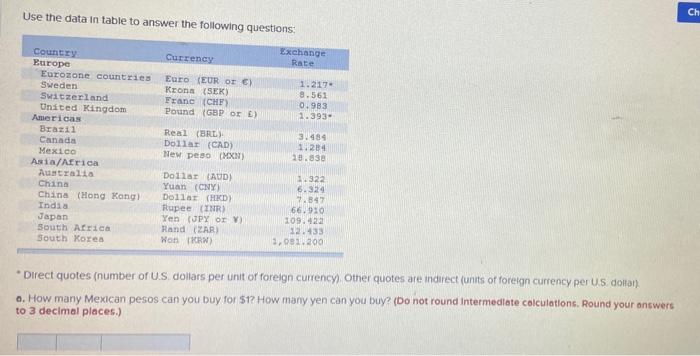

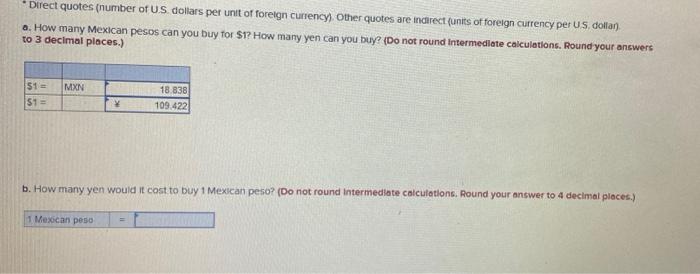

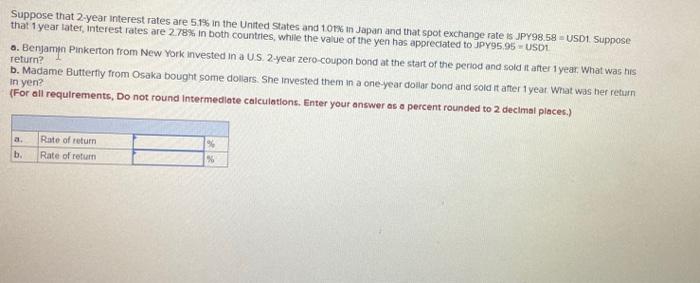

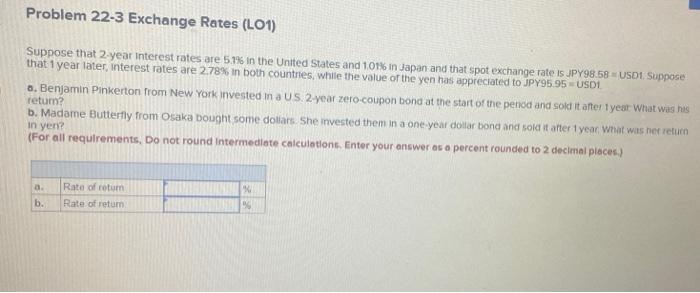

Ch Use the data in table to answer the following questions Exchange Country Currency Rate Europe Eurozone countries Euro (EURO ) 1.217- Sweden Krona (SEK) 8.561 Switzerland Franc (CHE) 0.983 United Kingdom Pound (GBP or E) 1.393- Americas Brazil Real (BRL) 3.484 Canada Dollar (CAD) 1.284 Mexico New Peso (MXN 10.83 Asia/Africa Australia Dollar (AUD) 1.322 China Yuan (CNY) 6.324 China Hong Kong Dollar (HKD) 7.847 India Rupee (INR) 66910 Japan Yen (JPY OLV 109.42 South Africa Rand (ZAR 32.433 South Korea Won KRW) 308 1.200 Direct quotes (number of US dollars per unit of foreign currency) Other quotes are indirect (units of foreign currency per US dollar) o. How many Mexican pesos can you buy for $1? How many yen can you buy? (Do not round Intermediate calculations. Round your answers to 3 decimal places.) Direct quotes (number of US dollars per unit of foreign currency) Other quotes are indirect units of foreign currency per US dollar) o. How many Mexican pesos can you buy for $1? How many yen can you buy? (Do not round Intermediate calculations. Round your answers to 3 decimal places.) MXN $1 = $1= 18.838 109.422 b. How many yen would it cost to buy 1 Mexican peso? (Do not round Intermediate calculations. Round your answer to 4 decimal places.) 1 Mexican peso Suppose that 2-year Interest rates are 5.1% in the United States and 101% in Japan and that spot exchange rates JPY98.58 USD1 Suppose that 1 year later, interest rates are 2.78% in both countries, while the value of the yen has appreciated to JPY95.95 USD o. Benjamin Pinkerton from New York invested in a US 2-year zero-coupon bond at the start of the period and sold it after 1 yearWhat was his Teturn? b. Madame Butterfly from Osaka bought some dollars. She invested them in a one-year dolar bond and sold it after 1 year What was her return in yen? (For all requirements. Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) a. Rate of return Rate of return b. % Problem 22-3 Exchange Rates (L01) Suppose that 2 year interest rates are 5 136 in the United States and 101% in Japan and that spot exchange rate is JPY98.58 USD1. Suppose that 1 year later interest rates are 278% in both countries, while the value of the yen has appreciated to JPY95.95 USD 0. Benjamin Pinkerton from New York invested in a US. 2-year zero-coupon bond at the start of the period and sold it after 1 year What was his return? b. Madame Butterfly from Osaka bought some dollars. She invested them in a one year dolar bond and sold it after year what was het return in yen? (For all requirements. Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places) a. Rate of retum Rate of retum b. 90