Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. (25 marks) A company is trying to calculate its weight average cost of capital (also known as the opportunity cost of capital). The

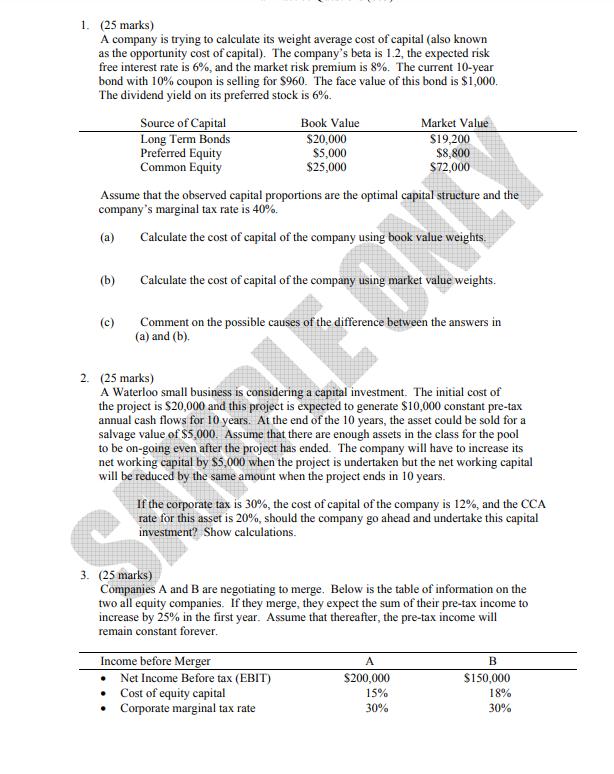

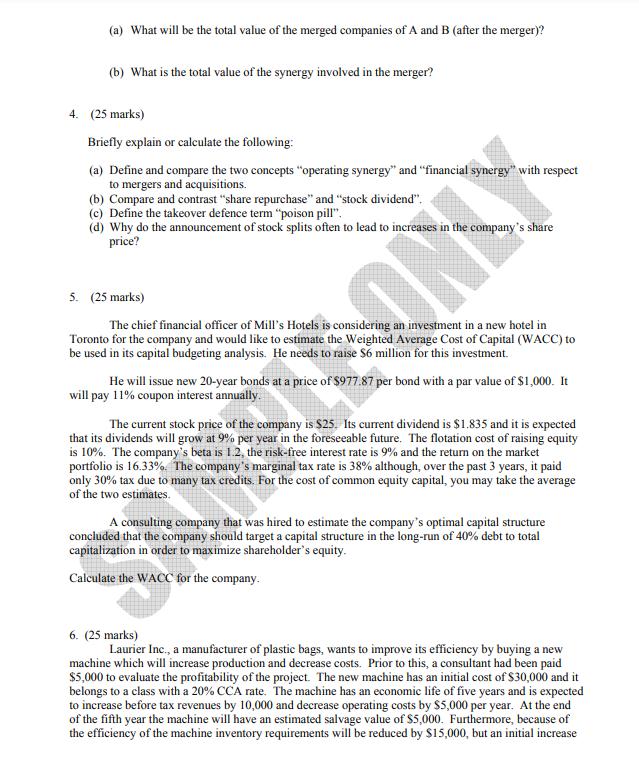

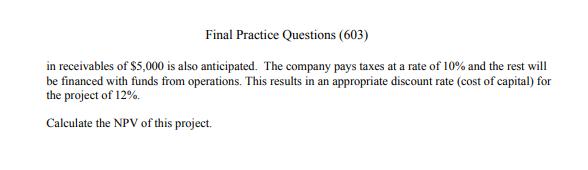

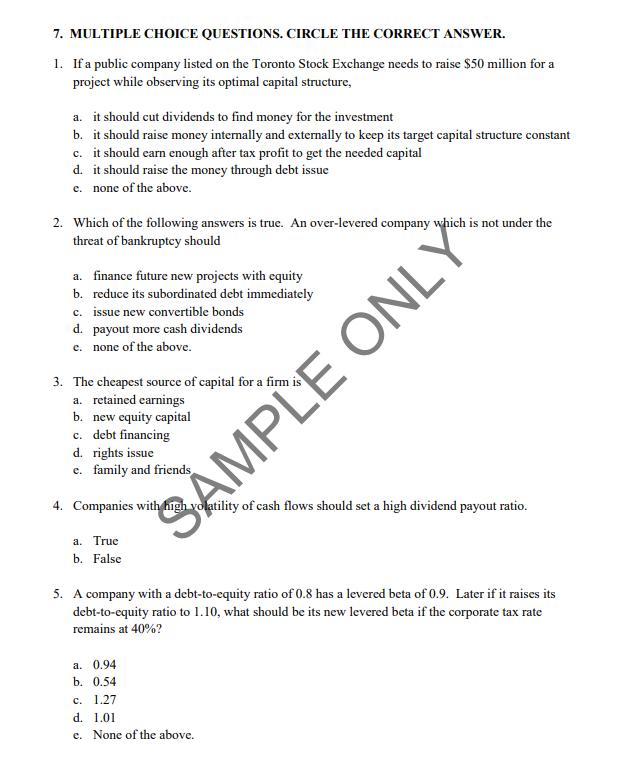

1. (25 marks) A company is trying to calculate its weight average cost of capital (also known as the opportunity cost of capital). The company's beta is 1.2, the expected risk free interest rate is 6%, and the market risk premium is 8%. The current 10-year bond with 10% coupon is selling for $960. The face value of this bond is $1,000. The dividend yield on its preferred stock is 6%. (b) Source of Capital Long Term Bonds Preferred Equity Common Equity (c) Assume that the observed capital proportions are the optimal capital structure and the company's marginal tax rate is 40%. (a) Book Value $20,000 $5,000 $25,000 Calculate the cost of capital of the company using book value weights. Market Value $19,200 $8,800 $72,000 Calculate the cost of capital of the company using market value weights. ww Comment on the possible causes of the difference between the answers in (a) and (b). 2. (25 marks) A Waterloo small business is considering a capital investment. The initial cost of the project is $20,000 and this project is expected to generate $10,000 constant pre-tax annual cash flows for 10 years. At the end of the 10 years, the asset could be sold for a salvage value of $5,000. Assume that there are enough assets in the class for the pool to be on-going even after the project has ended. The company will have to increase its net working capital by $5,000 when the project is undertaken but the net working capital will be reduced by the same amount when the project ends in 10 years. J Income before Merger If the corporate tax is 30%, the cost of capital of the company is 12%, and the CCA rate for this asset is 20%, should the company go ahead and undertake this capital investment? Show calculations. Net Income Before tax (EBIT) Cost of equity capital Corporate marginal tax rate 3. (25 marks) Companies A and B are negotiating to merge. Below is the table of information on the two all equity companies. If they merge, they expect the sum of their pre-tax income to increase by 25% in the first year. Assume that thereafter, the pre-tax income will remain constant forever. A $200,000 15% 30% B $150,000 18% 30% (a) What will be the total value of the merged companies of A and B (after the merger)? (b) What is the total value of the synergy involved in the merger? 4. (25 marks) Briefly explain or calculate the following: (a) Define and compare the two concepts "operating synergy" and "financial synergy" with respect to mergers and acquisitions. (b) Compare and contrast "share repurchase" and "stock dividend". (c) Define the takeover defence term "poison pill". (d) Why do the announcement of stock splits often to lead to increases in the company's share price? NO 5. (25 marks) The chief financial officer of Mill's Hotels is considering an investment in a new hotel in Toronto for the company and would like to estimate the Weighted Average Cost of Capital (WACC) to be used in its capital budgeting analysis. He needs to raise $6 million for this investment. He will issue new 20-year bonds at a price of $977.87 per bond with a par value of $1,000. It will pay 11% coupon interest annually. The current stock price of the company is $25. Its current dividend is $1.835 and it is expected that its dividends will grow at 9% per year in the foreseeable future. The flotation cost of raising equity is 10%. The company's beta is 1.2, the risk-free interest rate is 9% and the return on the market portfolio is 16.33%. The company's marginal tax rate is 38% although, over the past 3 years, it paid only 30% tax due to many tax credits. For the cost of common equity capital, you may take the average of the two estimates. A consulting company that was hired to estimate the company's optimal capital structure concluded that the company should target a capital structure in the long-run of 40% debt to total capitalization in order to maximize shareholder's equity. Calculate the WACC for the company. 