1 2

2 3

3 4

4

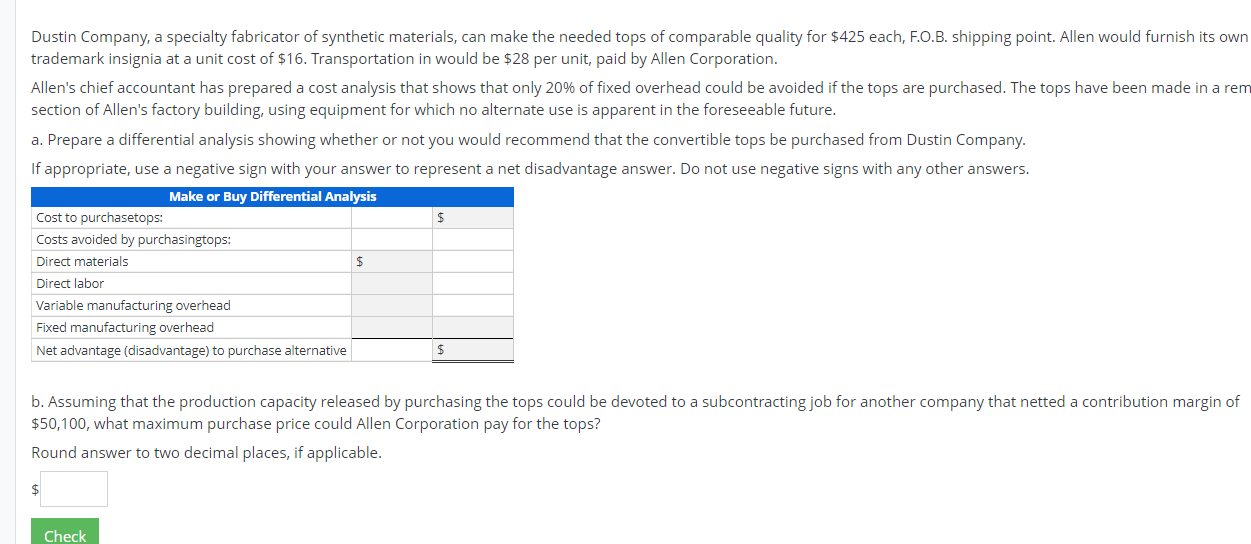

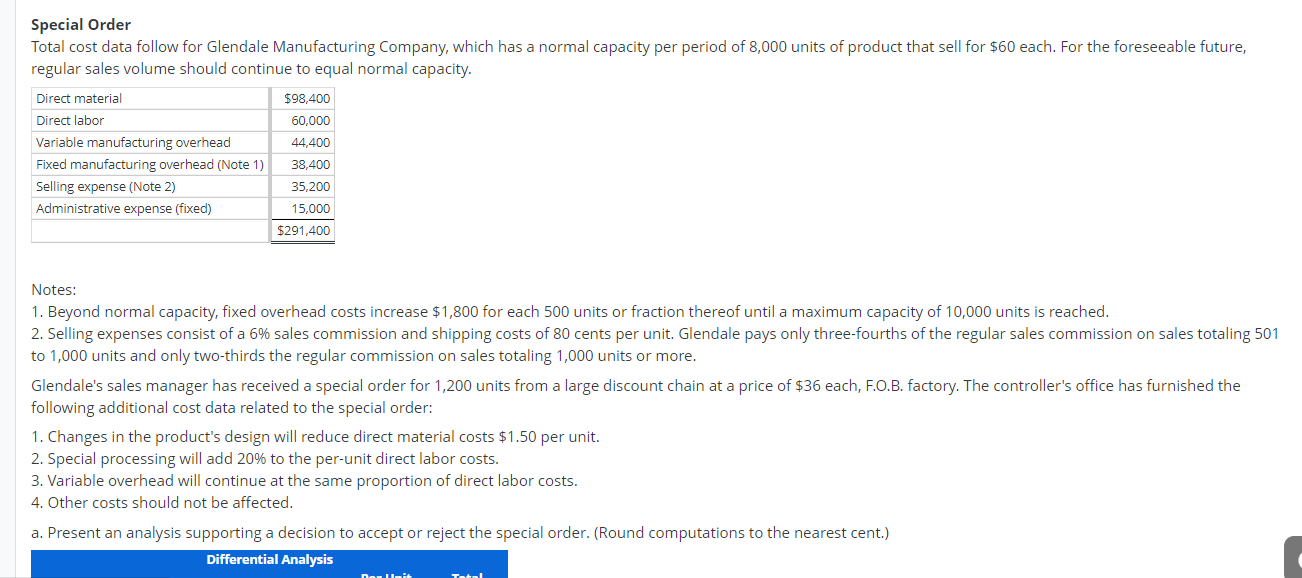

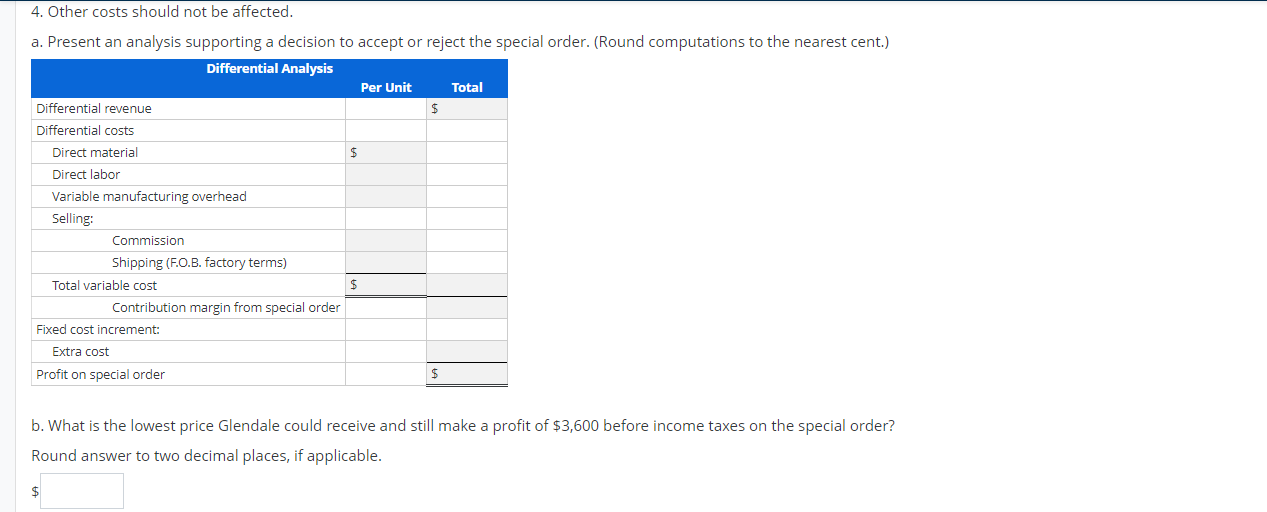

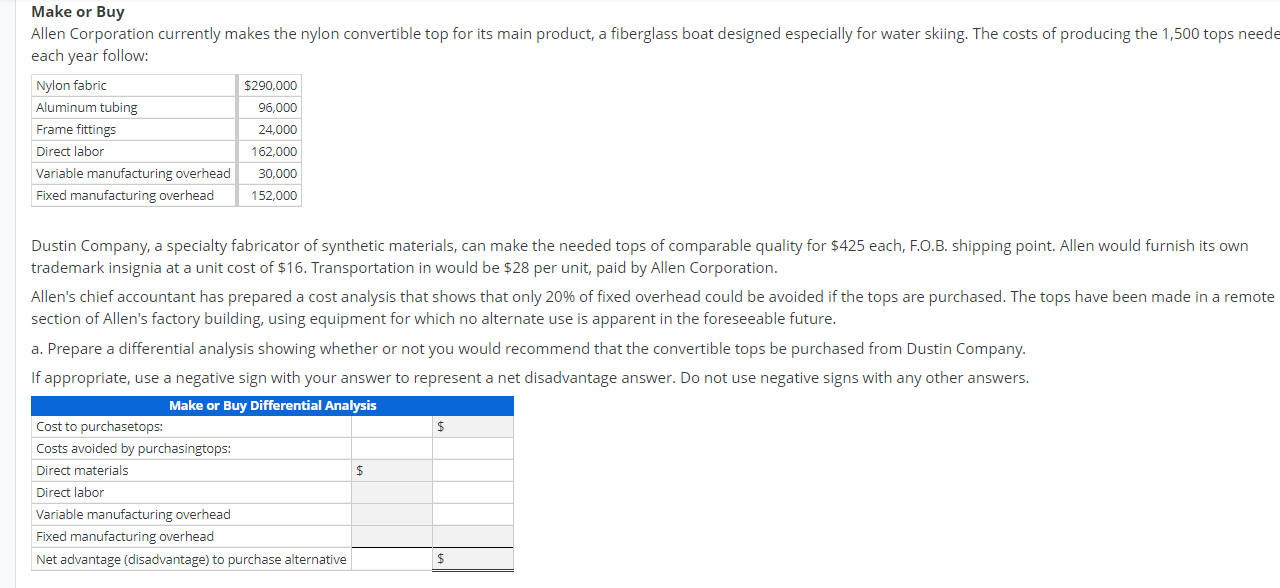

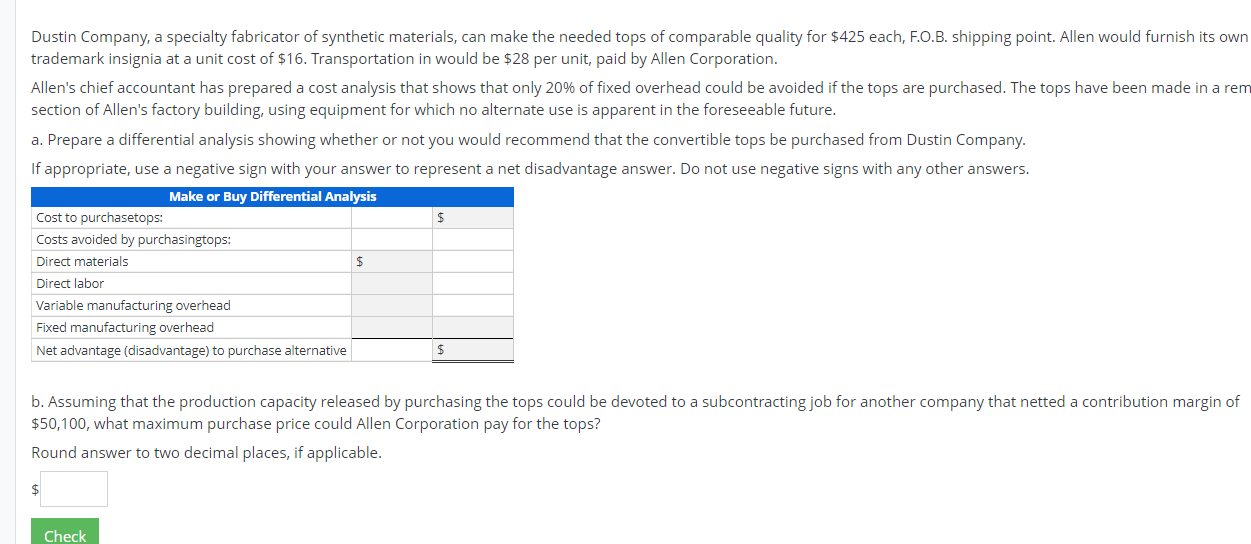

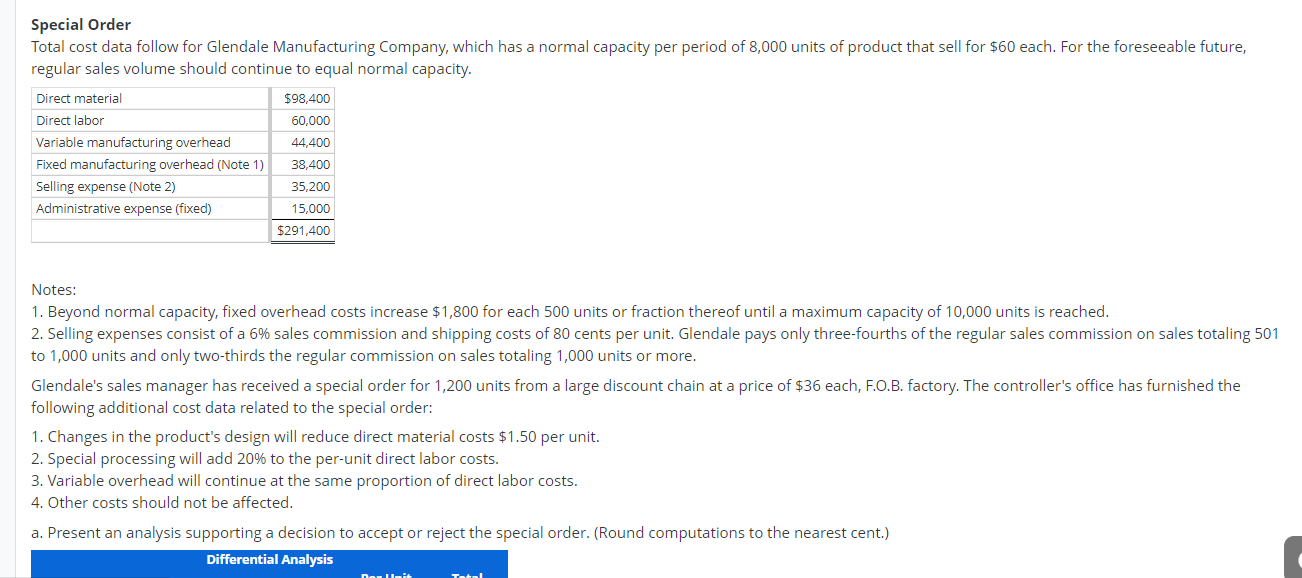

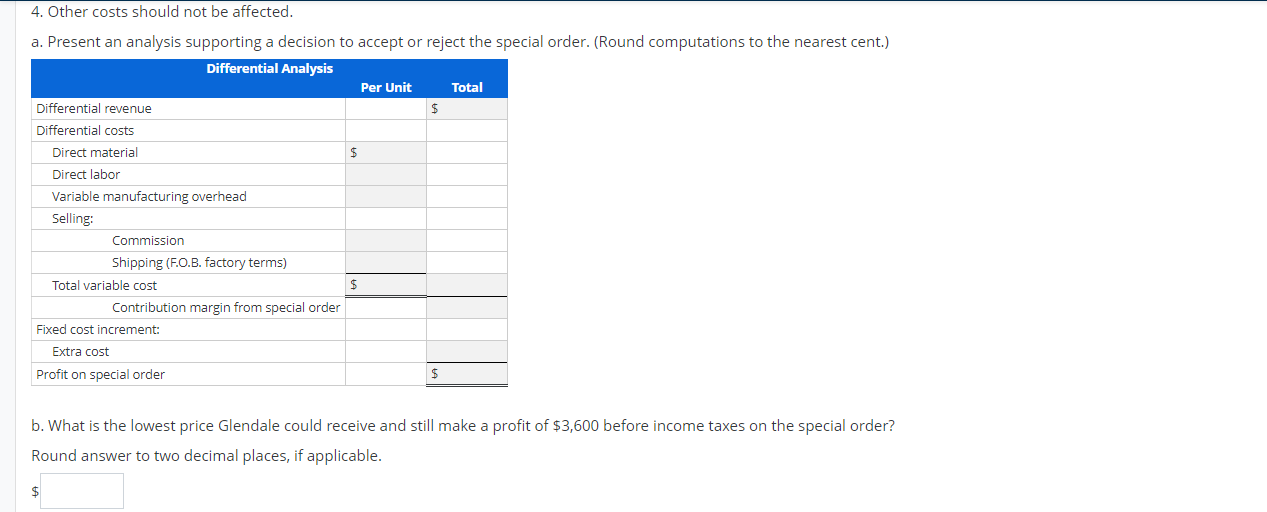

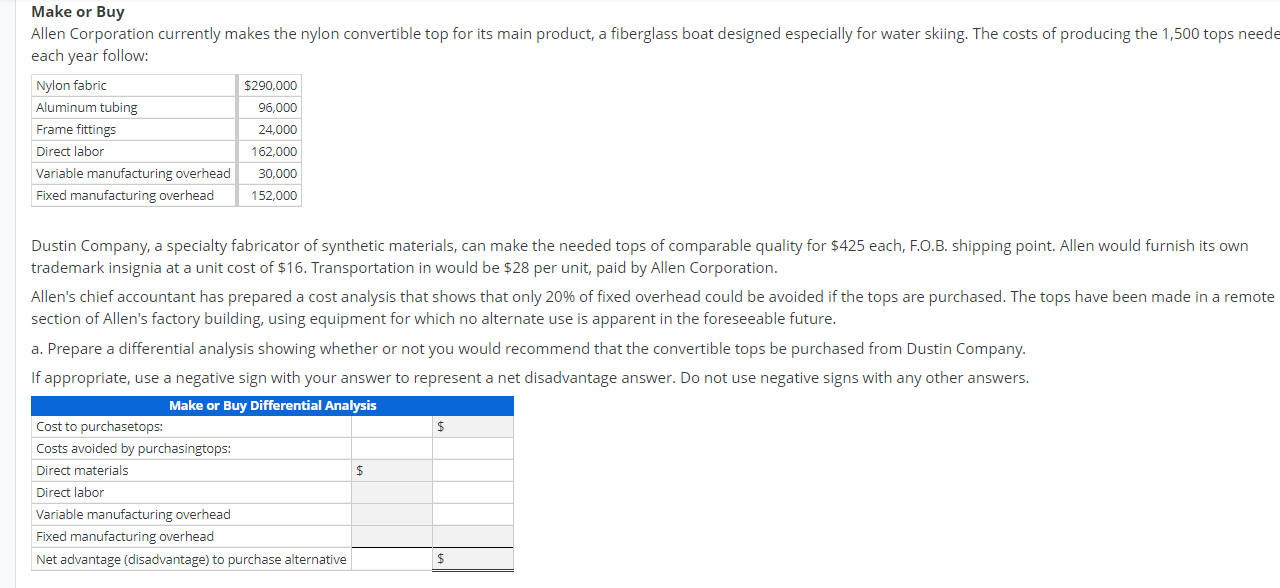

Special Order Total cost data follow for Glendale Manufacturing Company, which has a normal capacity per period of 8,000 units of product that sell for $60 each. For the foreseeable future, regular sales volume should continue to equal normal capacity. Direct material $98,400 Direct labor 60,000 Variable manufacturing overhead 44,400 Fixed manufacturing overhead (Note 1) 38,400 Selling expense (Note 2) 35,200 Administrative expense (fixed) 15,000 $291,400 Notes: 1. Beyond normal capacity, fixed overhead costs increase $1,800 for each 500 units or fraction thereof until a maximum capacity of 10,000 units is reached. 