Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2. 3. Pls answer each question Sheridan Inc. makes unfinished bookcases that it sells for $57. Production costs are $37 variable and $9 fixed.

1.

2.

3.

Pls answer each question

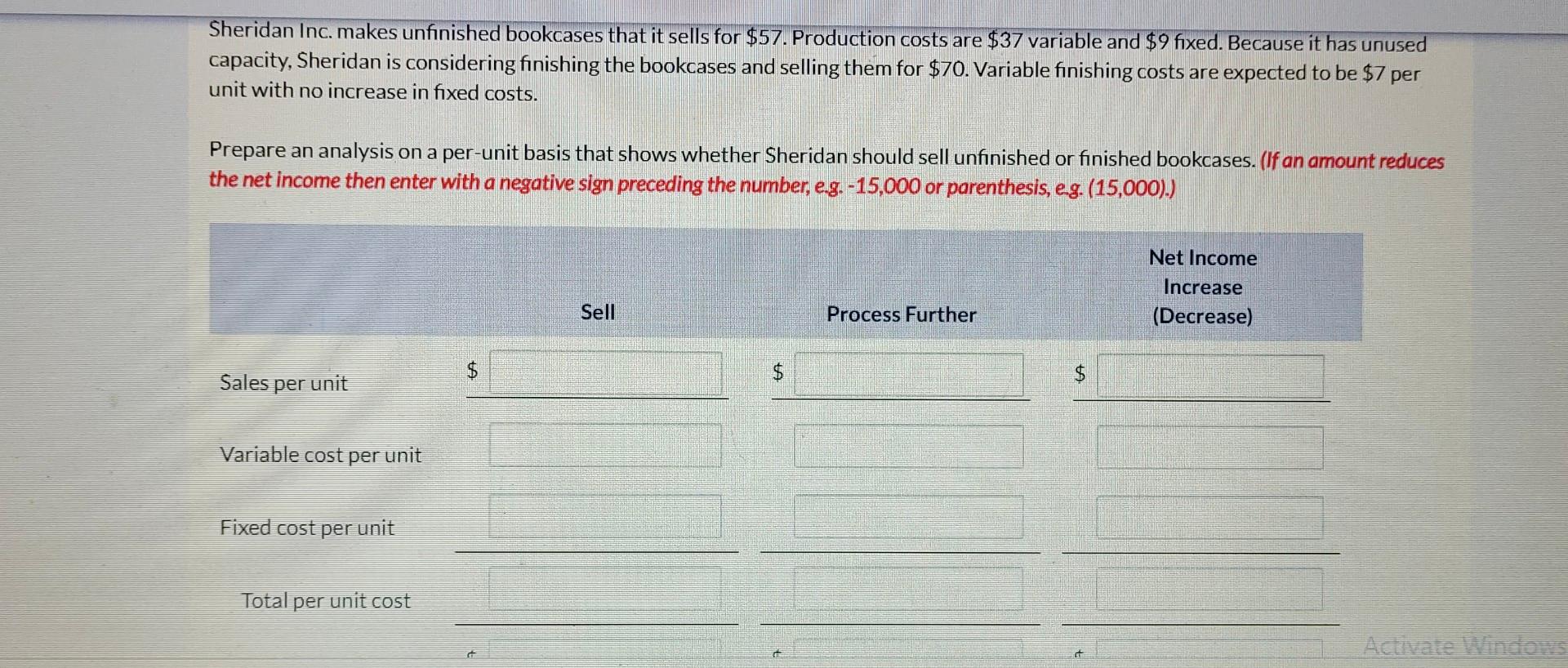

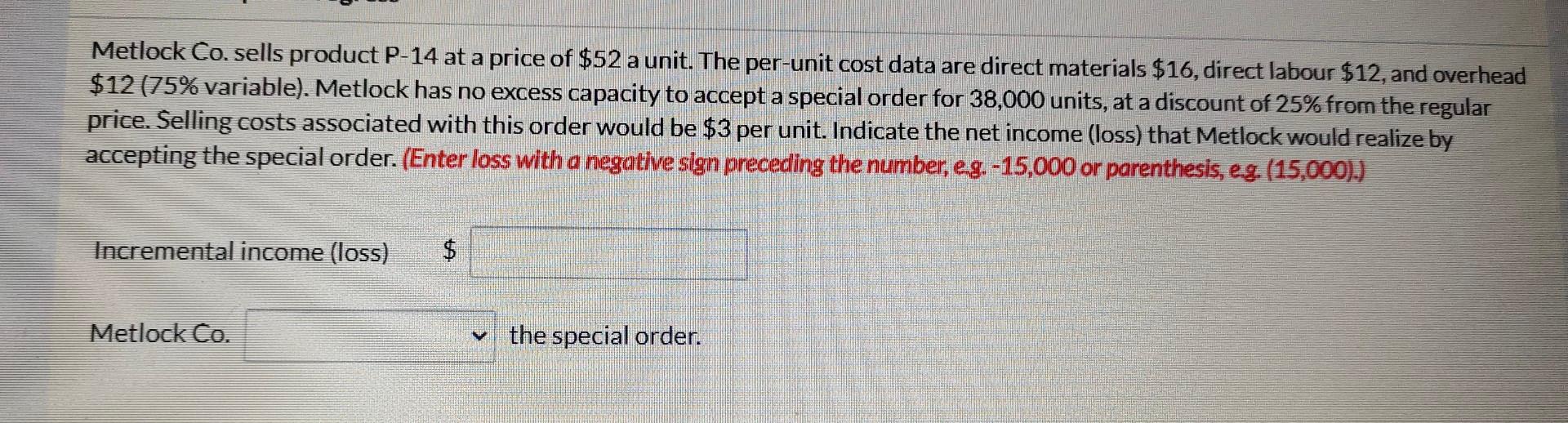

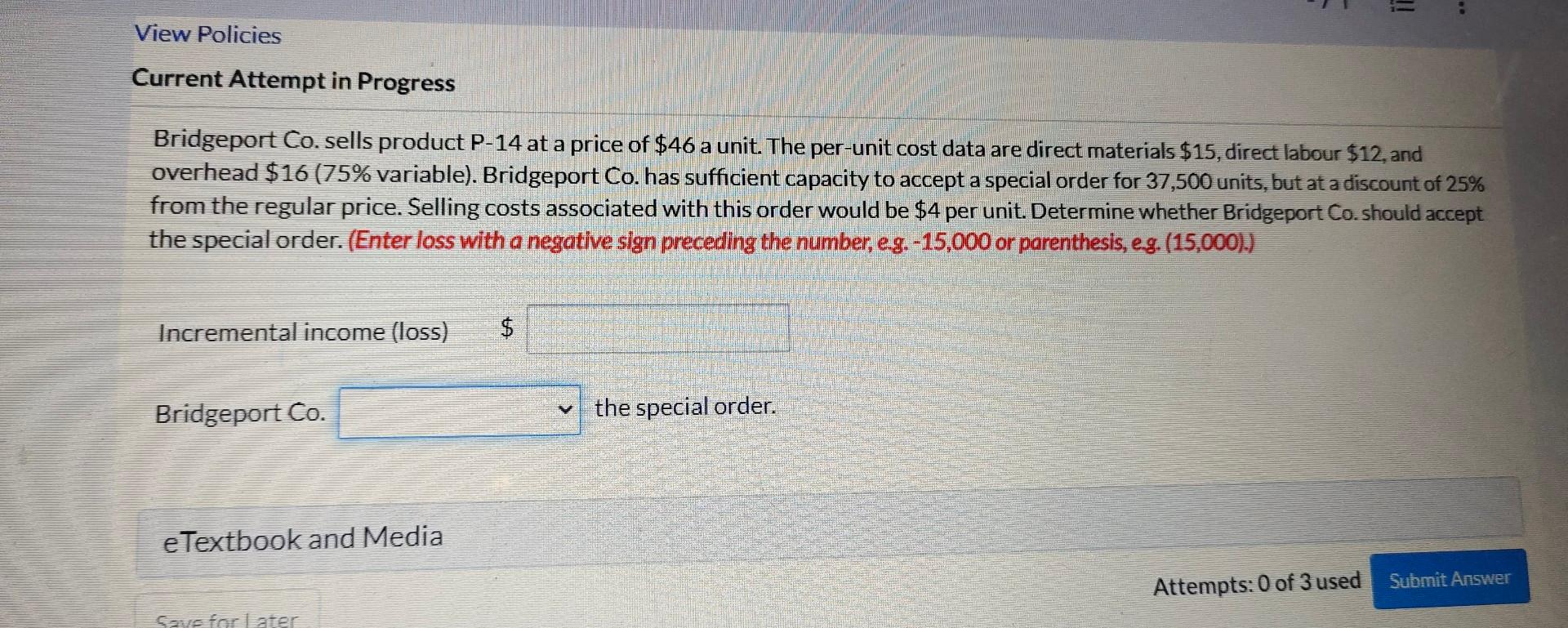

Sheridan Inc. makes unfinished bookcases that it sells for $57. Production costs are $37 variable and $9 fixed. Because it has unused capacity, Sheridan is considering finishing the bookcases and selling them for $70. Variable finishing costs are expected to be $7 per unit with no increase in fixed costs. Prepare an analysis on a per-unit basis that shows whether Sheridan should sell unfinished or finished bookcases. (If an amount reduces the net income then enter with a negative sign preceding the number, e.g. 15,000 or parenthesis, e.g. (15,000).) Metlock Co. sells product P-14 at a price of $52 a unit. The per-unit cost data are direct materials $16, direct labour $12, and overhead $12 (75\% variable). Metlock has no excess capacity to accept a special order for 38,000 units, at a discount of 25% from the regular price. Selling costs associated with this order would be $3 per unit. Indicate the net income (loss) that Metlock would realize by accepting the special order. (Enter loss with a negative sign preceding the number, eg. 15,000 or parenthesis, eg. (15,000).) Incremental income (loss) $ Metlock Co. the special order. Bridgeport Co. sells product P-14 at a price of $46 a unit. The per-unit cost data are direct materials $15, direct labour $12, and overhead $16 (75\% variable). Bridgeport Co. has sufficient capacity to accept a special order for 37,500 units, but at a discount of 25% from the regular price. Selling costs associated with this order would be $4 per unit. Determine whether Bridgeport Co. should accept the special order. (Enter loss with a negative sign preceding the number, eg. 15,000 or parenthesis, e.g. (15,000). ) Incremental income (loss) \$ Bridgeport Co. the special order. Attempts: 0 of 3 usedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started