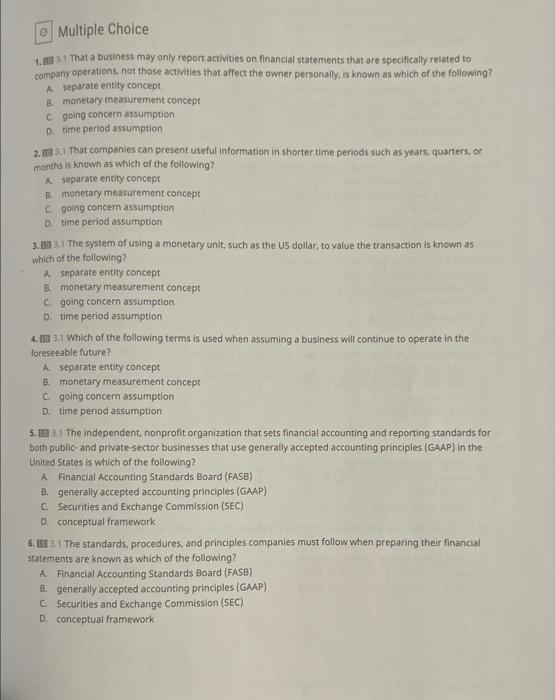

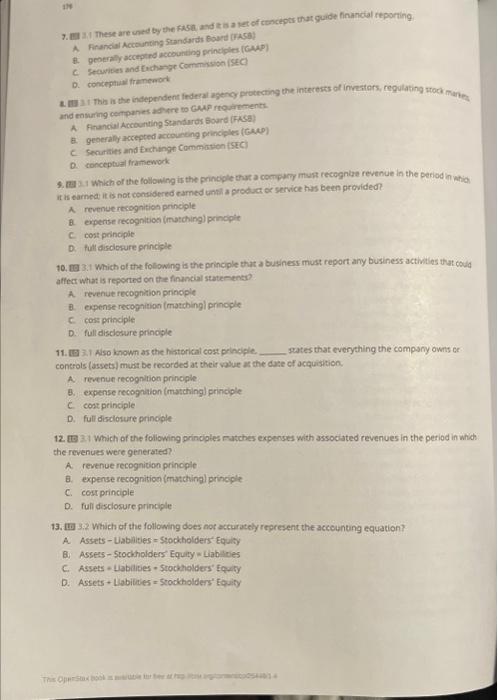

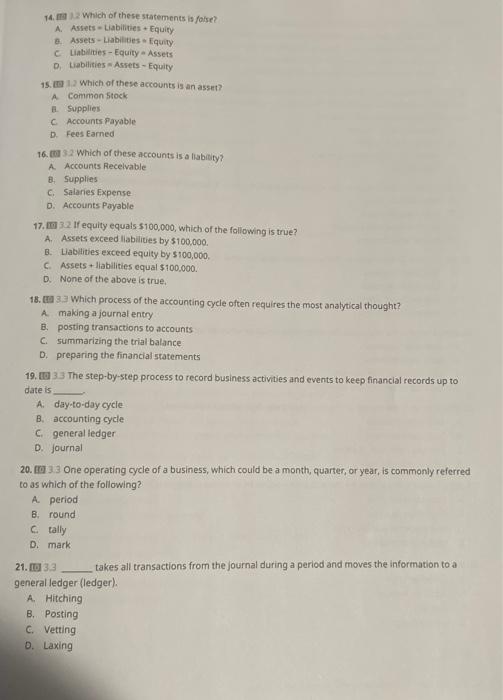

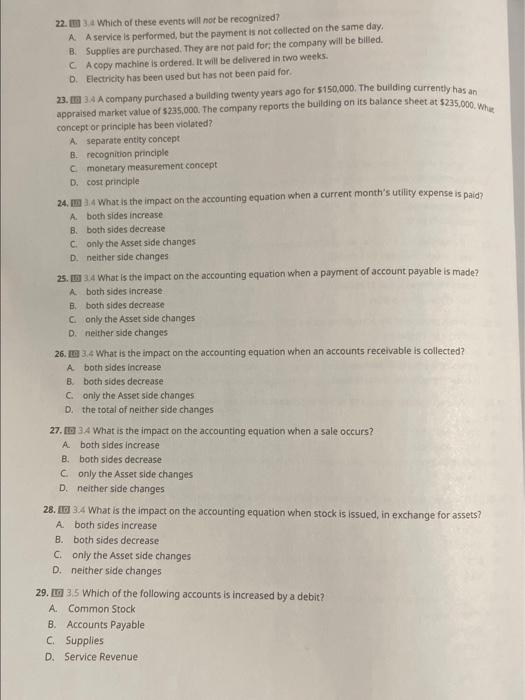

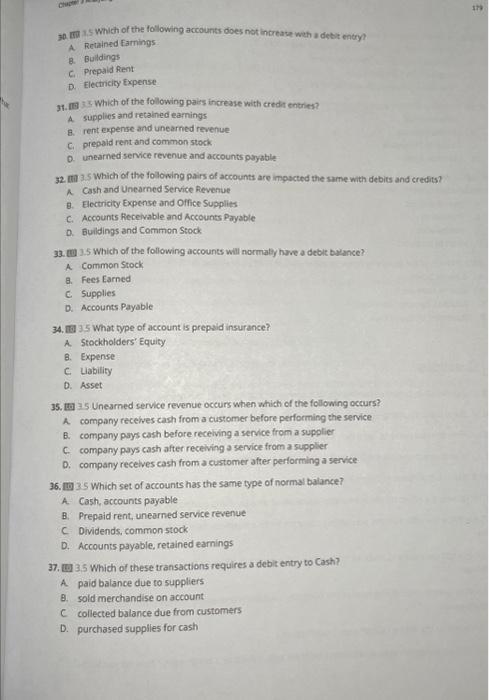

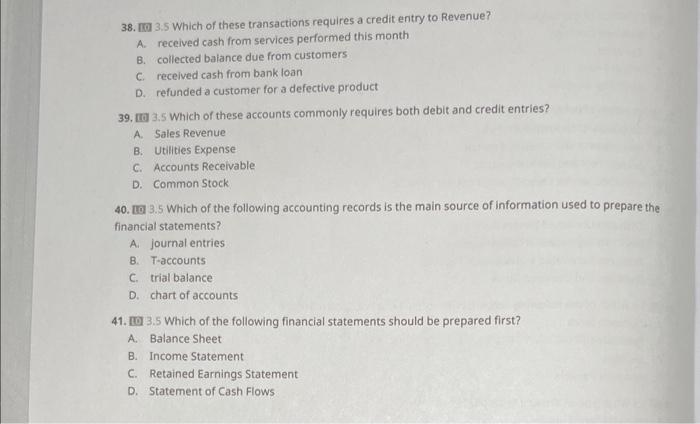

1. 60 3.1. That a business may only report activities on financial statements that are specifically related to company operations, not those activities that affect the owner personally is known as which of the following? A. separate entity concept E. monetary measurement concept C. going concern assumption D. time period assumption 2. Fal 31. That companies can present useful information in shorter time periods such as years, quarters, or months is known as which of the following? A separate entity concept B. monetary measurement concept C. going concern assumption D. time period assumption 3. tia 3.3 The system of using a monetary unit, such as the Us dollar, to value the transaction is known as which of the following? A. separate entity concept B. monetary measurement concept C. going concern assumption D. time period assumption 4. wa 3.7 Which of the following terms is used when assuming a business will continue to operate in the foreseeable future? A. separate entity concept B. monetary measurement concept C. going concern assumption D. time period assumption 5. E 3. The independent, nonprofit organization that sets financial accounting and reporting standards for both public-and private-sector businesses that use generally accepted accounting principles (GAAP) in the United States is which of the following? A. Financial Accounting Standards Board (FASB) B. generally accepted accounting principles (GAAP) C. Securities and Exchange Commission (SEC) D. conceptual framework 6. [] 3.1 The standards, procedures, and principles companies must follow when preparing their financial skatements are known as which of the following? A. Financial Accounting Standards Board (FASB) B. generally accepted accounting principies (GAAP) C. Securities and Exchange Commission (SEC) D. conceptual framework 7. E1. 1.I These are unet by the fast and t a a tet of conceper thut guide financial reporting A. Financia Accounting Standards Bourd (FaSA) 4. geoerally sectptind accounting princlples (GUP) C. Fequibes and tuchenge Commision (SEC) o. concephual franemort 1. IE 3 tha is the independent federal agency protecting the interests of investors, regulating rtock mane. and ensuring centpanes adsre to Gur rrpurements. A. Financial Accounting Standuras fourd (FASa). B. geoeraly accepted accoueeng principles (CNet). C. Senurtits and Eritinge Commation (SEC) D. conceptual framework 5. 1 Which of the following is the principle that a conpery must recognlae revenue in the period in whion. it s earned it is not considered earned unth a product or service has been provided? A revenue recogaition princple B. expense recognition (inatchingl peindpie C. cost ponncipie D. full disciorure grinciple 10. 3 3.1 Which of the following is the principle that a business must report any business actinilis that coula affect what is reported on the financial statements? 