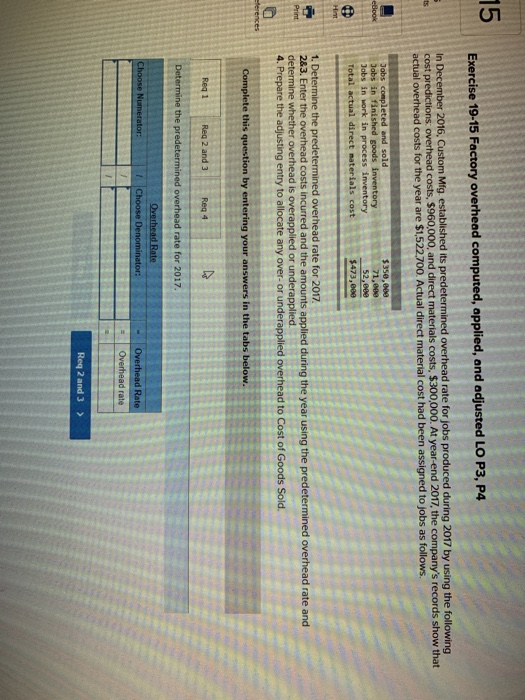

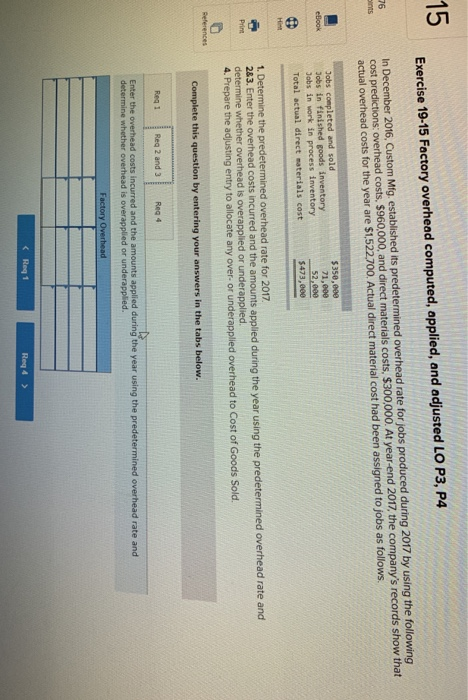

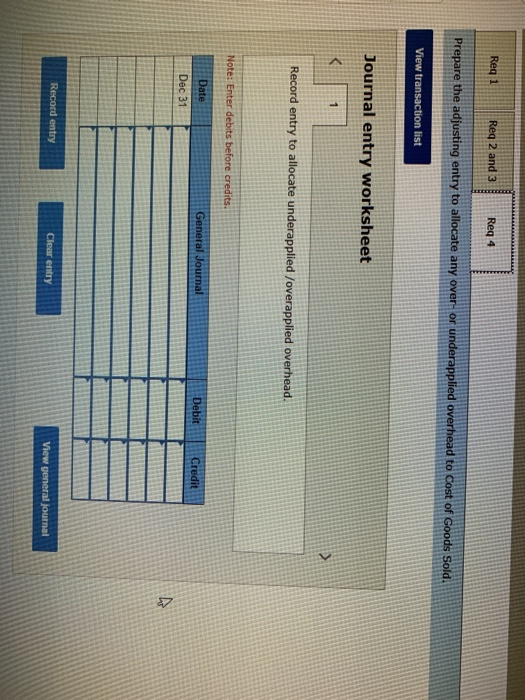

1 5 Exercise 19-15 Factory overhead com puted, applied, and adjusted LO P3, P4 In December 2016, Custom Mfg established its predetermined overhead rate for jobs produced during 2017 by using the following cost predictions overhead costs, $960,000, and direct materials costs, $300,000. At year-end 2017, the company's records show that actual overhead costs for the year are $1,522700. Actual direct material cost had been assigned to jobs as follows. Jobs completed and sold Jobs in finished goods inventory Jobs in work in process inventory $473,000 1. Determine the predetermined overhead rate for 2017 283. Enter the overhead costs incurred and the amounts applied during the year using the predetermined overhead rate and determine whether overhead is overapplied or underapplied 4. Prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold. terences tering your answers in the tabs below Req 1 Req 2 and 3Req 4 Ch Req 2 and 3> 15 Exercise 19-15 Factory overhead computed, applied, and adjusted LO P3, P4 In December 2016, Custom Mfg. established its predetermined overhead rate for jobs produced during 2017 by using the following cost predictions: overhead costs, $960,000, and direct materials costs, $300,000. At year-end 2017, the company's records show that actual overhead costs for the year are $1,522700. Actual direct material cost had been assigned to jobs as follows 76 Jobs completed and sold Jobs in finished goods inventory Dobs in work in process inventory Total actual direct materials cost5473,000 $350,000 71,000 52,000 the predetermined overhead rate for 2017 2&3. Enter the overhead costs incurred and the amounts applied during the year using the predetermined overhead rate and whether overhead is overapplied or underapplied 4. Prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Req I Req 2 and 3 Rea 4 Enter the overhead costs incurred and the amounts applied during the year using the predetermined overhead rate and determine whether overhead is overapplied or underapplied.