1.

2.

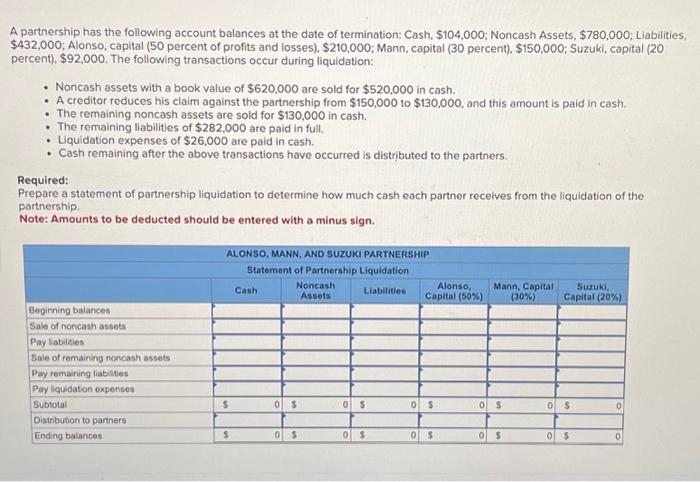

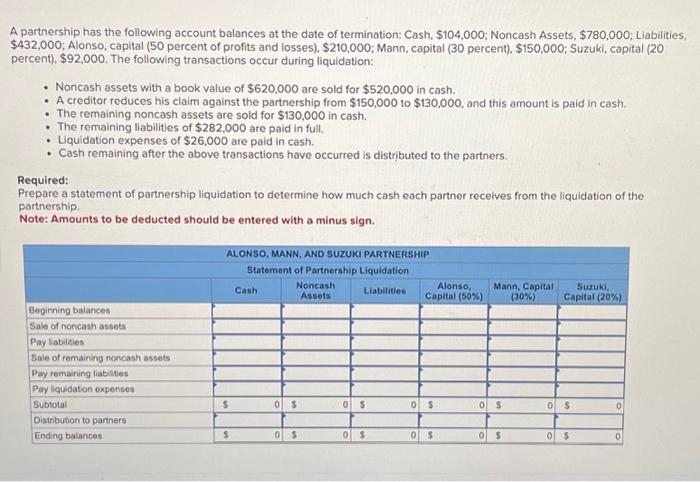

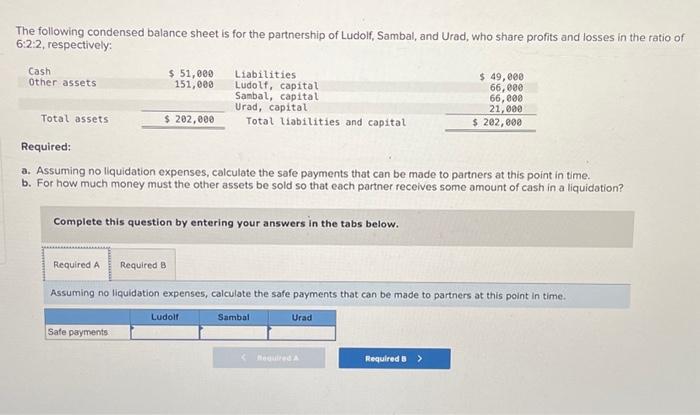

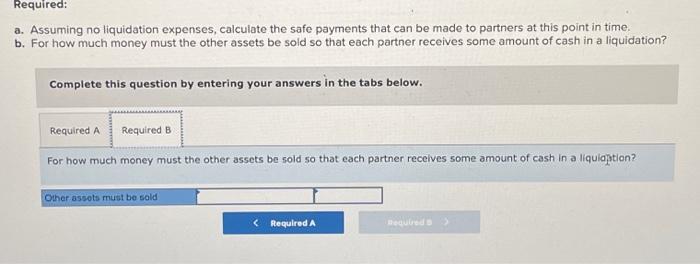

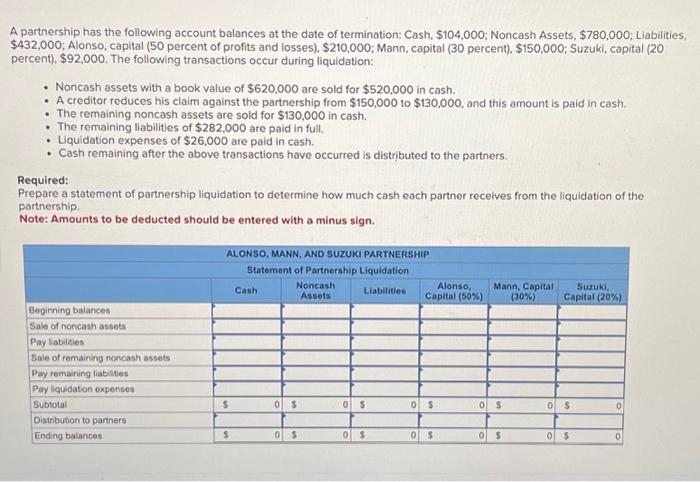

The following condensed balance sheet is for the partnership of Ludolf, Sambal, and Urad, who share profits and losses in the ratio of \\( 6: 2: 2 \\), respectively: Required: a. Assuming no liquidation expenses, calculate the safe payments that can be made to partners at this point in time. b. For how much money must the other assets be sold so that each partner receives some amount of cash in a liquidation? Complete this question by entering your answers in the tabs below. Assuming no liquidation expenses, calculate the safe payments that can be made to partners at this point in time. 3. Assuming no liquidation expenses, calculate the safe payments that can be made to partners at this point in time. . For how much money must the other assets be sold so that each partner receives some amount of cash in a liquidation? Complete this question by entering your answers in the tabs below. For how much money must the other assets be sold so that each partner recelves some amount of cash in a liquiaption? A partnership has the following account balances at the date of termination: Cash, \\( \\$ 104,000 \\); Noncash Assets, \\( \\$ 780,000 \\); Liabilitie \\( \\$ 432,000 \\); Alonso, capital ( 50 percent of profits and losses), \\( \\$ 210,000 ; \\) Mann, capital (30 percent), \\$150,000; Suzuki, capital (20 percent), \\( \\$ 92,000 \\). The following transactions occur during liquidation: - Noncash assets with a book value of \\( \\$ 620,000 \\) are sold for \\( \\$ 520,000 \\) in cash. - A creditor reduces his claim against the partnership from \\( \\$ 150,000 \\) to \\( \\$ 130,000 \\), and this amount is paid in cash. - The remaining noncash assets are sold for \\( \\$ 130,000 \\) in cash. - The remaining liabilities of \\( \\$ 282,000 \\) are paid in full. - Liquidation expenses of \\( \\$ 26,000 \\) are paid in cash. - Cash remaining after the above transactions have occurred is distributed to the partners. Required: Prepare a statement of partnership liquidation to determine how much cash each partner receives from the liquidation of the partnership. Note: Amounts to be deducted should be entered with a minus sign