1.

2.

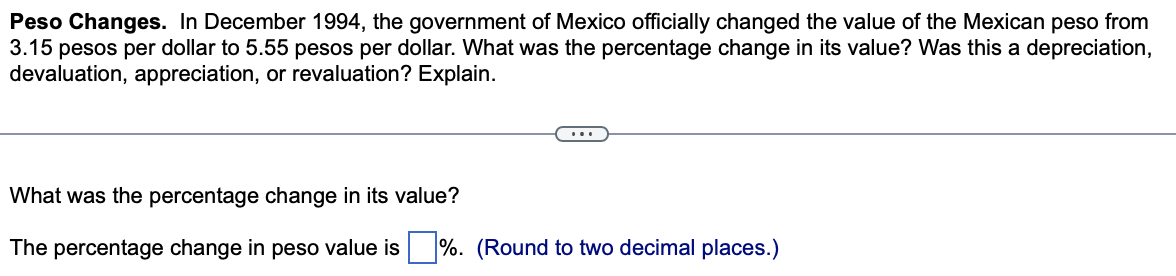

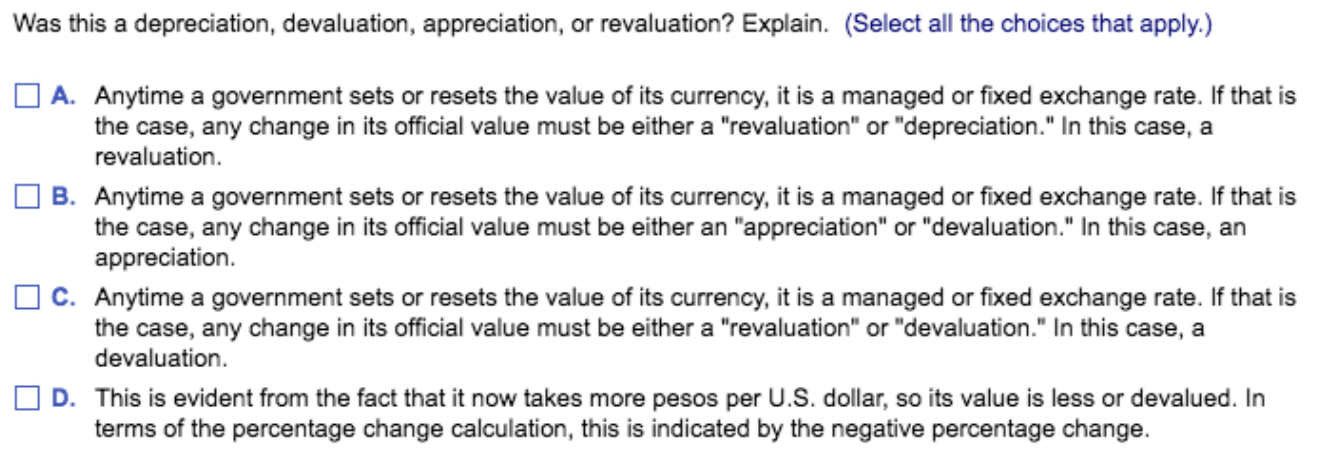

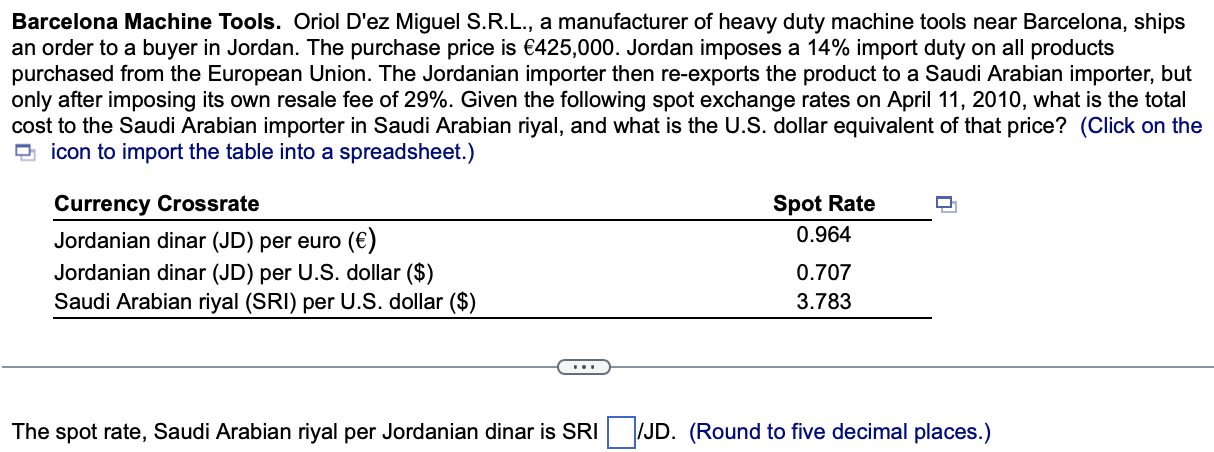

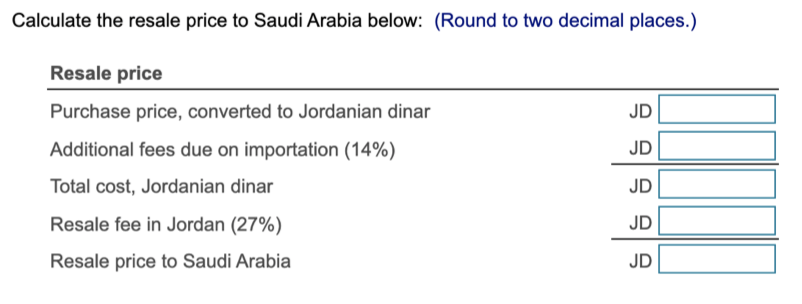

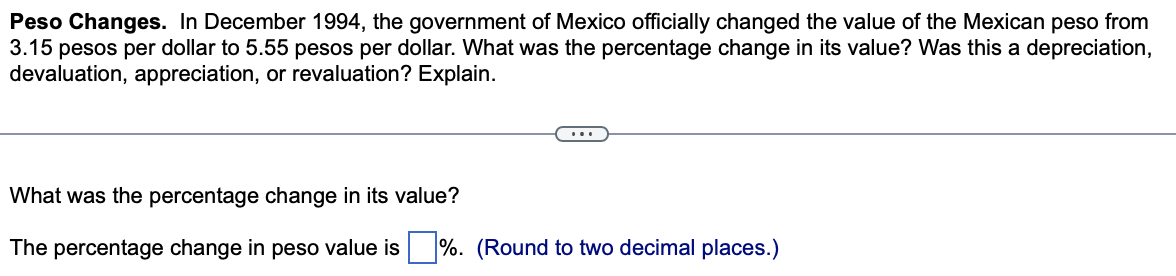

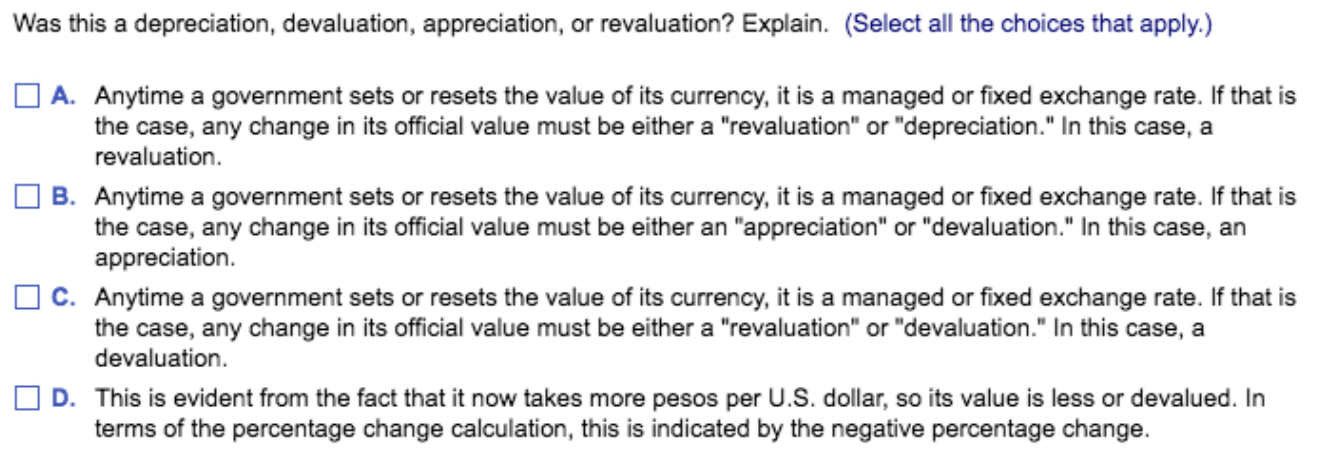

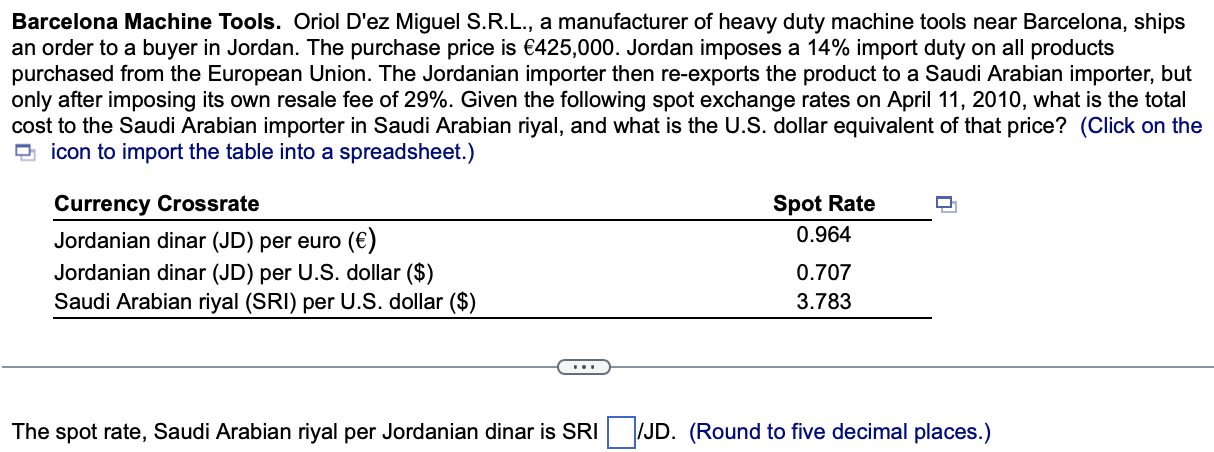

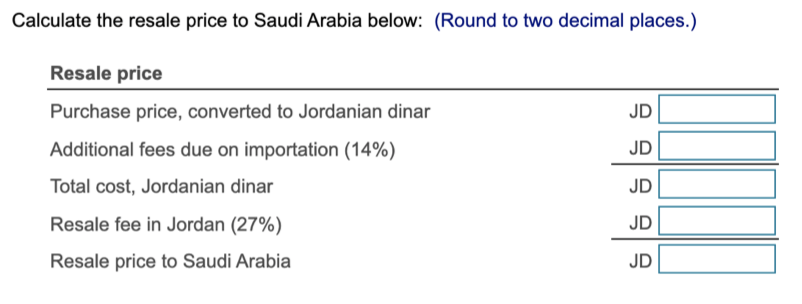

Peso Changes. In December 1994 , the government of Mexico officially changed the value of the Mexican peso from 3.15 pesos per dollar to 5.55 pesos per dollar. What was the percentage change in its value? Was this a depreciation, devaluation, appreciation, or revaluation? Explain. What was the percentage change in its value? The percentage change in peso value is \%. (Round to two decimal places.) las this a depreciation, devaluation, appreciation, or revaluation? Explain. (Select all the choices that apply.) A. Anytime