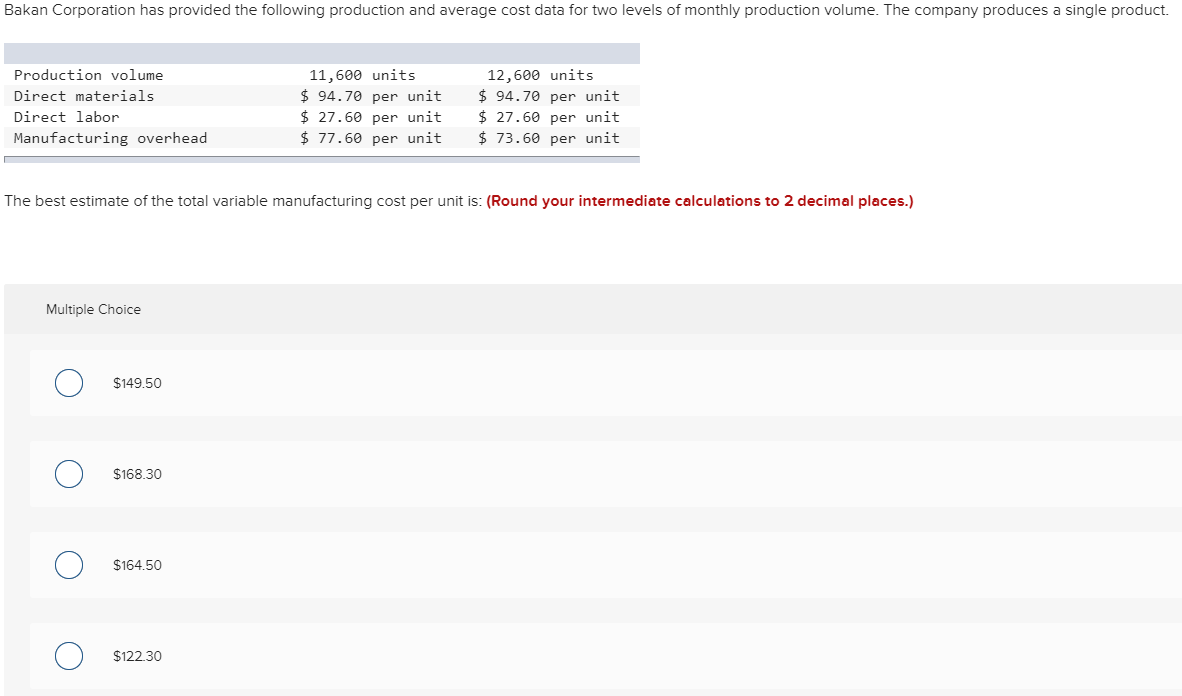

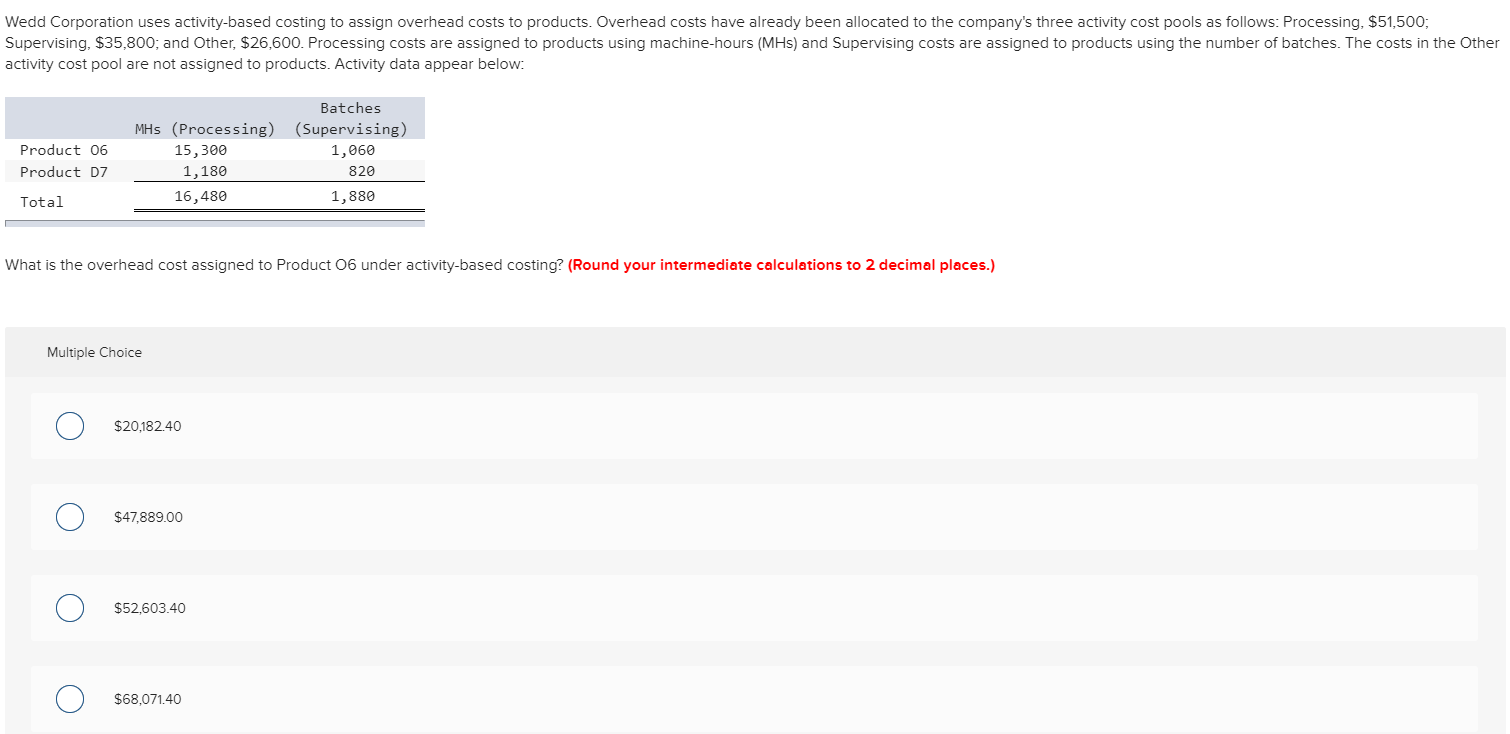

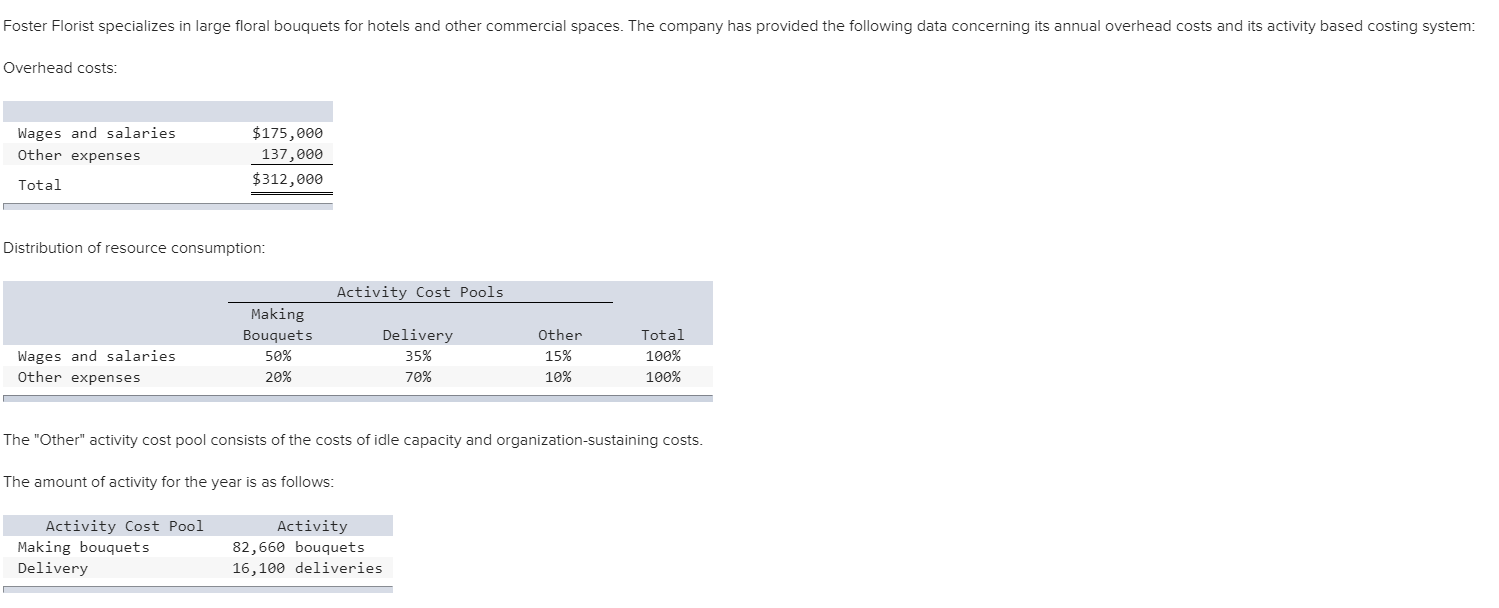

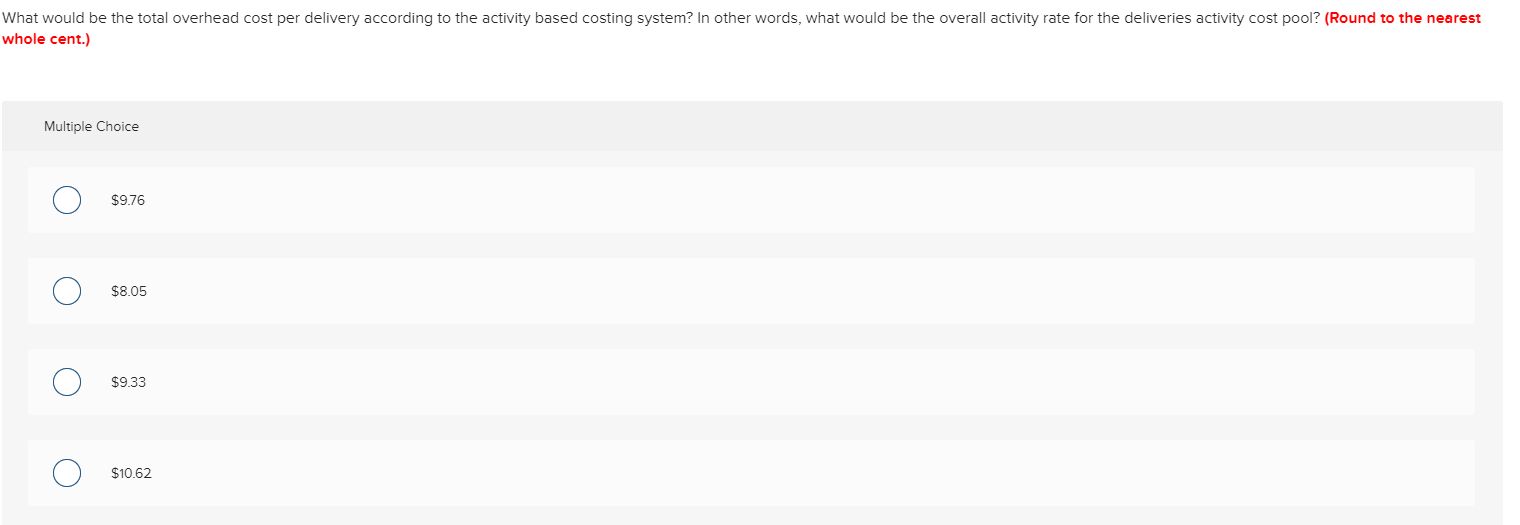

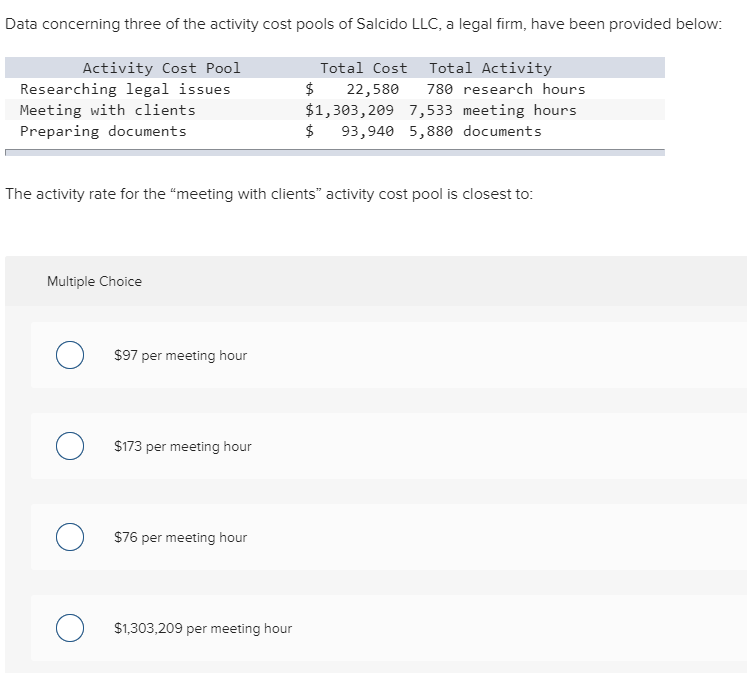

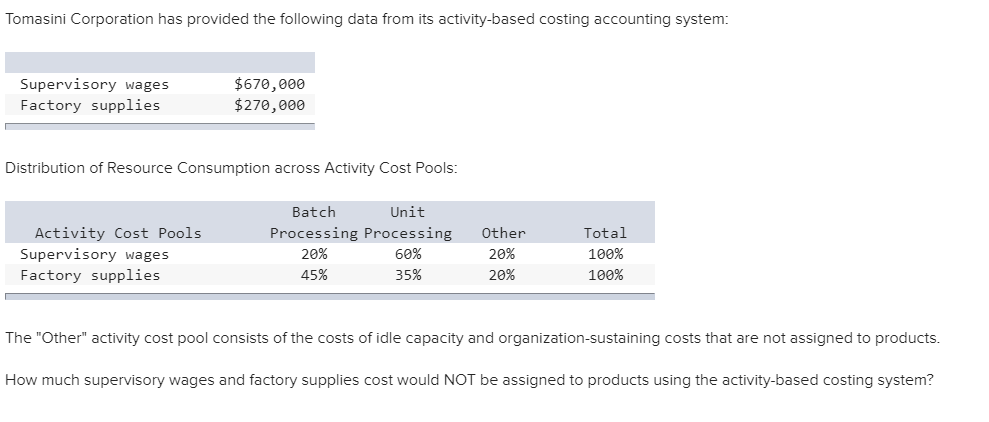

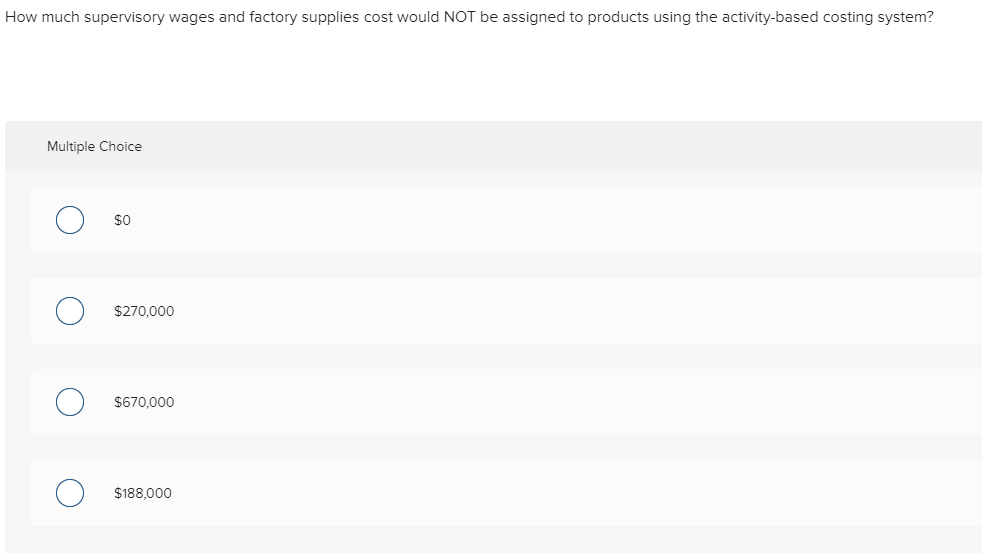

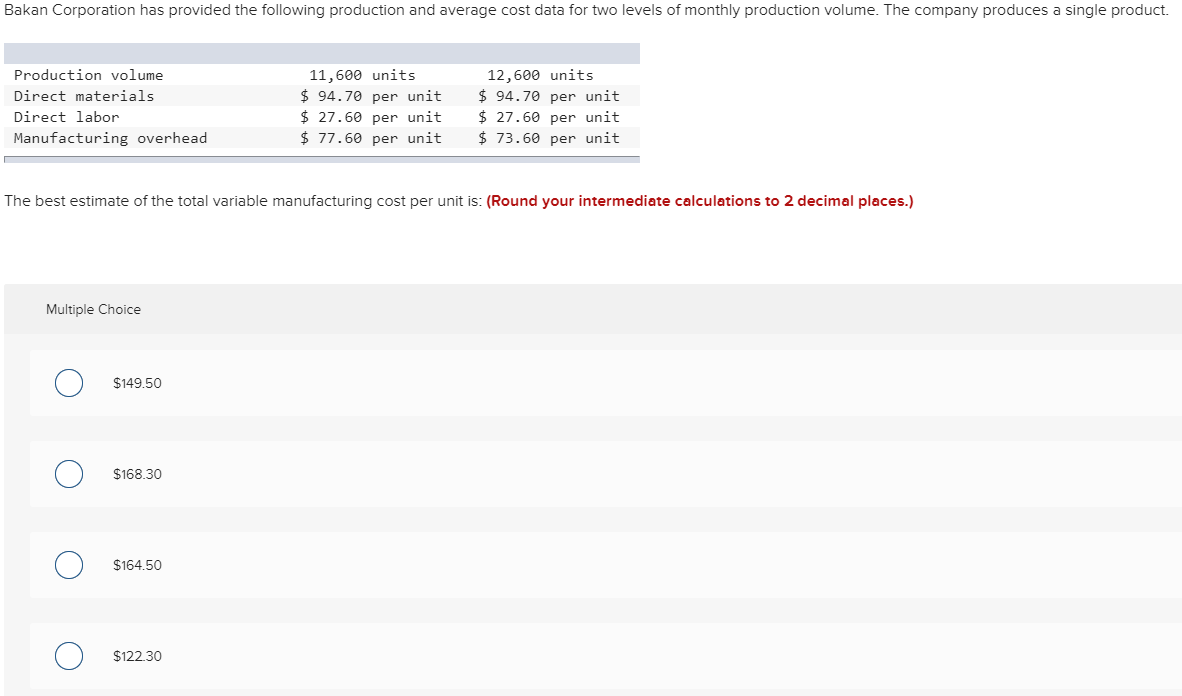

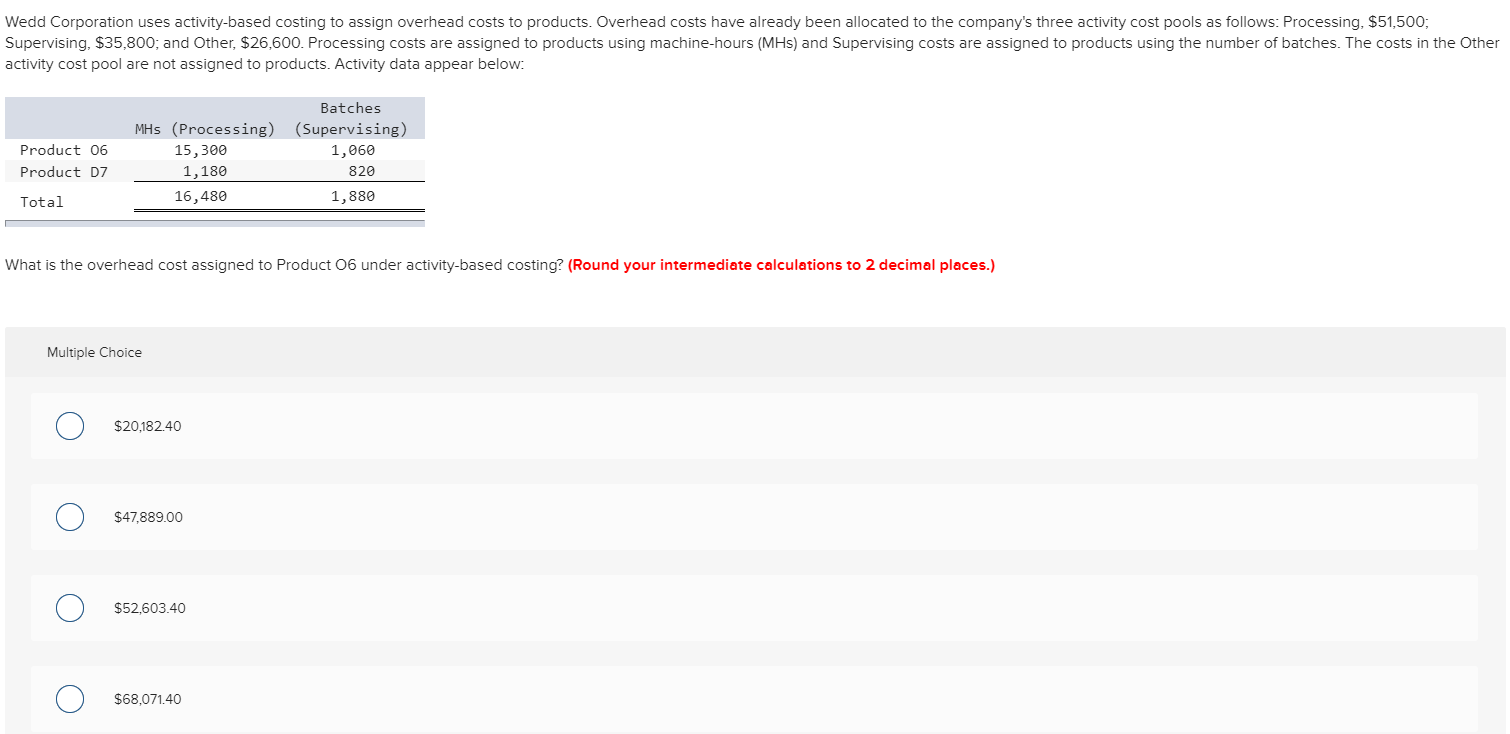

What would be the total overhead cost per delivery according to the activity based costing system? In other words, what