6. (25 marks) Laurier Inc., a manufacturer of plastic bags, wants to improve its efficiency by buying a new machine which will increase production and decrease costs. Prior to this, a consultant had been paid $5,000 to evaluate the profitability of the project. The new machine has an initial cost of $30,000 and it belongs to a class with a 20% CCA rate. The machine has an economic life of five years and is expected to increase before tax revenues by 10,000 and decrease operating costs by $5,000 per year. At the end of the fifth year the machine will have an estimated salvage value of $5,000. Furthermore, because of the efficiency of the machine inventory requirements will be reduced by $15,000, but an initial increase Final Practice Questions (603) in receivables of $5,000 is also anticipated. The company pays taxes at a rate of 10% and the rest will be financed with funds from operations. This results in an appropriate discount rate (cost of capital) for the project of 12%. Calculate the NPV of this project. 7. MULTIPLE CHOICE QUESTIONS. CIRCLE THE CORRECT ANSWER. 1. If a public company listed on the Toronto Stock Exchange needs to raise $50 million for a project while observing its optimal capital structure, a. it should cut dividends to find money for the investment b. it should raise money internally and externally to keep its target capital structure constant c. it should earn enough after tax profit to get the needed capital d. it should raise the money through debt issue e. none of the above. 2. Which of the following answers is true. An over-levered company which is not under the threat of bankruptcy should a. finance future new projects with equity b. reduce its subordinated debt immediately c. issue new convertible bonds d. payout more cash dividends e. none of the above. 3. The cheapest source of capital for a firm is a. retained earnings b. new equity capital c. debt financing d. rights issue e. family and friends 4. Companies with high volatility of cash flows should set a high dividend payout ratio. a. True b. False SAMPLE ONLY 5. A company with a debt-to-equity ratio of 0.8 has a levered beta of 0.9. Later if it raises its debt-to-equity ratio to 1.10, what should be its new levered beta if the corporate tax rate remains at 40%? a. 0.94 b. 0.54 c. 1.27 d. 1.01 e. None of the above. 6. Referring to the information in Question 5, what is the debt-to-asset ratio of the company? a. 0.44 b. 0.30 c. 0.33 d. 0.80 e. None of the above. 7. In a perfect capital market where there are no taxes or default risk, the value of the firm is determined by its: a. Dividend policy b. Debt-to-equity ratio (capital structure) c. Present value of its interest tax shield d. Corporate profits and cost of capital e. Total equity 8. Which of the following is false. Dividend policy may matter in corporate valuation because of: a. Information asymmetry b. Differential taxation of dividends and capital gains c. Dividend tax clientele effect d. Higher retention ratio e. None of the above SAMPLE ONLY 9. What should be the debt-to-asset ratio of a company which wants to earn a return on equity (ROE) of 20%. Assume that its net profit margin is 15% and its total asset turnover is 75%? a. 0.778 b. 1.778 c. 0.113 d. 0.438 e. None of the above 10. Consider the following market equilibrium information on two portfolios and the market portfolio. Portfolio A Portfolio B Market Portfolio What is the risk-free interest rate in this economy? a. 6% b. 10% c. 5% Expected return 15% 18% 14% d. 8% e. None of the above. Variance of returns 0.1225 0.25 ? LY

