Answered step by step

Verified Expert Solution

Question

1 Approved Answer

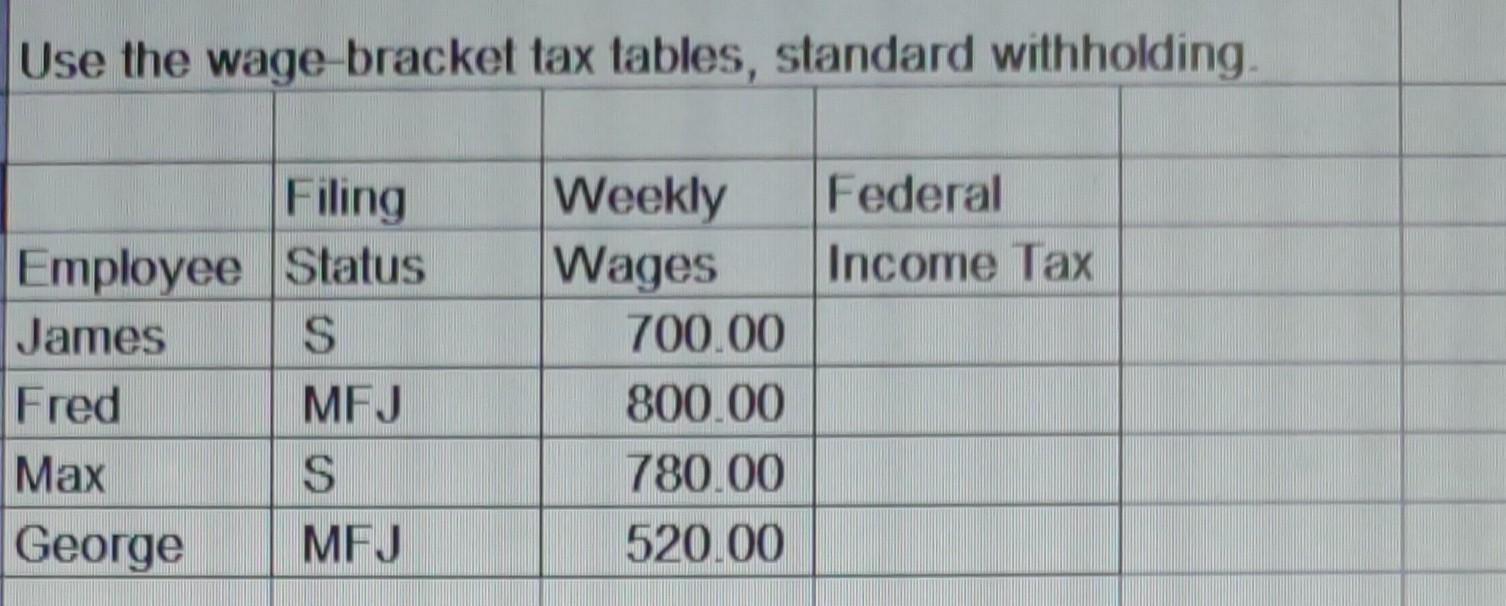

1 2 3 4 Use the wage-bracket tax tables, standard withholding. begin{tabular}{|l|l|l|l|} hline & Filing & Weekly & Federal hline Employee & Status &

