Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2. Which of the following statements regarding qualified disaster losses is FALSE? O Qualified disaster relief includes any area declared a major disaster by

1.

2.

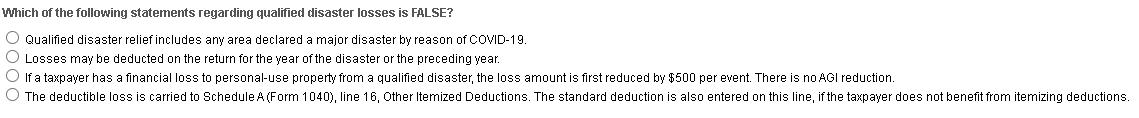

Which of the following statements regarding qualified disaster losses is FALSE? O Qualified disaster relief includes any area declared a major disaster by reason of COVID-19. O Losses may be deducted on the return for the year of the disaster or the preceding year. O If a taxpayer has a financial loss to personal-use property from a qualified disaster, the loss amount is first reduced by $500 per event. There is no AGI reduction. O The deductible loss is carried to Schedule A (Form 1040), line 16, Other Itemized Deductions. The standard deduction is also entered on this line, if the taxpayer does not benefit from itemizing deductions.

Step by Step Solution

★★★★★

3.58 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1 Correct option If a taxpayer has a financial los...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started