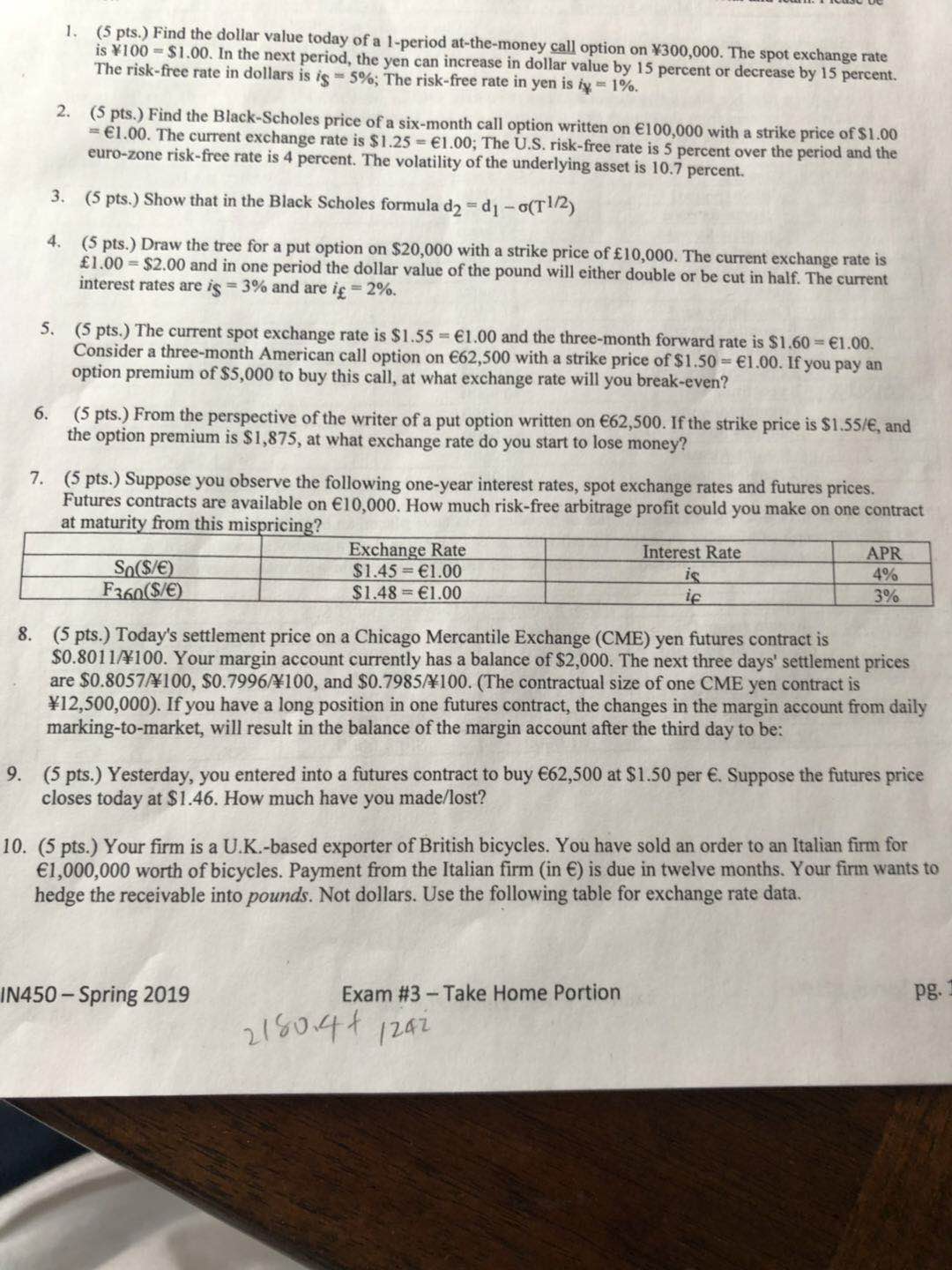

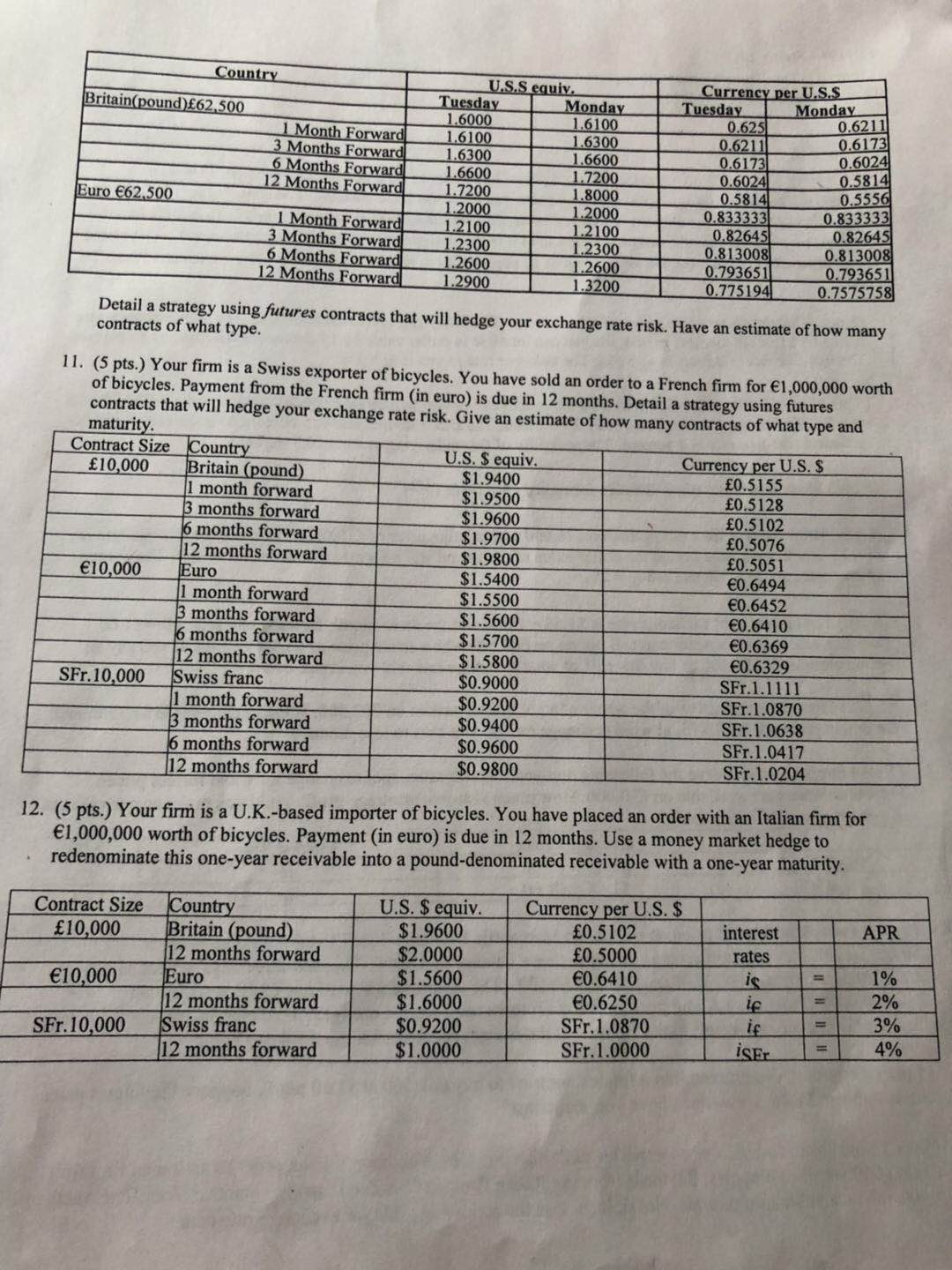

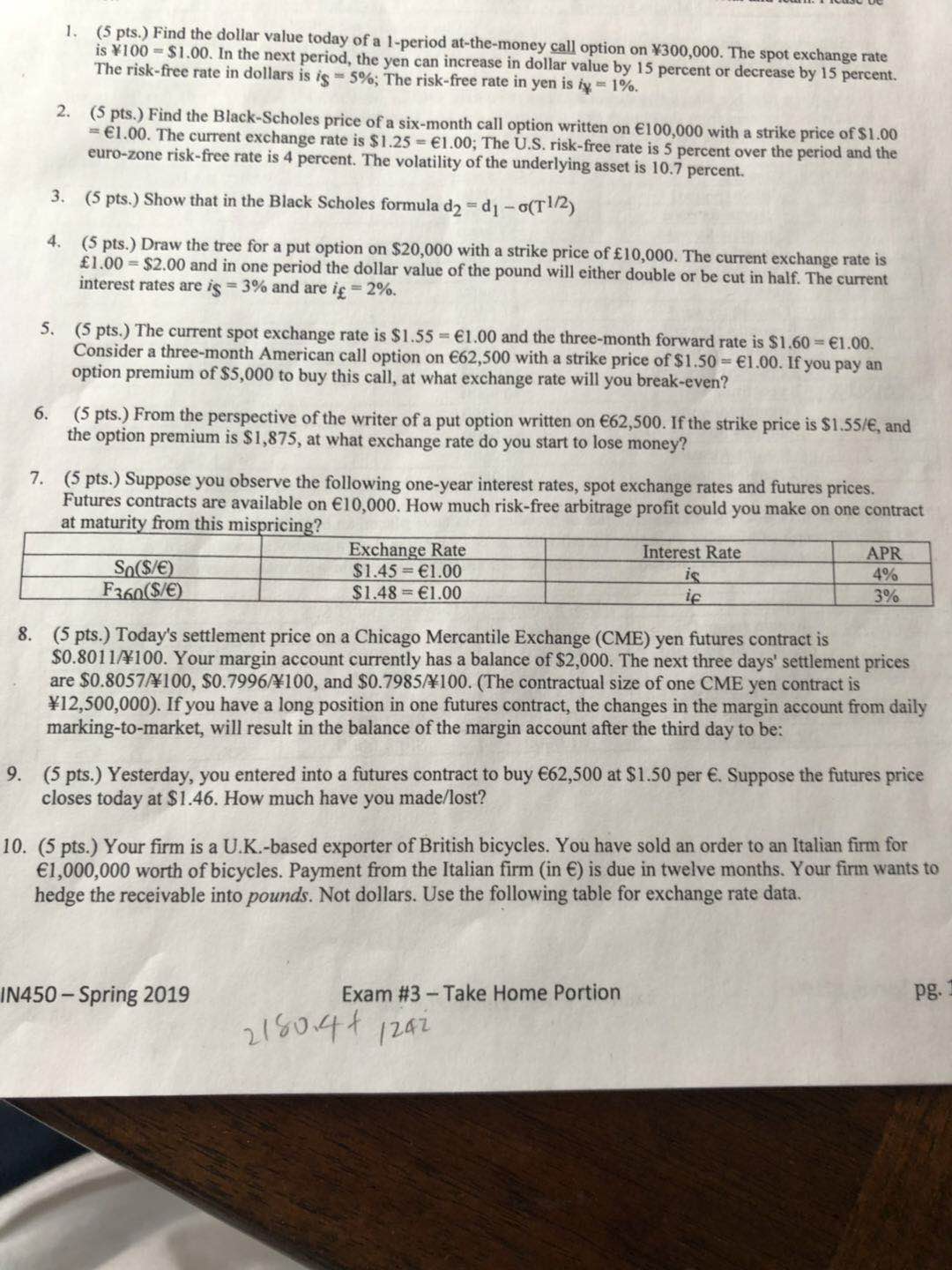

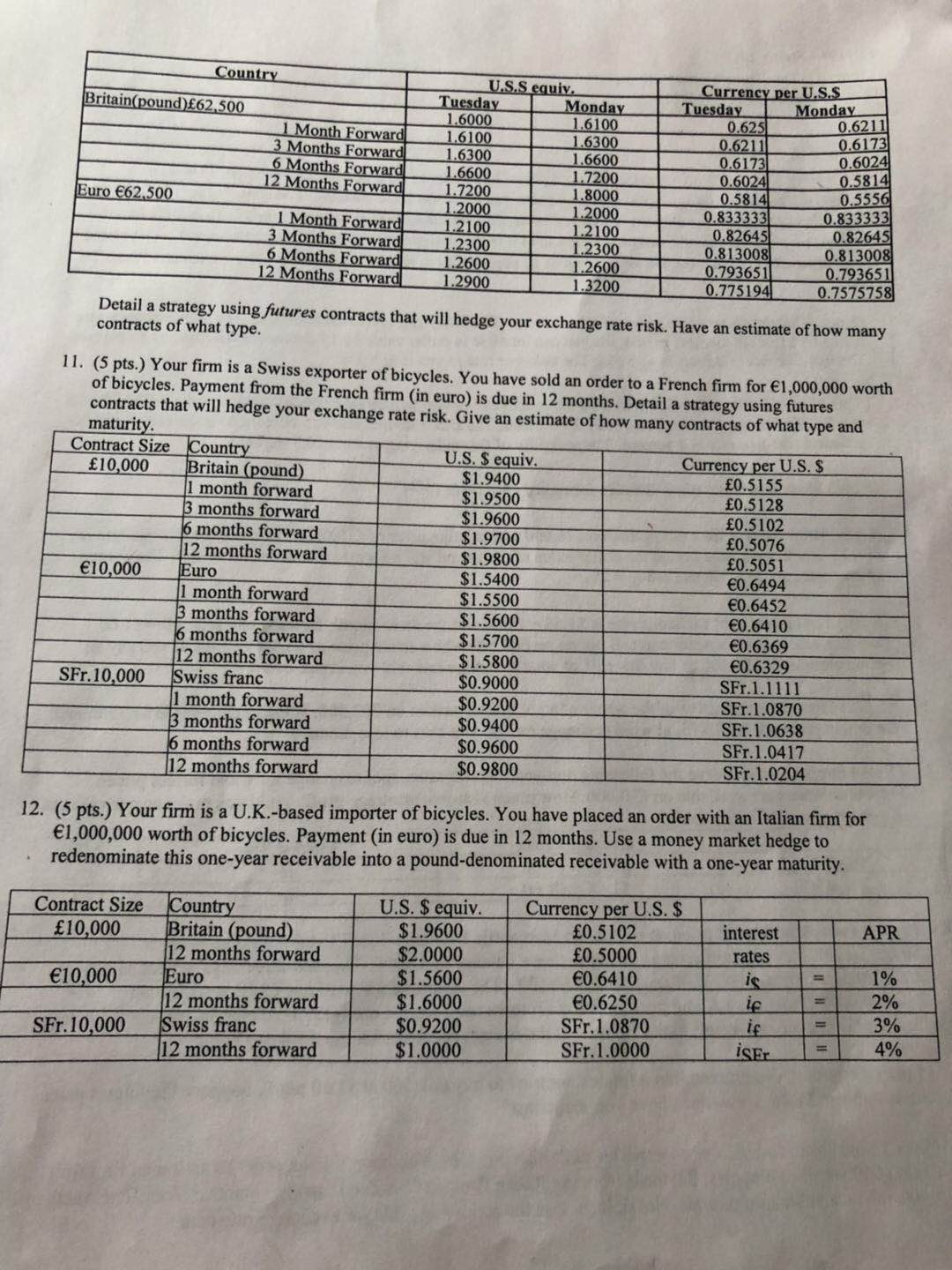

1 . ( 5 pis. ) Find the dollar value today of a 1 - period at- the -money call option on *300, 000 . The spot exchange rate is* 100 = $1. 00 . In the next period , the yen can increase in dollar value by 15 percent or decrease by 15 percent . The risk - free rate in dollars is is = 5%; The risk- free rate in yen is ty = 1%/0 . 2 . ( 5 pts . ) Find the Black - Scholes price of a six - month call option written on E100 , 000 with a strike price of $1 . 00 = $1. 00 . The current exchange rate is $1 . 25 = $1. 00 ; The U.S. risk- free rate is 5 percent over the period and the euro - zone risk - free rate is 4 percent . The volatility of the underlying asset is 10. 7 percent . 3 . ( 5 pts . ) Show that in the Black Scholes formula dy = dy - OCT 1 /2 ) 4 . ( 5 pis. ) Draw the tree for a put option on $20 , 000 with a strike price of $10, 000 . The current exchange rate is $1 . 00 = $2.00 and in one period the dollar value of the pound will either double or be cut in half . The current interest rates are is = 3% and are if = 2%6. 