would be the overall activity rate for the deliveries activity cost pool? (Round to the nearest whole cent.) Multiple Choice O $9.76 O $8.05 O $9.33 O $10.62 Data concerning three of the activity cost pools of Salcido LLC, a legal firm, have been provided below: Activity Cost Pool Researching legal issues Meeting with clients Preparing documents Total Cost Total Activity 22,580 780 research hours $1,303,209 7,533 meeting hours $ 93,940 5,880 documents The activity rate for the "meeting with clients activity cost pool is closest to: Multiple Choice $97 per meeting hour $173 per meeting hour $76 per meeting hour $1,303,209 per meeting hour Tomasini Corporation has provided the following data from its activity-based costing accounting system: Supervisory wages Factory supplies $670,000 $270,000 Distribution of Resource Consumption across Activity Cost Pools: Activity Cost Pools Supervisory wages Factory supplies Batch Unit Processing Processing 20% 60% 45% 35% Other 20% 20% Total 100% 100% The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products. How much supervisory wages and factory supplies cost would NOT be assigned to products using the activity-based costing system? How much supervisory wages and factory supplies cost would NOT be assigned to products using the activity-based costing system? Multiple Choice $0 O $270,000 $670,000 $188,000 O Bakan Corporation has provided the following production and average cost data for two levels of monthly production volume. The company produces a single product. Production volume Direct materials Direct labor Manufacturing overhead 11,600 units $ 94.70 per unit $ 27.60 per unit $ 77.60 per unit 12,600 units $ 94.70 per unit $ 27.60 per unit $ 73.60 per unit The best estimate of the total variable manufacturing cost per unit is: (Round your intermediate calculations to 2 decimal places.) Multiple Choice O $149.50 O $168.30 O $164.50 $122.30 Wedd Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $51,500; Supervising, $35,800; and Other, $26,600. Processing costs are assigned to products using machine-hours (MHS) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below: Product 06 Product D7 MHs (Processing) 15,300 1,180 16,480 Batches (Supervising) 1,060 820 1,880 Total What is the overhead cost assigned to Product 06 under activity-based costing? (Round your intermediate calculations to 2 decimal places.) Multiple Choice $20,182.40 $47,889.00 $52,603.40 O $68,071.40