2. Selling expenses consist of a 6% sales commission and shipping costs of 80 cents per unit. Glendale pays only three-fourths of the regular sales commission on sales totaling 501 to 1,000 units and only two-thirds the regular commission on sales totaling 1,000 units or more. Glendale's sales manager has received a special order for 1,200 units from a large discount chain at a price of $36 each, F.O.B. factory. The controller's office has furnished the following additional cost data related to the special order: 1. Changes in the product's design will reduce direct material costs $1.50 per unit. 2. Special processing will add 20% to the per-unit direct labor costs. 3. Variable overhead will continue at the same proportion of direct labor costs. 4. Other costs should not be affected. a. Present an analysis supporting a decision to accept or reject the special order. (Round computations to the nearest cent.) Differential Analysis 4. Other costs should not be affected. a. Present an analysis supporting a decision to accept or reject the special order. (Round computations to the nearest cent.) Differential Analysis Per Unit Total Differential revenue $ Differential costs Direct material $ Direct labor Variable manufacturing overhead Selling: Commission Shipping (F.O.B. factory terms) Total variable cost Contribution margin from special order Fixed cost increment: Extra cost Profit on special order $ b. What is the lowest price Glendale could receive and still make a profit of $3,600 before income taxes on the special order? Round answer to two decimal places, if applicable. Make or Buy Allen Corporation currently makes the nylon convertible top for its main product, a fiberglass boat designed especially for water