Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2. 3. 4. I am sorry that I have uploaded more than one question, because I still have many questions, but there are no

1.

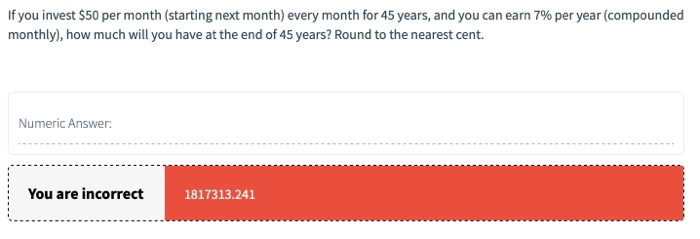

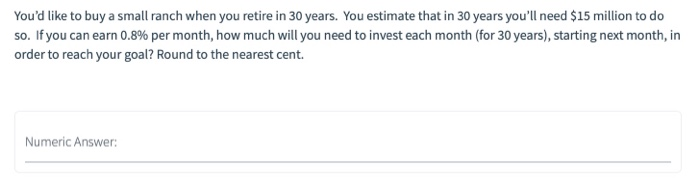

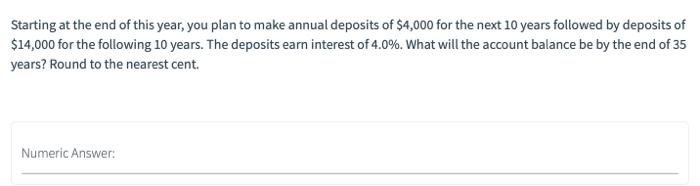

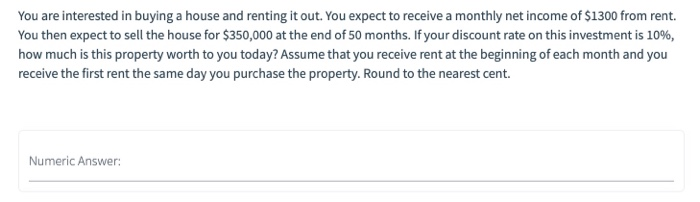

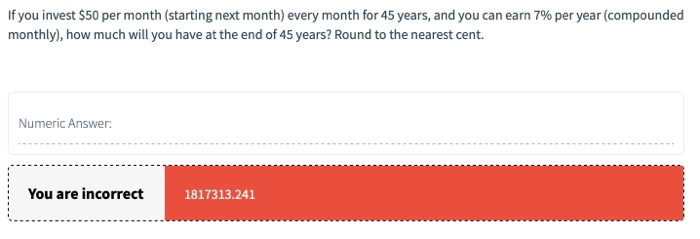

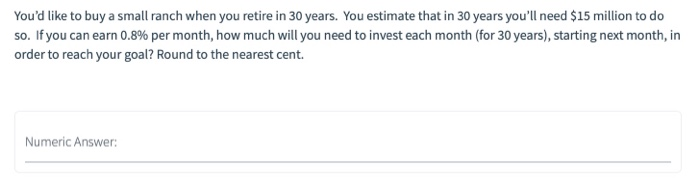

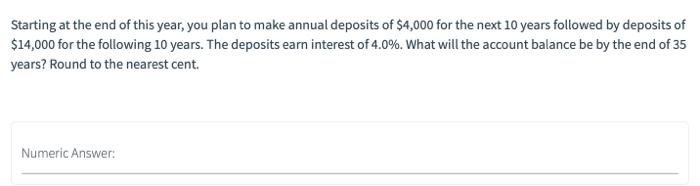

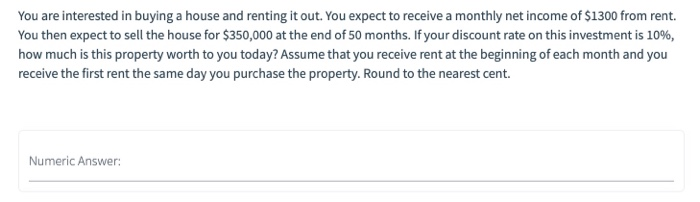

If you invest $50 per month (starting next month) every month for 45 years, and you can earn 7% per year (compounded monthly), how much will you have at the end of 45 years? Round to the nearest cent. Numeric Answer: You are incorrect 1817313.241 You'd like to buy a small ranch when you retire in 30 years. You estimate that in 30 years you'll need $15 million to do so. If you can earn 0.8% per month, how much will you need to invest each month (for 30 years), starting next month, in order to reach your goal? Round to the nearest cent. Numeric Answer: Starting at the end of this year, you plan to make annual deposits of $4,000 for the next 10 years followed by deposits of $14,000 for the following 10 years. The deposits earn interest of 4.0%. What will the account balance be by the end of 35 years? Round to the nearest cent. Numeric Answer: You are interested in buying a house and renting it out. You expect to receive a monthly net income of $1300 from rent. You then expect to sell the house for $350,000 at the end of 50 months. If your discount rate on this investment is 10%, how much is this property worth to you today? Assume that you receive rent at the beginning of each month and you receive the first rent the same day you purchase the property. Round to the nearest cent. Numeric

2.

3.

4.

I am sorry that I have uploaded more than one question, because I still have many questions, but there are no more questions. I hope you can help me answer this question. If you can only answer one question, please do not answer this question, thank you.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started