Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. (5 points) Under IFRS companies are expected to use current tax rates to calculate deferred taxes and income tax expense. Under what circumstance does

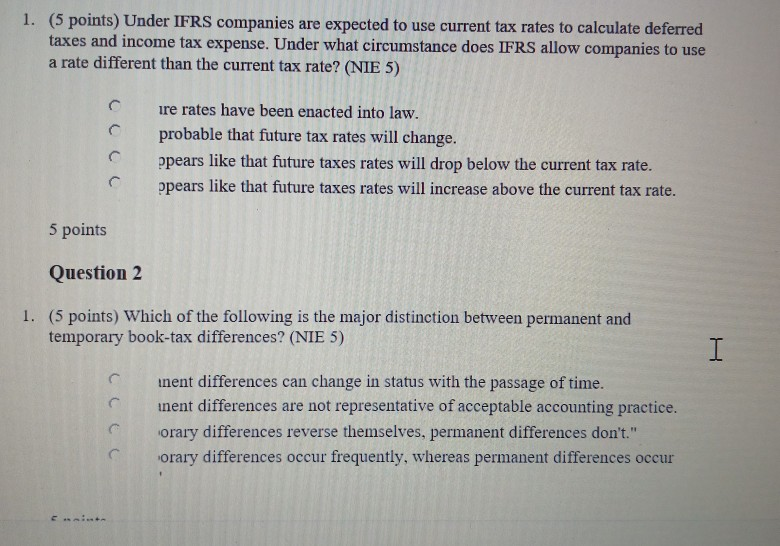

1. (5 points) Under IFRS companies are expected to use current tax rates to calculate deferred taxes and income tax expense. Under what circumstance does IFRS allow companies to use a rate different than the current tax rate? (NIE 5) ire rates have been enacted into law. probable that future tax rates will change. ppears like that future taxes rates will drop below the current tax rate. ppears like that future taxes rates will increase above the current tax rate. 5 points Question 2 1. (5 points) Which of the following is the major distinction between permanent and temporary book-tax differences? (NIE 5) CCCC inent differences can change in status with the passage of time. inent differences are not representative of acceptable accounting practice. orary differences reverse themselves, permanent differences don't." orary differences occur frequently, whereas permanent differences occur

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started