1

2

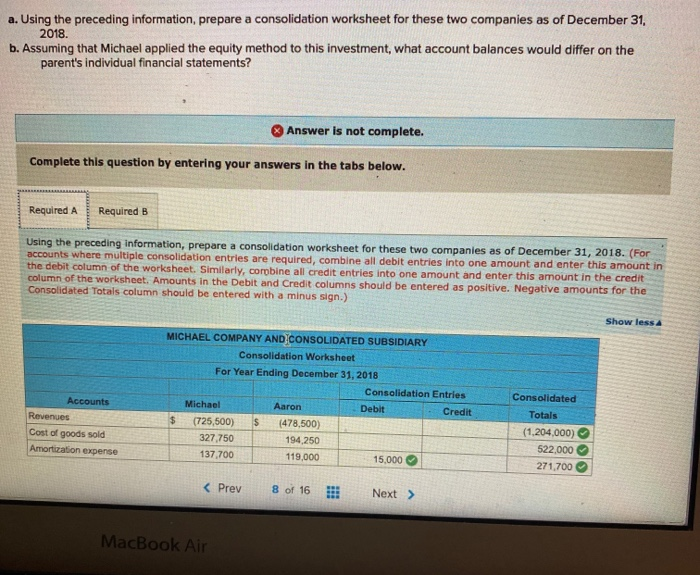

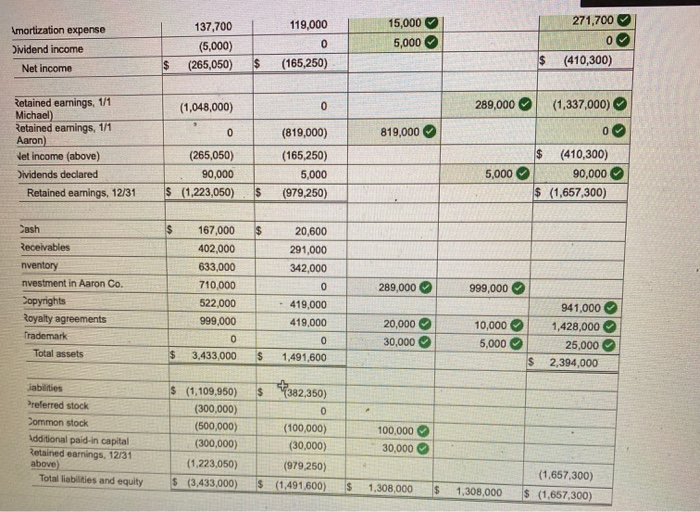

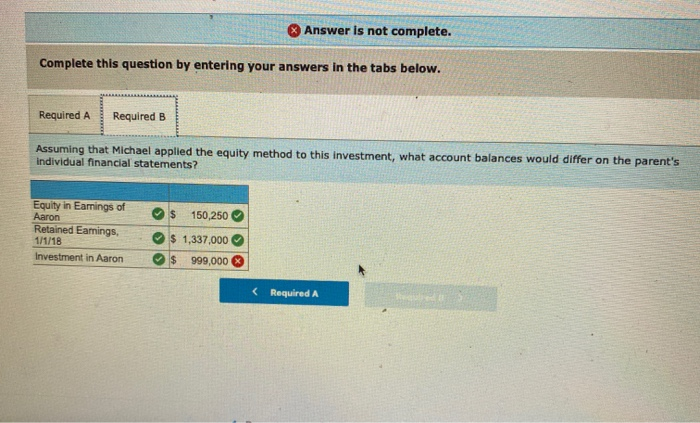

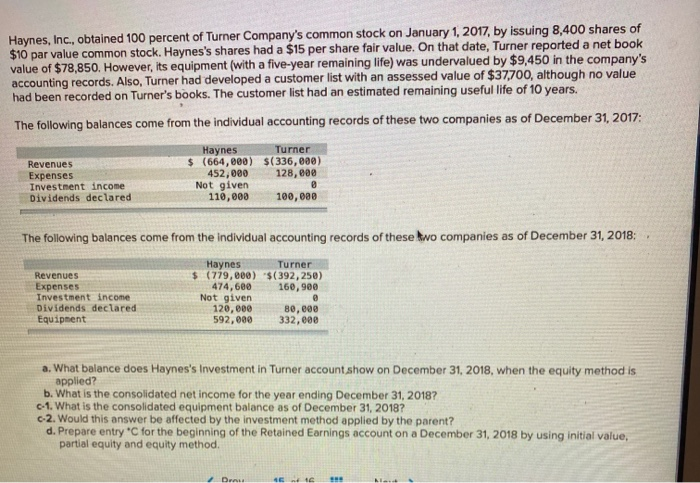

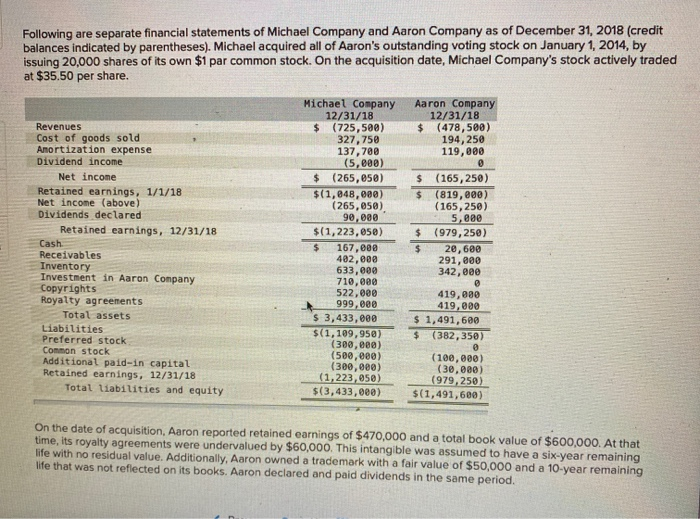

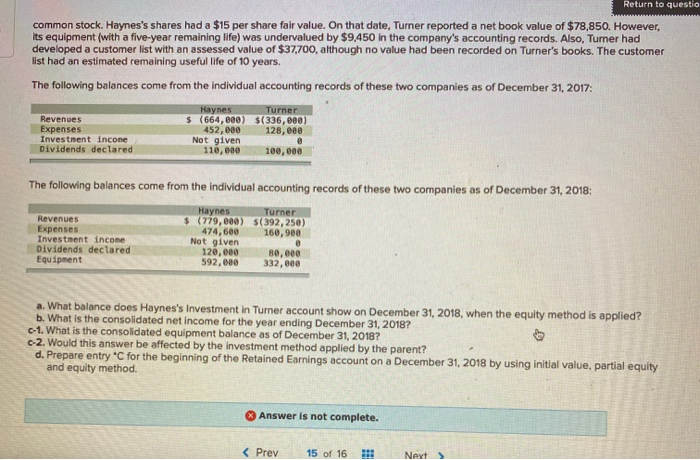

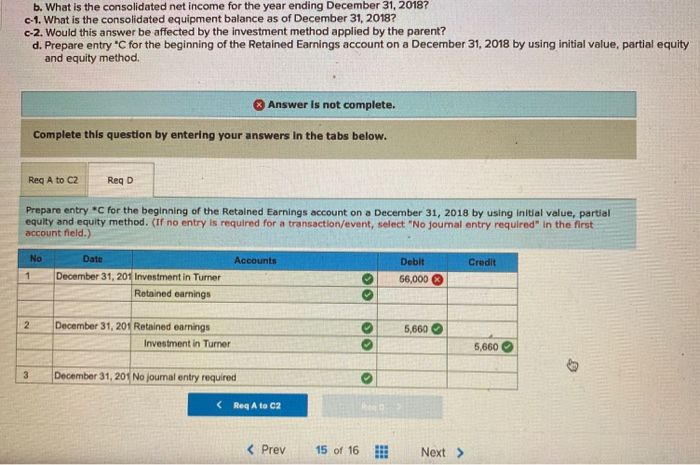

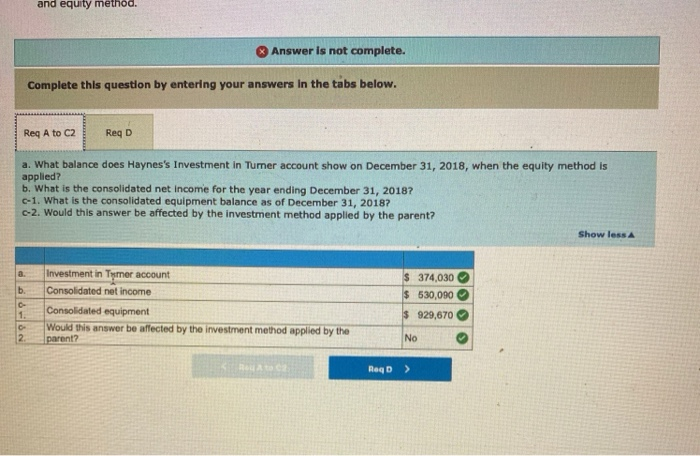

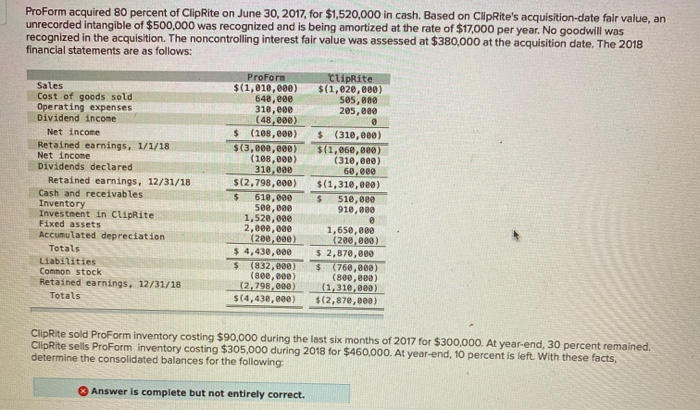

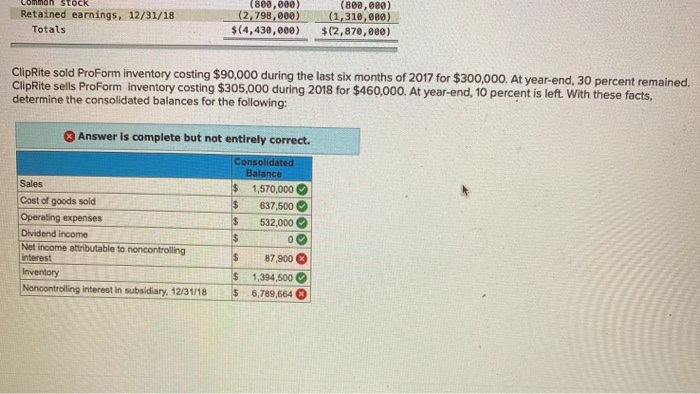

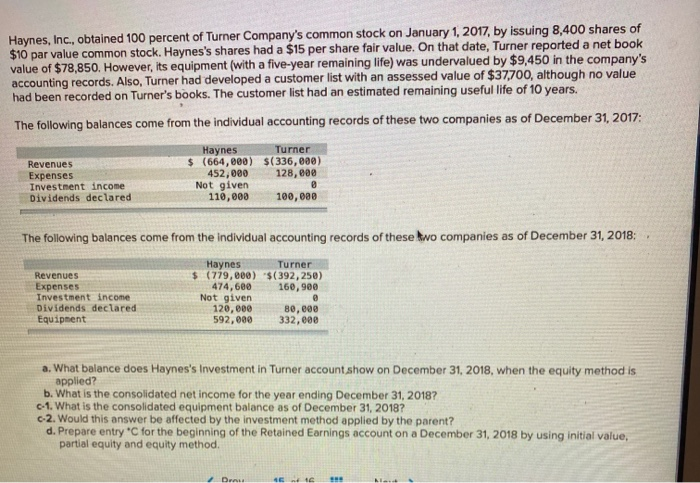

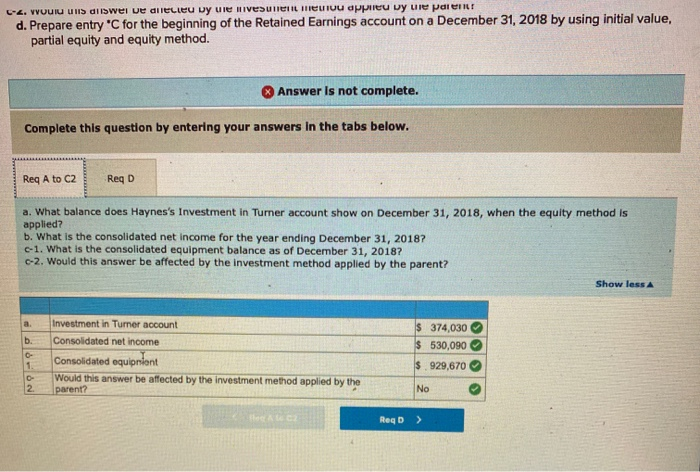

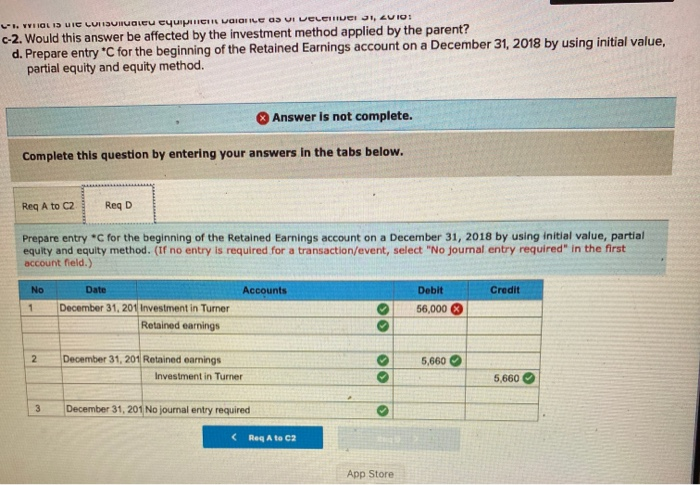

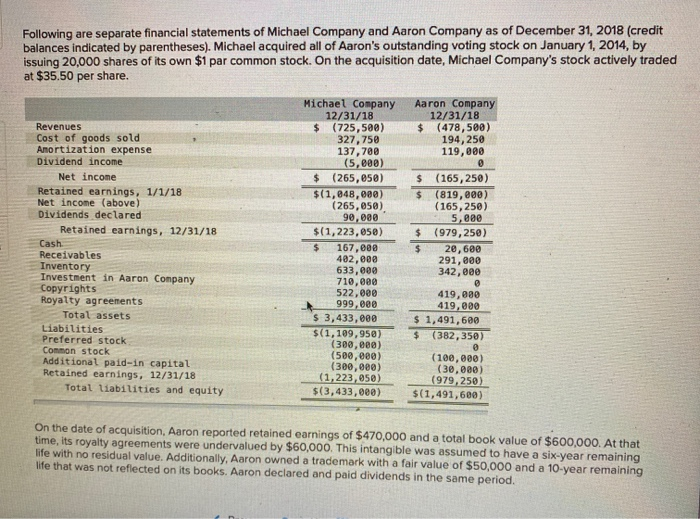

Return to questio common stock. Haynes's shares had a $15 per share fair value. On that date, Turner reported a net book value of $78,850. However, its equipment (with a five-year remaining life) was undervalued by $9.450 in the company's accounting records. Also, Turer had developed a customer list with an assessed value of $37,700, although no value had been recorded on Turner's books. The customer list had an estimated remaining useful life of 10 years. The following balances come