5 . ( 5 pts. ) The current spot exchange rate is $1. 55 = $1. 00 and the three - month forward rate is $1 . 60 = $1. 00 . Consider a three - month American call option on $62 , 500 with a strike price of $1. 50 = $1. 00. If you pay and option premium of $5, 000 to buy this call , at what exchange rate will you break - even ?` 6 . ( 5 pts . ) From the perspective of the writer of a put option written on E6 2 , 500 . If the strike price is $1. 55 / { , and the option premium is $1 , 875 , at what exchange rate do you start to lose money ? 7 . ( 5 pts . ) Suppose you observe the following one - year interest rates , spot exchange rates and futures prices . Futures contracts are available on E10 , 000 . How much risk- free arbitrage profit could you make on one contract at maturity from this mispricing ? So ( S / E ) Exchange Rate $1. 45 = $1. 00 Interest Rate APR F360 ( S/ E ) 4% $1. 48 = E1. 00 8 . ( 5 pts . ) Today's settlement price on a Chicago Mercantile Exchange ( CME ) yen futures contract is $0. 801 1 * *100. Your margin account currently has a balance of $2, 000 . The next three days' settlement prices are $0. 8057 / * 100 , $0. 7996 * *100 , and $0. 7985*100 . ( The contractual size of one CME yen contract is * 12 , 500 , 000 ) . If you have a long position in one futures contract , the changes in the margin account from daily marking - to - market , will result in the balance of the margin account after the third day to be : 9 . ( 5 pts . ) Yesterday , you entered into a futures contract to buy $6 2 , 500 at $1. 50 per E. Suppose the futures price closes today at $1 . 46 . How much have you made / lost ? 10 . ( 5 pts. ) Your firm is a U. K. - based exporter of British bicycles . You have sold an order to an Italian firm for E1 , 000, 000 worth of bicycles . Payment from the Italian firm ( in E ) is due in twelve months . Your firm wants to hedge the receivable into pounds . Not dollars . Use the following table for exchange rate data . IN450 - Spring 2019 Exam # 3 - Take Home Portion P8 . 2180.4+ 1242)Country U. S. S equiy . Britain ( pound ) $62, 500 Tuesday Monday Currency per U. S. 5 Tuesday Monday 1 Month Forward - 6000 3 Months Forward 1 , 6100 1. 