2. revenue recognition principle B. expense recogation (matchingl prinople c. coss principle D. full disclosure principle 11. EO. 3.1 Aso known as the histarical cost peinciple. sates that everything the company owns or controls (assets) must be recorded at their value as the dase ef acquisition. A revenur recognition princple Q. expense recogntion (matching) principle C. cost principle D. fuli disclosure prinople 12. Et 3.1 Which of the following principles matches expenses with associated revenues in the period in which the revenues were generated? A revenue recognicion princple 6. expense recognition imatchingl principle C. cost principle D. fuli disclosure principle 13. If 3.2 Which of the following does not eccurately represent the accounting equation? A. Assets-Uabalities = srockholders' Equity B. Assers - Stockholders Equity = Lablilies C. Assets + Habaicies - Srockholders' Equity D. Assets + Labilites = srockholders' Equity 14. fid 1.2 Which of these statements is fotse? A. Assets - Liabilities + Equity Q. Assets - Liabilibes = Equity C. Liabilities - Equity = Assets D. Labilities a Asrets - Equity 15. e 1.2 Which of these accounts is an asset? A Common 5 tock A. Supplies C. Accounts payable D. Fees Earned 16. [0] 32 Which of these accounts is a liabitity? A. Accounts Recelvable B.) Supplies c. Salaries Expense D. Accounts Payable 17. I6 32 If equity equals $100,000, which of the following is true? A. Assets exceed liabilities by $100,000. B. Lablities exceed equity by $100,000, C. Assets + llabilities equal $100,000. D. None of the above is true. 18. E3 33 Which process of the accounting cycle often requires the most anatytical thought? A making a journal entry B. posting transactions to accounts C. summariaing the trial balance D. preparing the financial statements 19. [Id 33 The step-by-step process to record business activities and events to keep financial records up to date is A. day-to-day cycle. B. accounting cycle C. general ledger D. journal 20. EO 3.3 One operating cycle of a business, which could be a month, quarter, or year, is commonly referred to as which of the following? A. period 8. round C. tally D. mark. 21. [t] 3.3 takes all transactions from the journal during a period and moves the information to a general ledger (ledger). A. Hitching B. Posting C. Vetting D. Laxing 22. [] 3.4 Which of these events will not be recognited? A A service is performed, but the payment is not collected on the same day. B. Supplies are purchased. They are not paid for; the company will be billed. C. A copy machine is ordered. It will be delivered in two weeks. D. Electricity has been used but has not been paid for. 23. [Di 3.4 A company purchased a building twenty years ago for 5150,000 . The buliding currently has an appraised market value of 5235,000 . The company reports the building on its balance sheet at 5235,000, Whet concept or principle has been violated? A. separate entity concept B. recognition principle C. monetary measurement concept D. cost principle: 24. Iii 3.4 What is the impact on the accounting equation when a current month's utility expense is paid? A. both sides increase B. both sides decrease C. only the Asset side changes D. neither side changes 25. [1i) 3.4. What is the impact on the accounting equation when a payment of account payable is made? A. both sides