from the individual accounting records of these two companies as of December 31, 2017: Revenues Expenses Investment incone Dividends declared Haynes Turner $ (664,880) $(336, 800) 452,000 128,000 Not given 110,000 100,000 The following balances come from the individual accounting records of these two companies as of December 31, 2018: Revenues Expenses Investment income Dividends declared Equipment Haynes Turner $ (779,000) $(392,250) 474,600 160,900 Not given 120,000 80,000 592,800 332,000 a. What balance does Haynes's Investment in Turner account show on December 31, 2018, when the equity method is applied? b. What is the consolidated net income for the year ending December 31, 2018? -1. What is the consolidated equipment balance as of December 31, 2018? c-2. Would this answer be affected by the investment method applied by the parent? d. Prepare entry "C for the beginning of the Retained Earnings account on a December 31, 2018 by using initial value, partial equity and equity method Answer is not complete. -1. VIOLIS UIC LUNDURUCU Eyup EI VOICIILE OD VI VOLETI JEI JI, LV101 c-2. Would this answer be affected by the investment method applied by the parent? d. Prepare entry *C for the beginning of the Retained Earnings account on a December 31, 2018 by using initial value, partial equity and equity method. Answer is not complete. Complete this question by entering your answers in the tabs below. Reg A to C2 Reg D Prepare entry "C for the beginning of the Retained Earnings account on a December 31, 2018 by using initial value, partial equity and equity method. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Accounts Credit Debit 56,000 1 Date December 31, 201 Investment in Turner Retained earnings 2. 5,660 December 31, 201 Retained earnings Investment in Turner 5,660 3 December 31, 201 No journal entry required MacBook Air Amortization expense Dividend income 137,700 (5,000) (265,050) 119,000 0 (165,250) 15,000 5,000 271,700 0 (410,300) Net income $ $ (1,048,000) 0 289,000 (1,337,000) 0 819,000 0 Retained earnings, 1/1 Michael) Retained eamings, 1/1 Aaron) Net income (above) Dividends declared Retained earnings, 12/31 (265,050) 90,000 $ (1,223,050) (819,000) (165,250) 5,000 (979,250) 5,000 $ (410,300) 90,000 $ (1,657,300) $ $ Cash Receivables 167,000 402,000 633,000 710,000 522,000 999,000 289,000 nventory nvestment in Aaron Co. Copyrights Royalty agreements Trademark Total assets 999,000 20,600 291,000 342,000 0 419,000 419,000 0 1,491,600 20,000 30,000 0 3,433,000 10,000 5,000 941,000 1,428,000 25,000 2,394,000 $ $ $ Jabilities Preferred stock Common stock Additional paid in capital Retained earnings, 12/31 above) Total liabilities and equity $ (1,109,950) (300,000) (500,000) (300,000) (1,223,050) $ (3,433,000) $ 47382,350) 0 (100,000) (30,000) (979 250) $ (1,491,600) 100,000 30,000 $ 1,308,000 $ 1,308,000 (1,657,300) $ (1.657,300) Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Assuming that Michael applied the equity method to this investment, what account balances would differ on the parent's individual financial statements? $ 150,250 Equity in Earnings of Aaron Retained Earnings, 1/1/18 Investment in Aaron $ 1,337,000 $ 999,000

1

1

2

2 please fix both

please fix both 1

1

2

2