6100 0. 625 0. 6211) . 6300 0 . 6211 0. 6173 6 Months Forward 1. 6300 12 Months Forward . 6600 .6600 1 . 720.0 0 . 6173 0. 6024 CUTO E62, 500 1. 7200 0. 6024 0. 5814 1 Month Forward 1. 2000 1. 8000 0 . 5814 0. 5556\ 1. 2300 1. 2100 0. 833333 2.833333| 3 Months Forward 1. 2100 2000 0. 82645\ . 2600 1. 2300 0 . 82645 6 Months Forward! . 2600 0. 8130.08 0 . 813008 12 Months Forward . 2900 1. 3200 0. 79365!) 0. 775 194| 0 . 79365 1 0. 7575758\ Detail a strategy using futures contracts that will hedge your exchange rate risk . Have an estimate of how many contracts of what type . 11 . ( 5 pts. ) Your firm is a Swiss exporter of bicycles . You have sold an order to a French firm for $1 , 000 , 000 worth of bicycles . Payment from the French firm ( in euro ) is due in 12 months . Detail a strategy using futures maturity . contracts that will hedge your exchange rate risk . Give an estimate of how many contracts of what type and Contract Size $10, 000 \Country \Britain ( pound ) U. S. Sequiv $1. 9400 Currency per U. S. S 1 month forward $1. 9500 $0. 5155 3 months forward $1. 9600 $0. 5128 6 months forward $0 . 