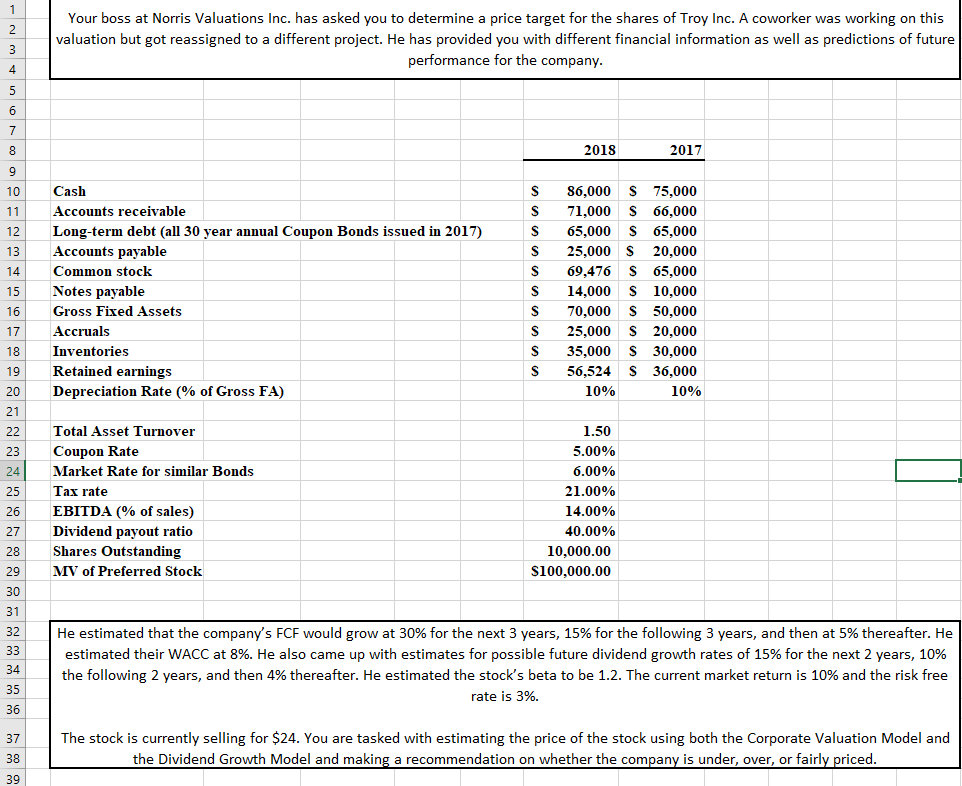

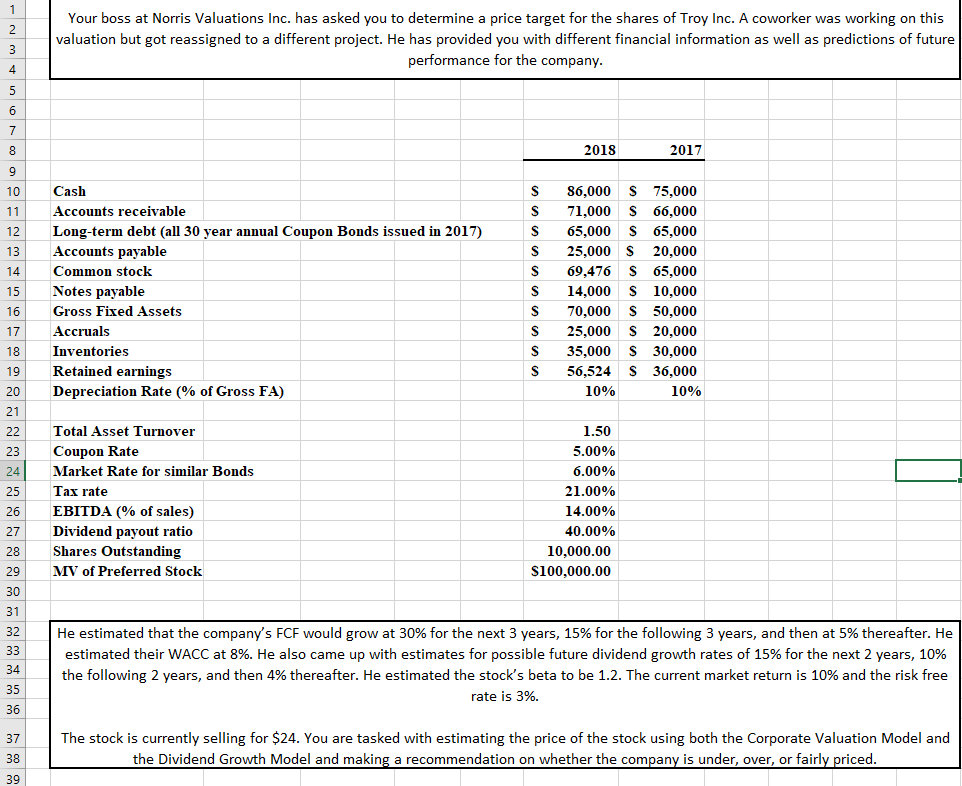

1 2 3 Your boss at Norris Valuations Inc. has asked you to determine a price target for the shares of Troy Inc. A coworker was working on this valuation but got reassigned to a different project. He has provided you with different financial information as well as predictions of future performance for the company. 7 8 2018 2017 9 10 Cash 86,000 $ 75,000 11 Accounts receivable 12 Long-term debt (all 30 year annual Coupon Bonds issued in 2017) 71,000 S 66,000 65,000 $ 65,000 25,000 S 20,000 13 Accounts payable 14 Common stock 69,476 $ 65,000 15 Notes payable 14,000 S 10,000 16 Gross Fixed Assets 70,000 $ 50,000 17 Accruals 25,000 $ 20,000 18 Inventories 35,000 S 30,000 19 Retained earnings 56,524 S 36,000 10% 20 Depreciation Rate (% of Gross FA) 10% 21 22 Total Asset Turnover 1.50 23 Coupon Rate 5.00% 24 Market Rate for similar Bonds 6.00% 25 Tax rate 21.00% 26 EBITDA (% of sales) 14.00% 27 Dividend payout ratio 40.00% 28 Shares Outstanding 10,000.00 $100,000.00 29 MV of Preferred Stock 30 31 32 33 34 35 He estimated that the company's FCF would grow at 30% for the next 3 years, 15% for the following 3 years, and then at 5% thereafter. He estimated their WACC at 8%. He also came up with estimates for possible future dividend growth rates of 15% for the next 2 years, 10% the following 2 years, and then 4% thereafter. He estimated the stock's beta to be 1.2. The current market return is 10% and the risk free rate is 3%. 36 37 The stock is currently selling for $24. You are tasked with estimating the price of the stock using both the Corporate Valuation Model and the Dividend Growth Model and making a recommendation on whether the company is under, over, or fairly priced. 