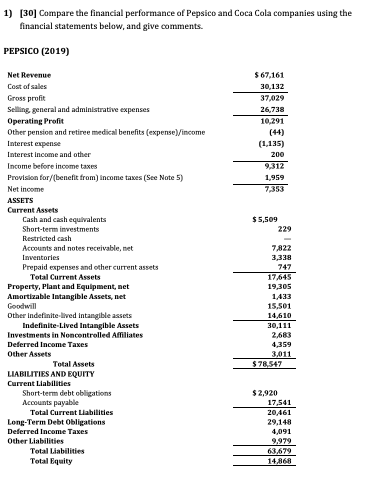

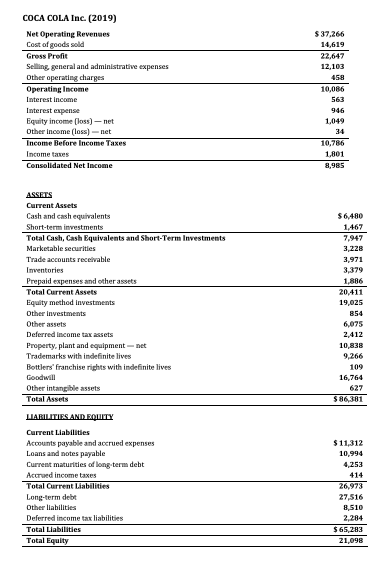

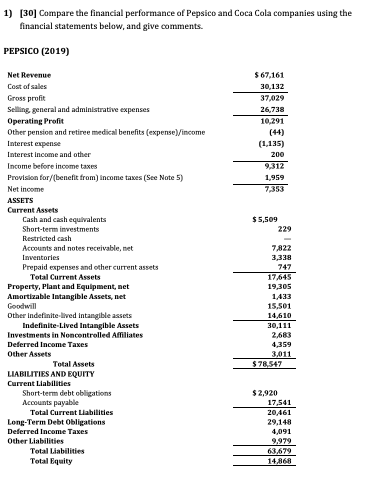

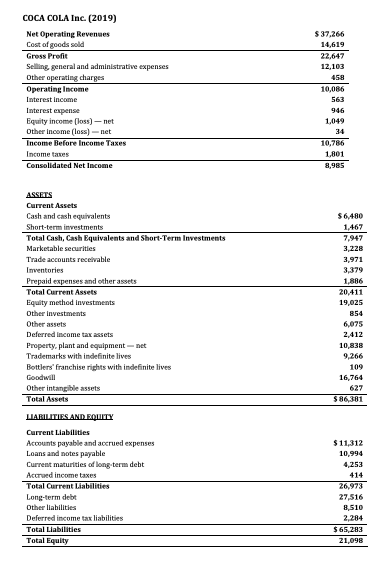

1) (30) Compare the financial performance of Pepsice and Coca Cola companies using the financial statements below, and give comments. PEPSICO (2019) $67.161 30,132 26.738 10.291 (44) (1.135) Net Revenue Cost of sales Gross profit Selling general and administrative expenses Operating Profit Other pension and retire medical benefits (expense)/income Interest expense Interest income and other Income before income taxes Provision for/benefit from income taxes (See Note 5) Net income ASSETS Current Assets Cash and cash equivalents Short-term investments Restricted cash Accounts and notes receivable, net 9,312 1,959 $5,509 229 7.822 3.338 30.111 Prepaid expenses and other current assets Total Current Assets Property, Plant and Equipment, net Amortizable Intangible Assets, net Goodwill Other indefinite-lived intangible assets Indefinite-Lived Intangible Assets Investments in Noncentrolled Affiliates Deferred Income Taxes Other Assets Total Assets LIABILITIES AND EQUITY Current Liabilities Short-term debt obligations $78.547 $ 2,920 20,461 Total Current Liabilities Long-Term Debt Obligations Deferred Income Taxes Other Liabilities Total Liabilities Total Equity 4.091 9,979 63.679 14.868 COCA COLA Inc. (2019) Net Operating Revenues Cost of goods sold Gross Profit $ 37,266 14.619 22.647 12 103 Other operating charges Operating Income 10,086 1.049 Interest Expense Equity incomess)-net Other Income (less)-net Income Before Income Taxes Income taxes Consolidated Net Income 1.801 $6,480 1,467 7.947 ASSETS Current Assets Cash and cash equivalents Short-term investments Total Cash, Cash Equivalents and Short-Term Investments Marketable securities Trade accounts receivable Inventories Prepaid expenses and other assets Total Current Assets Equity method investments Other investments Other assets Deferred income tax assets Property, plant and equipment het Trademarks with indefinite lives Bottlers' franchise rights with indefinite lives 2.971 3.379 1.886 10,319 16,764 Other intangible assets Total Assets S881 LIABILITIES AND EQUITY $11.312 10,990 Current Liabilities Accounts payable and accrued expenses Loans and notes payable Current artis long-term det Acerad income taxes Total Current Liabilities Long-term debe Other lates Deferred income tal es Total Liabilities Total Equity 24973 27,516 8.510 2.284 565.23 21,098 1) (30) Compare the financial performance of Pepsice and Coca Cola companies using the financial statements below, and give comments. PEPSICO (2019) $67.161 30,132 26.738 10.291 (44) (1.135) Net Revenue Cost of sales Gross profit Selling general and administrative expenses Operating Profit Other pension and retire medical benefits (expense)/income Interest expense Interest income and other Income before income taxes Provision for/benefit from income taxes (See Note 5) Net income ASSETS Current Assets Cash and cash equivalents Short-term investments Restricted cash Accounts and notes receivable, net 9,312 1,959 $5,509 229 7.822 3.338 30.111 Prepaid expenses and other current assets Total Current Assets Property, Plant and Equipment, net Amortizable Intangible Assets, net Goodwill Other indefinite-lived intangible assets Indefinite-Lived Intangible Assets Investments in Noncentrolled Affiliates Deferred Income Taxes Other Assets Total Assets LIABILITIES AND EQUITY Current Liabilities Short-term debt obligations $78.547 $ 2,920 20,461 Total Current Liabilities Long-Term Debt Obligations Deferred Income Taxes Other Liabilities Total Liabilities Total Equity 4.091 9,979 63.679 14.868 COCA COLA Inc. (2019) Net Operating Revenues Cost of goods sold Gross Profit $ 37,266 14.619 22.647 12 103 Other operating charges Operating Income 10,086 1.049 Interest Expense Equity incomess)-net Other Income (less)-net Income Before Income Taxes Income taxes Consolidated Net Income 1.801 $6,480 1,467 7.947 ASSETS Current Assets Cash and cash equivalents Short-term investments Total Cash, Cash Equivalents and Short-Term Investments Marketable securities Trade accounts receivable Inventories Prepaid expenses and other assets Total Current Assets Equity method investments Other investments Other assets Deferred income tax assets Property, plant and equipment het Trademarks with indefinite lives Bottlers' franchise rights with indefinite lives 2.971 3.379 1.886 10,319 16,764 Other intangible assets Total Assets S881 LIABILITIES AND EQUITY $11.312 10,990 Current Liabilities Accounts payable and accrued expenses Loans and notes payable Current artis long-term det Acerad income taxes Total Current Liabilities Long-term debe Other lates Deferred income tal es Total Liabilities Total Equity 24973 27,516 8.510 2.284 565.23 21,098