a government sets or resets the value of its currency, it is a managed or fixed exchange rate. If that is the case, any change in its official value must be either a "revaluation" or "depreciation." In this case, a revaluation. B. Anytime a government sets or resets the value of its currency, it is a managed or fixed exchange rate. If that is the case, any change in its official value must be either an "appreciation" or "devaluation." In this case, an appreciation. C. Anytime a government sets or resets the value of its currency, it is a managed or fixed exchange rate. If that is the case, any change in its official value must be either a "revaluation" or "devaluation." In this case, a devaluation. D. This is evident from the fact that it now takes more pesos per U.S. dollar, so its value is less or devalued. In terms of the percentage change calculation, this is indicated by the negative percentage change. Barcelona Machine Tools. Oriol D'ez Miguel S.R.L., a manufacturer of heavy duty machine tools near Barcelona, ships an order to a buyer in Jordan. The purchase price is 425,000. Jordan imposes a 14% import duty on all products purchased from the European Union. The Jordanian importer then re-exports the product to a Saudi Arabian importer, but only after imposing its own resale fee of 29%. Given the following spot exchange rates on April 11,2010 , what is the total cost to the Saudi Arabian importer in Saudi Arabian riyal, and what is the U.S. dollar equivalent of that price? (Click on the icon to import the table into a spreadsheet.) The spot rate, Saudi Arabian riyal per Jordanian dinar is SRI IJD. (Round to five decimal places.) Calculate the resale price to Saudi Arabia below: (Round to two decimal places.)