38 39 4 5 6 S S S S S S S S S S 1 2 3 Your boss at Norris Valuations Inc. has asked you to determine a price target for the shares of Troy Inc. A coworker was working on this valuation but got reassigned to a different project. He has provided you with different financial information as well as predictions of future performance for the company. 7 8 2018 2017 9 10 Cash 86,000 $ 75,000 11 Accounts receivable 12 Long-term debt (all 30 year annual Coupon Bonds issued in 2017) 71,000 S 66,000 65,000 $ 65,000 25,000 S 20,000 13 Accounts payable 14 Common stock 69,476 $ 65,000 15 Notes payable 14,000 S 10,000 16 Gross Fixed Assets 70,000 $ 50,000 17 Accruals 25,000 $ 20,000 18 Inventories 35,000 S 30,000 19 Retained earnings 56,524 S 36,000 10% 20 Depreciation Rate (% of Gross FA) 10% 21 22 Total Asset Turnover 1.50 23 Coupon Rate 5.00% 24 Market Rate for similar Bonds 6.00% 25 Tax rate 21.00% 26 EBITDA (% of sales) 14.00% 27 Dividend payout ratio 40.00% 28 Shares Outstanding 10,000.00 $100,000.00 29 MV of Preferred Stock 30 31 32 33 34 35 He estimated that the company's FCF would grow at 30% for the next 3 years, 15% for the following 3 years, and then at 5% thereafter. He estimated their WACC at 8%. He also came up with estimates for possible future dividend growth rates of 15% for the next 2 years, 10% the following 2 years, and then 4% thereafter. He estimated the stock's beta to be 1.2. The current market return is 10% and the risk free rate is 3%. 36 37 The stock is currently selling for $24. You are tasked with estimating the price of the stock using both the Corporate Valuation Model and the Dividend Growth Model and making a recommendation on whether the company is under, over, or fairly priced. 38 39 4 5 6 S S S S S S S S S S