Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2.Equipment acquired on January 8 at a cost of $137,550 has an estimated useful life of 16 years, has an estimated residual value of

1.

2.Equipment acquired on January 8 at a cost of $137,550 has an estimated useful life of 16 years, has an estimated residual value of $9,550, and is depreciated by the straight-line method.

3.

3.

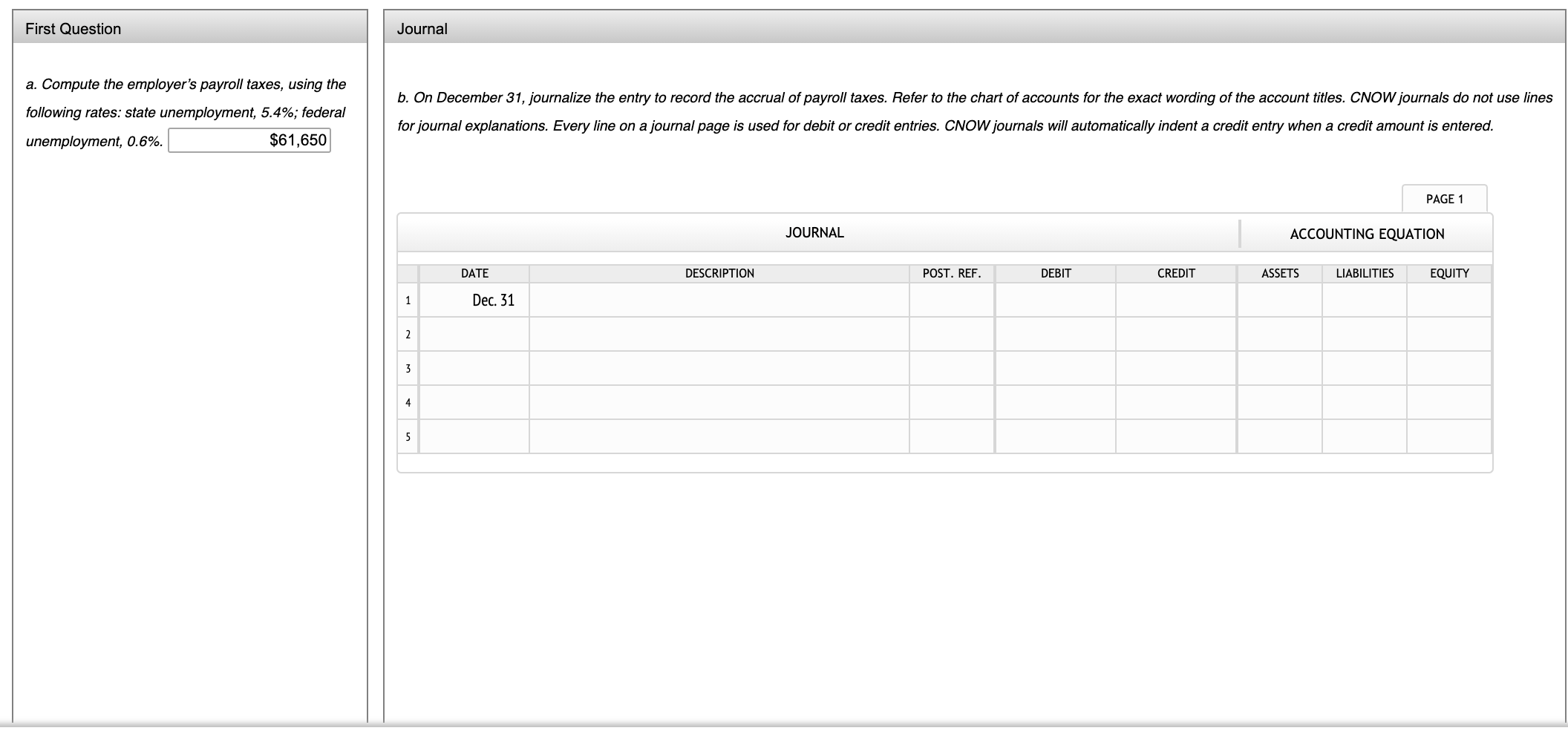

3.  4. According to a summary of the payroll of Guthrie Co., $790,000 was subject to the 6.0% social security tax and the 1.5% Medicare tax. Also, $40,000 was subject to state and federal unemployment taxes.

4. According to a summary of the payroll of Guthrie Co., $790,000 was subject to the 6.0% social security tax and the 1.5% Medicare tax. Also, $40,000 was subject to state and federal unemployment taxes.