skiing. The costs of producing the 1,500 tops neede each year follow: Nylon fabric $290,000 Aluminum tubing 96,000 Frame fittings 24,000 Direct labor 162,000 Variable manufacturing overhead 30,000 Fixed manufacturing overhead 152,000 Dustin Company, a specialty fabricator of synthetic materials, can make the needed tops of comparable quality for $425 each, F.O.B. shipping point. Allen would furnish its own trademark insignia at a unit cost of $16. Transportation in would be $28 per unit, paid by Allen Corporation. Allen's chief accountant has prepared a cost analysis that shows that only 20% of fixed overhead could be avoided if the tops are purchased. The tops have been made in a remote section of Allen's factory building, using equipment for which no alternate use is apparent in the foreseeable future. a. Prepare a differential analysis showing whether or not you would recommend that the convertible tops be purchased from Dustin Company. If appropriate, use a negative sign with your answer to represent a net disadvantage answer. Do not use negative signs with any other answers. Make or Buy Differential Analysis Cost to purchasetops: Costs avoided by purchasingtops: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Net advantage (disadvantage) to purchase alternative $ $ Dustin Company, a specialty fabricator of synthetic materials, can make the needed tops of comparable quality for $425 each, F.O.B. shipping point. Allen would furnish its own trademark insignia at a unit cost of $16. Transportation in would be $28 per unit, paid by Allen Corporation. Allen's chief accountant has prepared a cost analysis that shows that only 20% of fixed overhead could be avoided if the tops are purchased. The tops have been made in a rem section of Allen's factory building, using equipment for which no alternate use is apparent in the foreseeable future. a. Prepare a differential analysis showing whether or not you would recommend that the convertible tops be purchased from Dustin Company. If appropriate, use a negative sign with your answer to represent a net disadvantage answer. Do not use negative signs with any other answers. Make or Buy Differential Analysis Cost to purchasetops: Costs avoided by purchasingtops: $ Direct labor Variable manufacturing overhead Fixed manufacturing overhead Net advantage (disadvantage) to purchase alternative $ $ Direct materials b. Assuming that the production capacity released by purchasing the tops could be devoted to a subcontracting job for another company that netted a contribution margin of $50,100, what maximum purchase price could Allen Corporation pay for the tops? Round answer to two decimal places, if applicable. Check

2

2 3

3 4

4