1)

2)

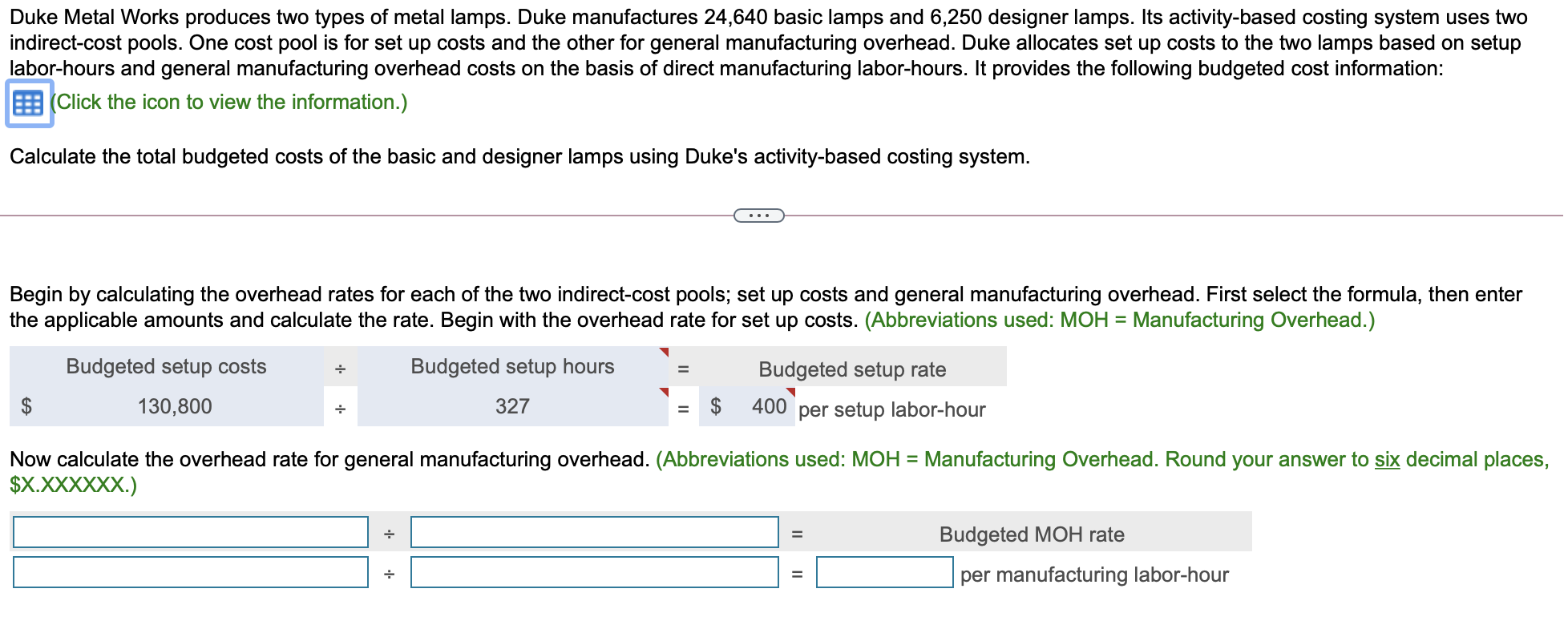

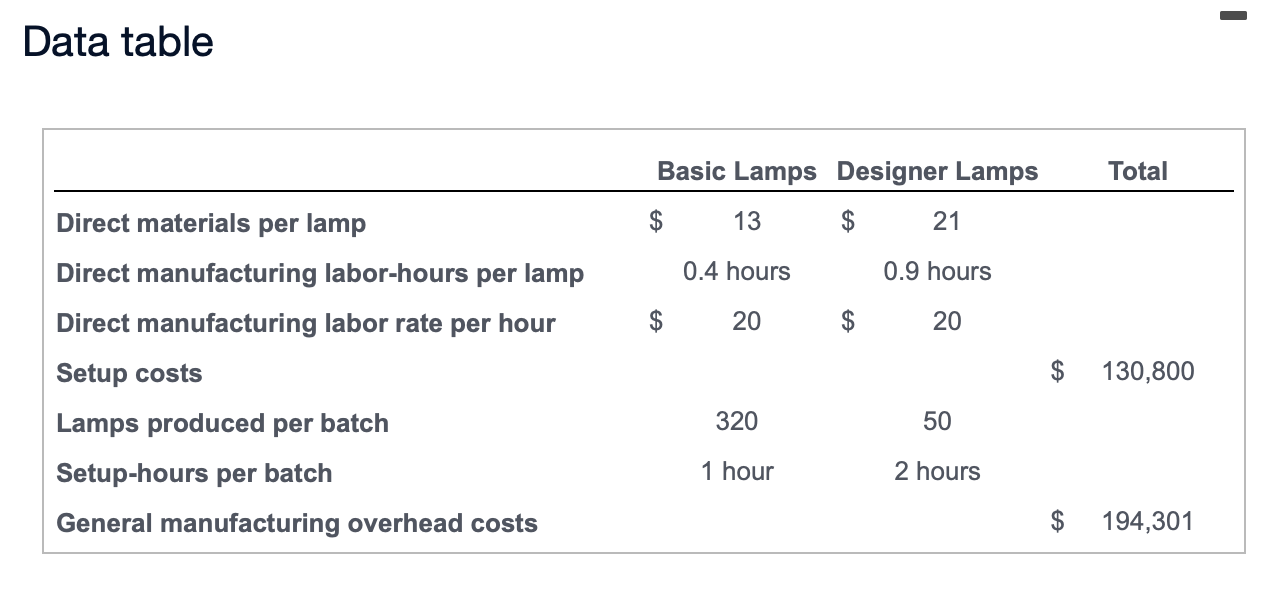

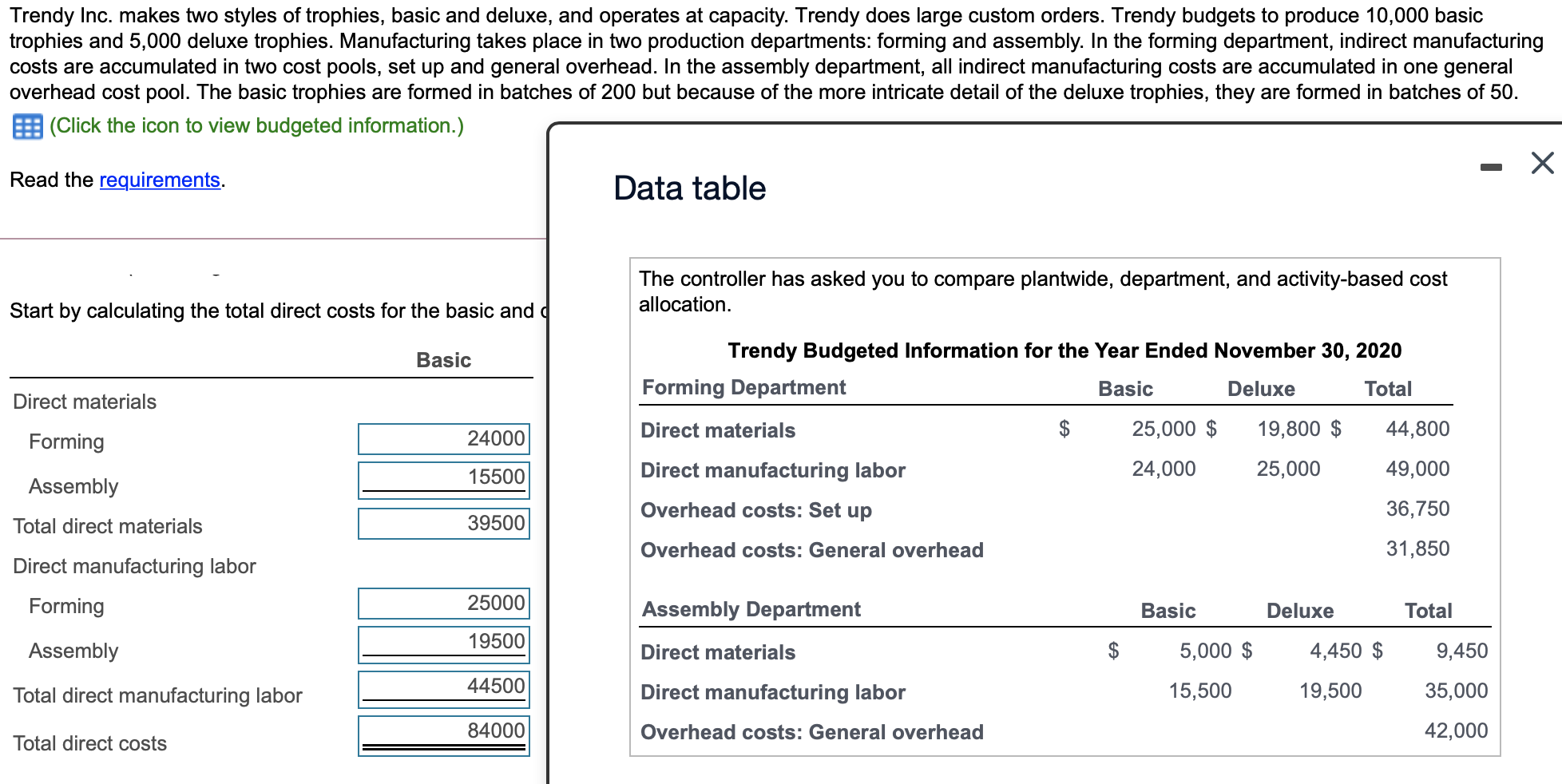

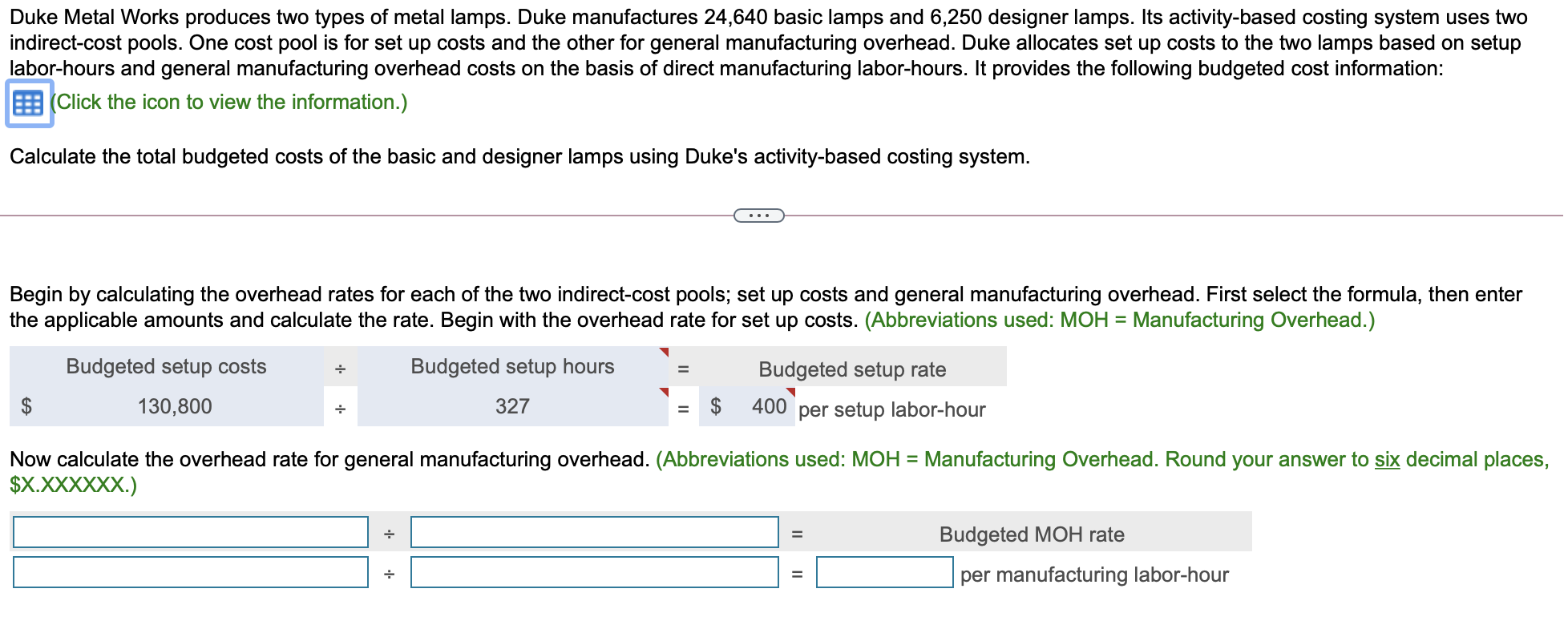

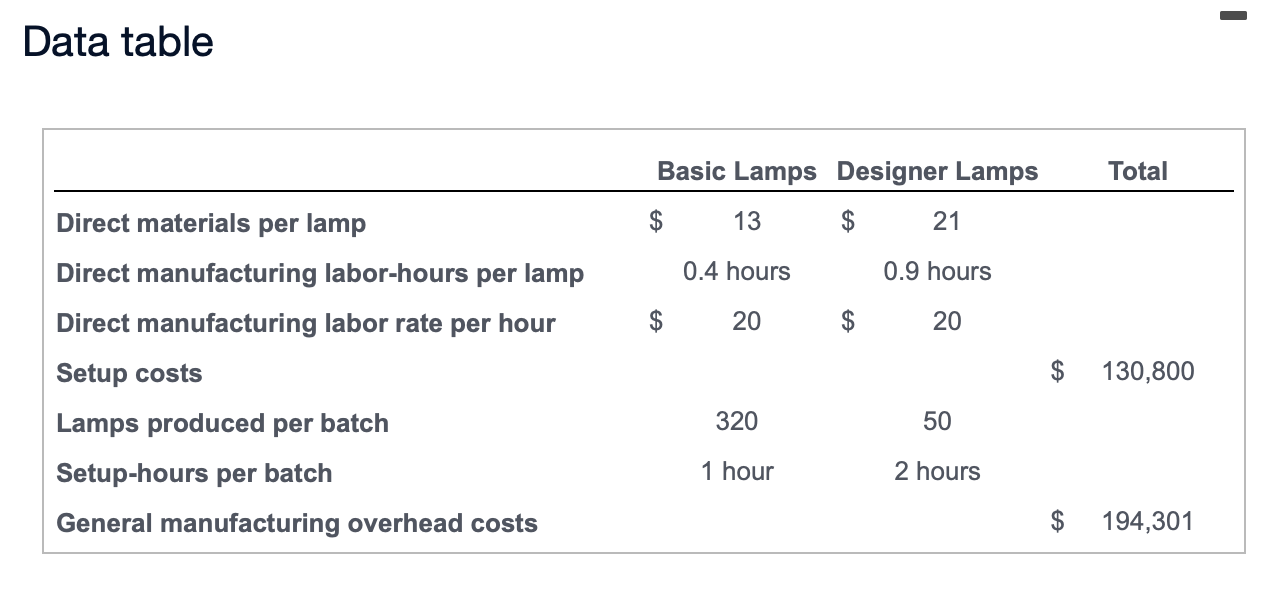

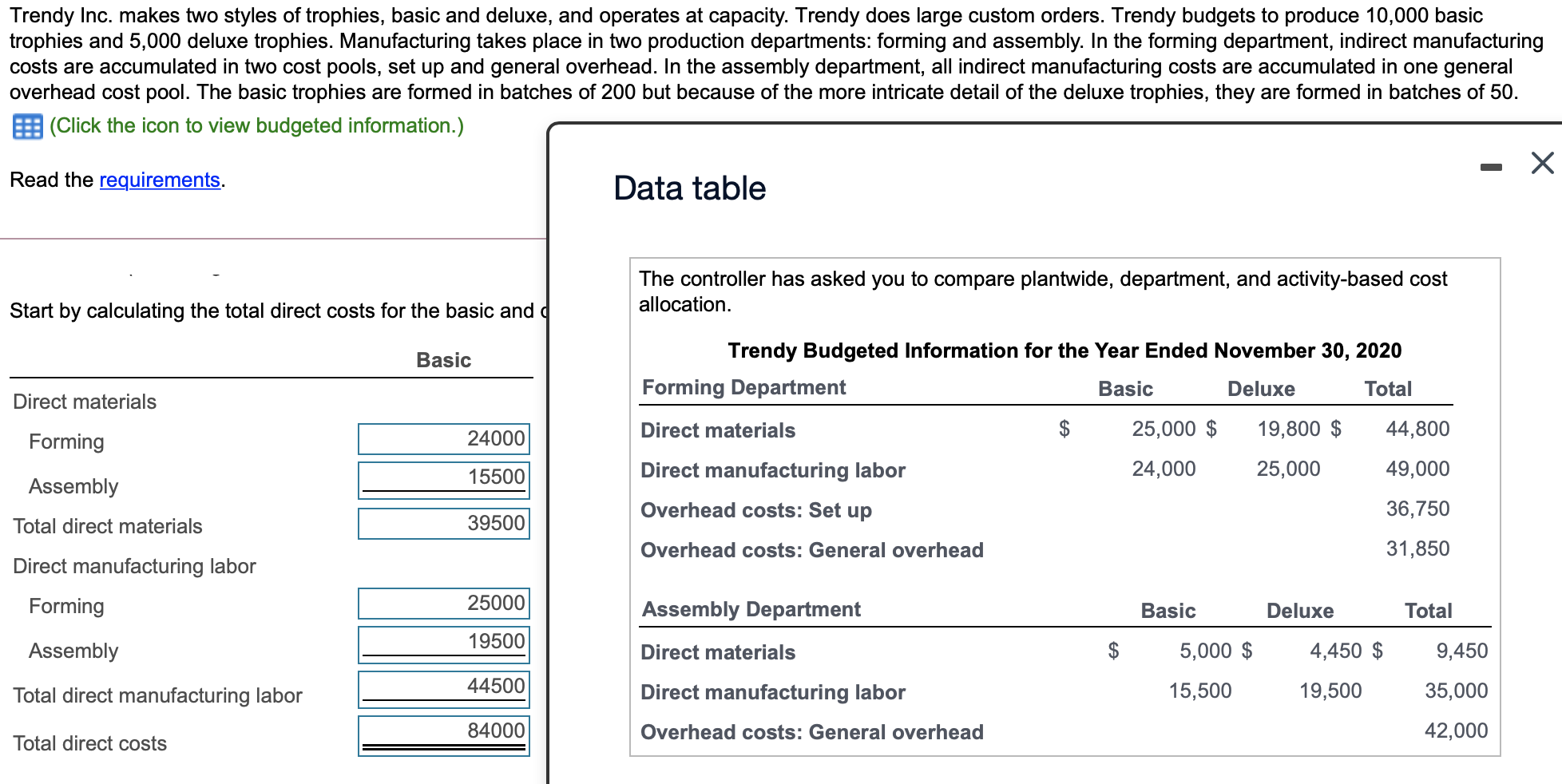

Duke Metal Works produces two types of metal lamps. Duke manufactures 24,640 basic lamps and 6,250 designer lamps. Its activity-based costing system uses two indirect-cost pools. One cost pool is for set up costs and the other for general manufacturing overhead. Duke allocates set up costs to the two lamps based on setup labor-hours and general manufacturing overhead costs on the basis of direct manufacturing