Answered step by step

Verified Expert Solution

Question

1 Approved Answer

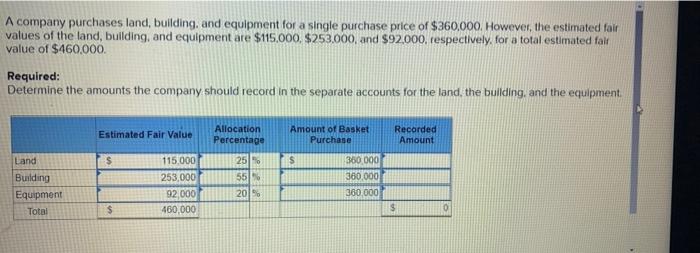

1) 2) i need help on the asset turnover 3) A company purchases land, building, and equipment for a single purchase price of $360,000. However,

1)

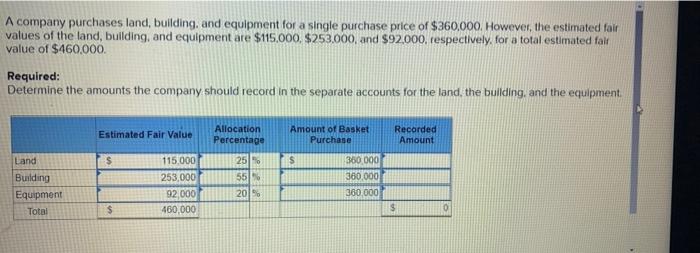

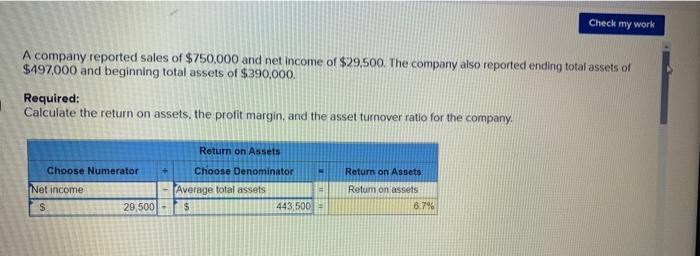

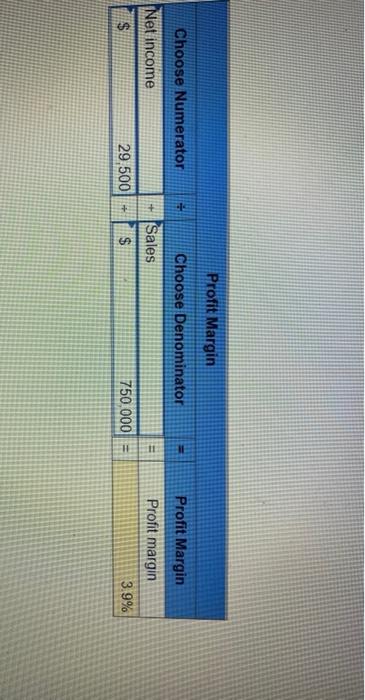

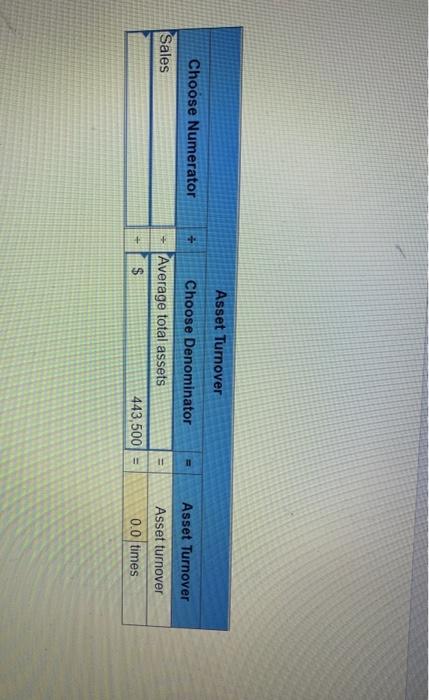

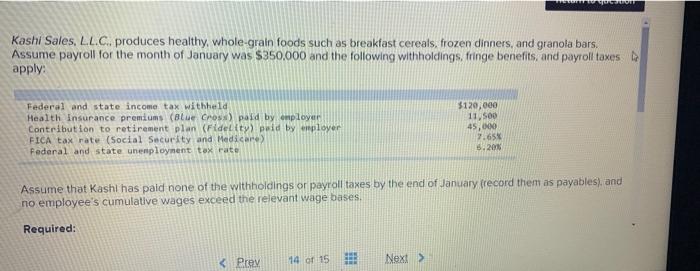

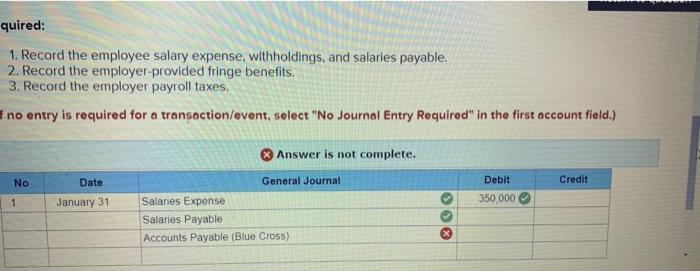

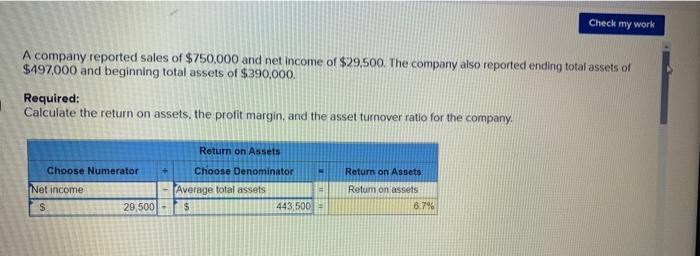

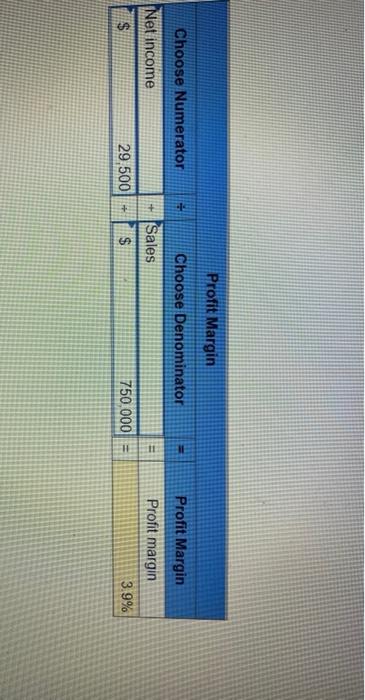

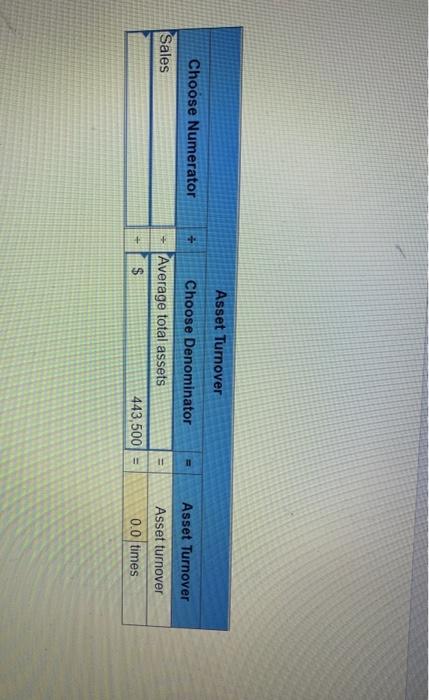

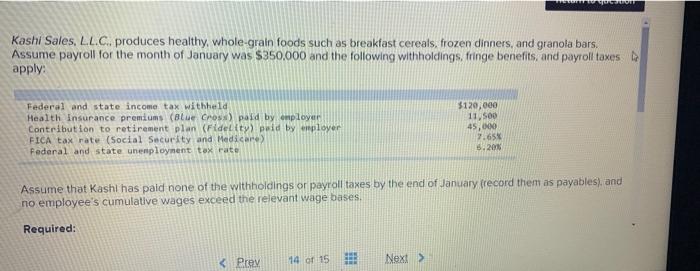

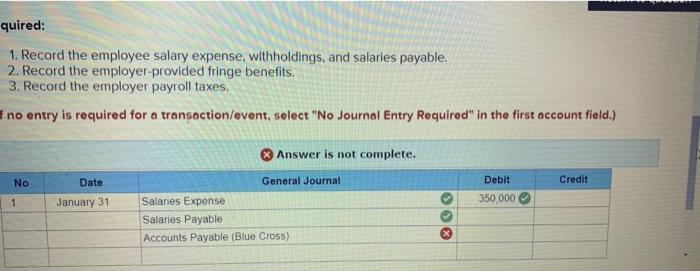

A company purchases land, building, and equipment for a single purchase price of $360,000. However, the estimated for values of the land, building, and equipment are $115.000, $253,000, and $92,000, respectively, for a total estimated fall value of $460,000 Required: Determine the amounts the company should record in the separate accounts for the land, the building, and the equipment Estimated Fair Value Allocation Percentage Amount of Basket Purchase Recorded Amount $ is Land Building Equipment Total 115.000 253,000 92,000 480,000 25% 551 20% 350.000 360.000 360 000 $ $ 0 Check my work A company reported sales of $750,000 and net income of $29,500. The company also reported ending total assets of $497,000 and beginning total assets of $390,000. Required: Calculate the return on assets, the profit margin, and the asset turnover ratio for the company