Step by Step Solution

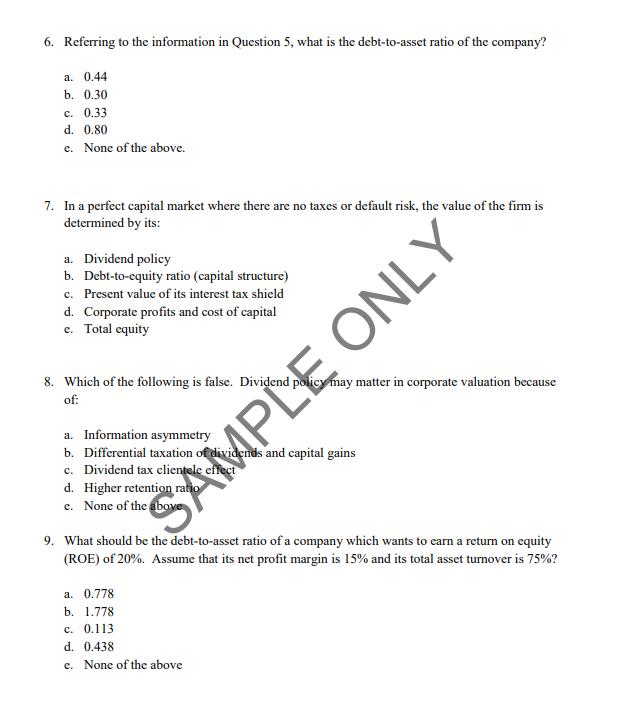

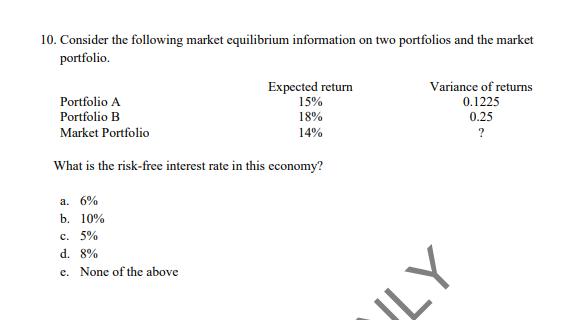

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Here are the answers to the questions 1 25 marks A company is trying to calculate its weight average cost of capital also known as the opportunity cost of capital The companys beta is 12 the expected ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started