increase. Q. both sides decrease C. only the Asset side changes D. neither side changes 26. IT 3.4 What is the impact on the accounting equation when an accounts receivable is collected? A both sides increase B. both sides decrease C. only the Asset side changes D. the total of neither side changes 27. [I] 3.4 What is the impact on the accounting equation when a sale occurs? A. both sides increase B. both sides decrease C. only the Asser side changes D. neither side changes 28. f[C] 3.4 What is the impact on the accounting equation when stock is issued, in exchange for assets? A. both sides increase B. both sides decrease C. only the Asset side changes D. neither side changes 29. Eg 3.5 Which of the following accounts is increased by a debit? A. Common Stock B. Accounts Payable C. Supplies D. Service Revenue 30. Iid 1,5 Which of the following accounts does not increase weh a debit entry? A. Retained farnings: B. Buldings C. prepald fient D. Electricity Expense 31. Da :3. Which of the following pairs increase with credit entries? A supplies and retained earnings B. rent expense and unearned revenue- Ci prepald rent and common stock. 0. unearned senvice revenue and accounts paysble 32. Itil 3.5 Which of the folowing pairs of accounts are impocted the same with debits and credits? A Cash and Unearned Senvice Aevenue g. Electricity Expense and Office Supplits C. Accounts Recelvable and Accounts Payable 0. Euldings and Common Stock. 33. 20.5 Which of the following accounts will normalyy hare a debit buiace? A. Common Stock 8. Fees Earned c. Supplies D. Accounts Payable 34. Did 35 What type of account is prepaid insurance? A. Stockholders' Equity B. Expense C. Liability D. Asset 35. [Ea 35 Unearned service revenue occurs when which of the following occurs? A. company recelves cash from a customer before perfocming the service B. company pays cash before recelving a service from a supglier C. company pays cash after receiving a service from a supplier D. company recelves cash from a customer after performing a service- 36. [D] 35 Which set of accounts has the same type of normal balance? A. Cash, accounts payable B. Prepaid rent, unearned service revenue C. Dividends, commonstock D. Accounts payable, retained earnings 37. [u. 3.5 Which of these transactions requires a debit entry to Cash? A. paid balance due to suppliers A. sold merchandise on account C collected balance due from customers D. purchased supplies for cash 38. no. 3.5 Which of these transactions requires a credit entry to Revenue? A. received cash from services performed this month B. collected balance due from customers C. received cash from bank loan D. refunded a customer for a defective product 39. [] 3.5 Which of these accounts commonly requires both debit and credit entries? A. Sales Revenue B. Utilities Expense C. Accounts Receivable D. Common Stock 40. 10. 3.5 Which of the following accounting records is the main source of information used to prepare the financial statements? A. journal entries B. T-accounts C. trial balance D. chart of accounts 41. 0 3.5 Which of the following financial statements should be prepared first? A. Balance Sheet B. Income Statement C. Retained Earnings Statement D. Statement of Cash Flows