5102 12 months forward $1. 9700 \Euro $1. 9800 $0 . 5076 E10, 000 |1 month forward $1. 5400 60 . 505 1 $1. 5500 EO. 6494 3 months forward 6 months forward $1. 5600 EO. 6452 SFr. 10, 000 12 months forward $1. 5700 EO . 6410 \Swiss franc $1. 5800 ED. 6369 \1 month forward $0. 9000 ED. 6329 $0 . 9200 SFr . 1 . 1 1 1 1 3 months forward $0. 9400 SFT . 1 . 0870 6 months forward $0. 9600 SFT. 1. 0638 \12 months forward $0. 9800 SFT . 1 . 0417 SFT. 1. 0204 12. ( 5 pts . ) Your firm is a U . K . - based importer of bicycles . You have placed an order with an Italian firm for E1, 000, 000 worth of bicycles . Payment ( in euro ) is due in 12 months . Use a money market hedge to redenominate this one - year receivable into a pound - denominated receivable with a one - year maturity . Contract Size* $10 , 000 \Country J . S. Sequiv . Britain ( pound ) Currency per U. S. S $1. 9600 (0 . 5102 interest APR 12 months forward $2.0000 $1. 5600 $0. 5000 rates E10, 000 Euro CO . 6410 1%/0 \12 months forward $1. 6000 EO . 6250 is if 2%/0 SFT. 10, 000 \Swiss franc $0. 9200 SFr . 1 . 0870 if 3%/0 12 months forward $1. 0000 SFT . 1. 0000 ISET 4%0