Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 2 3 requirements: consolidated workseet entries for 30 june 2018 and finanacial statements need to be prepared. Case Study Sovereign Ltd acquired 100% of

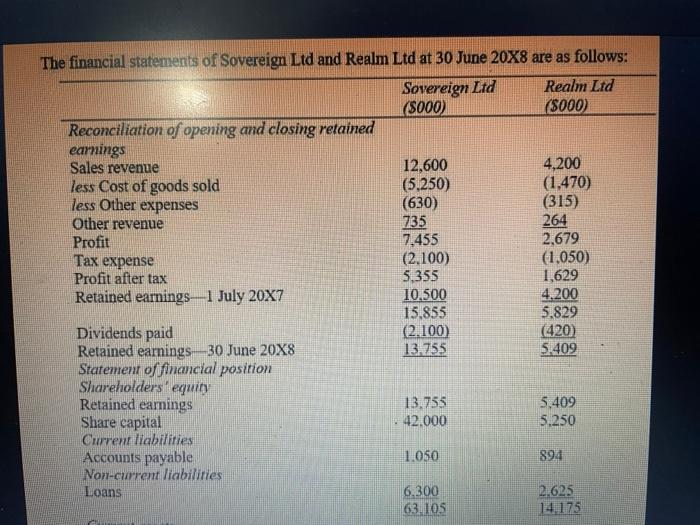

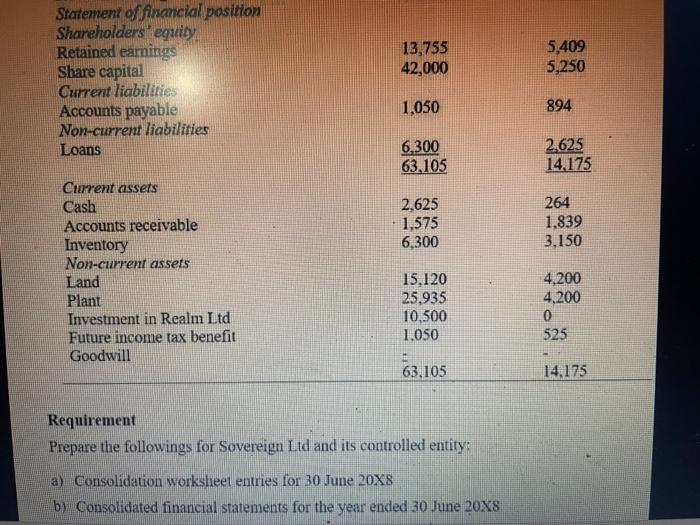

1

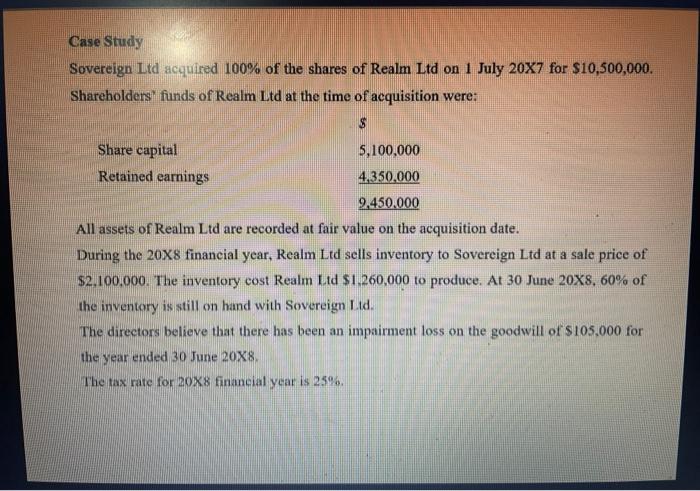

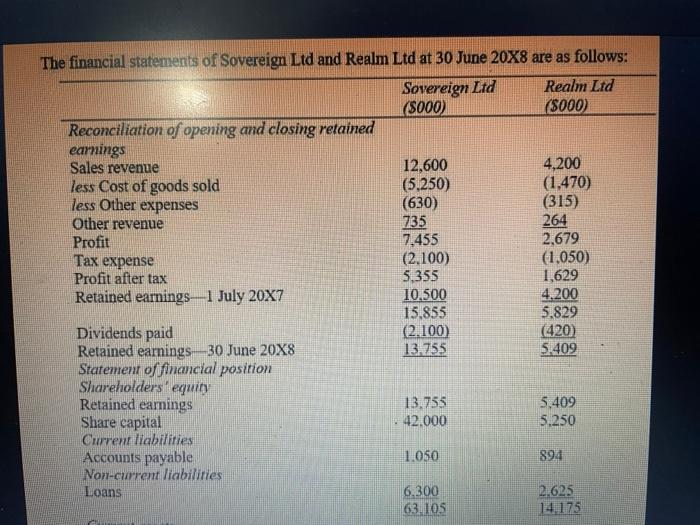

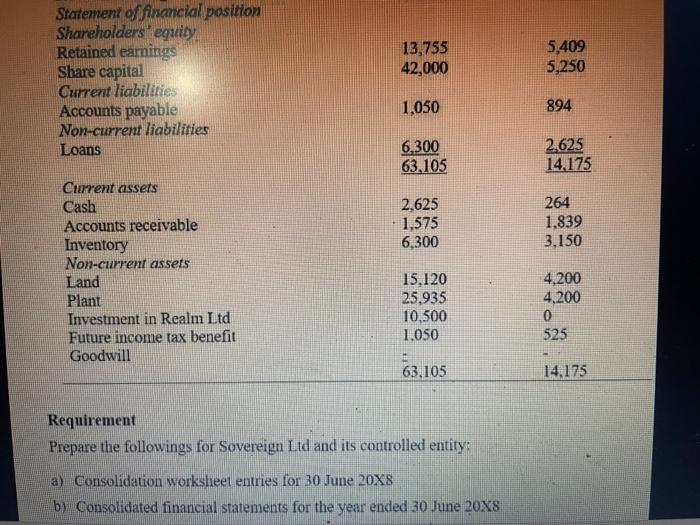

Case Study Sovereign Ltd acquired 100% of the shares of Realm Ltd on 1 July 20X7 for $10,500,000. Shareholders' funds of Realm Ltd at the time of acquisition were: All assets of Realm Ltd are recorded at fair value on the acquisition date. During the 20X8 financial year, Realm Ltd sells inventory to Sovereign Ltd at a sale price of $2,100,000. The inventory cost Realm L.td $1,260,000 to produce. At 30 June 20X8, 60% of the inventory is still on hand with Sovereign I.td. The directors believe that there has been an impairment loss on the goodwill of $105,000 for the year ended 30 June 20X8. The tax rate for 20X8 financial yeat is 25%. The financial statements of Sovereign Ltd and Realm Ltd at 30 June 20X8 are as follows: Requirement Prepare the followings for Sovereign L.td and its controlled entity: a) Consolidation worksheet entries for 30 June 208 b) Consolidated financial statements for the year ended 30 June 20XS

2

3

requirements:

consolidated workseet entries for 30 june 2018 and finanacial statements need to be prepared.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started