labor-hours. It provides the following budgeted cost information: (Click the icon to view the information.) Calculate the total budgeted costs of the basic and designer lamps using Duke's activity-based costing system. Begin by calculating the overhead rates for each of the two indirect-cost pools; set up costs and general manufacturing overhead. First select the formula, then enter the applicable amounts and calculate the rate. Begin with the overhead rate for set up costs. (Abbreviations used: MOH = Manufacturing Overhead.) - Budgeted setup costs + Budgeted setup hours Budgeted setup rate 400 per setup labor-hour 130,800 + 327 $ Now calculate the overhead rate for general manufacturing overhead. (Abbreviations used: MOH = Manufacturing Overhead. Round your answer to six decimal places, $X.XXXXXX.) = Budgeted MOH rate : II per manufacturing labor-hour - Data table Basic Lamps Designer Lamps Total $ 13 21 0.4 hours 0.9 hours 20 20 Direct materials per lamp Direct manufacturing labor-hours per lamp Direct manufacturing labor rate per hour Setup costs Lamps produced per batch Setup-hours per batch General manufacturing overhead costs $ 130,800 320 50 1 hour 2 hours $ 194,301 Trendy Inc. makes two styles of trophies, basic and deluxe, and operates at capacity. Trendy does large custom orders. Trendy budgets to produce 10,000 basic trophies and 5,000 deluxe trophies. Manufacturing takes place in two production departments: forming and assembly. In the forming department, indirect manufacturing costs are accumulated in two cost pools, set up and general overhead. In the assembly department, all indirect manufacturing costs are accumulated in one general overhead cost pool. The basic trophies are formed in batches of 200 but because of the more intricate detail of the deluxe trophies, they are formed in batches of 50. B (Click the icon to view budgeted information.) Read the requirements. Data table The controller has asked you to compare plantwide, department, and activity-based cost allocation. Start by calculating the total direct costs for the basic and Basic Direct materials Forming 24000 Trendy Budgeted Information for the Year Ended November 30, 2020 Forming Department Basic Deluxe Total Direct materials 25,000 $ 19,800 $ 44,800 Direct manufacturing labor 24,000 25,000 49,000 Overhead costs: Set up 36,750 Overhead costs: General overhead 31,850 15500 Assembly Total direct materials 39500 Direct manufacturing labor Forming 25000 Basic Deluxe Total 19500 Assembly Assembly Department Direct materials Direct manufacturing labor $ 5,000 $ 4,450 $ 9,450 44500 Total direct manufacturing labor 15,500 19,500 35,000 84000 Overhead costs: General overhead 42,000 Total direct costs