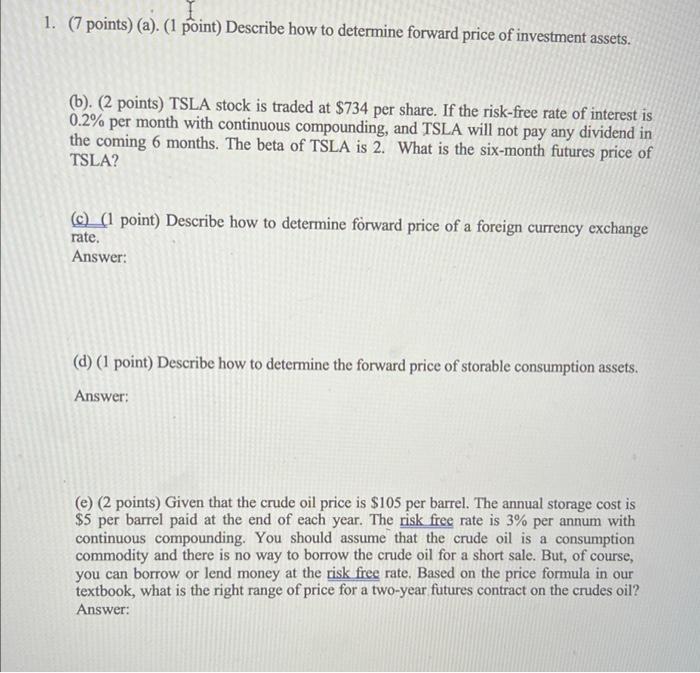

1. (7 points) (a). (1 point) Describe how to determine forward price of investment assets. (b). (2 points) TSLA stock is traded at $734 per share. If the risk-free rate of interest is 0.2% per month with continuous compounding, and TSLA will not pay any dividend in the coming 6 months. The beta of TSLA is 2. What is the six-month futures price of TSLA? () (1 point) Describe how to determine forward price of a foreign currency exchange rate. Answer: (d) (1 point) Describe how to determine the forward price of storable consumption assets. Answer: (e) (2 points) Given that the crude oil price is $105 per barrel. The annual storage cost is $5 per barrel paid at the end of each year. The risk free rate is 3% per annum with continuous compounding. You should assume that the crude oil is a consumption commodity and there is no way to borrow the crude oil for a short sale. But, of course, you can borrow or lend money at the risk free rate. Based on the price formula in our textbook, what is the right range of price for a two-year futures contract on the crudes oil? Answer: 1. (7 points) (a). (1 point) Describe how to determine forward price of investment assets. (b). (2 points) TSLA stock is traded at $734 per share. If the risk-free rate of interest is 0.2% per month with continuous compounding, and TSLA will not pay any dividend in the coming 6 months. The beta of TSLA is 2. What is the six-month futures price of TSLA? () (1 point) Describe how to determine forward price of a foreign currency exchange rate. Answer: (d) (1 point) Describe how to determine the forward price of storable consumption assets. Answer: (e) (2 points) Given that the crude oil price is $105 per barrel. The annual storage cost is $5 per barrel paid at the end of each year. The risk free rate is 3% per annum with continuous compounding. You should assume that the crude oil is a consumption commodity and there is no way to borrow the crude oil for a short sale. But, of course, you can borrow or lend money at the risk free rate. Based on the price formula in our textbook, what is the right range of price for a two-year futures contract on the crudes oil