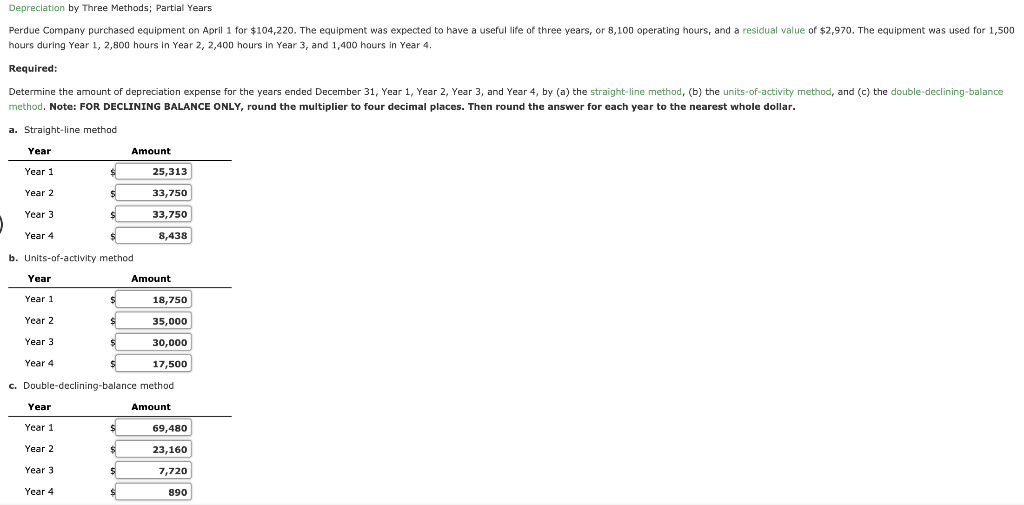

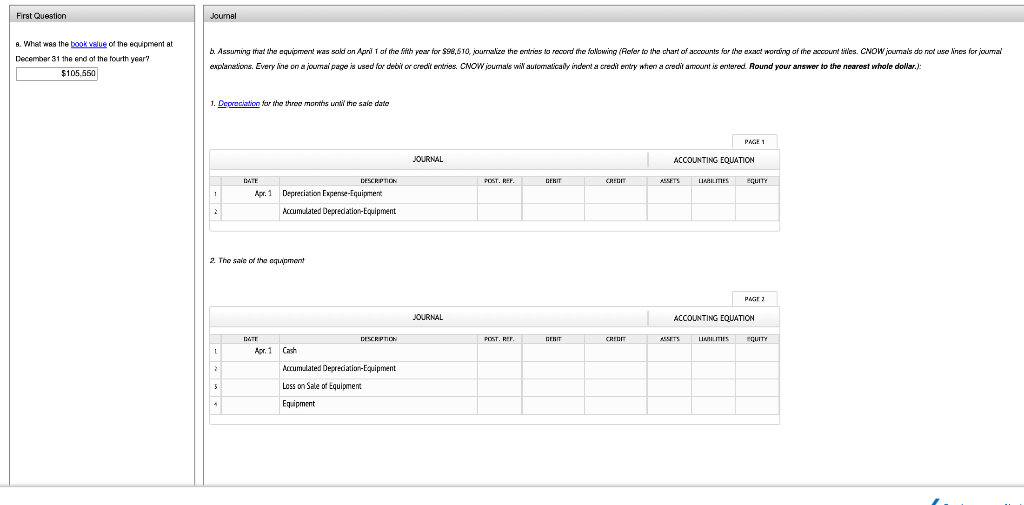

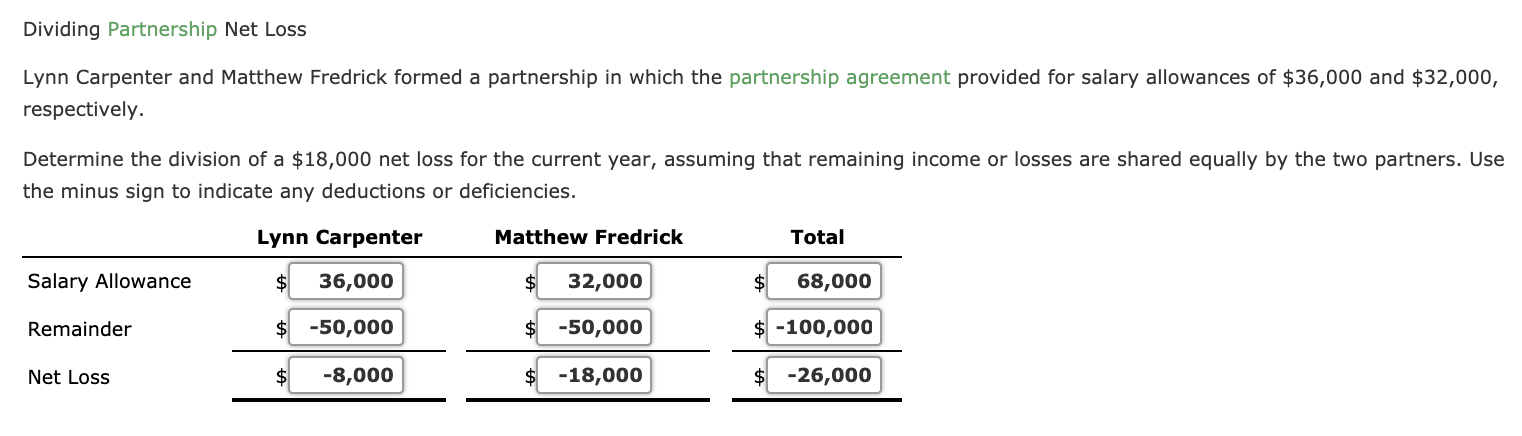

Depreciation by Three Methods; Partial Years Perdue Company purchased equipment on April 1 for $104,220. The equipment was expected to have a useful life of three years, or 8,100 operating hours, and a residual value hours during Year 1, 2,800 hours in Year 2, 2,400 hours in Year 3, and 1,400 hours in Year 4. $2,970. The equipment was used for 1,500 Required: Determine the amount of depreciation expense for the years ended December 31, Year 1, Year 2, Year 3, and Year 4, by (a) the straight-line method, (b) the units-of-activity method, and (c) the double-declining-balance method. Note: FOR DECLINING BALANCE ONLY, round the multiplier to four decimal places. Then round the answer for each year to the nearest whole dollar. a. Straight-line method Year Amount Year 1 $ 25,313 Year 2 33,750 Year 3 33,750 Year 4 8,438 b. Units-of-activity method Year Amount Year 1 18,750 Year 2 35,000 Year 3 30,000 Year 4 17,500 c. Double-declining-balance method Year Amount Year 1 69,480 Year 2 23,160 Year 3 7,720 Year 4 $ 890 First Question Joumal a. What was the book value of the equipment at December 31 the end of the fourth year? $105,550 6. Assuming that the equipment was sold on April 1 of the Sith your for 598,810, journalize the entries to record the followingRefer to the chart of accounts for the exact wording of the accurat sites. CNOW journals do not use Anes for journal explanations. Every line on a journal page is used for