1

2

3

4

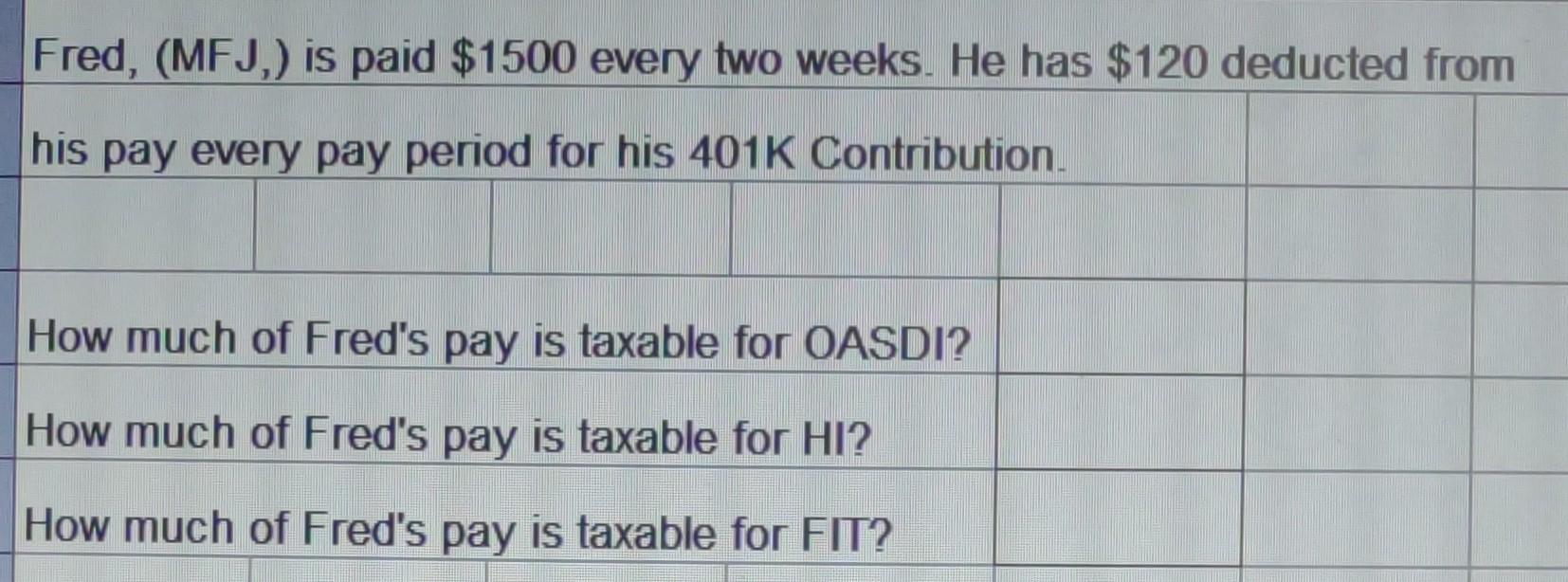

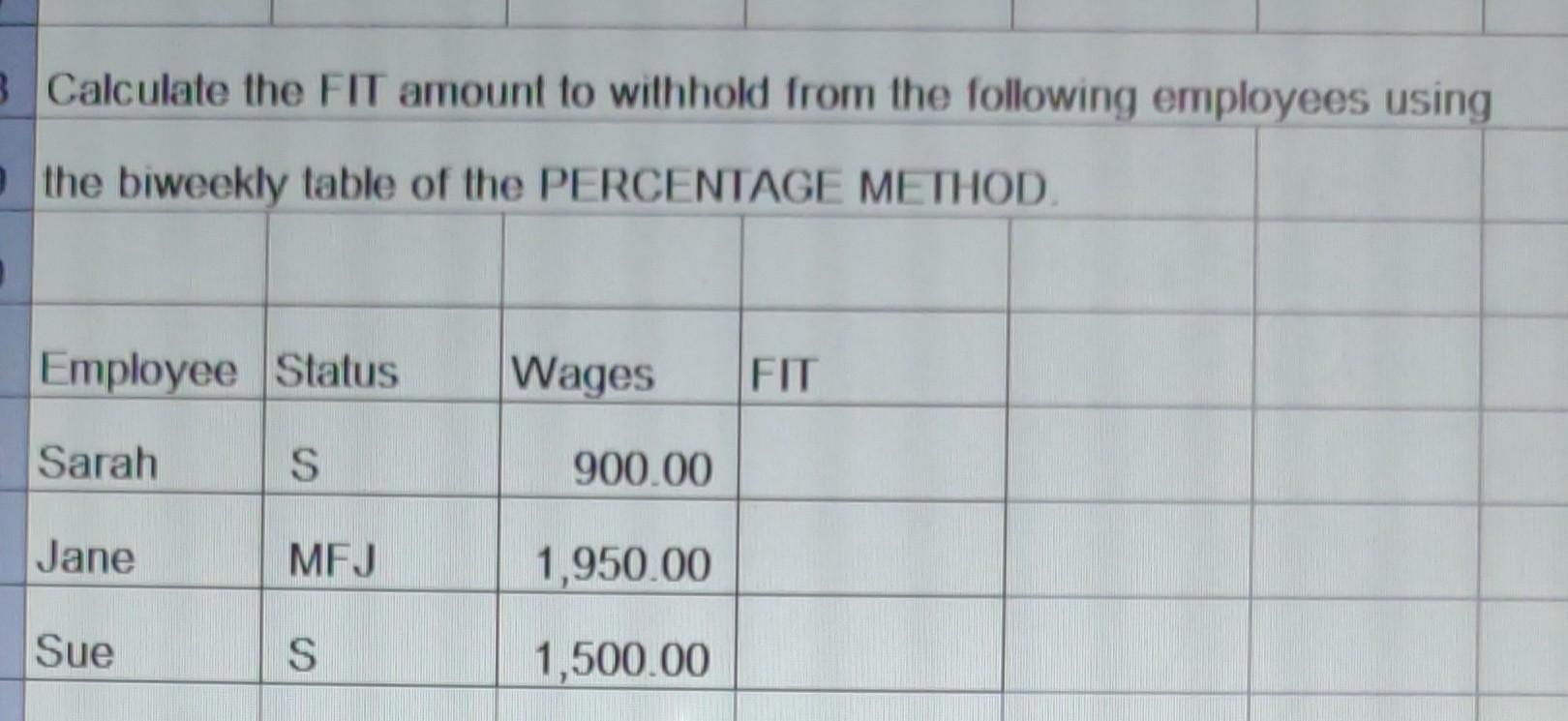

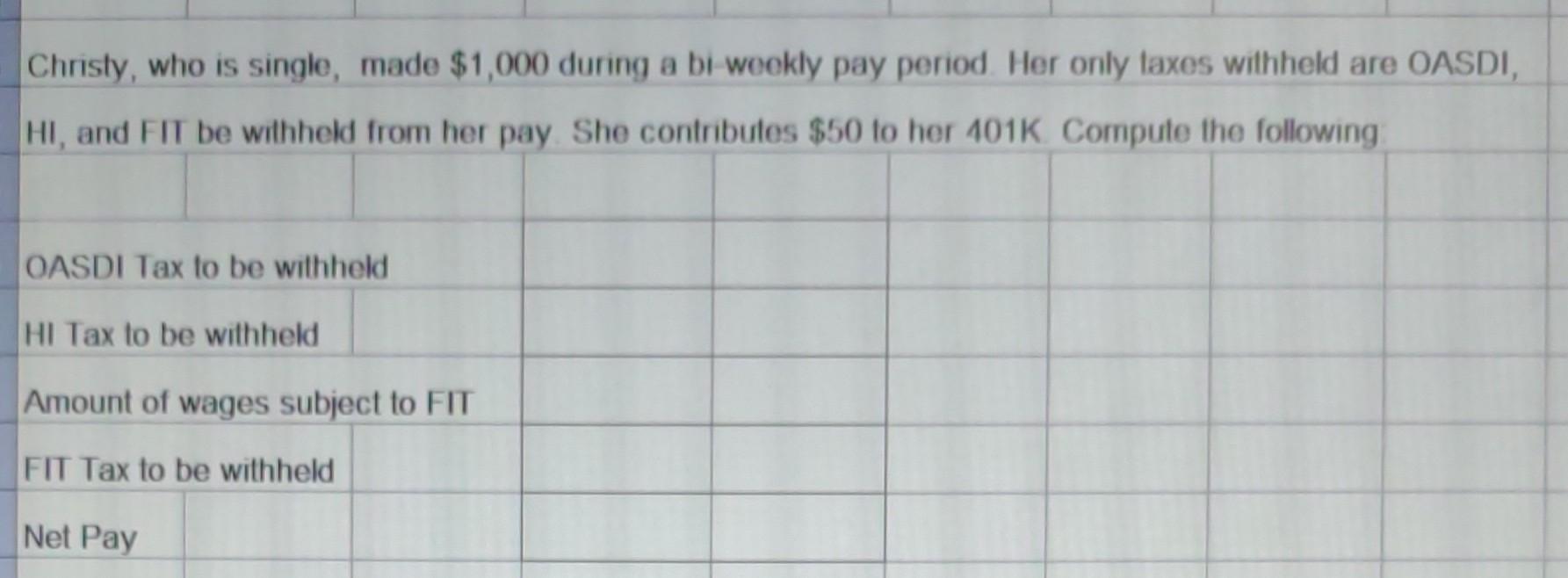

Use the wage-bracket tax tables, standard withholding. \begin{tabular}{|l|l|l|l|} \hline & Filing & Weekly & Federal \\ \hline Employee & Status & Wages & Income Tax \\ \hline James & S & 700.00 & \\ \hline Fred & MFJ & 800.00 & \\ \hline Max & S & 780.00 & \\ \hline George & MFJ & 520.00 & \\ \hline \end{tabular} Fred, (MFJ, ) is paid $1500 every two weeks. He has $120 deducted from his pay every pay period for his 401K Contribution. How much of Fred's pay is taxable for OASDI? How much of Fred's pay is taxable for HI? How much of Fred's pay is taxable for FIT? Calculate the FIT amount to withhold from the following employees using Christy, who is single, made $1,000 during a bi wookly pay period. Her only laxes withheld are OASDI, Use the wage-bracket tax tables, standard withholding. \begin{tabular}{|l|l|l|l|} \hline & Filing & Weekly & Federal \\ \hline Employee & Status & Wages & Income Tax \\ \hline James & S & 700.00 & \\ \hline Fred & MFJ & 800.00 & \\ \hline Max & S & 780.00 & \\ \hline George & MFJ & 520.00 & \\ \hline \end{tabular} Fred, (MFJ, ) is paid $1500 every two weeks. He has $120 deducted from his pay every pay period for his 401K Contribution. How much of Fred's pay is taxable for OASDI? How much of Fred's pay is taxable for HI? How much of Fred's pay is taxable for FIT? Calculate the FIT amount to withhold from the following employees using Christy, who is single, made $1,000 during a bi wookly pay period. Her only laxes withheld are OASDI

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started