1.

2.

3.

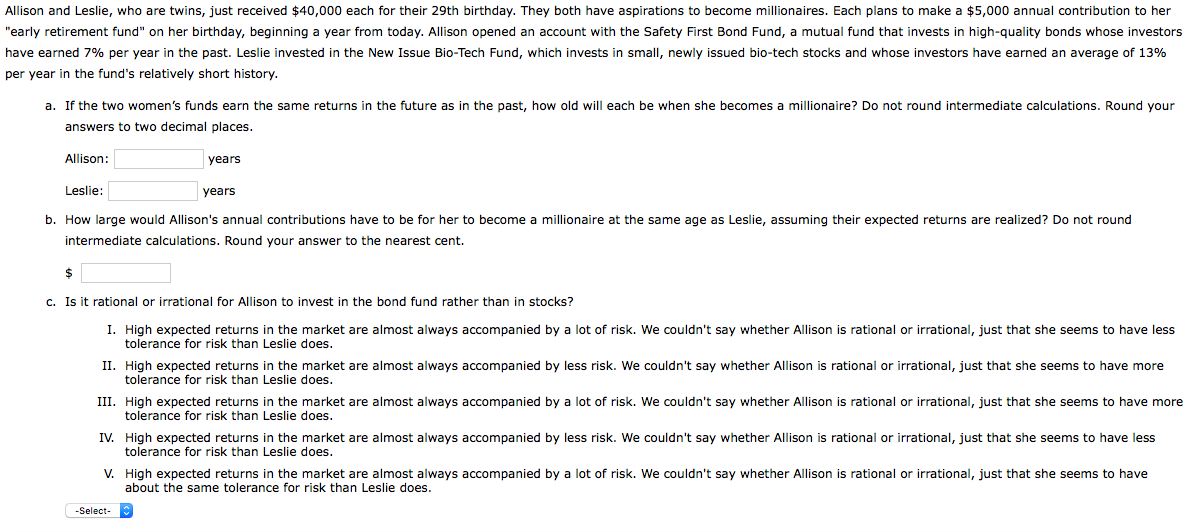

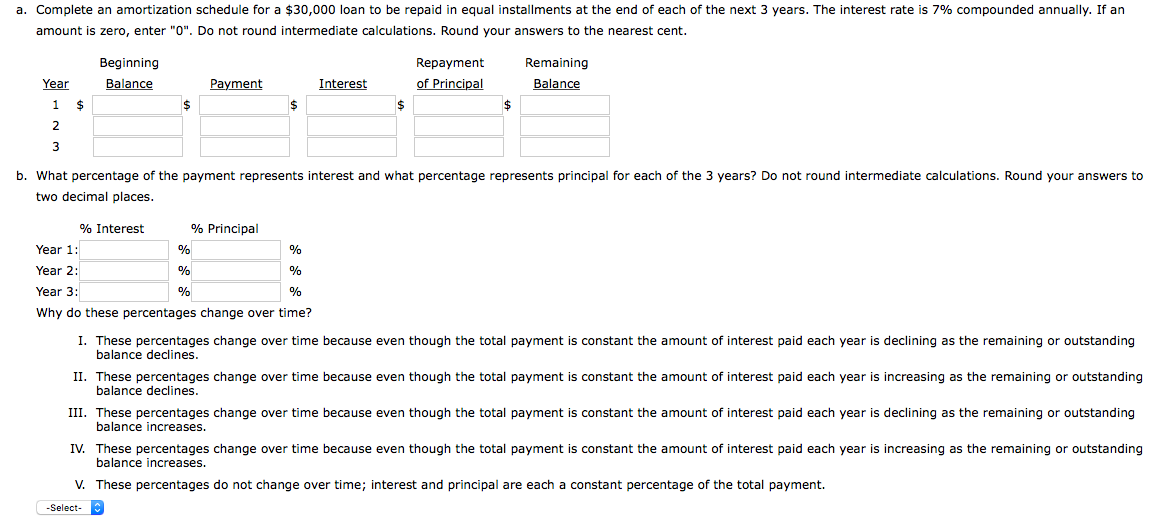

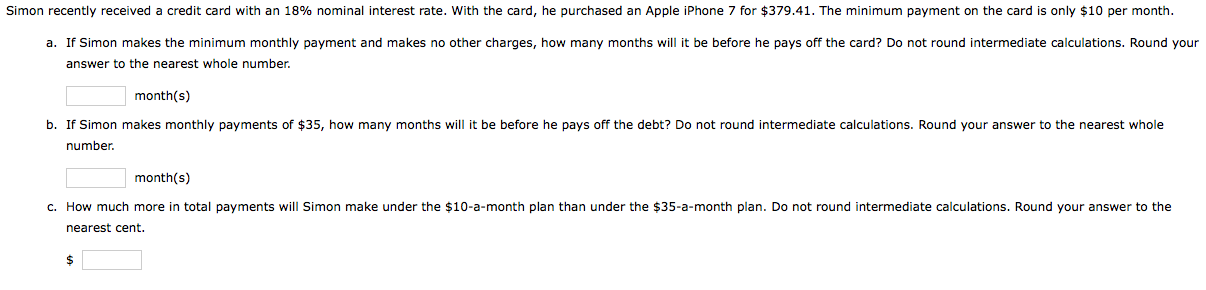

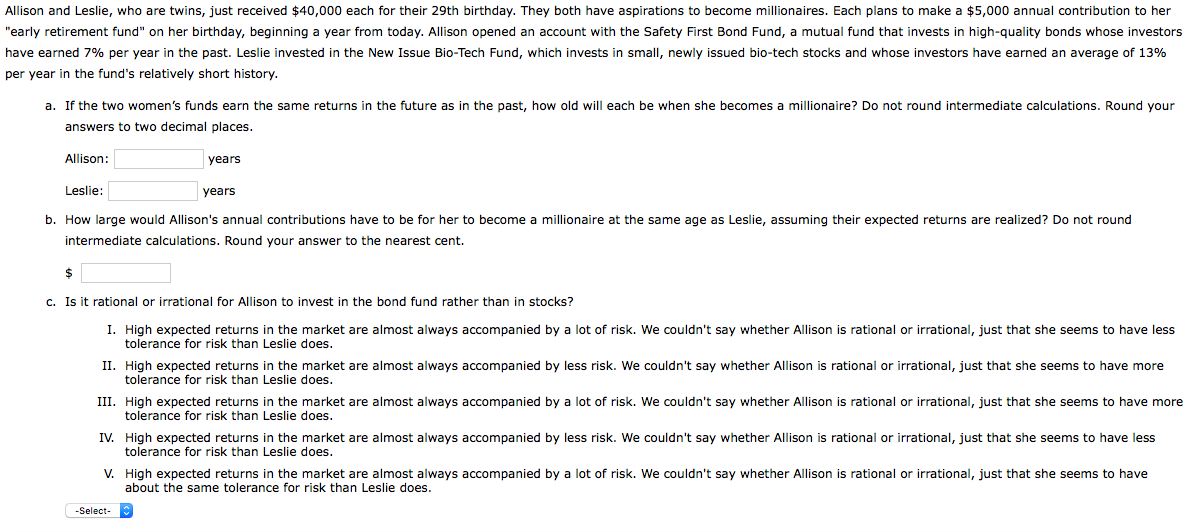

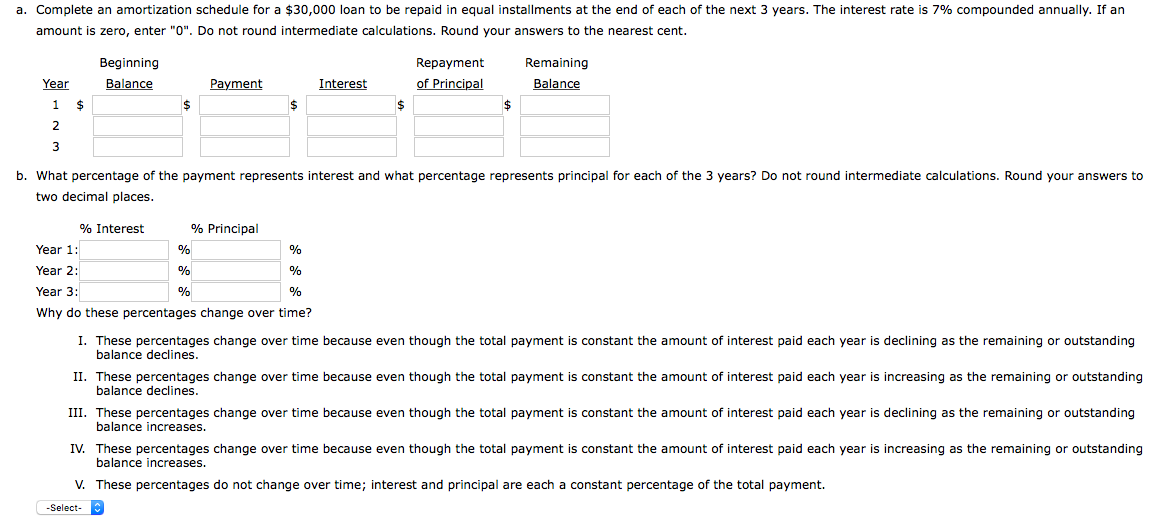

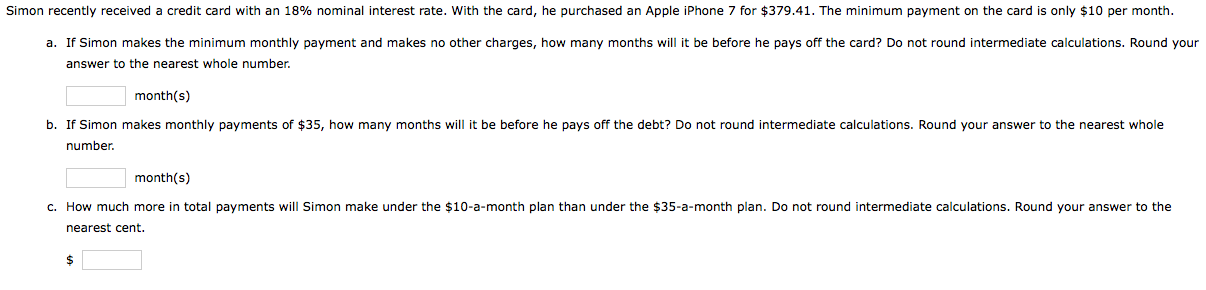

Allison and Leslie, who are twins, just received $40,000 each for their 29th birthday. They both have aspirations to become millionaires. Each plans to make a $5,000 annual contribution to her "early retirement fund" on her birthday, beginning a year from today. Allison opened an account with the Safety First Bond Fund, a mutual fund that invests in high-quality bonds whose investors have earned 7% per year in the past. Leslie invested in the New Issue Bio-Tech Fund, which invests in small, newly issued bio-tech stocks and whose investors have earned an average of 13% per year in the fund's relatively short history. millionaire? Do not round intermediate calculations. Round your a. If the two women's funds earn the same returns in the future as in the past, how old will each be when she becomes answers to two decimal places. Allison: years Leslie: years b. How large would Allison's annual contributions have to be for her to become a millionaire at the same age as Leslie, assuming their expected returns are realized? Do not round intermediate calculations. Round your answer to the nearest cent. $ c. Is it rational or irrational for Allison to invest in the bond fund rather than in stocks? 