1.

2.

3.

please answer all 5 problems, thank you!

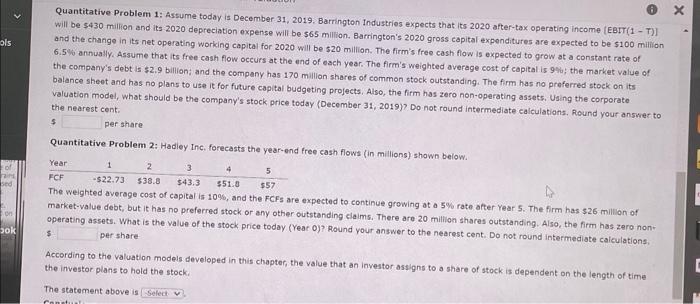

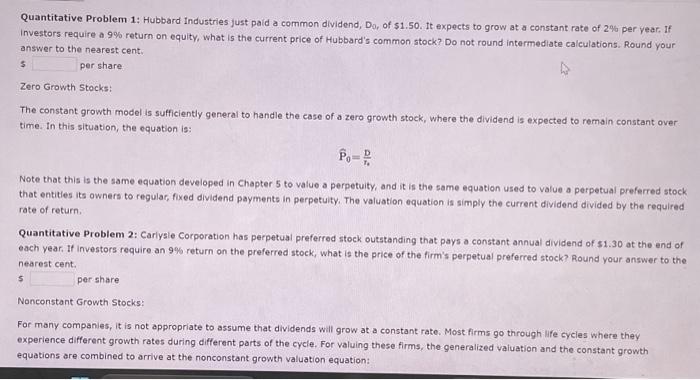

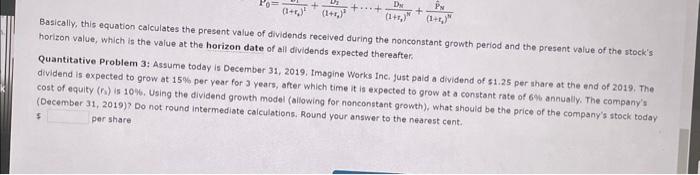

P0=(1+r2)21+(1+r0)2D2++(1+r3)NDN+(1+ri)NP^N horizon value, which is the value at the horizon date of all dividends expected thereafter. Quantitative Problem 3: Assume today is December 31, 2019, tmogine Works Inc. just paid a dividend of $1.25 per thare at the end of 2019. The cost of equity (r) is 10\%, Using the dividend growth model (allowing for nonconstant growth), what should be the price of the company's stock today 5 per share Quantitative Problem 1: Hubbard Industries just paid a common dividend, D0, of $1.50. 1t expects to grow at a constant rate of 2% per year. If Investors require a 9% return on equity, what is the current price of Hubbard's common stock? Do not round intermediate calculations. Round your answer to the nearest cent. s per share Zero Growth Stocks: The constant growth model is sufficiently general to handle the case of a zero growth stock, where the dividend is expected to remain constant over time. In this situation, the equation is: P^0=TiD Note that this is the same equation developed in Chepter 5 to value a perpetuity, and it is the same equation used to value a perpetual preferred stock that entities its owners to regular, fixed dividend payments in perpetuity. The valuation equation is simply the current dividend divided by the required rate of return. Quantitative Problem 2: Cariysie Corporation has perpetual preferred stock outstanding that pays a constant annual dividend of s1.30 at the end of each year. If investors require an 9% return on the preferred stock, what is the price of the firm's perpetual preferred stock? Round your answer to the nearest cent. 5 pershare Nonconstant Growth Stocks: For many companies, it is not appropriate to assume that dividends will grow at a constant rate. Most firms go through life cycles where they experience different growth rates during different parts of the cycle. For valuing these firms, the generalized valuation and the constant growth equations are combined to arrive at the nonconstant growth valuation equation: Quantitative Problem 1: Assume today is December 31, 2019. Barrington Industries expects that its 2020 after-tax operating income (EBrT(1 - T)] will be $430 million and its 2020 depreciation expense will be 565 million. Barrington's 2020 gross capital expenditures are expected to be $100 mililon and the change in its net operating working capital for 2020 will be $20 million. The firm's free cash flow is expected to grow at a constant rate of 6.5% annually. Assume that its free cash flow occurs at the end of each year. The firm's weighted average cost of capital is 9%; the market value of the company's debt is $2.9 billion; and the company has 170 million shares of common stock outstanding. The firm has no preferred stock on its balance sheet and has no plans to use it for future capital budgeting projects, Also, the firm has zero non-operating assets, Using the corporate valuation model, what should be the company's stock price today (December 31,2019 )? Do not round intermediate calculations. Round your answer to the nearest cent. per share Quantitative Problem 2; Hadiey Inc, forecasts the year-end free cash flows (in millions) shown below. Mrw weignted average cost of capital is 10\%, and the FCFs are expected to continue growing at a 5% rate after Year 5 . The firm has $26 million of market-value debt, but it has no preferred stock or any other outstanding claims. There are 20 millilon shares outstanding. Also, the firm has zero nont operating assets. What is the value of the stock price today (Year 0)? Round your answer to the nearest cent. Do not round intermediate calculations, pershare According to the valuation models developed in this chapter, the value that an investor assigns to a share of stock is dependent on the length of time the investor plans to hold the stock. The statement above is