Return on Assets Choose Numerator Choose Denominator Average total assets $ 443,500 Return on Assets Rotum on assets Net income S 29,500 6.79 Profit Margin Choose Numerator -- Choose Denominator I + Sales 11 Net income $ Profit Margin Profit margin 3.9% 29,500 + $ 750.000 Asset Turnover Choose Numerator Choose Denominator Asset Turnover Sales + Average total assets Asset turnover 0.0 times $ 443,500 = WAGON Kashi Sales, L.L.C. produces healthy, whole-grain foods such as breakfast cereals, frozen dinners, and granola bars. Assume payroll for the month of January was $350.000 and the following withholdings fringe benefits, and payroll taxes apply Federal and state income tax withheld Health Insurance premiums (Blue Cross) paid by employer Contribution to retirement plan (Fidelity paid by employer FICA tax rate (Social Security and Medicare Federal and state unemployment tax rate $120,000 11,500 45,000 7.65% 5.2016 Assume that Kashi has paid none of the withholdings or payroll taxes by the end of January (record them as payables) and no employee's cumulative wages exceed the relevant wage bases. Required: quired: 1. Record the employee salary expense, withholdings, and salarles payable. 2. Record the employer-provided fringe benefits. 3. Record the employer payroll taxes. no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Answer is not complete. No Date General Journal Debit Credit 1 January 31 350,000 Salaries Expense Salaries Payable Accounts Payable (Blue Cross)

2)

i need help on the asset turnover

3)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started