1. High expected returns in the market are almost always accompanied by a lot of risk. We couldn't say whether Allison is rational or irrational, just that she seems to have less tolerance for risk than Leslie does. II. High expected returns in the market are almost always accompanied by less risk. We couldn't say whether Allison is rational or irrational, just that she seems to have more tolerance for risk than Leslie does. III. High expected returns in the market are almost always accompanied by a lot of risk. We couldn't say whether Allison is rational or irrational, just that she seems to have more tolerance for risk than Leslie does. IV. High expected returns in the market are almost always accompanied by less risk. We couldn't say whether Allison is rational or irrational, just that she seems to have less tolerance for risk than Leslie does. V. High expected returns in the market are almost always accompanied by a lot of risk. We couldn't say whether Allison is rational or irrational, just that she seems to have about the same tolerance for risk than Leslie does. -Select- a. Complete an amortization schedule for a $30,000 loan to be repaid in equal installments at the end of each of the next 3 years. The interest rate is 7% compounded annually. If an amount is zero, enter "0". Do not round intermediate calculations. Round your answers to the nearest cent. Beginning Balance Repayment of Principal Remaining Balance Payment Interest Year 1 $ $ 2 3 b. What percentage of the payment represents interest and what percentage represents principal for each of the 3 years? Do not round intermediate calculations. Round your answers to two decimal places. % Interest % Principal Year 1: % % Year 2: % % Year 3: % % Why do these percentages change over time? 1. These percentages change over time because even though the total payment is constant the amount of interest paid each year is declining as the remaining or outstanding balance declines. II. These percentages change over time because even though the total payment is constant the amount of interest paid each year increasing as the remaining or outstanding balance declines. III. These percentages change over time because even though the total payment is constant the amount of interest paid each year is declining as the remaining or outstanding balance increases. IV. These percentages change over time because even though the total payment is constant the amount of interest paid each year is increasing as the remaining or outstanding balance increases. V. These percentages do not change over time; interest and principal are each a constant percentage of the total payment. -Select- Simon recently received a credit card with an 18% nominal interest rate. With the card, he purchased an Apple iPhone 7 for $379.41. The minimum payment on the card is only $10 per month. a. If Simon makes the minimum monthly payment and makes no other charges, how many months will it be before he pays off the card? Do not round intermediate calculations. Round your answer to the nearest whole number. month(s) b. If Simon makes monthly payments of $35, how many months will it be before he pays off the debt? Do not round intermediate calculations. Round your answer to the nearest whole number month(s) C. How much more in total payments will Simon make under the $10-a-month plan than under the $35-a-month plan. Do not round intermediate calculations. Round your answer to the nearest cent. $