Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2. XYZ Corp. will pay a $2 per share dividend in two months. Its stock price currently is $60 per share. A European call

1.

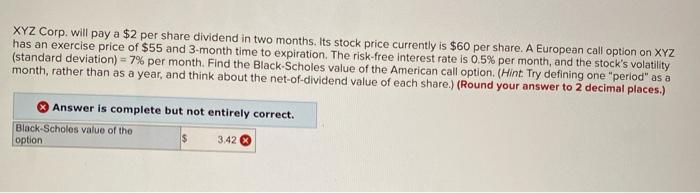

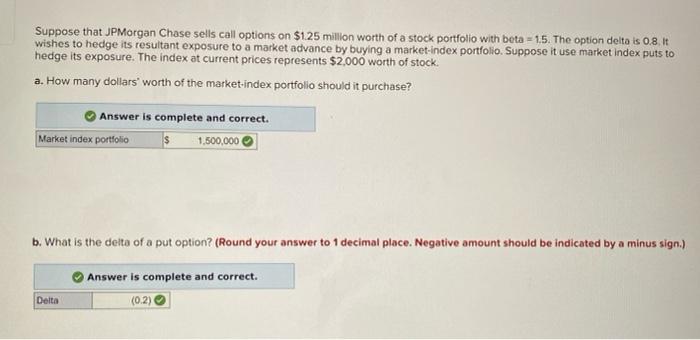

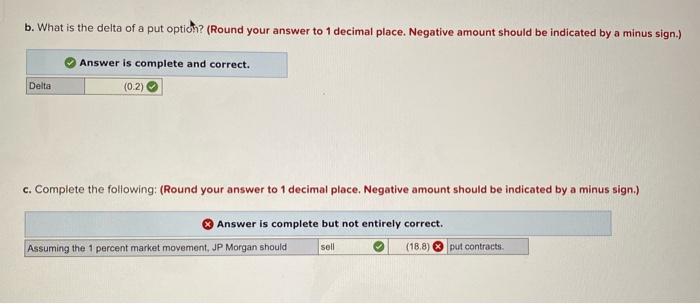

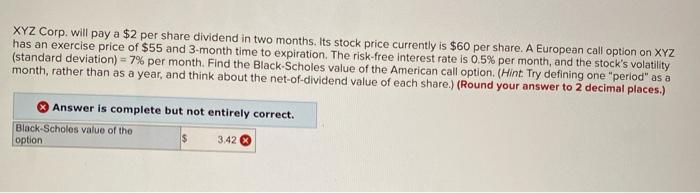

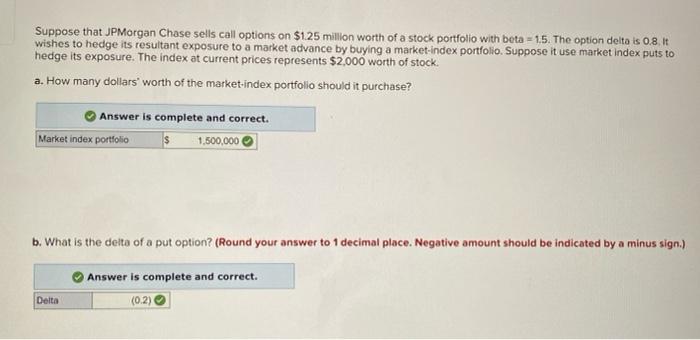

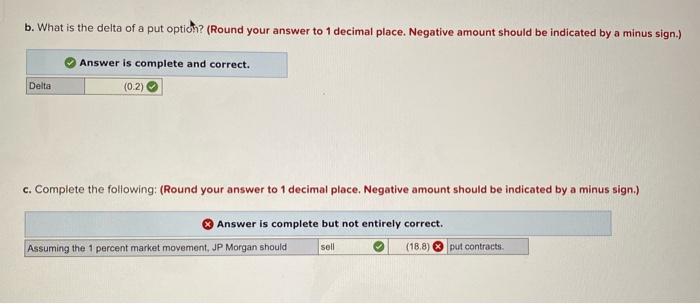

XYZ Corp. will pay a $2 per share dividend in two months. Its stock price currently is $60 per share. A European call option on XYZ has an exercise price of $55 and 3 -month time to expiration. The risk-free interest rate is 0.5% per month, and the stock's volatility (standard deviation) =7% per month. Find the Black-Scholes value of the American call option. (Hint. Try defining one "period" as a month, rather than as a year, and think about the net-of-dividend value of each share.) (Round your answer to 2 decimal places.) Suppose that JPMorgan Chase sells call options on $1.25 million worth of a stock portfolio with beta =1.5. The option delta is 0.8 it wishes to hedge its resultant exposure to a market advance by buying a market-index portfolio. Suppose it use market index puts to hedge its exposure. The index at current prices represents $2,000 worth of stock. a. How many dollars' worth of the market-index portfollo should it purchase? Answer is complete and correct. Market index portiosio b. What is the delta of a put option? (Round your answer to 1 decimal place. Negative amount should be indicated by a minus sign.) b. What is the delta of a put optich? (Round your answer to 1 decimal place. Negative amount should be indicated by a minus sign.) Answer is complete and correct. c. Complete the following: (Round your answer to 1 decimal place. Negative amount should be indicated by a minus sign.)

2.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started