Question

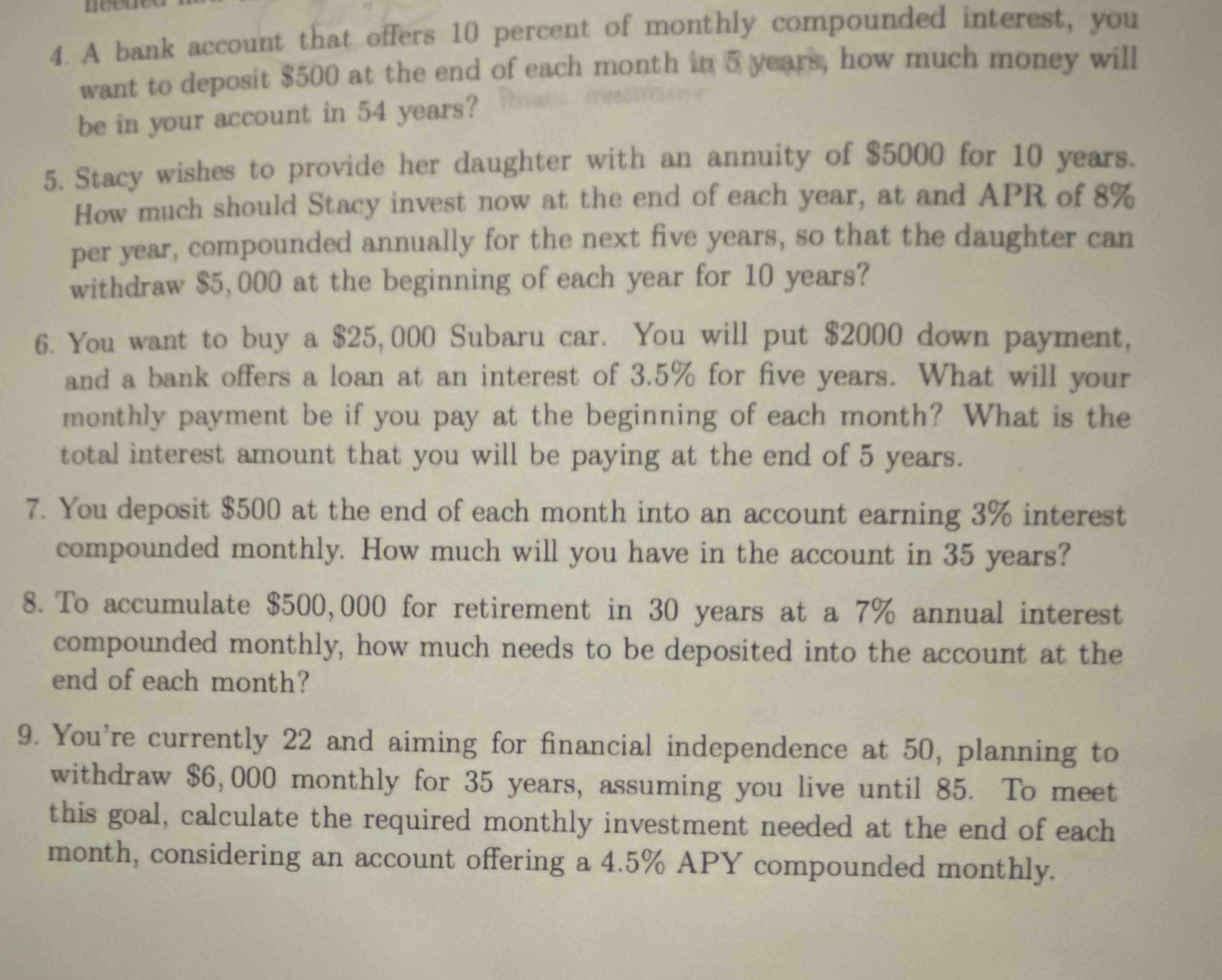

1. A bank account that offers 10 percent of monthly compounded interest, you want to deposit $500 at the end of each month, how much

1. A bank account that offers 10 percent of monthly compounded interest, you want to deposit

$500at the end of each month, how much money will be in your account in 54 years?\ 2.Stacy wishes to provide her daughter with an annuity of

$5000for 10 years. How much should Stacy invest now at the end of each year, at and APR of

8%per year, compounded annually for the next five years, so that the daughter can withdraw

$5,000at the beginning of each year for 10 years?\ 3.You want to buy a

$25,000Subaru car. You will put

$2000down payment,\ and a bank offers a loan at an interest of

3.5%for five years. What will your monthly payment be if you pay at the beginning of each month? What is the total interest amount that you will be paying at the end of 5 years.\ 4. You deposit

$500at the end of each month into an account earning

3%interest compounded monthly. How much will you have in the account in 35 years?\ 5. To accumulate

$500,000for retirement in 30 years at a

7%annual interest compounded monthly, how much needs to be deposited into the account at the end of each month?\ 6. You're currently 22 and aiming for financial independence at 50 , planning to withdraw

$6,000monthly for 35 years, assuming you live until 85 . To meet this goal, calculate the required monthly investment needed at the end of each month, considering an account offering a

4.5%APY compounded monthly.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started