Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain the fair value of goodwill calculation that is needed for goodwill impairment loss I know it is 500M - 385M I just don't

Please explain the fair value of goodwill calculation that is needed for goodwill impairment loss

I know it is 500M - 385M I just don't understand where those numbers come from

Thanks!

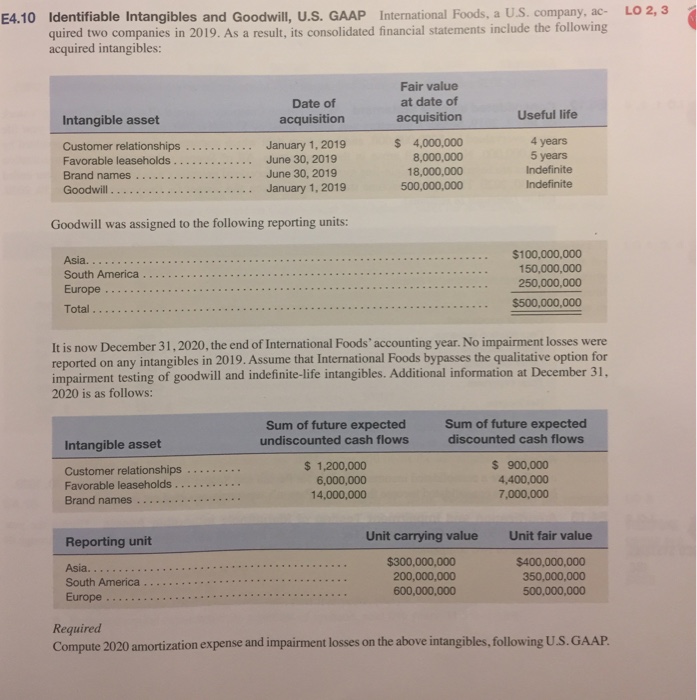

F4.10 Identifiable Intangibles and Goodwill, U.S. GAAP International Foods, a S. company, ac quired two companies in 2019. As a result, its consolidated financial statements include the following acquired intangibles: Intangible asset Date of acquisition Useful life Customer relationships ........... Favorable leaseholds ............. Brand names .................. Goodwill....... January 1, 2019 June 30, 2019 June 30, 2019 January 1, 2019 Fair value at date of acquisition $ 4,000,000 8,000,000 18,000,000 500,000,000 4 years 5 years Indefinite Indefinite Goodwill was assigned to the following reporting units: Asia. ..... South America ............................... Europe. ..... . $100,000,000 150,000,000 250,000,000 $500,000,000 Total ............................... .. It is now December 31, 2020, the end of International Foods' accounting year. No impairment losses were reported on any intangibles in 2019. Assume that International Foods bypasses the qualitative option for impairment testing of goodwill and indefinite-life intangibles. Additional information at December 31, 2020 is as follows: Sum of future expected undiscounted cash flows Sum of future expected discounted cash flows Intangible asset Customer relationships ..... Favorable leaseholds ......... Brand names ... $ 1,200,000 6,000,000 14,000,000 $ 900.000 4,400,000 7,000,000 Reporting unit Unit fair value Asia............ South America ..... Europe ... Unit carrying value $300,000,000 200,000,000 600,000,000 $400,000,000 350,000,000 500,000,000 Required Compute 2020 amortization expense and impairment losses on the above intangibles, following U.S. GAAPStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started