decit or crediterries. CNOW journals will automatically index a credit entry when a credit amount is entered. Round your answer to the nearest whole dollar.): 1. Depreciation for the three months the sale date PAGE 1 JOURNAL ACCOUNTING EQUATION POST. REF. DERIT CREDIT ASSETS LAAILMES EQUITY 1 DATE DESCRPTION Apr. 1 Depreciation Expense-Equipment Accumulated Deprecation Equipment 2. The sale of the equipment PAGE 3 JOURNAL ACCOUNTING EQUATION DATE POST. REF. DERIT CREDIT LIABILITIES QUITY 1 Apr DESCRPTION Cast Accumulated Depreciation Equipment Loss on Sale of Equipment Equipment Dividing Partnership Net Loss Lynn Carpenter and Matthew Fredrick formed a partnership in which the partnership agreement provided for salary allowances of $36,000 and $32,000, respectively. Determine the division of a $18,000 net loss for the current year, assuming that remaining income or losses are shared equally by the two partners. Use the minus sign to indicate any deductions or deficiencies. Lynn Carpenter Matthew Fredrick Total Salary Allowance $ 36,000 $ 32,000 $ 68,000 Remainder $ -50,000 $ -50,000 $ -100,000 Net Loss $ -8,000 $ -18,000 $ -26,000 First Question Journal a. Compute the employer's payroll taxes, using the following rates: state unemployment, 5.4%; federal unemployment, 0.6%. $61,650 b. On December 31, journalize the entry to record the accrual of payroll taxes. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. PAGE 1 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 Dec. 31 2 3 4 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started